USDJPY.1000.DUB trade ideas

USDJPY MARCH 18 WEEKLY & DAILY BIAS

WEEKLY

After touching a weekly fvg price started to correct possibly targeting the nearest weekly buyside liquidity to continue going down. Order flow for me is bearish untill it starts forming higher low and higher highs. For now all I see is a correction on the weekly

DAILY

Daily Bias: BULLISH

I think this week will continue to be bullish until the weekly buyside is achieved or there is also a daily order block above that could be targeted and decide from there if it will continue the bearish tone one weekly

JPY/USD Price Action & Trade Setup

Market Structure & Trend:

The chart illustrates JPY/USD on the 4-hour timeframe, showing a rising channel pattern.

Price has recently rejected from resistance near 0.0068058 and is now showing signs of a bearish move.

Trade Setup:

Bearish bias: The pair is breaking down from the channel, indicating a potential trend reversal.

Key levels:

Resistance: 0.0068058

Support Zone: 0.0064368 (Target area)

Potential Move: A continuation of this bearish movement may lead to a drop toward the support zone.

Conclusion:

If the price sustains below the midline of the channel, further downside is likely.

A retest of support at 0.0064368 could offer potential opportunities for either a bounce or a continuation of the bearish trend.

📌 What’s next? Watch for price action near the support zone for potential trade setups.

USDJPY BUY OPPORTUNITY The USD/JPY pair has broken out above the 148.2 resistance level, which has now become a support level. This breakout suggests that the pair has gained significant bullish momentum and is likely to continue rising.

_New Support Level:_ 148.2

_Target Levels:_

- _TP1: 149.3_

- _TP2: 150.1_

- _TP3: 151.2_

- _TP4: 152.3_

- _TP5: 155.0_

_Reasons for the Breakout:_

1. _Technical Reversal:_ The USD/JPY pair has formed a technical reversal pattern, indicating a potential change in trend.

2. _Momentum Indicators:_ The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are showing bullish signals, indicating a potential rise in prices.

3. _Fundamental Analysis:_ The USD/JPY pair has been influenced by positive economic data from the UK, including a strong labor market and rising wages.

_Trading Strategy:_

Buyers may look to enter the market at the new support level of 148.2, with a stop-loss below 146.5. The TP levels can be used to take profits, or to adjust the stop-loss to break-even.

Keep best wishes to Travis 👍

USDJPY InsightHello, subscribers!

Please share your personal opinions in the comments. Don't forget to like and subscribe!

Key Points

- Friedrich Merz, leader of the Christian Democratic Union (CDU), expressed confidence in the constitutional amendment vote to ease the debt limit. Lars Klingbeil, leader of the Social Democratic Party (SPD), also stated he is certain the amendment will pass.

- U.S. President Trump announced plans to hold talks with Russian President Putin, raising expectations for peace negotiations between Russia and Ukraine.

- The Bank of Japan's interest rate decision this week is expected to result in no change.

- The FOMC meeting is anticipated to see the Federal Reserve keeping interest rates unchanged, with projections emerging that the Fed may only cut rates once this year.

Major Economic Events This Week

+ March 19: Bank of Japan interest rate decision, Eurozone February Consumer Price Index, FOMC meeting results

+ March 20: Bank of England interest rate decision

USDJPY Chart Analysis

The pair is maintaining its upward momentum, supported by trendline support. In this rally, the 150 level appears to be a key resistance point. However, with the Bank of Japan’s rate decision and the FOMC meeting scheduled this week, it is crucial to monitor any potential trend changes. If the price breaks above the recent high, a move toward 154 could be possible. Conversely, if resistance holds at 150, a decline toward 145 is likely.

Correction on USD/JPY is over. Bear is Back on Action!Hi All,

As you can see from my previous trade, I close my trade at the level around $150 because the price action showed correction was coming.

The price has been testing on this level $149 zone 3 times which shows this level is pretty strong level where bears keep pushing the price down. In addition, the price is still below 100 EMA as well which is showing again bears are in control. Lastly, in 4 hours time frame, has printed hang in man red candle.

I enter the trade at $148.50, TP $140, SL 148.50. Let's hope it play out well.

Good luck traders,

Redpanda trader

USD/JPY Eyes 151 Resistance After Bullish BreakoutLast week, USD/JPY reached my target at the 146 zone. After testing this support level, the pair began to reverse upward and broke above the falling wedge pattern, signaling a potential trend change.

On Friday, the pair formed a higher low, followed by another one today.

As of now, USD/JPY is trading at 147.75, just below a key horizontal resistance level. A breakout above this level could lead to further upside, with the next target around the 151 resistance zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

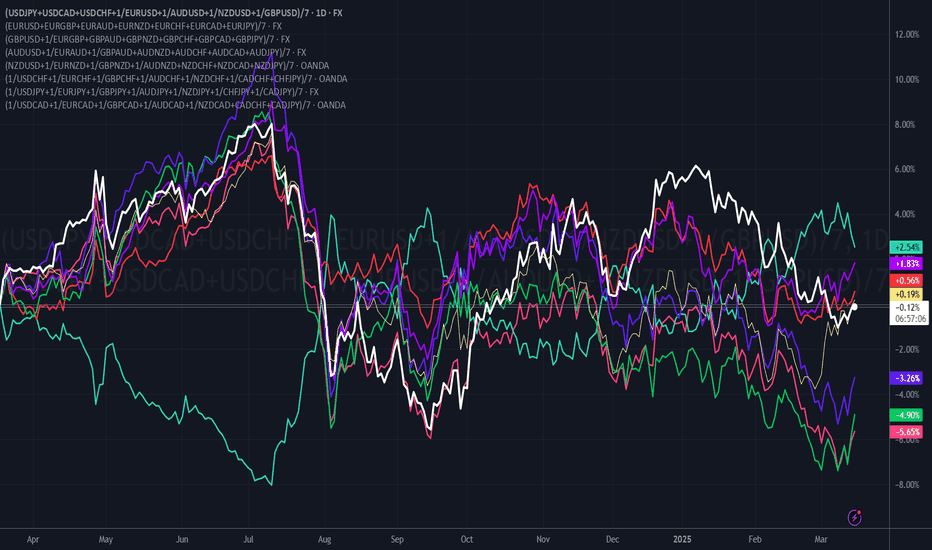

Sentiment Extreme on the Yen Could Bode Well for Commodity FXI take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope.

Matt Simpson, Market Analyst at City index and Forex.com

USDJPY Massive Short! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 150.60

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 149.93

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

USDJPY S&R IN 1-H AT MUST WATCH OUTHello Guys Here Is Chart Of USDJPY in 1-H AT

Entry Level: BUY Around 148,300 - 148,000

Target Will Be : 149,300

Support: 148,000 The yellow circles highlight previous points where the price respected this trendline as support

However, if the price breaks below the trendline, the bullish scenario may be invalidated.

USD/JPY Technical Analysis & Trade Outlook – March 16, 2025Current Price: 148.618

EMA (30): 148.545 (short-term trend)

EMA (200): 148.286 (long-term trend)

Resistance Zone: 149.233

Support Zone: 148.286

Analysis & Price Action:

The price is trending upwards, forming higher lows, indicating bullish momentum.

The price is above both the 30 EMA and 200 EMA, which suggests an ongoing uptrend.

A support level around 148.286 is holding, reinforcing a bullish bias.

Forecast & Trade Plan:

A potential breakout above the minor resistance could push USD/JPY towards the 149.233 target.

If price retraces, a bounce off 148.286 would present a buy opportunity.

If price breaks below 148.286, the bullish outlook weakens, and further downside may follow.

📌 Bias: Bullish towards 149.233

📌 Confirmation: Watch price action at support and resistance levels

📌 Risk Management: Consider stop-loss below 148.200 to protect downside.

Would you like further details on trade entry points?