USDJPY - 4H more fall expectedFX:USDJPY - 4H Update 🔻

If you've traded USDJPY in recent years, you're no stranger to the significance of the 150.00 zone. This level has historically acted as a critical resistance and psychological barrier.

Now, the pair is trading below this key level and has also broken the ascending channel support on the daily timeframe, signaling that bulls are likely out of the game. The recent drop to 147.00 and bounce toward 151.00 could be setting up the next short opportunity.

📌 What to watch for:

A liquidity grab above the 151.50–152.00 zone could occur before the next fall.

This aligns with institutional behavior, hunting stops before continuing the trend.

We're now in a sell-the-rally phase, watching for confirmations around the red zone.

Remember, I previously signaled a short from the 157 zone, which played out beautifully. We’re now gearing up for the next big short, and this setup might just be it.

📉 Stay cautious, wait for price action signals, and trust the structure.

💸 If you’ve missed previous entries, don’t miss what’s coming next!

🔔 Follow for real-time updates and live trade ideas!

USDJPY trade ideas

USD/JPY : Bulls are coming back?! Let's See! (READ THE CAPTION)Upon analyzing the USD/JPY daily chart, we observe that the price precisely hit our previously forecasted target of 148.65 before declining further to 146.5. Following that, USDJPY rallied back up to 151 and is currently trading around 150.680. Should the price manage to stabilize above 150.5, we can anticipate further gains in this pair. This analysis will be updated accordingly.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

JPY/USD - Will we make a strong bounce?The JPY/USD is in a downward channel. Will it find support around 0.006 and rebound, or will it break below this key level?

The pair has nearly reached a major support zone—an area where buyers have previously shown strong interest. This level has historically acted as both strong resistance and support, increasing the likelihood of a bounce if buyers step in.

What do we want to see?

For a continuation to the upside, we need this level to hold as support. A bullish engulfing candle could signal a potential reversal.

If JPY/USD is to move lower, we need a clear break below support with high volume to confirm the breakout. In that case, lower prices could follow.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

USDJPY Faces Strong Resistance at 151.20 USDJPY Faces Strong Resistance at 151.20

USDJPY tested a strong resistance zone near 151.20. The initial reaction was solid, reinforcing the importance of this level.

Sellers appear to be defending 151.20, as the price has moved down twice after testing the area, successfully halting bullish momentum both times.

If this resistance holds, USDJPY could continue its downward move toward these targets: 🎯 148.85 🎯 148.20 🎯 146.95 🎯 145.80

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/JPY - Bearish breakdown signals further downside potential!The USD/JPY pair has been experiencing a clear daily downtrend, characterized by a bearish market structure and strong downward momentum. Sellers have remained in control, pushing prices lower as the pair continues to respect the prevailing bearish trend. With each failed attempt at recovery, the market structure reinforces the dominance of sellers, signaling that the path of least resistance remains to the downside.

Despite this overall downtrend, the 4-hour timeframe recently exhibited a rising channel, where price action formed higher highs and higher lows, suggesting a temporary bullish retracement within the larger bearish structure. However, this channel has now been broken, signaling a potential shift back toward the primary trend. A break of this nature often suggests that the bullish correction has exhausted its strength, and sellers are regaining control to push the price lower once again.

Following the breakdown of this rising channel, the price has failed to reclaim previous highs, instead forming a lower high—a strong indication that bearish pressure is resuming. Given this development, there is a significant possibility that USD/JPY could retrace toward key technical levels, such as the Golden Pocket (between the 0.618 and 0.65 Fibonacci retracement levels) or even the 4-hour Fair Value Gap (FVG) around 145.00.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

USDJPY 4H USDJPY Analysis

The previous bearish outlook was invalidated early in the week with a break above 149.4, confirming a bullish trend. The uptrend is expected to continue toward 152.73.

However, on the higher timeframe, an unusual price structure suggests a bearish formation, aligning with my projected setup.

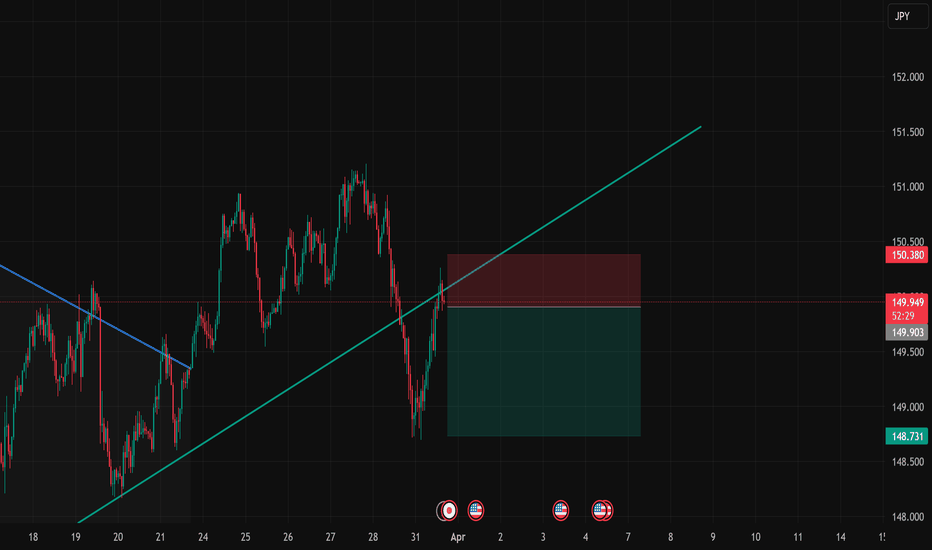

USDJPY NEXT MOVE Support Breakdown:

The analysis assumes that the price will respect the support level and bounce back up. However, if the support at around 149.000 is broken, we might see a further decline rather than a bullish reversal.

2. False Breakout at Resistance:

The target suggests a move toward 151.000 resistance. However, price might fail to break above resistance and reverse back down, trapping buyers in a bull trap.

3. Sideways Movement (Consolidation):

The price may not follow the expected movement and could enter a range-bound phase, moving sideways between support and resistance.

4. Fundamental Factors:

Unexpected economic news, central bank intervention, or geopolitical events could disrupt the technical setup, leading to an outcome that does not follow the projected path.

Bearish drop off overlap resistance?USD/JPY is reacting off the pivot and could drop to the 1st support which has been identified as an overlap support.

Pivot: 151.23

1st Support: 149.91

1st Resistance: 152.23

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Daily CLS I KL - Order Block, Model 3 Continuation setupHey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔

USDJPY I Weekly CLS, KL - Monthly OB, Model 2Hey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔

USDJPY → Key Level Retest. Attempt to change the trend FX:USDJPY in the correction phase is retesting the previously broken boundary of the downtrend. The market is trying to break the trend on the background of the dollar correction

The dollar is having a rather difficult life because of economic and geopolitical nuances regarding the USA, as well as high inflation. Against this background, the index may continue a deeper correction, as the rhetoric of interest rate cuts may be prolonged, which may put pressure on the markets.

The currency pair tried to overcome the downtrend resistance earlier and succeeded, but this is not enough for a trend change, it needs confirmation.

Support levels: 148.92, 148.21

Resistance levels: 150.16, 150.95

If the bulls hold the defense above 148.92 - 149.5, we have a good chance to catch a trend change. It will be the readiness to go to the resistance of 150.16 range, and the breakout of this level and price fixation above it will be the confirmation of the trend change

Regards R. Linda!

USD/JPY Trend Before and After Tariff Announcement✍ ✍ ✍ USD/JPY news:

➡️ Federal Reserve officials have indicated that interest rates should remain in the current range of 4.25%–4.50% for an extended period until they can assess the impact of Trump’s tariffs on inflation and economic growth.

➡️ Stronger-than-expected US ADP data provided significant support for the sharp rise in USD/JPY.

➡️ Meanwhile, the Japanese Yen (JPY) weakened against other currencies, as Trump’s policies could have a significant impact on Japan’s economic growth, given its status as one of the US’s key trading partners.

Personal opinion:

➡️ Trump’s tariff policies will significantly impact the economy nhant65. So JPY will weaken and USD/JPY will be strongly supported

➡️ Analyze based on physical dimensions - support and quantify reasonable volume with EMA to come up with a suitable strategy

Plan:

🔆Set up price zone:

👉Buy USD/JPY 149.75 – 149.85

❌SL: 149.40| ✅TP: 150.45 – 150.95

FM wishes you a successful trading day 💰💰💰

USD/JPY: Tariff Looms, Pressuring Range FloorOn Wednesday, the USD/JPY continued to weaken and further dropped below the 150 mark, which has turned into a strong resistance level (three consecutive upward attacks have stalled here).

The new round of weakness is exerting pressure on the 20-day moving average (149.06, where bears have encountered strong resistance in the past two days). This moving average, together with the 50% retracement level (148.87) of the upward move from 146.53 to 151.20, provides good support.

Ahead of tonight's tariff decision, the rising risk - averse sentiment continues to shore up the demand for the Japanese yen as a safe - haven asset.

If President Trump opts to fully implement the import tariffs, this currency pair is likely to decline more rapidly, which will exacerbate the trade war and further disrupt the already fragile global economic situation.

A sustained break below 149.06/148.87 will confirm the end of the corrective phase (146.32/151.20), with downward targets at 148.32 and 147.64 (Fibonacci 61.8% and 76.4% retracement levels respectively).

The strong resistance at 150.00 (psychological barrier/10-day moving average) should cap the upside and maintain a bearish bias. However, a valid upward break would reverse the situation.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

USDJPYHello Traders! 👋

What are your thoughts on USDJPY?

USDJPY is moving within a descending channel and has currently reached the top of the channel, just below a resistance zone.

We anticipate some consolidation in this area, followed by a potential drop toward the bottom of the channel.

For a safer sell entry, it’s better to wait for a break below the specified support level.

After the breakout, a pullback to the broken support could offer a good sell opportunity.

💡Will USD/JPY respect the channel and head lower, or break out to the upside? Share your view below! 👇

Don’t forget to like and share your thoughts in the comments! ❤️

USDJPY Trending Lower - Will It Drop To 145.200?OANDA:USDJPY is currently trading within a descending channel, indicating a strong bearish structure. The price has broken below a key support zone and may now pull back for a potential retest. This level previously acted as support and could now serve as resistance, aligning with a possible bearish continuation.

If sellers confirm resistance at this zone, the price is likely to move downward toward the 145.200 target. However, a failure to reject this level could indicate a potential shift in momentum.

Traders should monitor for bearish confirmation signals, such as bearish engulfing candles, strong wicks rejecting the resistance zone, or increased selling volume, before considering short positions.

Let me know your thoughts or any additional insights you might have!

USDJPY Price ActionHello Traders,

As you can see, the price dropped from the previous supply zone and has formed a new one. Along the way, it created both internal and external liquidity, which helps strengthen the newly formed zone — a common pattern we see repeatedly.

Remember, just because price didn’t move as expected and hit your stop loss, it doesn’t mean your analysis was wrong. That’s exactly why we use stop losses — to protect our capital before chasing profit.

I’ve marked the internal and external liquidity, along with the new supply and demand zones on the chart. As always, without liquidity, there’s no valid zone confirmation. Risk management is key — that’s all you really need.

Wishing you all the best and happy trading.

Thank you!

Falling towards overlap support?USD/JPY is falling towards the support level which is an overlap support that aligns with the 61.8% Fibonacci retracement and the 138.2% Fibonacci extension and could bounce from this level to our take profit.

Entry: 149.59

Why we like it:

There is an overlap support level that aligns with the 61.8% Fibonacci retracement and the 138.2% Fibonacci extension.

Stop loss: 149.21

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 150.11

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

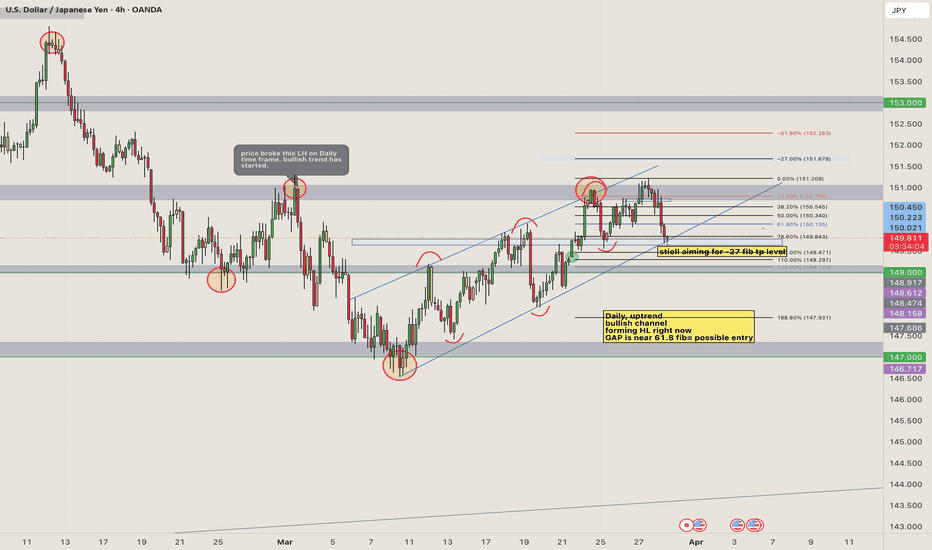

USDJPY-LONGusdjpy has been on a bullish uptrend over the last few days. From a technical standpoint, no market structure has been changed yet for uptrend. On the daily however, downtrend has changed, LH has been broken and Higher high is in the process of being made. price has been respecting my upward channel and im looking for buys with a TP near my -27 area. Will wait for fundamental news to align with my technical for sure but im bullish on UJ.