USD/JPY: Bear Wedge and Pin Candle Flash Warning SignsThe ducks may be lining up for a resumption of the USD/JPY downtrend.

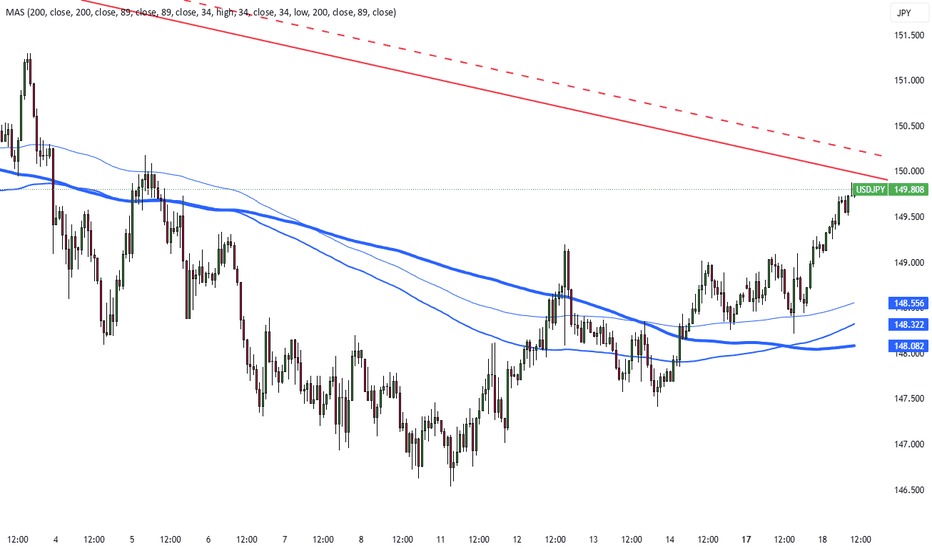

Firstly, it remains in a defined falling channel. Secondly, Tuesday’s reversal delivered a bearish pin candle, often seen around market tops. Thirdly, the rebound from last week’s lows resembles a bear wedge pattern, warning of a potential downside break and resumption of the bear trend.

Momentum indicators aren’t fully on board, with RSI (14) and MACD trending higher, so the case for initiating shorts is not yet a slam dunk. But it should be on the watchlist.

A break of the bear wedge would put a retest of 148.65 on the radar, with a move beyond that level opening the door for a possible flush towards 147.10, where buyers were lurking last week. If the price were to keep pushing higher and break channel resistance, the bearish bias would be invalidated.

As covered in the attached analysis, when it comes to risks around rates guidance from the Fed and BOJ later today, this scribe sees those for the former skewed towards a slightly more dovish outcome than market pricing, and a more hawkish tone from the BOJ.

Good luck!

DS

USDJPY.1000.DUB trade ideas

USD/JPY Direction 151 After the BoJ📊 Market Context

As of March 18, 2025, the USD/JPY exchange rate stands around 149.38, reaching its highest level since March 5. This movement is driven by expectations regarding upcoming monetary policy decisions from both the Bank of Japan (BoJ) and the U.S. Federal Reserve.

🔍 Technical Analysis

The technical analysis of USD/JPY highlights the following key points:

Current Trend: USD/JPY shows a moderate recovery, with a 0.49% increase on March 17.

Key Resistance: The area between 150.00 and 151.00 represents a significant resistance level. A decisive breakout above this zone could pave the way for further gains.

Important Supports: Support levels are found at 148.00 and 146.50. A drop below these levels could indicate a deeper correction.

Technical Indicators: Moving averages and key oscillators suggest a short-term bullish trend.

🌍 Fundamental Analysis

Several fundamental factors are influencing the USD/JPY exchange rate:

BoJ Decision: The Bank of Japan recently raised its key interest rate from 0.25% to 0.5%, citing higher wages and rising inflation. However, for today's meeting, the BoJ is expected to keep rates unchanged while assessing the impact of global trade tensions on the Japanese economy.

U.S. Monetary Policy: The Federal Reserve is expected to keep interest rates stable in the upcoming meeting, with the Fed Funds rate projected to remain between 4.25% and 4.5%.

Trade Tensions: U.S. trade policies under the Trump administration are creating economic uncertainties, influencing central bank decisions and currency markets.

🎯 Conclusion

USD/JPY is currently in a consolidation phase near recent highs. If the BoJ maintains an accommodative monetary policy and the Fed keeps rates stable, the dollar could continue strengthening against the yen, targeting the key resistance level of 151.00. However, uncertainties related to trade tensions and future central bank actions require close monitoring by investors.

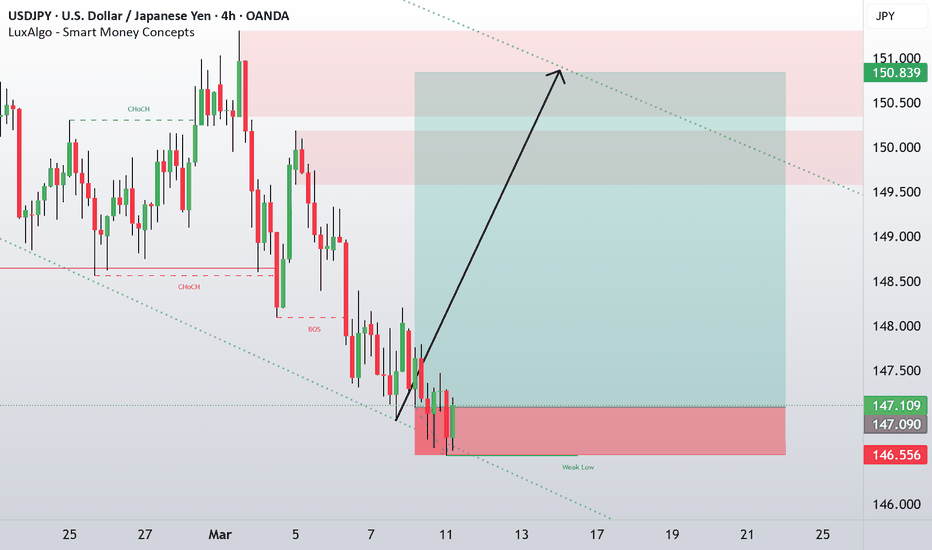

Bearish drop?USD/JPY is reacting off the resistance level which is a pullback resistance that aligns with the 127.2% Fibonacci extension and the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 149.44

Why we like it:

There is a pullback resistance level that aligns with the 127.2% Fibonacci extension and the 61.8 Fibonacci retracement.

Stop loss: 150.97

Why we like it:

There is an overlap resistance level that is slightly above the 50% Fibonacci retracement.

Take profit: 147.54

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

#002 USDJPY Moving Average 0206SGT 1503202560SMA SL set on 4H/1H, some buffer after the resistance.

1:2RR

I think that less is more is really good(learned it from Kei).

Let's say we make on average +0.3R profit per trade, but, due to all kinds of mistakes we make due to emotions, after 10, 20, 30 etc trades, we might find ourselves at +1R or +2R only at best. Instead of getting +3R, +6R, +9R or so after 10, 20, 30 trades.

So, trading less is more.

If we make 1 or 2 trades, and win once or twice, we already gotten +1R +2R, or if we won twice, +4R. And it's good.

It's the equivalent of trading 10, 20, 30 trades filled with mistakes.

Minus the stress, and commission paid.

I think I should just trade less now.

It seems that I am not progressing much, but I think I am actually progressing by ticking the boxes of questions and tasks I wanted to try but takes alot of time to try.

0215SGT 15032025

Btw, I stopped trading the trust the process of taking the opposite of my main trades because I always lose right? So, if I take the opposite trade then in theory, I would be making money.

I stopped because I trade too much. And it became tough for me to think which is my real main idea that I put effort in and hope it would fail, and which is the opposite is true I am taking.

0217SGT 15032025

USDJPY ShortI am already in a short trade with USDJPY but I will be looking for further short positioning if price can retrace to around the dotted line.

I’m looking for shorts primarily with the overall fundamental context of the US Dollar right now as a whole.

I’m not necissarily looking for a long term trade, just looking to hold over the next few days as recent lower timeframe price action (1H, 3H) have been bullish and investors may have found value in the dollar at these recent lows.

USDJPY: Bearish Continuation & Short Trade

USDJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short USDJPY

Entry - 149.59

Sl - 150.38

Tp - 148.25

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

BOJ vs Fed: diverging rate paths could weigh on USDJPYThe Bank of Japan is expected to keep rates unchanged tomorrow, but the most likely course of action will be rate increases, potentially reaching 1% by the end of the year from the current 0.5%. The Federal Reserve is also expected to hold rates tomorrow. However, with the US economy showing signs of softness, trade tariffs weighing on consumers, and sentiment at very low levels, the Fed is likely to keep rates steady. If the market gets its way, there could be up to three Fed rate cuts before the end of the year.

The combination of strong inflation and high wage growth in Japan versus moderating US economic growth suggests that the dollar-yen pair could continue to trade lower. The short-term trend remains bearish below the swing high of 151.29 from March 3, when rates reached 0.5%.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

USDJPY..next move .....Here's a structured analysis of the USD/JPY buy trade setup:

### *Trade Summary*

- *Entry*: 149.70

- *Stop Loss (SL)*: 148.00 (170 pips risk)

- *Targets*:

1. *151.00* (+130 pips)

2. *152.00* (+230 pips total)

3. *155.00* (+530 pips total)

---

### *Key Analysis*

1. *Risk-Reward Ratios*:

- *1st Target*: 0.76:1 (Risk > Reward).

- *2nd Target*: 1.35:1.

- *3rd Target*: 3.12:1 (Strong reward for risk taken).

2. *Position Sizing*:

- Ensure the 170-pip SL aligns with your risk tolerance (e.g., 1–2% of capital).

- Example: For a $10,000 account risking 1% ($100), pip value = $100 / 170 ≈ $0.59 per pip.

3. *Market Context*:

- *Fundamental*: Fed-BOJ policy divergence supports USD strength. Monitor BOJ intervention risks and Fed signals.

- *Technical*: 150.00 is a psychological level; breakout could accelerate gains. 148.00 likely marks a structural support zone.

4. *Trade Management*:

- *Partial Profit-Taking*: Close a portion at 151.00 to mitigate the sub-1:1 R:R, letting the rest ride.

- *Trailing Stop*: After hitting 151.00, move SL to breakeven (149.70). Adjust further upward as targets are reached (e.g., SL to 150.50 at 152.00).

- *Carry Trade Benefit*: Earn positive swap rates if held overnight.

5. *Risks*:

- *BOJ Intervention*: Potential sharp JPY strengthening if Japan acts to curb yen weakness.

- *Fed Policy Shifts*: Unexpected dovishness could weaken USD.

- *Volatility*: USD/JPY is sensitive to global risk sentiment and U.S. Treasury yield fluctuations.

---

### *Recommendations*

- *Use Caution on 1st Target*: Prioritize partial profits given the unfavorable R:R, but retain a portion for higher targets.

- *Monitor Newsflow*: Watch for BOJ/Fed announcements, U.S. CPI, and employment data.

- *Technical Confirmation*: Ensure bullish momentum holds (e.g., rising MACD, break above 150.00 with volume).

*Verdict*: A strategic trade with clear targets, but requires disciplined risk management and adaptability to news-driven volatility.

USDJPY Price ActionHello Traders,

I've marked a Liquidity Area and another Supply Zone on the chart. Here's what might happen next: after sweeping the liquidity, the price could touch the Supply Zone and then drop. Before acting on this, make sure you switch to either the 5-minute or 15-minute timeframe and clearly mark a Demand Zone there.

Wait patiently for the breakout. When the price breaks through that Demand Zone on the lower timeframe, set a pending order. Place your stop-loss at the recent swing high, and set your take profit at the next targeted Liquidity Level.

Many traders often wait for Fair Value Gaps (FVG), but this causes them to miss opportunities. Especially if you're struggling to pass trading challenges, give this method a try. Managing your risk carefully is the key to success.

Good luck and happy trading!

Thank you!

Japanese Yen Hits Two-Week Low Before BoJ MeetingThe yen fell past 149.5 per dollar, a two-week low, ahead of the BoJ's policy decision. The central bank is expected to hold rates at 0.5% on Wednesday while assessing U.S. policy impacts. Despite a pause, rate hikes are anticipated later this year as rising wages and inflation support policy normalization. Major firms agreed to wage hikes for the third straight year, increasing consumer spending and inflation.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

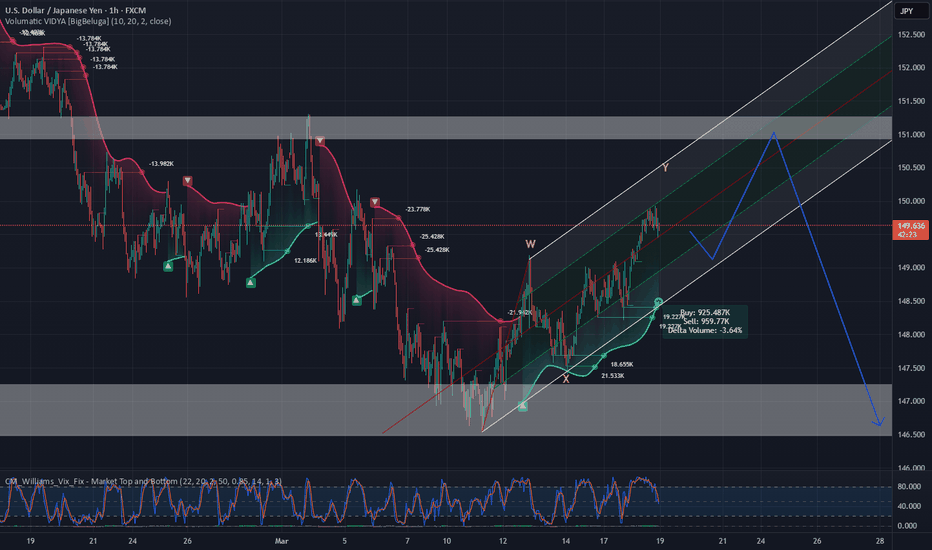

USDJPY 1H forecastAnticipating a sell-off on the USDJPY, we have an impulse pattern to the upside as a double correction pattern.

Wave (W) is a simple Zig-Zag correction, wave (X) is a simple Zig-Zag correction, and wave (Y) is a simple Zig-Zag correction.

Wave (W) and (Y) are equal we can anticipate a collapse after the price reaches 150.030

USDJPY UPDATEPrice moved up as we speculated but unfortunately it didn't trigger our orders at around 147.986 before rising.

Currently, it still shows a potential of rising to 151.067. Let's look for a retracement so that we can join the move

REMINDER

1. We shouldn't panic if we miss a good opportunity, there will always be more in the future.

2. Let's stay disciplined and focused on the process.

Below is the link of the previous analysis incase you missed it: