Trade Setup: USDJPYIn this video, I’m sharing a high-probability trade setup on USDJPY, explaining exactly why I am taking a buy, how I arrived at this decision, and my clear target for this trade.

🔍 What You’ll Learn:

✅ Detailed technical breakdown of USDJPY 📊

✅ How I analyze market structure for trade confirmation 🔎

✅ Key liquidity zones & areas of value 📉📈

✅ How to set realistic targets and manage risk 🎯

✅ Smart Money Concepts (SMC) & price action analysis

Whether you're a beginner or an advanced trader, this breakdown will help you understand the thought process behind a well-planned forex trade setup.

💡 Watch now and let’s break down the market together!

📌 Drop a comment – Do you agree with this trade setup? What’s your outlook on USDJPY? 🚀

👍 Like & Share this with a trader who needs it!

USDJPY.1000.DUB trade ideas

USD/JPY "The Ninja" Forex Bank Heist Plan (Day / Scalping Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/JPY "The Ninja" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (148.600) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 152.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/JPY "The Ninja" Forex Bank Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

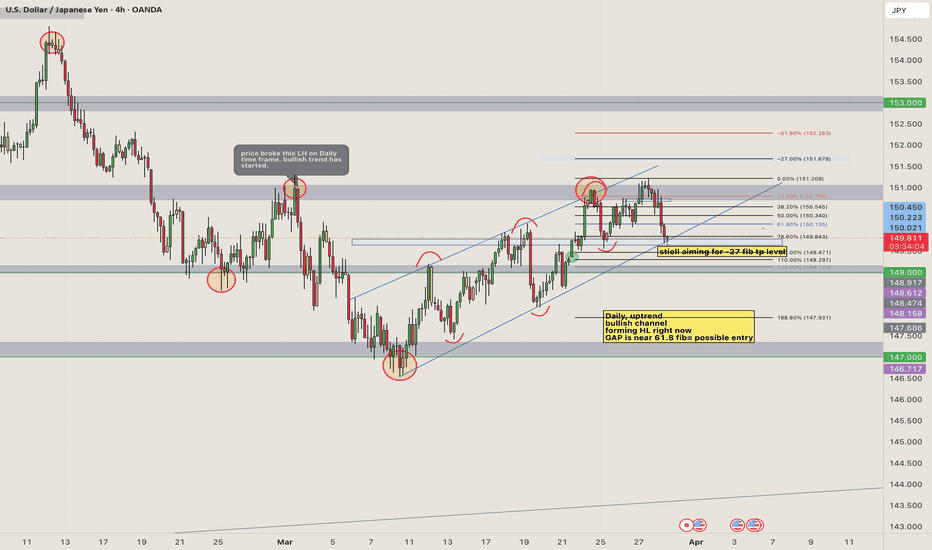

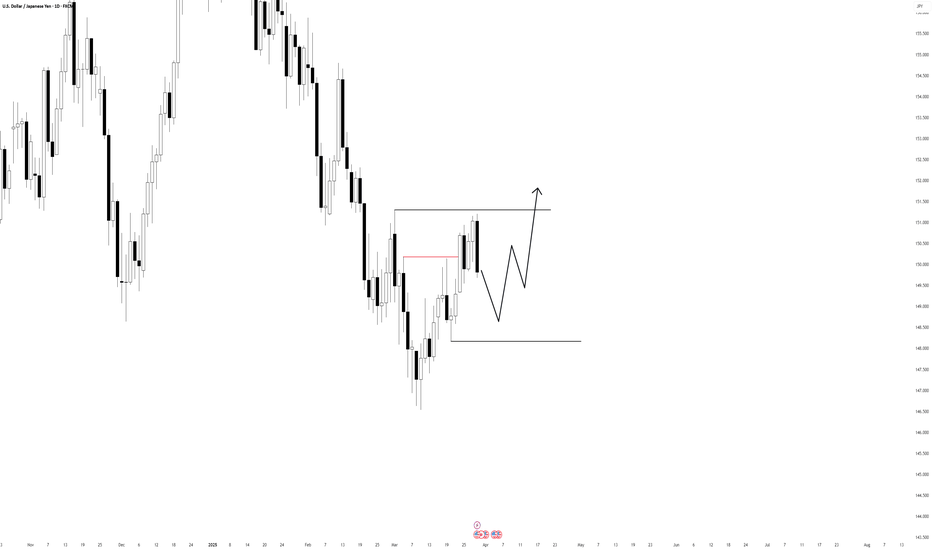

USDJPY-LONGusdjpy has been on a bullish uptrend over the last few days. From a technical standpoint, no market structure has been changed yet for uptrend. On the daily however, downtrend has changed, LH has been broken and Higher high is in the process of being made. price has been respecting my upward channel and im looking for buys with a TP near my -27 area. Will wait for fundamental news to align with my technical for sure but im bullish on UJ.

UsdJpy Trade IdeaIts been a minute! Gonna start this week off some potential UJ longs. Price flipped bullish last week while still maintaining bullish structures. I'm personally looking for price to continue pushing the upside as long as smaller time frames tap back into support (blue box) with structures flipping.

Falling towards overlap support?USD/JPY is falling towards the support level which is an overlap support that aligns with the 61.8% Fibonacci retracement and the 138.2% Fibonacci extension and could bounce from this level to our take profit.

Entry: 149.59

Why we like it:

There is an overlap support level that aligns with the 61.8% Fibonacci retracement and the 138.2% Fibonacci extension.

Stop loss: 149.21

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 150.11

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY - Critical area for the pair!The USD/JPY pair currently sits at a critical technical juncture, trading around the 149.84 level, where market participants are closely watching for directional cues. The price action has been respecting an ascending trendline since early March, suggesting underlying bullish momentum, while simultaneously testing the lower boundary of a significant resistance zone highlighted in blue on the chart. This confluence creates a decisive moment for traders – a break below the trendline could trigger another downward leg toward support near 149.00, while sustained strength above the current level might signal continuation of the uptrend toward the upper resistance band at 151.00. The chart's annotated projection suggests the possibility of one more pullback before resuming higher, making this a pivotal area for determining whether bears will gain temporary control or if bulls will maintain dominance without further consolidation.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPY/USD 4H Chart Analysis – Head & Shoulders Breakdown & BearishThis detailed technical analysis covers a Head & Shoulders pattern formation on the 4-hour chart of JPY/USD, highlighting a potential bearish reversal setup. The pattern suggests a shift from an uptrend to a downtrend, supported by a trendline breakdown and key resistance & support levels.

1️⃣ Understanding the Chart Pattern: Head & Shoulders (H&S)

📉 What is the Head & Shoulders Pattern?

The Head & Shoulders (H&S) is a classic bearish reversal pattern that appears after a prolonged uptrend, signaling a shift in market sentiment from bullish to bearish. It consists of three main parts:

Left Shoulder: A peak followed by a retracement.

Head: A higher peak, indicating the last strong bullish attempt.

Right Shoulder: A lower peak, failing to reach the height of the head, showing weakening momentum.

Neckline: A crucial support level that connects the lows of the shoulders. A confirmed break below this neckline is the trigger for a bearish continuation.

📊 Breakdown of the Pattern in This Chart

Left Shoulder (First Peak): The price made a high and then pulled back.

Head (Higher Peak): The market made another higher high but failed to sustain it, indicating exhaustion.

Right Shoulder (Lower Peak): A weaker attempt to push higher, but price failed to break previous highs, confirming the loss of bullish strength.

Neckline Breakout: The dotted trendline shows the ascending support that was eventually broken, confirming bearish momentum.

2️⃣ Key Technical Levels & Market Structure

Understanding the important levels in the market is crucial for setting up an effective trade.

🟧 Resistance Zone (Supply Area)

The resistance level, marked in a beige box, is located around 0.006800.

Price was rejected multiple times from this zone, confirming strong selling pressure.

The head of the pattern was formed in this region before a sharp drop.

🔵 Support Level (Neckline & Demand Area)

The neckline of the Head & Shoulders pattern was acting as support before being broken.

This level was tested multiple times before the final breakdown.

Once broken, it turned into a resistance level, meaning price may pull back to this area before continuing downward.

📉 Trendline Breakout (Bearish Confirmation)

A dashed trendline was previously supporting the uptrend but was broken, confirming the bearish shift in market structure.

This signals a trend reversal and a possible extended move lower.

3️⃣ Trading Strategy & Execution

A well-planned entry, stop loss, and take-profit strategy is essential for managing risk effectively.

📌 Entry Strategy (Short Setup)

Ideal Entry: Look for price to pull back to the neckline (previous support turned resistance).

Confirmation: Watch for bearish candlestick patterns such as:

Bearish engulfing

Pin bar rejection

Shooting star

Lower highs forming near the neckline

A rejection in this zone confirms seller dominance and a high-probability short setup.

📌 Stop Loss Placement

The Stop Loss is placed above the right shoulder at 0.006725.

This ensures protection from false breakouts or unexpected bullish moves.

📌 Profit Target Projection

Take-Profit Target: The projected move suggests a target at 0.006493.

This aligns with previous structural support, increasing its significance.

The measured move for Head & Shoulders suggests that price could fall further after confirmation.

Risk-Reward Ratio

The Risk (Stop Loss): Around 50 pips.

The Reward (Profit Target): Around 180 pips.

This results in a Risk-Reward Ratio of approximately 1:3, making it an attractive trade.

4️⃣ Market Sentiment & Expected Price Movement

📉 Bearish Scenario (Most Likely)

Price retests the neckline but fails to break above it.

Sellers step in, rejecting the resistance level, leading to further downside.

Price targets the next major support at 0.006493, completing the Head & Shoulders move.

📈 Bullish Scenario (Alternative)

If price reclaims the neckline and moves back above 0.006725, the pattern is invalidated.

This could lead to a bullish continuation back toward previous highs.

In this case, traders should cut losses early and avoid forcing a short trade.

5️⃣ Risk Management & Best Practices

1️⃣ Position Sizing:

Risk only 1-2% of your account per trade to maintain long-term profitability.

2️⃣ Confirmation Before Entry:

Wait for price to reject the neckline resistance before entering short.

Avoid entering too early without clear bearish signs.

3️⃣ Monitor News & Fundamentals:

Major economic events, interest rate decisions, or central bank announcements could impact JPY/USD price action.

🔎 Final Conclusion: Bearish Outlook on JPY/USD

The Head & Shoulders breakdown signals a trend reversal from bullish to bearish.

The neckline breakout confirms seller control over the market.

The best short entry is on a pullback to previous support (now resistance).

Target at 0.006493, with a Stop Loss at 0.006725 ensures controlled risk.

📢 Trading Bias: Bearish 📉

💡 Watch for a retest & rejection before entering short.

USDJPY 4H USDJPY Analysis

The previous bearish outlook was invalidated early in the week with a break above 149.4, confirming a bullish trend. The uptrend is expected to continue toward 152.73.

However, on the higher timeframe, an unusual price structure suggests a bearish formation, aligning with my projected setup.

USDJPY bearish engulfing, bearish flag , bearish hammerThe USD JPY was in correction mode of the down trend, On daily time frame it has formed the bearish engulfing candle along with that we can also see a bearish flag and on weekly chart it has formed the inverted hammer , all these indciates the proce gone go down to 145.5 where it has strong support.

USDJPY - Key Levels to WatchThe USD/JPY pair is showing an interesting setup on the 4-hour chart—here's what to watch:

🔹 1️⃣ Ascending Channel in Play: The pair is trending within a bullish channel, signaling an overall upward momentum. Traders should keep an eye on this structure for potential opportunities.

🔹 2️⃣ Support Zone Under Test: Price action is near the critical blue-shaded support area at 149.815. This level has historically held as a strong rebound zone. Buyer activity here could determine the next move!

🔹 3️⃣ Potential Scenarios:

Bullish Case: A strong bounce from the support zone could propel the price higher, maintaining the channel's bullish trend.

Bearish Case: A failure to hold the support level may lead to further declines, possibly testing the lower boundary of the channel.

Insights for Traders: Patience is key—monitor the 149.815 zone for signals before committing to a trade. The combination of price patterns and volume data will provide clarity.