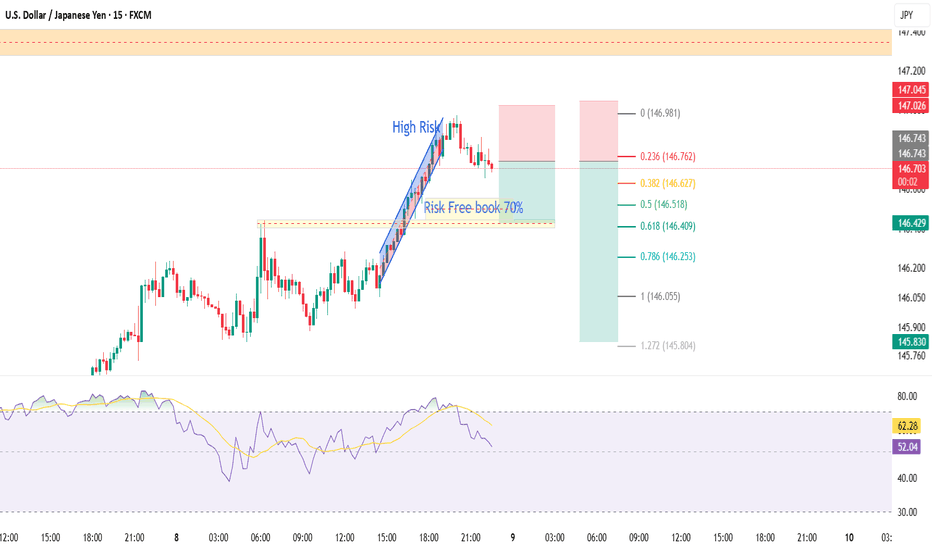

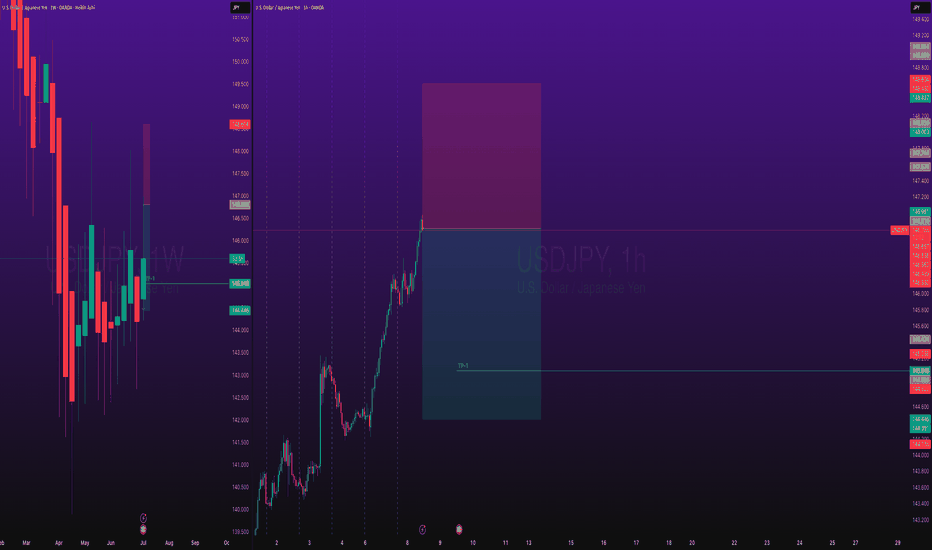

USD/JPY Long Trade SetupBuy dips - 146.50-146.60

Stop Loss -145.80 - Below retest zone; invalidates breakout.

TP-1 148.80 - Scale 50 % Pattern target / June high cluster.

TP-2 150.00 - Round-number magnet, option strikes.

Rationale

The dollar-yen cross has snapped out of its early-summer drift and vaulted back above the 100-day simple moving average for the first time since February, reaching ¥147.19 on 9 July – a two-and-a-half-week high – as the greenback rides an upswing in U.S. yields and tariff-driven inflation fears. The technical breakout puts the familiar 148.00/150.00 band – the June swing high and the psychological round number – back in play for trend-followers over the next several sessions.

Policy divergence as wide as ever

Federal Reserve – higher-for-longer: Minutes from the June FOMC showed staff pushing inflation projections higher and flagging “upside risks” should tariff pass-through accelerate, reinforcing the market’s view that rate cuts will be pushed into Q4 at the earliest. Five straight sessions of rising Treasury yields have followed, lifting the 10-year to 4.45 % and widening the U.S.–Japan real-rate gap.

Bank of Japan – stuck on hold: Former BOJ board member Makoto Sakurai told Reuters the central bank will “wait at least until March 2026” before considering another hike, as Trump’s 25 % tariff on Japanese goods (effective 1 August) clouds the export outlook and will likely force the BOJ to cut its growth forecast at the 31 July Outlook Report. With headline CPI still only just above target and real wages contracting.

USDJPY trade ideas

USDJPY 30Min Engaged ( Bullish Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish From now Price : 146.750

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USDJPY Will Go Down! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 146.736.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 144.416 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY 30Min Engaged ( Bullish Entry Detected )➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Break : 145.100

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

USDJPY – Key Support Bounce with Macro TailwindsUSDJPY is bouncing off a key trendline and 61.8% Fib zone (143.25–143.60) with confluence across multiple JPY crosses (EURJPY, AUDJPY, CADJPY). This area has historically triggered strong upside momentum, and the current setup aligns with both technical structure and macro drivers.

📊 Fundamentals Supporting the Move:

✅ US Yields Stable: US10Y is holding above 4.20%, keeping USDJPY supported. If yields push back toward 4.30%, expect USDJPY to retest 145.30 and potentially 147.80.

✅ BoJ Dovish: Japan shows no shift in policy. Despite weak Tankan data, BoJ remains patient, and no meaningful rate hike or YCC change is expected soon.

✅ USD Macro Resilience: Core PCE held firm at 2.6%. Focus now shifts to ISM Services PMI (Wed) and NFP (Fri). Markets are still pricing a soft landing – supporting risk-on and a stronger USD.

✅ JPY as a Fading Safe Haven: Even with geopolitical headlines (Trump tariff tensions, Taiwan, Middle East), JPY demand remains weak. Traders are favoring USD and Gold over JPY as risk hedges.

⚠️ Risks to Watch:

Dovish US Data Surprise: Weak NFP or ISM could drag yields down and trigger USDJPY reversal.

Verbal or Actual BoJ Intervention: If we approach 148.50–150, Japan may step in again.

Geopolitical Escalation: Any sharp risk-off could trigger safe haven demand for JPY, though this has underperformed recently.

🔎 Correlation Dynamics:

📈 USDJPY is leading JPY crosses like EURJPY and AUDJPY. The recent bounce started simultaneously across the JPY complex, with USDJPY slightly ahead.

📉 If US yields drop or risk sentiment shifts, USDJPY may lag gold or bonds but eventually catch up.

🧠 Trading Plan:

📍 Entry Zone: 143.30–143.60 (trendline + Fib confluence)

🎯 Target 1: 145.30 (38.2% Fib)

🎯 Target 2: 147.80 (channel resistance)

🛑 Invalidation: Daily close below 141.50 with US yields breaking down

📅 Upcoming Events to Watch:

Wed July 3: ISM Services PMI (key for USD reaction)

Fri July 5: US Non-Farm Payrolls + Average Hourly Earnings

JPY Risk: Verbal intervention possible near 148+

🧭 Summary:

USDJPY is positioned for a bullish continuation, backed by:

Rising yields

Resilient US macro

Weak JPY fundamentals

Technical structure respecting trendline support

Short-term traders can target the 145–147.80 range ahead of NFP, with a tight eye on yield and risk sentiment.

📌 If this analysis helps, drop a like and follow for more real-time macro-technical breakdowns. Stay nimble ahead of NFP! 🧠📈

USDJPY H4 I Bearish Reversal Based on the H4 chart analysis, the price is approaching our buy entry level at 147.36, a pullback support that aligns closely with the 161.8% Fib retracement.

Our take profit is set at 145.99, a pullback support.

The stop loss is placed at 148.70, above the 161.8% Fib extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USD/JPY) back down Trend Read The captionSMC trading point update

Technical analysis of USD/JPY (U.S. Dollar / Japanese Yen) on the 3-hour timeframe, anticipating a rejection from a descending trendline resistance and a move down toward key support levels.

---

Analysis Overview:

Trend Bias: Bearish correction expected

Structure: Price is reacting at a descending trendline, which has held as resistance on multiple occasions.

Indicators:

EMA 200 (144.756): Price is currently above, but projected to break below it.

RSI (14): Overbought at ~74, signaling potential for a reversal.

---

Key Technical Components:

1. Descending Trendline Resistance:

Price is approaching/has touched a well-respected downtrend line, marked by three strong rejections (red arrows).

This trendline has consistently capped bullish moves, indicating strong seller interest.

2. Bearish Reversal Expectation:

The projected path suggests a potential fake breakout or double-top, followed by a steep decline.

A two-stage drop is anticipated, with price first targeting the EMA 200 zone, then extending lower.

3. Target Points:

First target: Around 145.244, near EMA 200.

Final target: 143.048, aligning with the key support zone (highlighted in yellow), where price previously bounced.

4. RSI (14):

Currently overbought (73.29), signaling a likely retracement.

Prior peaks at this level led to notable corrections.

---

Trade Setup Idea:

Parameter Level

Entry Near current price (~146.85) if bearish pattern confirms

Stop-Loss Above trendline (~147.30–147.50)

Target 1 145.24 (EMA 200 zone)

Target 2 143.05 (Support zone)

This setup offers a high-probability short opportunity if resistance holds.

---

Risk Factors:

Upcoming economic events could trigger volatility (news icon marked).

A clean breakout and close above the trendline (~147.50+) would invalidate this bearish thesis.

Mr SMC Trading point

---

Summary:

The analysis suggests a potential USD/JPY reversal from a descending trendline, supported by overbought RSI and prior rejections. The bearish projection targets a move toward 143.048, following a dip below the EMA 200 level at 145.244.

Please support boost 🚀 this analysis)

USDJPY – A Bull Trap in the Making?USDJPY has just broken above the descending trendline but stalled right at the confluence resistance near 147.100 – a former strong distribution zone. Although buyers have pushed the price higher, the current price structure is sketching a potential double top pattern, signaling a possible exhaustion of the bullish momentum.

If this pattern confirms and price breaks below the FVG support zone around 145.161, then 144.300 will likely be the next target – a level that previously halted price before the recent rally. Price action should be closely monitored here, as a breakdown below 145.161 could be an early reversal signal.

Disappointing Nonfarm data has pushed bond yields lower and weakened the USD, reinforcing expectations of an earlier Fed rate cut. If this week’s CPI also comes in lower than expected, USDJPY could sharply drop from the current top.

Forex Strategy: Long EUR/USD, Long USD/JPY, and Long USD/CHFForex Strategy: Long EUR/USD, Long USD/JPY, and Long USD/CHF

In my Forex strategy, I focus on going long on three key currency pairs: EUR/USD, USD/JPY, and USD/CHF. The core principle of this strategy lies in balancing these positions, with the total units of USD/CHF and USD/JPY equaling the total units of EUR/USD. This approach helps to hedge risks while capitalizing on favorable market conditions for the U.S. dollar.

The rationale behind going long on EUR/USD is based on expected strength in the Euro against the dollar, driven by economic indicators or geopolitical events in the Eurozone. Simultaneously, the USD/JPY long position is placed to benefit from any upward movement in the U.S. dollar against the Japanese yen, often influenced by U.S. interest rate changes or global risk sentiment.

The USD/CHF long position complements the other trades by maintaining a strong U.S. dollar exposure while mitigating potential volatility in other pairs. By ensuring the total units of USD/CHF and USD/JPY match the units in EUR/USD, I aim to maintain a balanced and diversified exposure to the market, minimizing risk while maximizing potential profit.

This strategy is dynamic and continuously adjusted based on market conditions and currency pair correlations.

X1: USDJPY Short TradeFX:USDJPY Short swing trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Risking 1% to make 1.35%

Don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Lingrid | USDJPY Pullback From the Key Resistance ZoneThe price perfectly fulfilled my previous idea . FX:USDJPY is moving inside an upward channel after reclaiming support near 145.25 and breaking out from its previous range. The pair printed a higher low and is now approaching resistance around 146.78, testing the upper boundary of the ascending channel. If it fails to break through the red resistance trendline, a retracement toward the 145.25–145.00 support is likely.

📈 Key Levels

Buy zone: 146.78 - 147.00

Sell trigger: rejection from 146.78 and lower high below resistance

Target: 145.25

Buy trigger: bullish breakout above 147.00 with momentum confirmation

💡 Risks

Price rejection near 146.78 may cause a sharp pullback

A surge above 147.00 breaks trendline structure

Market reaction to macro data could distort short-term pattern

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Yen Falls After Trump's 25% Tariff on JapanThe Japanese yen weakened beyond 146 per dollar on Tuesday, hitting a two-week low after President Trump confirmed a 25% tariff on Japanese imports starting August 1, lower than the earlier 35% threat but still above the standard 10%. Japan’s Prime Minister Ishiba pledged to keep negotiating for a favorable outcome. Although Japan’s May current account surplus came in stronger than expected, disappointing wage growth limited hopes for further Bank of Japan rate hikes, adding pressure on the yen.

Key resistance is at 146.20; major support at 144.85.

USDJPY Structural Analysis : Breakout Demand Play + Target🗺️ Market Structure & Key Technical Zones

On the USDJPY 4-hour timeframe, the market is clearly respecting smart money levels and giving us an ideal case study of institutional demand, trend continuation, and liquidity engineering.

🔰 1. Major Support Zone (142.500 – 143.200):

This zone acted as a high-value area where price consolidated previously before rallying. It has been tested multiple times and each touch has led to a strong bullish reaction, indicating accumulation by large players.

Think of this zone as the market’s base camp — when price visits it, big money steps in to reload longs.

🔰 2. Channel Formation & Breakout:

A clean bullish channel formed mid-June, with price respecting both bounds while gradually climbing. Once the channel was broken with strong volume (noted by the breakout candle), it suggested a shift from controlled bullish flow to an impulsive move — a change in pace that often indicates smart money is active.

🧱 Institutional Concepts in Action

🔵 QFL (Quick Flip Level):

This area marks a prior consolidation or sideways action that gets aggressively broken. In this chart, price dipped to a QFL zone then sharply reversed — suggesting a trap for early shorts and a liquidity grab before moving up. A classic “manipulation → accumulation → expansion” sequence.

🟦 Breaker Demand (BR Demand):

This is where previous resistance has flipped into new support. Breaker blocks are extremely important in identifying where institutions may re-enter positions. Price respected this area before continuing higher — confirming bullish control.

Price tapped into this BR demand, showed low-wick rejections, and moved strongly, signaling confidence from large orders.

📊 Volume Burst Zone (~147.2–147.7):

This zone has historically seen high volume and sudden price acceleration. Price is re-approaching it now. This is where a lot of pending orders and take-profits are likely clustered — expect strong reactions here.

📈 Current Price Action

Price is climbing along a clean bullish trendline, reinforcing current momentum.

Price has broken previous structure highs and is now making higher highs and higher lows — a textbook bullish trend.

Buyers are in control as long as the price continues to respect:

The bullish trendline

The BR demand zone (~145.5)

🔮 Projection & Potential Scenarios

🟢 Bullish Continuation Case:

If current momentum holds, the price is likely to push toward the Next Reversal Zone (148.500–149.000).

This zone aligns with multiple confluences:

Fibonacci extension targets

Previous high liquidity trap zone

Potential institutional profit-taking level

Expect this zone to cause a reversal or deep pullback.

🔴 Bearish Breakdown Case:

If price breaks below the BR Demand Zone and closes under the trendline, expect a drop back toward the Central Zone (~144.8–145.0), or even deeper into the Major Support Zone.

This would shift market structure back to neutral or bearish depending on volume and rejection patterns.

📌 Summary:

✅ Bias: Bullish

🎯 Short-Term Target: 147.5 (volume burst area)

🧱 Key Support: 145.50 (breaker demand)

❗ Trendline Break = Red Flag

🏁 Final Reversal Zone: 148.500–149.000

💬 Final Thoughts

This chart is a brilliant example of smart money accumulation and market engineering. USDJPY continues to respect well-defined zones, presenting high-probability opportunities for traders who understand structure and patience.

This setup is NOT about chasing price — it's about following the footprints of volume, breakout structure, and institutional intent. Stick to the plan and manage risk around key invalidation zones.