USDJPY at Major Support Level - Will Buyers Step In?OANDA:USDJPY has reached a major support level, marked by significant buying pressure. This area has historically acted as a strong demand zone, increasing the likelihood of a bullish reaction if buyers step in again.

The current market structure suggests that if the price confirms a rejection from this support level, there is a high probability of an upward move. I anticipate that, if rejection occurs, the market may head higher toward the 147.570 level, which serves as a logical target within the current structure. However, a break below this support would invalidate the bullish bias and could lead to further downside.

This setup reflects the potential for a retracement after an impulsive move, supported by the confluence of previous price behavior and the current structure. If you agree with this analysis or have additional insights, feel free to share your thoughts in the comments!

USDJPY trade ideas

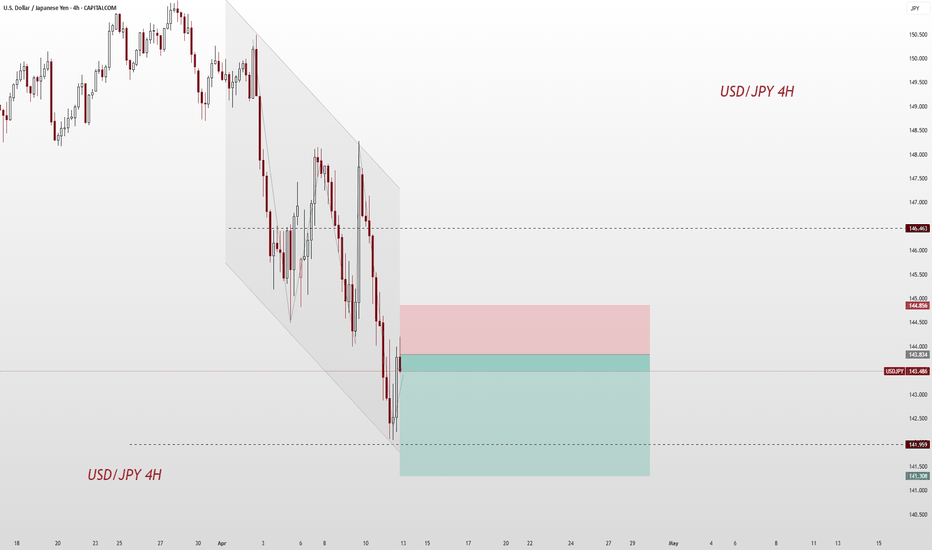

USD/JPY) demand and supply analysis ); Read The ChaptianSMC Trading point update

shows a bearish setup for USD/JPY on the 1-hour timeframe. Here’s a breakdown

---

1. Trend Context:

Downtrend: The pair is clearly in a bearish channel, forming lower highs and lower lows.

200 EMA (~146.297) is above price and sloping down — confirms bearish bias.

---

2. Key Zones Identified:

Supply Zone (~144.800–145.200): A strong area of resistance where sellers may re-enter. If price returns here, it’s a potential short setup.

Demand Zone (~142.800–143.100): A possible reaction point where short-term buyers may provide a bounce.

Target Point (~141.168): A projected target if the downtrend continues and demand zone fails.

---

3. Expected Scenarios:

Primary Bearish Move:

Price may react from current levels or from the demand zone.

A pullback to the supply zone is expected before continuation downward.

Then, sell-off toward the target zone around 141.168.

Alternate Play:

Price could bounce between the demand and supply zones a bit more before breaking down.

---

4. Indicators:

RSI (~46.37): Shows room to the downside before oversold, aligning with bearish momentum.

Mild bullish divergence in RSI recently, suggesting potential for a small pullback or bounce.

Mr SMC Trading point

---

Summary of Idea:

This is a sell setup:

Sell entries: Ideal around the supply zone (144.8–145.2).

First target: Demand zone (~143.0)

Final target: 141.168

Invalidation: Break above 146.30 (200 EMA and channel resistance).

pales support boost 🚀 analysis follow,)

#USDJPY: Huge Risk To Buy Read The Description

Trading JPY pairs is risky due to the market’s volatility.

USDJPY fell below our buying zone due to JPY’s bullishness and USD’s weakness. While USD has yet to recover, JPY is consolidating. The market is undecided, leading to unusual market movements. We have three targets in this chart analysis. Use it as an alternative bias and have your own analysis and trade management.

Thanks for your support. We expect it to increase, helping us post more analysis.

Much Love🧡

Team Setupsfx

#USDJPY:1351+ Bullish Move One Not To Miss| Three TPs| JPY has been bullish since the dollar strengthened, potentially leading to a trade war that would make the Japanese yen more valuable to global investors. However, we may see a strong correction on all XXXJPY pairs, potentially returning stronger with a major bullish correction. We’re not sure if the price will hit all three take profit zones, but we’re interested in how far it goes.

Use accurate risk management. This analysis is purely for educational purposes only. Use your own knowledge and analysis before taking any entries.

Team Setupsfx_

USD/JPY Under Pressure – Bears Take the Lead After Break of Supp📊 USD/JPY Daily Technical Outlook – April 11, 2025

Overview:

The USD/JPY pair experienced a significant decline on Friday, opening at 145.22, reaching a high of 145.50, and a low of 142.04, before closing at 142.30. This downward movement reflects the continuation of the bearish trend from earlier in the week, influenced by safe-haven flows into the Japanese yen amid escalating trade tensions and weaker U.S. economic data.

Mitrade

📈 Current Market Structure:

After a period of consolidation, the pair broke below key support levels, signaling strong selling momentum. This move comes amid concerns over the U.S. economic outlook and increased demand for the Japanese yen as a safe-haven currency.

🔹 Key Resistance Levels:

143.45: The previous support level, now acting as immediate resistance. A break above this level could indicate a potential reversal.

145.08/145.91: A significant resistance zone. A move above this area could challenge the bearish outlook.

147.85: A major resistance area, which could be a target for buyers if the bullish trend resumes.

FOREX24.PRO

🔸 Key Support Levels:

142.04: The low for the day, which acts as immediate support. A stay above this level may prevent further declines.

Mitrade

139.59: A significant support level. A break below this could signal a continuation of the downtrend.

FX.co

137.92: Strong support, marking a previous high from March 2023.

FX.co

📐 Price Action Patterns:

The strong bearish candles in recent days indicate dominance by sellers. The breakout below previous support levels and the formation of lower lows support the continuation of the downtrend. However, traders should watch for potential reversal patterns as the price approaches key support areas.

🧭 Potential Scenarios:

✅ Bullish Scenario: If USD/JPY holds above 142.04, the pair may attempt a rebound towards 143.45 and potentially 145.08/145.91, driven by short-term profit-taking and potential easing of risk-off sentiment.

❌ Bearish Scenario: If USD/JPY fails to sustain above 142.04, a decline to 139.59 could occur. A break below this level could lead to further declines towards 137.92.

📌 Conclusion:

USD/JPY is exhibiting strong bearish momentum, influenced by safe-haven flows into the Japanese yen and concerns over the U.S. economic outlook. A sustained break below support levels could lead to further declines. Traders should monitor key support and resistance levels and stay informed on global economic developments.

Mitrade

Note: This analysis is based on data available up to April 11, 2025. Always monitor the latest developments and apply appropriate risk management when trading.

USD/JPY - What to expect as price consolidates above support?Introduction

The USD/JPY pair has been in a clear daily downtrend, marked by a bearish market structure and strong downside momentum. Sellers remain firmly in control, consistently driving prices lower as the pair respects the prevailing trend. Each failed recovery attempt only reinforces the bearish structure, suggesting that the path of least resistance continues to be to the downside.

FVG

Following the most recent drop, the pair is now consolidating just above a key support level. A short-term relief bounce toward the 4-hour Fair Value Gap (FVG) wouldn't be unexpected. This particular FVG, formed during the last leg down, remains unfilled — and such gaps are often revisited before the trend resumes.

Confluences

Notably, this FVG aligns with the Golden Pocket Fibonacci retracement zone (0.618–0.65), adding further confluence and making it a potentially strong resistance area. If price does retrace into this zone, it could face significant selling pressure and resume its move back toward the daily support zone.

Conclusion

While a bounce from daily support is possible, I expect USD/JPY to encounter resistance at the 4H FVG level. This could cap any recovery attempts and signal a continuation of the broader bearish trend.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

USDJPY Bearish Flag Breakdown – Eyes on 140.11 Support ZoneUSDJPY is showing signs of a bearish continuation, following a breakdown from a rising wedge pattern. The recent strong drop confirms a shift in momentum from bullish to bearish, with price now forming a bear flag just below a key structure.

Key Technical Zones:

Current Price: 147.78

Resistance Area (Invalidation Zone): 148.11 – 151.44

Support Targets:

TP1: 142.87

TP2: 140.11

Technical Confluence & Patterns:

✅ Series of Rising Wedges followed by sharp breakdowns

✅ Bear Flag Pattern forming after recent drop

✅ Lower highs & lower lows confirming downtrend

✅ Volume spike during breakdown, low volume on pullback

Trade Outlook:

📉 Bias: Bearish below 148.11

📌 Entry Zone: On confirmation of flag breakdown

🎯 Target 1: 142.87 – Previous horizontal support

🎯 Target 2: 140.11 – Major swing support / demand zone

🛑 Invalidation: Break above 151.44 (major resistance zone)

Conclusion:

USDJPY is set up for a potential bearish continuation as it respects a textbook flag breakdown setup. A close below 147.50 would reinforce bearish pressure with further downside toward 142.87 and 140.11. Traders should monitor momentum and structure confirmation before entering positions.

Let me know if you want a short caption or video script version! 📉

USD/JPY Bearish Reversal Setup – Short from Resistance ZoneCurrent Price: ~146.252

EMA 30 (Red): ~146.573

EMA 200 (Blue): ~146.662

The price is below both EMAs, suggesting short-term bearish momentum.

📉 Trade Setup:

Entry Point: 146.551 (marked on the chart)

Stop Loss (SL): 148.514 (above resistance zone)

Take Profit (TP): 142.374 (marked as “EA TARGET POINT”)

Risk/Reward Ratio (RR): Approx. 1:2.5+

📌 Zone Analysis:

Resistance Zone: 147.6 – 148.5 (highlighted in purple)

Previous highs rejected from this level multiple times.

Sellers appear to be defending this zone strongly.

Support Zone: 142.3 – 143.0

Previous accumulation zone marked for the TP.

🧠 Bias & Interpretation:

Bearish Bias: Confirmed by:

Price rejection from resistance.

Below both EMA 30 & EMA 200.

Bearish engulfing patterns near the resistance zone.

Potential Strategy: Short from 146.551 targeting 142.374 with tight SL at 148.514.

⚠️ Watch for:

Any bullish crossover between EMA 30 and EMA 200 could shift momentum.

False breakouts above the resistance zone before actual reversal.

Key U.S. or Japan news that may cause volatility.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/JPY: Bearish Trend Remains StrongUSD/JPY: Bearish Trend Remains Strong

In our previous analysis, USD/JPY tested the resistance zone and responded as expected. The market is still uncertain regarding Trump's tariff policies, but as long as the price respects the 144.40 resistance level, the downward trend is likely to continue.

It may take time, but based on current data, the direction remains bearish. Potential targets for further declines are 142.00, 140.00, and 138.00.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WHY USDJPY BULLISH ??DETAILED ANALYSISUSDJPY is currently reacting strongly from a well-established demand zone near the 142.50–143.00 level. After a sharp correction, price has shown signs of exhaustion at support, suggesting a potential bullish reversal is underway. If this bounce sustains, we could see a significant upside move toward the 157.00 region, aligning with the previous high and maintaining the longer-term bullish structure.

From a technical standpoint, this level has historically acted as a key pivot zone. The bullish engulfing candlestick pattern forming here hints at renewed buyer interest, and with risk-reward highly favorable, this could be an ideal entry point for swing traders. The risk remains limited below 139.00, while the upside potential offers over 1:3 reward.

Fundamentally, the divergence in monetary policy between the Federal Reserve and the Bank of Japan continues to support a bullish outlook for USDJPY. Recent U.S. inflation data came in hotter than expected, reigniting speculation that the Fed may delay rate cuts. Meanwhile, the BoJ has shown minimal inclination to shift away from ultra-loose policy, keeping the yen pressured.

This pair remains one of the top-watched on TradingView, drawing high search volume due to its volatility and potential breakout structure. With market sentiment leaning risk-on and yield differentials favoring the dollar, this rebound from support could be the beginning of a new leg up. Keep an eye on DXY movements and U.S. treasury yields for confirmation.

USD/JPY) Bullish reversal analysis Read The ChaptianSMC Trading point update

This chart is for USD/JPY on the 1-hour timeframe, and it presents a bullish trade setup. Let’s break down the idea

---

Key Observations:

1. Current Price:

USD/JPY is trading around 146.281.

2. Overall Bias:

Bullish setup expecting a bounce from demand into a higher target zone.

3. EMA 200:

Price is currently below the 200 EMA (147.942), which usually suggests a bearish trend — but this setup is aiming for a short-term bullish retracement.

4. Demand Zone (Buy Area):

Marked in yellow between 145.822 and slightly above.

Labeled as "FVG orders" (Fair Value Gap), suggesting institutional interest or imbalance fill.

5. Trendline Support:

The price is approaching a rising trendline, adding confluence for a potential bounce.

6. Expected Move:

Price is expected to bounce from the demand zone, form a higher low, and then move up toward the target zone at 148.221.

Two upside targets are drawn:

First Move: ~1.12% (30.6 pips)

Full Target: ~1.76% (256.1 pips)

Mr SMC Trading point

7. RSI (Relative Strength Index):

RSI is around 37.66, nearing oversold territory, supporting a bullish reversal idea.

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Around 145.822 (fair value gap & trendline support)

Target Zone: 148.221

Stop Loss: Likely just below the demand zone or trendline

Confluence Factors:

Trendline support

RSI nearing oversold

Fair value gap zone

EMA 200 overhead (target acts as resistance)

---

Pelas support boost 🚀 analysis follow

XAU/USD 15-Min Chart Breakdown!Market Outlook – 15-Minute Chart Analysis

After reaching an all-time high (ATH), price action retraced to 3193 before finding support and consolidating within a rising wedge pattern inside a defined channel. The confluence of the rising wedge, declining volume, and resistance near the upper boundary of the channel suggests a potential bearish move.

We anticipate a downward push to fill the weekend breakaway gap, as illustrated on the chart. As long as the shiny metal remains below the key resistance at 3216, the bearish outlook remains valid, with the target marked clearly on the chart.

However, if price breaks above the channel’s upper boundary and decisively surpasses the 3216 resistance level, we could see a bullish continuation toward 3236.

⚠️ Reminder: Every trade carries risk. Always apply proper risk management to protect your capital first.

Wishing you a successful and green trading week!

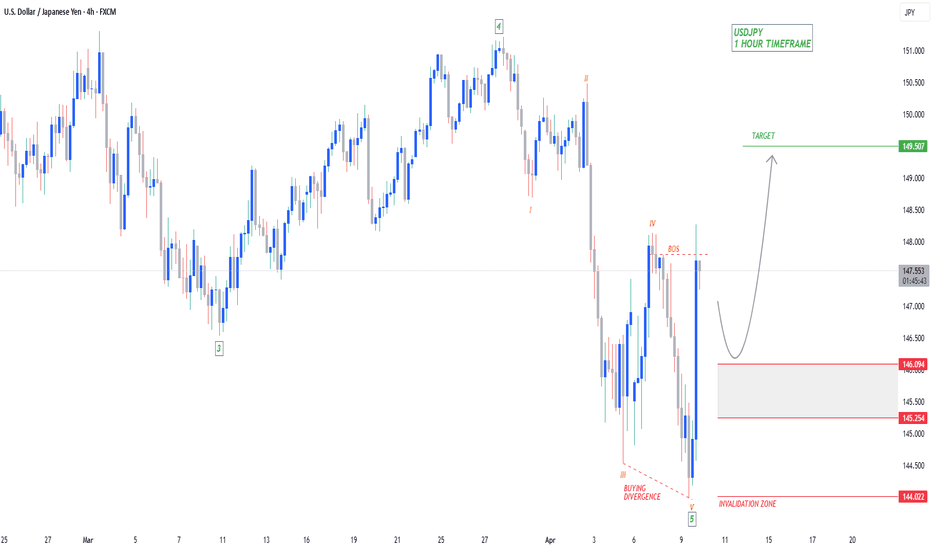

USDJPY Bullish to $149.500Rather than buying at the top of the ‘Impulse Wave’, wait for a ‘Wave 2’ or ‘Wave B’ correction towards the support zone, so you can buy back at a cheaper price.

⭕️5 Major Wave Bearish Move Complete.

⭕️5 Minor Waves Complete in Wave 5.

⭕️BOS Confirming Bullish Structure Now Valid.

USD/JPY Bullish Reversal Setup – Long Entry at 141.964 Targeting ahemdsaeed25: USD/JPY Long Setup – Eyeing 150.537 Target"

"Potential Bullish Reversal on USD/JPY"

"Swing Trade Alert: USD/JPY Long from 141.964"

"USD/JPY Breakout Play – Buy Zone Identified"

Let me know your tone preference (technical, casual, professional, etc.) and I can tailor the title further.

ahemdsaeed25: This chart is for the USD/JPY (U.S. Dollar / Japanese Yen) pair on the 1-hour timeframe, and it's displaying a bullish setup with a clear trade idea. Here's a breakdown of the analysis:

Key Components:

Current Price: Around 142.574.

Entry Point: 141.964

Stop Loss: 140.547

Take Profit / Target Point: 150.537

Reward-to-Risk Ratio: Favorable (approximately 5.94% upside, large potential move).

Indicators:

EMA 50 (Red Line): 142.798 — acting as near-term dynamic resistance.

EMA 200 (Blue Line): 144.699 — major resistance and a trend filter (downward trend visible).

Zone Analysis:

Support Zone (Purple Box near 141.964 - 140.547): This is the accumulation/buy zone.

USD/JPY 4H Chart – Technical & Fundamental AnalysisUSD/JPY 4H Chart – Technical & Fundamental Analysis

On the 4-hour time frame, price is in a clear downtrend, forming lower highs and lower lows. As the downward movement continues, we’ve identified a minor key resistance level at 148.800, along with two minor key support levels — one at 146.000 near the current price, and another at 140.400.

Price has already broken below the minor support, triggering sellers’ pending orders. This also serves as an accumulation phase for market makers. As expected, price did not immediately continue pushing lower below the next support level. Instead, market makers aimed for a liquidity hunt — which has now occurred, pushing price upwards and liquidating sellers' stop-losses, creating a clear liquidity zone.

Our current objective is to wait for price to break below the minor key level and then place a sell stop order at 145.920, with a stop-loss at 148.100 (above the liquidity zone), and take-profit at 140.960 — the next minor support. This setup offers a 1:2 risk-to-reward ratio.

Fundamental Outlook:

USD/JPY remains under pressure amid a weakening U.S. dollar, driven by soft labor market data and heightened economic uncertainty. This week’s U.S. Unemployment Claims are projected at 223K, up from 219K, reflecting potential labor market softening. A higher-than-expected print may dampen expectations for additional rate hikes by the Federal Reserve, weighing further on the dollar.

In contrast, the Japanese yen has strengthened on the back of improved domestic data and renewed safe-haven demand. Upward revisions to Japan’s GDP, along with stable inflation figures, have increased confidence in the yen. Furthermore, recent remarks from the Bank of Japan hinting at a more hawkish tone have added to the currency’s appeal. Global geopolitical risks — including potential trade tensions tied to former President Trump’s resurgence — are also reinforcing the yen’s safe-haven status.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

USDJPY Is Nearing An Important Resistance Under a Strong JPYHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 144.100 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 144.100 resistance area.

Trade safe, Joe.

USDJPY Is Bearish! Short!

Here is our detailed technical review for USDJPY.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 143.347.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 141.021 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USD/JPY: Yen's Bull Run Amid UncertaintyThis week, the Japanese yen made a remarkable performance in the foreign exchange market. The USD/JPY exchange rate started with a significant decline. Reaching a high on Monday, it then trended downwards and hit a low of 142.050 during the week. By Friday, it closed at 143.486, registering a weekly drop of around 1.35%.

In the context of surging market risk - averse sentiment, the yen became a much - sought - after asset. Although its appreciation against the US dollar was relatively moderate, its volatility increased substantially. This sharp rise in volatility clearly shows that the market's appetite for the yen as a safe - haven currency has grown rapidly.

The ongoing Russia - Ukraine conflict remains a major source of uncertainty in the global financial arena. Coupled with tariff - related discussions and potential trade - policy changes, these factors have further enhanced the yen's attractiveness as a safe - haven. Additionally, the US dollar index has dropped to a two - year low. This decline has relieved the downward pressure on the USD/JPY exchange rate, enabling the yen to gain some ground.

The yen's strength this week mainly stems from the weakness of the US dollar and the influx of risk - averse capital. Looking ahead in the short - term, the USD/JPY exchange rate is expected to test the 143.00 level. The Russia - Ukraine situation and persistent trade uncertainties will likely continue to support the yen. Moreover, the market's close attention to the Bank of Japan's monetary policies may exacerbate the yen's volatility.

The bullish momentum of the yen is steadily accumulating. If the US dollar continues to be under pressure, there is a high probability that the USD/JPY exchange rate could decline towards 142.00. However, it should be noted that currency markets are highly complex and prone to sudden reversals. Even though the current trends indicate continued strengthening of the yen, unforeseen geopolitical events or shifts in central - bank policies could quickly change the market situation.

Investment itself doesn't carry risks; it's only when investment is out of control that risks arise. When trading, always remember not to act on impulse. I will share trading signals every day. All the signals have been accurate without any mistakes for a whole month. No matter what gains or losses you've had in the past, with my help, you have the hope of achieving a breakthrough in your investment.

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

USD/JPY Bearish Trade Setup – SBR + DBD Zone Rejection📉 Trend Analysis:

🔴 Downtrend confirmed by lower highs and lower lows.

📉 Descending trendline indicates continuous bearish pressure.

🔹 Key Levels & Zones:

🔵 Resistance Zone (SBR + DBD) – 144.123 📍 (Sell Entry Point)

🟠 Stop Loss – 145.209 🚫 (Above resistance to avoid fake breakouts)

🟢 Target Point – 139.694 🎯 (Strong support area)

🏹 Expected Price Action:

🔸 Scenario:

🔺 Price moves up toward the resistance zone (🔵 SBR + DBD Zone)

🔻 Bears take control (Rejection expected)

⚡ Drop towards target at 139.694

📊 Trade Plan:

✅ Entry – Wait for rejection at 144.123 (🔵)

✅ Stop Loss – Keep at 145.209 (🛑🔺)

✅ Take Profit – Aim for 139.694 (✅🎯)

💡 Risk-Reward Ratio: Good (More reward than risk)