USDJPY.1000.DUB trade ideas

USD_JPY WILL KEEP FALLING|SHORT|

✅USD_JPY is trading along the falling resistance

And as the pair will hit it soon

I am expecting the price to go down

To retest the demand levels below at 147.500

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY DAILY ANALYSISHello traders here is my setup for USDJPY for the week as you can see the price has been on a down trend, and now you can see that the price have done a retracement and it is now on the level of structure that was recently broken and it is likely to act as resistance now I have to wait for confirmations like bearish engulfment then I would look to short the USDJPY.

NP: This is not a financial advice its just my prediction, what do you think?

USD/JPY Short Setup AnalysisPrice is currently respecting a descending channel, making lower highs and lower lows, indicating a strong bearish trend. The market is approaching a key resistance zone around 149.165 - 150.000, where a confluence of trendline resistance and a supply zone is expected to reject further upside. A sell limit is placed at 149.165, targeting a move back down to the lower boundary of the channel near 146.544.

Mid-day bullish trendFX:USDJPY

Technical Analysis:

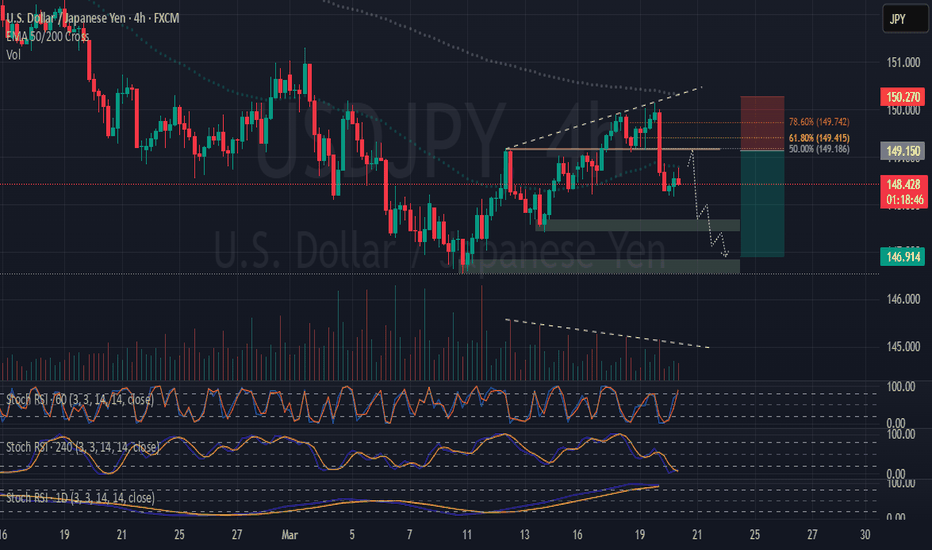

The trend structure on the four-hour chart is bearish.

The trend is correcting (upward movement) due to the formation of a bottom at 146.53. From the buyers' perspective, if the resistance at 151.17 is broken, it can reach the next resistance at 154.86. From the sellers' perspective, as long as the resistance at 151.17 holds, it can prevent price growth and pull the price down to the bottom at 146.53.

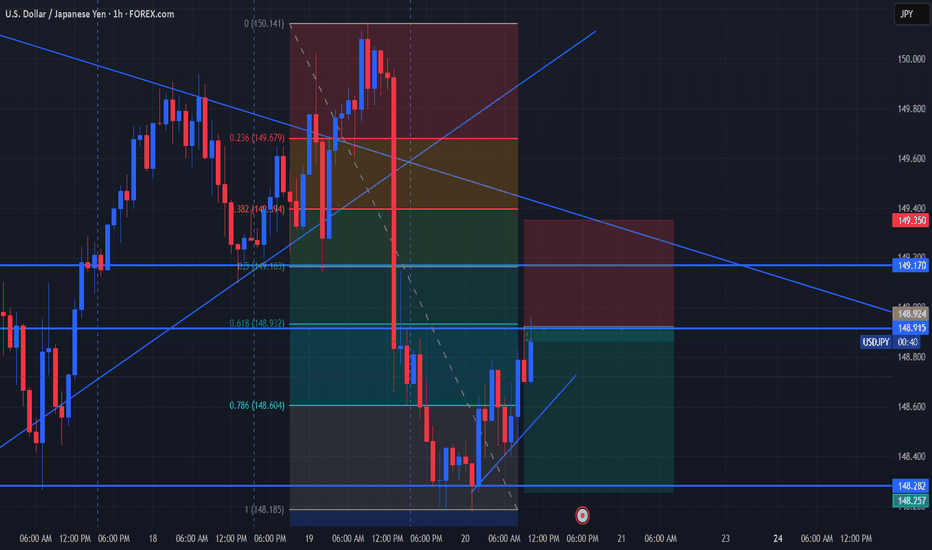

Heading into overlap resistance?USD/JPY is rising towards the resistance level which is an overlap resistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 149.13

Why we like it:

There is an overlap resistance level that line sup with the 50% Fibonacci retracement.

Stop loss: 149.83

Why we like it:

There is a pullback resistance level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 148.19

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/JPY - Breakdown Confirmation & Potential DeclineUSD/JPY - Breakdown Confirmation & Potential Decline

Chart Overview:

The USD/JPY price action has broken down from a previously established ascending channel.

A lower high formation suggests weakening bullish momentum, indicating a potential continuation of the downtrend.

The key support zones are marked below, with the price likely to move towards these levels if bearish momentum persists.

Technical Analysis:

Breakdown Zone: The price has breached the lower trendline of the ascending channel, confirming a bearish breakdown.

Resistance Levels: The price faces resistance around 0.0067786 - 0.0068488.

Support Targets: Possible downside targets at 0.0066848, 0.0066012, and 0.0065720.

Bearish Confirmation: A retest of the breakdown level followed by rejection strengthens the bearish outlook.

Trade Consideration:

Bearish Bias: A short position could be considered if the price fails to reclaim the broken trendline.

Stop Loss: Above the breakdown zone to avoid potential fakeouts.

Target Levels: Lower support zones for potential take-profit areas.

Conclusion:

The breakdown from the rising channel suggests a shift in market sentiment, with a bearish move likely. Traders should monitor price action for further confirmations.

USDJPY My Opinion! SELL!

My dear friends,

My technical analysis for USDJPY is below:

The market is trading on 149.96 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 148.72

Recommended Stop Loss - 150.69

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

USDJPY to the downside - Volume fatigue?Seeing a textbook bearish divergence on USDJPY – price making higher highs while volume fades. Breakdown from the rising wedge confirms weakness, and I’m eyeing a short entry around 149.18–149.74 (Fib 50%-78.6%). Stoch RSI overbought across multiple timeframes, EMA resistance holding… Looks like a clean setup for a drop toward 146.91. Let’s see if the rejection plays out.

USDJPY: Short sell trade with LuBotGood morning everyone,

this morning I received a signal alert notification from LuBot, a short on trend with a 12H timeframe.

The signal follows the main rules of a good trend, the trend cloud is negative, the moving averages are in favor of the bearish trend, the supertrend is also bearish and the last trend signal is the short one in red.

Regarding the structure and price action we see the gray candles, so the short-term structure is uncertain and currently seems to have simply made a false break of the previous highs with a return below them and the ema21.

The signal then triggers after a retracement on the trendcloud area with closing below the ema21 thus showing bearish strength.

LuBot recommends a stop above the ema200 and take profit below the latest lows and I will currently follow these levels.

Based on the subsequent movements I will decide whether to move the stop above the previous highs or the take profit to the lows area in case the price action continues to show uncertainty.

👍 If you liked this post let me know with a like

🙋♂️ Remember to follow me so you don't miss my future analyses

⚠️ Disclaimer: This post is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.

TAGS: FX:USDJPY FOREXCOM:USDJPY SAXO:USDJPY KRAKEN:USDJPY FX_IDC:USDJPY FPMARKETS:USDJPY PEPPERSTONE:USDJPY CAPITALCOM:USDJPY SKILLING:USDJPY OANDA:USDJPY

USD/JPY Analysis: Dollar Weakens After Fed DecisionUSD/JPY Analysis: Dollar Weakens After Fed Decision

Yesterday, the Federal Reserve announced its interest rate decision, which, as expected, remained unchanged. Fed Chair Jerome Powell emphasised that there is no rush to cut rates amid uncertainty surrounding US inflation and the tariff policies implemented by the Trump administration.

This key announcement triggered volatility in financial markets, notably:

→ US stock indices rose;

→ the US dollar weakened, which was evident in currency (and cryptocurrency) charts involving USD pairs.

The most significant movement occurred in the USD/JPY chart, as the Bank of Japan was also active yesterday. While it also left interest rates unchanged, it acknowledged growing uncertainty around Japan’s economy and added a new reference to the "changing trade environment."

Technical Analysis of USD/JPY

As we noted on 21 February when analysing the Japanese yen’s exchange rate against the US dollar:

→ Price fluctuations are forming a downward channel (marked in red).

→ The former support at the lower boundary of the blue channel may now act as resistance.

Since then, the price has:

→ Tested the breakout level (indicated by an arrow) before continuing to decline within the channel, confirming its relevance.

→ Reached the lower boundary of the channel and rebounded upwards from the 147 yen per dollar level.

Given that the price is closely interacting with the channel lines and is currently around its median, it suggests that supply and demand are relatively balanced under these conditions. This is further supported by the fact that neither the Fed nor the Bank of Japan introduced surprises, leaving interest rates unchanged.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDJPY -bias long based on confluences bullish indicatios:

Bullish divergenc ein daily time frame

Fib level 0.618 respected.

4 hr: Inverted hs pattern made.

Trend line support broken and respected after retracement.

resistance broken at 148.88

Formation of IHS in 1 hr as well.

trade plan bias long @ 148.782

SL:148.05

TP1:149.50

TP2:150.160

Bearish indications:

LLLH in daily time frame

JPY/USD Breakout from Falling Channel – Bullish Trading SetupOverview of the Chart:

The Japanese Yen (JPY) against the U.S. Dollar (USD) 1-hour chart showcases a well-defined market structure, transitioning from a downtrend within a falling channel to a breakout with bullish momentum. The chart highlights critical support and resistance levels, a confirmed breakout, and a forecasted price movement that could indicate further bullish continuation.

This analysis will break down the chart patterns, technical indicators, and potential trade setups, providing a professional outlook on price action behavior.

Technical Breakdown of the Chart

1. Falling Channel Pattern – Downtrend Phase

The price had been trading within a descending channel, marked by two parallel trendlines (blue lines), indicating a controlled downtrend.

A falling channel is a bullish reversal pattern, as it signals that bearish momentum is weakening.

Within the channel, price action consistently created lower highs and lower lows, adhering to the structure of the pattern.

The red dashed trendline inside the channel acted as a dynamic resistance, rejecting price movements multiple times before the breakout.

📌 Key Observation: The falling channel pattern suggests accumulation, where selling pressure gradually diminishes, paving the way for a bullish reversal.

2. Support Zone & Bullish Breakout

The price eventually reached a strong horizontal support level (highlighted blue zone at the bottom), which acted as a critical demand area.

This support level had previously led to strong rebounds, making it a significant zone for potential reversals.

Bullish breakout confirmation:

A strong bullish candle closed above the upper boundary of the channel, breaking the trendline resistance.

The breakout suggests a shift in market structure from a downtrend to an uptrend, as buyers regained control.

The price has now moved above the previous resistance, confirming the bullish momentum.

📌 Key Takeaway: The breakout is a strong signal that sellers have lost control, and a potential bullish trend could emerge.

3. Resistance Zone – Key Barrier for Buyers

The next area of interest is the resistance level (highlighted in a blue rectangular zone).

This level has historically acted as a strong supply zone, where price previously struggled to break through.

If the price manages to sustain above this level, it would confirm bullish continuation toward higher price targets.

📌 Technical View: If buyers break past this resistance, it could lead to a strong bullish rally, reinforcing the new uptrend.

4. Target Projection & Forecasted Price Movement

The chart outlines a forecasted bullish path using a zigzag projection (black lines). Here’s the expected price action:

Short-Term Movement:

Price might face temporary resistance near the blue resistance zone.

A minor pullback or consolidation in this area is expected before further movement.

Retest of Support:

If price pulls back, it could retest the broken channel resistance or the support zone.

A successful retest and bounce would validate the strength of the breakout.

Bullish Continuation:

If the resistance zone is broken, price is likely to continue toward the target level of 0.006842, a previous swing high.

This level acts as the final upside target based on historical resistance levels.

📌 Key Insight: The market structure suggests that price will follow a higher-high, higher-low pattern, which is characteristic of an uptrend.