“USD/JPY | 30M CHoch > inducement > 4H Play”30M just gave a clean CHoCH, breaking a major LH, signaling bullish intent—at least for now. I’m waiting for inducement to be taken before price taps into my order block, lining up with the 4H move. The goal? Ride price up into 4H supply, then look for the sell-off from mitigation. Letting price show its hand first.

Bless Trading!

USDJPY.1000.DUB trade ideas

USDJPYWeekly

1. Historically extreme COT in trade positioning; the trend usually turns in favor of the dollar on trade position changes.

2. MACD has bullish convergence.

3. The 2021 trend line has been touched at the 61.8% Fibo.

4. Possible formation of an ABC wave 4 triangle. The possible next wave will be a 5 and the target level is 175, the extreme target is 206

Daily and hour timeframe

5. The last movement is a higher high and higher low, this could be a new channel

6. The invalidation level for my arguments is 147.350

What do you think?

USD/JPY Price Rejection at Resistance with Potential Bearish.hello traders.

what are your thoughs on USD/JPY.

my idea is

. Trade Setup:

Entry: Around 148.153, aligning with the pullback area.

Stop Loss: Above 148.624, placed strategically to avoid minor fluctuations.

Take Profit Levels:

First Target: 147.596 – a potential support level where price may find temporary stability.

Final Target: 147.167 – deeper support level indicating further bearish continuation.

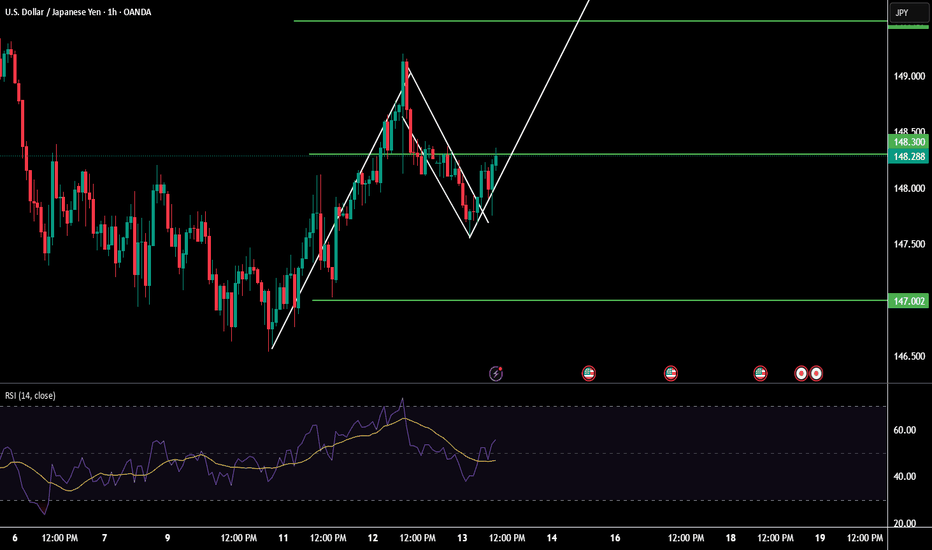

USD/JPY Bearish Outlook: Key Support Levels to WatchUSD/JPY 4-hour chart is showing a clear downtrend, with price forming lower highs and lower lows. A recent retracement has tested a previous support-turned-resistance zone (148.240 - 148.262), and rejection from this level indicates the potential for further downside movement.

Bearish Confirmation & Entry:

The price is currently testing the 148.240 - 148.262 resistance zone.

A strong rejection from this level would confirm a sell setup.

The trade setup suggests a move towards the next key support zones if momentum continues downward.

Target Levels:

First Take Profit (TP1): 146.543 (Recent low & strong support level)

Second Take Profit (TP2): 145.807 (Key demand zone)

Final Take Profit (TP3): 142.960 (Major psychological support)

Risk Management:

Stop-loss placement: Above the 148.262 resistance zone, ensuring protection against unexpected bullish reversals.

The risk-to-reward ratio is favorable, with a structured trade setup providing a high-probability short opportunity.

USD/JPY at a Key Level: Is a New Trend Emerging?USD/JPY is currently in the D1 discount zone and approaching a D1 FVG, where a potential reaction may occur. The price is moving within a downtrend channel for now.

If a reaction happens at this level, we should wait for a channel breakout. A trade opportunity arises either on the breakout retest or immediately after the breakout, confirming bullish momentum and increasing the probability of an upward move.

Risk Management Strategy:

To secure profits and manage risk effectively, consider scaling out at key levels:

• Target 1: Close 25% of the position to secure initial profits.

• Target 2: Close 50% of the position to lock in more gains.

• Target 3: Close 100% of the remaining position for full take profit.

Risk Reward 1.3

Monitoring price action closely at this level is crucial.

USDJPY SHORTsMarket structure bearish DW

Entry at both Weekly and Daily

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 149.000

H4 Candlestick rejection

Levels 10.23

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Bullish bounce?USD/JPY is falling towards the support level which is an overlap support that aligns with the 127.2% Fibonacci extension and the 71% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 147.31

Why we like it:

There is an overlap support level that aligns with the 127.2% Fibonacci extension and the 71% Fibonacci retracement.

Stop loss: 146.54

Why we like it:

There is a pullback support level.

Take profit: 148.14

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish Quarterly Outlook on USDJPY - Read Me :) In this chart I've outlined my price anticipation / forecast for Q2 2025.

Over the next 3-4 months I feel that it's very likely for USDJPY to trade to 160. If you have any fundamentals that could add to this please add under the comment sections.

Disclosure: My price analysis was not primarily based on any fundamentals but instead it's based on a technical view as to where I think price is most likely to trade to based on historic price action. I did do very some research (linked below) which appears to add further confidence to my view.

Morgan Stanley fundamental research on the US dollar, fixed income market and other credit markets: www.morganstanley.com

Based on a quick read on the above article, Morgan Stanley views the dollar to remain strong for reasons explained in the article. Stronger dollar equals higher JPY prices.

Quick note on yields (see the above link as my source). "...., risk premiums are still below long-term averages and are still likely to move higher — the timing and extent of which remain distinctly uncertain. It is very possible that U.S. Treasury yields remain in a broad 4%-5% range in 2025, which, if it did happen, would be a big positive after 2024’s mediocre performance".

Key takeaways for me:

If yields go higher, then the US dollar (DXY) will very likely trade higher and this will therefore result in higher prices for USDJPY.

Let's see how things turn out :)

Diego

USDJPYThis pair has been under pressure because of Mr. Trump, but now it's time to see it rebound toward the top of the harmonic pattern. Today is a good day to start positioning yourself. However, remember that we're looking at a daily chart, which means that time is a factor, so this isn't a trade for over-leveraging.

USDJPY UNFINISHED BUSINESS UPPER SIDE BFR WE GO DOWN AGAIN :)Im waiting this to play out on the 15m time frame

Will buy around 147.44-147.34 area (with good candle BULL Confirmation)

I have 2 Target for this 149.473 and 151.12 (151.12 will be good area to look for SELL)

I will update this once im in

Happy trading :)

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Is Going Down! Short!

Please, check our technical outlook for USDJPY.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 147.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 146.645 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!