Tariffs, Stagflation, and Yen Strength Set the Stage for a CleanAlright degenerates, here’s your clean macro breakdown.

Pair with strongest directional bias right now: USD/JPY

Bias: SHORT USD/JPY (Bearish USD / Bullish JPY)

WHY? Because the U.S. just tripped over its own tariffs and dragged the dollar with it.

1. U.S. melting down:

• Trump went full trade-war goblin: 10% base tariffs on everything, up to 100% on certain countries.

• Fed now cornered — inflation UP, growth DOWN = stagflation vibes.

• Powell already out here looking like he wants to cut rates yesterday.

• S&P nuked -4.9%, $2.5 trillion gone in a day. This is not a drill.

2. Japan not looking great, but better than the U.S.:

• BOJ possibly delaying hikes, but inflation’s been above 2% for 3 years.

• Tokyo CPI still hot.

• Plus: classic safe-haven flow kicking in thanks to all the macro chaos.

• Yen doing what yen does—acting like gold in a suit.

3. Geopolitical backdrop:

• EU & Japan both throwing shade at U.S. tariffs.

• Retaliation incoming? Risk-off vibes continue.

• Markets shifting to JPY like it’s 2020 all over again.

4. Central Bank energy:

• Fed: Shaky, reactive, duck-and-cover mode.

• BOJ: Holding back, but not out. Inflation gives them ammo.

⸻

TL;DR:

• USD is getting wrecked by its own government.

• JPY benefiting from safe-haven flows + stable inflation.

• Every major factor (macro, policy, geopolitics, sentiment) leans one way.

• USD/JPY short looks clean AF from a fundamental standpoint.

Not financial advice. I don’t care what you do. Just don’t long this trash.

Now go slap some fibs and RSI on this thing and pretend you knew it all along.

USDJPY.1000.DUB trade ideas

USD/JPY "The Ninja" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 1H timeframe (148.250) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

daily reject daily, sweep + breakerwe framed our bias from the monthly timeframe on the daily timeframe the daily rejects the daily bb and we have a sweep and a break of the market structure on the 4hr timeframe, hence on the 1hr we have our entry on the breaker close to the nearest liquidity.

overall trend is bullish.

USDJPY - LongThe tariffs (if they are maintained) are going to destroy Japans economy, which is heavily reliant on car exports to the US. As their trade balance goes red, and their domestic economy goes into recession, the yen will crater as the underlying debt crisis percolating in the background exasperates the issue.

ONENTRY

USD/JPY ONENTRY '1TWO 1 Strategy'

Timeframe: 30 Minutes

Key Session: Asian Market Hours (00:00 - 05:30 +2GMT)

Strategy Rules

1. Identify the Asian Range

Mark the high and low of USD/JPY between 00:00 - 05:30 ( +2GMT )

Only trade if the range is >25pips (avoids noise).

2. Wait for Breakout + Pullback

Breakout: Price must close outside the range (candle body, not wick).

Pullback: Enter on a 50% retracement of the Asian range.

Longs: Breakout above range → buy at 50% pullback.

Shorts: Breakout below range → sell at 50% pullback.

3. Trade Execution

Entry: 50% retracement level of the Asian range.

Stop Loss:

Longs: Below the range low (for breakouts above).

Shorts: Above the range high (for breakouts below).

Take Profit : 1:1 Risk-Reward (RR).

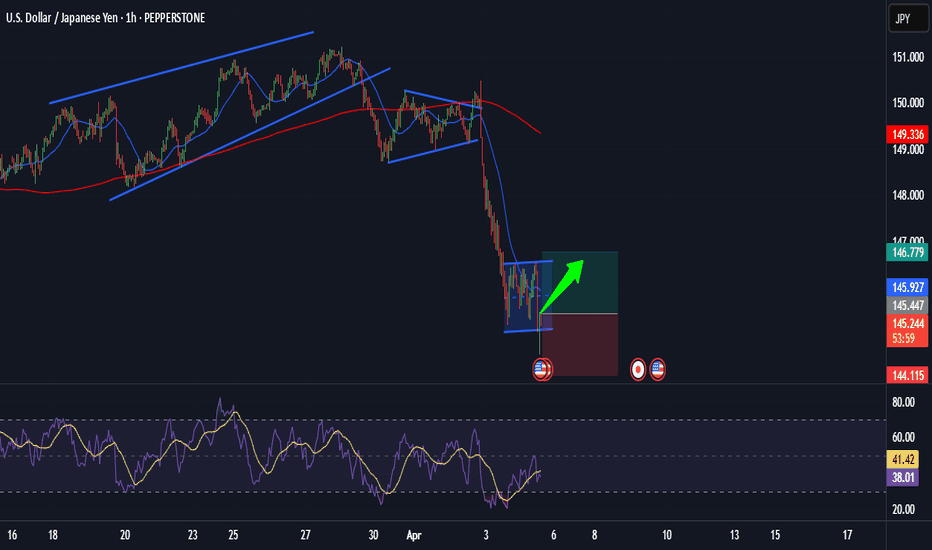

USD/JPY Ready for Liftoff? Catch This Potential Rebound! Hi traders! , Analyzing USD/JPY on the 1H timeframe, spotting a potential long entry:

🔹 Entry: 145.44

🔹 TP: 146.78

🔹 SL: 144.115

USD/JPY has formed a consolidation zone after a sharp downtrend, indicating a potential bullish reversal. If buyers step in, we could see a move towards 146.78. RSI is recovering from oversold levels, supporting the upside scenario.

⚠️ DISCLAIMER: This is not financial advice. Every trader makes their own decision.

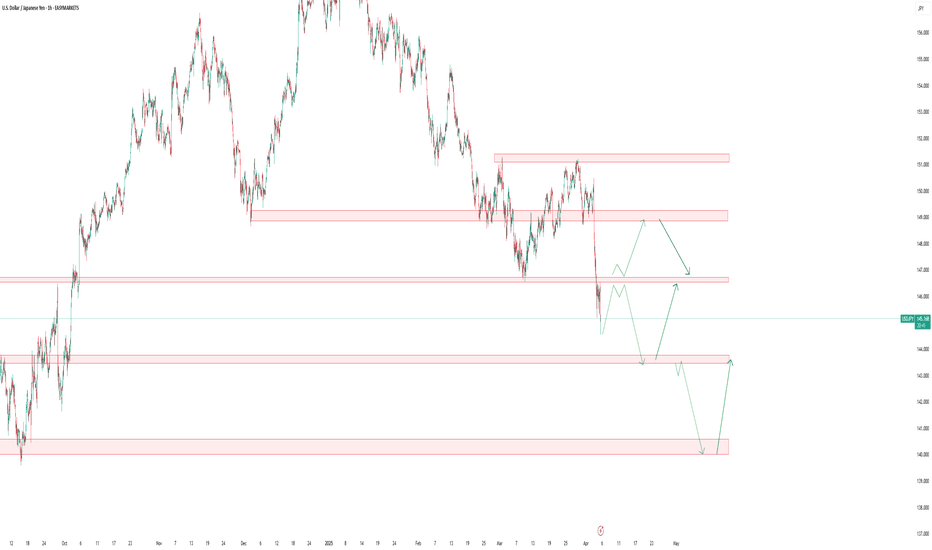

USDJPY MONTHLY IS TIMEFRAME ANALYSIS Price once more fall into the weak trendline formed by a struggling bullish move that started since 2022. We may likely see a possible break below the trendline which may insight a possible sell opportunity . We also see a Head and shoulder like pattern. A break below the Trendline will further confirm the head & shoulder reversal pattern formation.

USD/JPY - Bearish breakdown signals further downside potential!The USD/JPY pair has been experiencing a clear daily downtrend, characterized by a bearish market structure and strong downward momentum. Sellers have remained in control, pushing prices lower as the pair continues to respect the prevailing bearish trend. With each failed attempt at recovery, the market structure reinforces the dominance of sellers, signaling that the path of least resistance remains to the downside.

Despite this overall downtrend, the 4-hour timeframe recently exhibited a rising channel, where price action formed higher highs and higher lows, suggesting a temporary bullish retracement within the larger bearish structure. However, this channel has now been broken, signaling a potential shift back toward the primary trend. A break of this nature often suggests that the bullish correction has exhausted its strength, and sellers are regaining control to push the price lower once again.

Following the breakdown of this rising channel, the price has failed to reclaim previous highs, instead forming a lower high—a strong indication that bearish pressure is resuming. Given this development, there is a significant possibility that USD/JPY could retrace toward key technical levels, such as the Golden Pocket (between the 0.618 and 0.65 Fibonacci retracement levels) or even the 4-hour Fair Value Gap (FVG) around 145.00.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

USD/JPY(20250404)Today's AnalysisToday's long and short boundaries:

146.84

Support and resistance levels

150.91

149.39

148.40

145.27

144.28

142.76

Trading strategy:

If the price breaks through 146.84, consider buying, the first target price is 148.40

If the price breaks through 145.27, consider selling, the first target price is 144.28

NFP beats but focus is fixated on trade warToday’s NFP report was NEVER going to take much attention away from the trade war – and so it has proved with mixed readings. US rates were being priced lower amid deteriorating trade war risks, which remains the main focal point. Powell is up next, while CPI, PPI and UoM surveys all on tap next week.

The nonfarm payrolls data beat expectations, with a headline print of 228K. Most of those gains were in full-time jobs. But the unemployment rate ticked higher to 4.2% from 4.1% unexpectedly. Market’s focus is on trade war, and rightly so. They were never going to go wild on this NFP release.

Average earnings came in as expected, rising 0.3% on a month-over-month basis, but the prior month weas revised lower a tad. Year-over-year rate was weaker 3.8% vs. 4.0%. Nothing to get too excited over, but potentially good news as far as inflation is concerned.

By Fawad Razaqzada, market analyst with FOREX.com

USD/JPY Market Update – 04 April 2025The USD/JPY pair has been trending lower, reflecting recent weakness in the US dollar and renewed strength in the Japanese yen, which is often viewed as a safe-haven asset in times of uncertainty.

In addition, markets appear to be pricing in potential policy divergence between the Bank of Japan (BOJ) and the US Federal Reserve, contributing to recent moves.

It’s worth noting that upcoming US employment data may have a significant impact on this pair, potentially increasing market volatility.

From a technical standpoint, several scenarios may unfold:

• The pair could approach the 146.5 area, where signs of resistance have previously emerged. If bearish momentum continues, it may revisit the 143.5 region. A break below this level could see the pair testing the psychological 140 mark – a zone that, historically, has attracted buyer interest.

• Alternatively, if the price moves above the 143.7 level and establishes support, it could indicate a shift in short-term sentiment. In such a case, a potential move towards the 150 level may be observed, particularly if supported by stronger-than-expected US employment figures.

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#006 Moving Average USDJPY SELL 1644SGT 04042025Add : Shorted on the 5 Minutes Time Frame, but time frame too small to publish on tradingview, so, I posted on the 15 Minutes Time Frame instead.

1648SGT

04042025

---

Trump Tariff caused USD to get dumped yesterday.

US stocks also got dumped for 6 to 7 weeks consecutively.

If you look at the Daily time frame you would see the big red candle on USDJPY's dump.

I was looking at opportunities on all JPY pairs, and I took a liking to USDJPY because I am expecting USD to continue to get dumped.

Shorting the resistance level.

If you look at price on the 1H or 4H time frame, you would realise price is in a consolidation towards the down side, and I like that.

NFP and unemployment rate news coming out later in the day. in about 4 hours time. Current time is 1647SGT.

Might exit before the news got released.

1647SGT 04042025

The Day Ahead US Jobs & FED Powell speech US March Jobs Report

Most important release this week.

Strong report boosts the dollar and bond yields

Weak report supports stocks and pressures the dollar

Canada March Jobs Report

Strong numbers lift the Canadian dollar

Weak numbers weigh on CAD

Germany, France, Italy Data

Includes factory orders, industrial production, and retail sales

Weak data puts pressure on the euro

Strong data supports the euro

Japan February Household Spending

Low spending signals continued Bank of Japan easing, weakens the yen

Higher spending may support the yen

UK March Car Sales and Construction PMI

Positive surprises could lift the pound

Sweden March CPI

Hot inflation could delay rate cuts and support the krona

Cooler CPI may lead to SEK weakness

Central Bank Watch

Fed’s Powell and Barr Speaking

Hawkish tone strengthens the dollar and lifts yields

Dovish comments could boost risk assets and weaken the dollar

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.