USD/JPY Bearish Setup - Breakout from Ascending ChannelUSD/JPY Bearish Setup – Breakout from Ascending Channel

Price action on USD/JPY has broken down from an ascending channel, signaling potential bearish momentum ahead. The breakdown suggests a possible continuation toward lower support levels.

1st Support Level: 144.800 – 144.200

2nd Support Level: 143.000 – 142.400

Watch for price consolidation or retests at the 1st support level. A clean break below this zone could open the path toward the 2nd support level.

Key Notes:

Bearish volume increase post-breakout

Ichimoku cloud starting to thin, showing weakening bullish momentum

Structure favors selling rallies below the channel

📉 Bias: Bearish

💡 Plan: Wait for confirmation on lower timeframes before entering short positions

USDJPY trade ideas

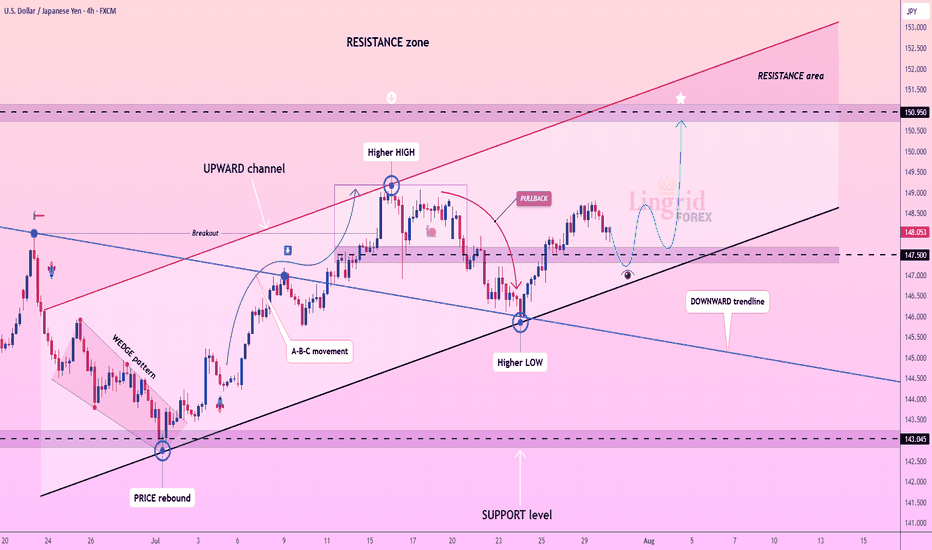

Lingrid | USDJPY Possible Strong Bullish RallyThe price perfectly fulfilled my previous idea . FX:USDJPY is trading within an upward channel after forming a higher low near the 147.50 zone, bouncing from the support trendline. Price action suggests a bullish structure continuation toward the 150.95 resistance, especially if the recent consolidation breaks higher. The overall formation aligns with a healthy correction phase before a potential push into the resistance area. Confirmation above 148.60 would likely accelerate the bullish move.

📌 Key Levels Buy zone: 147.50–147.25

Sell trigger: Below 147.00

Target: 150.95

Buy trigger: Break above 148.80

⚠️ Risks

Break below 147.50 may shift sentiment bearish

Strong resistance awaits near 150.00

Broader market volatility could invalidate pattern

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

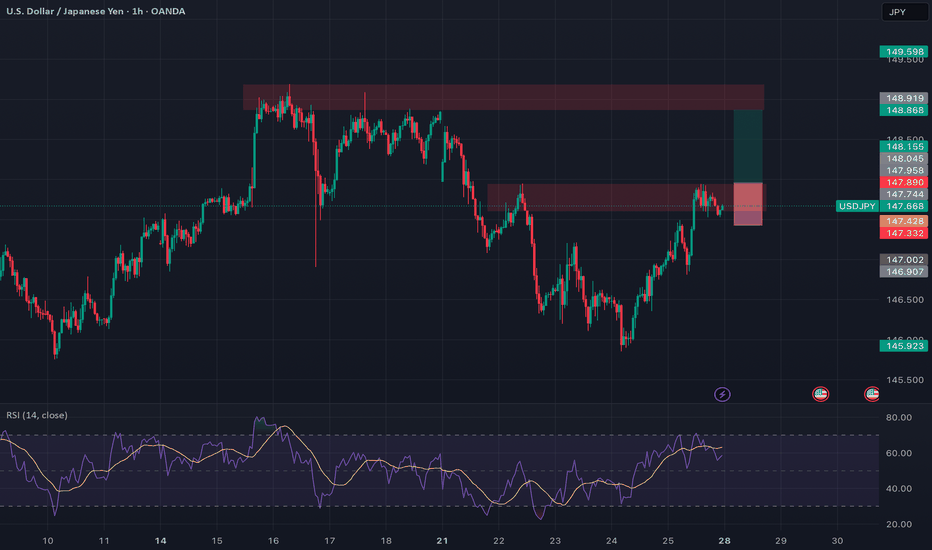

USDJPY M15 Pending SELL Setup 🧭 1. Market Structure (15M + Higher TF Context)

Recent Shift: Bullish structure broke down with an aggressive bearish move (clear BOS).

Consolidation Zone (~147.45–148.17): Price accumulated after the impulsive drop.

Now: Currently trading just above 147.00, testing intraday support.

✅ Structure:

Prev. Highs swept (liquidity grab at top), followed by impulsive drop.

Price formed a bearish flag, broke down, and is now retesting the lower zone.

🗃️ 2. Liquidity Zones

🔴 Buy-side Liquidity Grab: Fakeout to the upside just before the dump — textbook inducement.

🔵 Sell-side Liquidity: Now building under 147.00, with lows being swept but no follow-through (yet) → potential liquidity engineering.

⚠️ If price closes below 146.90, sellers may step in with conviction.

🕯️ 3. Candlestick Behavior

Inside the consolidation box, candles show:

Weak bullish momentum

No strong engulfing or continuation

On the breakout, large bearish candles with follow-through, showing institutional intent

Now: Wicks on both sides → market indecision, likely accumulation before expansion

🔍 4. Chart Patterns Identified

🏁 Bear Flag: Formed after breakdown → continuation pattern

📦 Consolidation box (~147.0–148.15): Liquidity build-up

📉 Descending Triangle Potential: Multiple touches at support (~147.00) with lower highs — bearish pressure building

🔢 5. Fibonacci Reference (Swing High ~149.10 to Swing Low ~146.90)

Level Price Notes

0.382 ~147.70 Rejected here

0.5 ~148.00 Mid-consolidation box

0.618 ~148.25 Price failed to touch

📉 Bias stays bearish unless 148.25 is breached & closed above with volume.

📌 6. Trade Setup

📍 Pending Sell Setup

🔄 Alternative Scenario

📍 Invalidation & Buy Scenario

Only if strong bullish candle closes above 148.20

That would flip structure bullish

But current order flow does not favor this yet.

🧠 Final Notes:

Wait for clear breakout and candle close below 146.90 — no impulse entries inside the range.

Use 1M/5M price action to fine-tune entries once breakout occurs (look for break of structure + BOS on LTF).

Watch Tokyo/London open for real volume to kick in.

USD/JPY Breakout Falls Flat - Fibonacci Support TestUSD/JPY showed a strong breakout last week in the aftermath of the Fed, BoJ and the Core PCE report.

The big fundamental drive there was lower odds of rate cuts starting from the Fed - and this pushed back the worry of a larger case of carry unwind as USD/JPY remains more than 40% above the early-2021 levels that showed before the carry trade episode got started.

But - chasing the pair continues to be a major challenge as I've highlighted in these pieces, and the Fibonacci resistance that showed up on Thursday has since led to a strong pullback, with USD/JPY now testing another key Fibonacci level for support at 146.95, which is the 61.8% retracement of the recovery move that started last September.

The risk here is that markets pricing in rate cuts from the Fed could cause a rally in the Japanese Yen which brings USD/JPY back to that 140.00 level. And if that breaks, there could be even more motivation for hedges built around that carry trade to unwind. Similar to last July, that could eventually hit other asset classes as the leverage brought on by low rates in Japan quickly draws out of the market. So, there's some significant macro risk here, and this is one of the reasons why we saw such a strong breakout last week when it looked like that rate compression between the U.S. and Japan was not going to happen.

The big question now in USD/JPY is whether bulls step in to hold support. Two weeks ago, following Japanese elections, it was the 145.92 level that held support, and that remains a big line in the sand today. But, if we see sellers grind below 145.00, that could cause other current longs in USD/JPY to get cautious. - js

Fundamental Market Analysis for August 4, 2025 USDJPYAfter Friday’s weak U.S. jobs report, USD/JPY fell sharply, breaking below 150. At the start of the new week the pair stabilized around 147–148, yet the fundamental backdrop remains tilted against the dollar: expectations for Fed cuts in the coming months are weighing on U.S. yields and narrowing the U.S.–Japan yield spread—the primary long-run driver of USD/JPY.

Exclusive for our readers – a 202% bonus on deposits of $202 or more! Give the promo code PROFIT202 to customer support and start trading with TRIPLED capital. Full promo details are available via the link.

The Bank of Japan continues an ultra-loose stance, with forecasts showing inflation around target but little appetite for aggressive tightening in the near term. That leaves the main channel of yen support tied to U.S. yield dynamics and global demand for safe-haven assets. With softer U.S. yields and elevated U.S. political uncertainty, demand for defensive currencies may stay resilient.

Additional risk factors include commentary from Japan’s Ministry of Finance regarding the yen and potential bouts of volatility around Fed communications and incoming U.S. data. Today’s base case favors selling USD/JPY on corrective upticks toward 146, as pressure from lower U.S. yields persists.

Trade idea: SELL 147.550, SL 148.550, TP 146.050

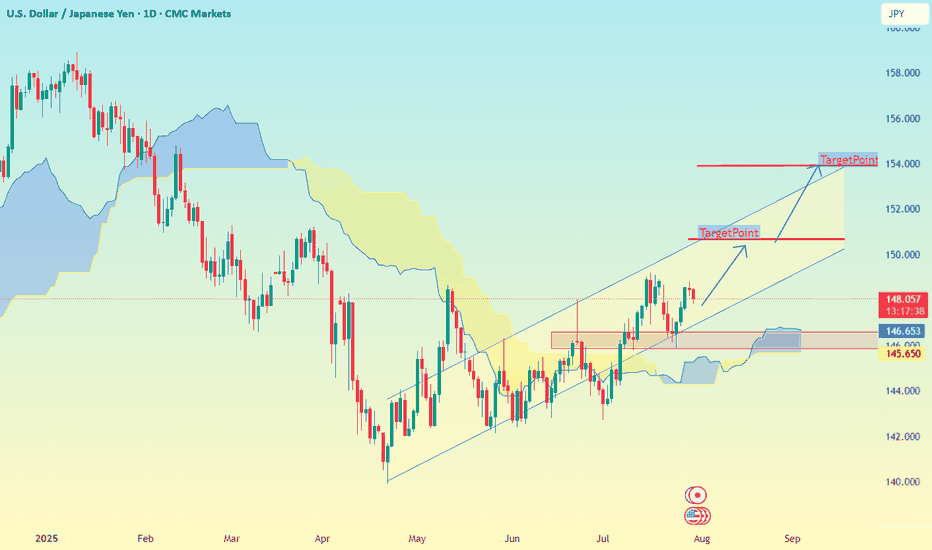

USD/JPY on the 1D timeframeBased on the chart I provided for USD/JPY on the 1D timeframe, here is the target analysis:

📉 Downtrend Analysis:

The chart is showing a descending channel, indicating a bearish trend.

Price has been respecting the upper and lower bounds of the channel.

Two target zones are marked with labels “TakeProfit”, suggesting projected bearish targets.

🎯 Identified Targets:

1. First Target Zone (TakeProfit):

📍 Around 152.00

This is the first expected support area where price may bounce or consolidate.

2. Second Target Zone (TakeProfit):

📍 Around 146.50 – 146.00

This level aligns with historical support and volume profile concentration.

USD/JPY Analysis is Ready USD/JPY is showing a bullish setup. Price broke out of a rising channel and is expected to retest the 148.887 support level before moving higher toward the 150.600 and 151.568 resistance zones, targeting the 152.000 area. The demand zone adds strength to the potential upside.

UJ| Bullsih Bias | Professional Sweep Forming Off 30M OB (Refined & Structured):

• Pair: USDJPY

• Bias: Bullish

• 4H Overview: After breaking previous highs, price pulled back into a sell-side liquidity (SSL) zone. This move shows signs of exhaustion following the sweep, hinting at bullish continuation.

• 30M Structure: Price took out internal liquidity/SSL and is now reacting from a refined 30-minute order block. Looks like a professional sweep is in play, with refined structure holding.

• Entry Zone: Waiting for further confirmation on the lower timeframes once the market opens.

• Targets: 5M and 30M structural highs depending on how price delivers.

• Mindset Note: This setup is a prime example of letting price come to you. Trusting HTF structure and recognizing the sweep fuels the patience needed to strike on LTF intent.

UDSJPY DRIVEN BY A BULLISH TRENDThe USDJPY pair is currently trading within a well-defined upward channel, showcasing a bullish trend that has been unfolding over recent periods. This upward trajectory is supported by a series of higher lows, with the most recent formation occurring near the 147.40 support level.

The pair's ability to hold above this level and potentially bounce off the trend-line suggests a strong foundation for further upside movement. A key level to watch in this context is 147.80, which, if breached to the upside, would likely provide further confirmation of the bullish momentum. Such a break would not only reinforce the existing upward trend but also potentially accelerate the pace of the advance.

In conclusion, the USDJPY pair's current technical setup appears conducive to further upside movement, driven by the bullish trend within the upward channel and supported by the recent higher low formation. A break above 147.80 would be a key catalyst for accelerating the bullish momentum, potentially paving the way for a move towards higher resistance levels.

USD/JPY - Potential Targets this WeekDear Friends in Trading,

How I see it,

Let me know if anything is unclear, inputs and questions always welcome.

I don't always have the right answers, but I do share my opinion freely.

Keynotes:

If attempts to fill all imbalances fail and or struggles for a clear

and decisive break above 149.500. Potential for more downside remains high.

NFP produced either a trend reversal igniter or a much-needed correction candle.

I remain bearish on this pair until the Killzone is decisively breached.

Talk of the town remains rate cuts that's very long overdue.

Interesting article to read in this regard:

www.tradingview.com

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

USDJPY Targets Completion of 7 Swing RallyThe USDJPY pair exhibits an incomplete bullish sequence originating from the April 22, 2025 low, signaling potential for further upside. We can project the extreme target area for this rally can be projected using using the 100% to 161.8% Fibonacci extension from the April 22 low. This places the target range between 150.88 and 156.33. The ongoing rally from the May 27, 2025 low is unfolding as a double three Elliott Wave structure. This structure has two zigzag corrective structure driving the upward momentum.

From the May 27 low, wave W concluded at 148.03. A corrective pullback in wave X then followed, which bottomed at 142.67. Currently, wave Y is in progress, with internal subdivision as a zigzag pattern. From the wave X low, wave ((a)) peaked at 149.18, followed by a corrective wave ((b)) that unfolded as a zigzag. Within this structure, wave (a) ended at 147.81 and wave (b) reached 149.08. Wave (c) completed at 145.87, finalizing wave ((b)) in the higher degree. The pair has since resumed its ascent in wave ((c)), developing as a five-wave impulse.

From wave ((b)), wave (i) concluded at 148.71, with a minor pullback in wave (ii) at 147.79. In the near term, as long as the pivot low at 145.87 holds, dips are expected to attract buyers in a 3, 7, or 11-swing corrective pattern, supporting further upside toward the Fibonacci extension targets.

USDJPY: Breaking Out With Macro Backing 🟢 USDJPY | Breakout Opportunity Above Resistance

Timeframe: 1H

Bias: Bullish

Type: Break and Retest

📊 Technical Setup

USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation.

• Entry: Above 147.90 (after confirmed candle close + retest)

• SL: Below 147.30

• TP: 148.90 / 149.60

• RR: ~1:2.5

• Indicators: RSI showing strong upside momentum, holding above 50

🧠 Fundamentals + Macro Confluence

• USD Strength: Strong macro & delayed rate cuts support USD upside

• JPY Weakness: BOJ remains dovish; risk-on sentiment weighing on JPY

• COT + Conditional Score: USD score increased to 17, JPY dropped to 8

• Risk Sentiment: VIX at 14.2 = RISK ON → bearish JPY bias

🧭 Gameplan

“Wait for confirmation above resistance before entering”

🔔 Set alerts around 147.90 and monitor lower timeframes for retest and bullish candle structure.

USD/JPYThis is a trade setup for USD/JPY, based on volume and trend analysis.

Entry Price: 150.360

Stop-Loss (SL): 150.740

Take-Profit (TP): 149.963

The trade is intended to be executed instantly at the mentioned price, in alignment with both volume behavior and the current trend direction.

Disclaimer: This setup is shared purely for backtesting purposes and to document trade ideas. It is not financial advice. Always perform your own analysis before making any trading decisions.

DeGRAM | USDJPY fixed above the descending channel📊 Technical Analysis

● Dollar-yen has punched through the 16-month descending channel top and twice retested it as support (false-break tags), carving a rising trend line that now guides price away from 144.90.

● Inside the break zone a smaller pennant is forming; a 4 h close above 147.18 completes the pattern and activates the channel-height target at 150.80 near the November swing cap.

💡 Fundamental Analysis

● US 2-yr yields pushed to a three-month high after hotter CPI core-services and Barkin’s “inflation progress has stalled”, while the BoJ July minutes flagged only “gradual” QT—widening the policy gap and reviving carry demand for yen shorts.

✨ Summary

Long 145.2-146.2; pennant break >147.18 targets 150.80. Bias void on a 4 h close below 142.80.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

USDJPY: The Fed & BOJ Likely To Keep Rates In Place. Buy It!Welcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market:

USDJPY

The FED and BOJ are expected to keep their perspective interest rates, come Wednesday. The USD is stabilizing, a US-Japanese tariff deal inked, and investors are slowing moving money from the Yen safe haven to riskier assets.

Look for USDJPY to slowly move higher.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USD_JPY RESISTANCE AHEAD|SHORT|

✅USD_JPY is going up now

But a strong resistance level is ahead at 151.232

Thus I am expecting a pullback

And a move down towards the target of 150.368

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BoJ keep interest rate unchanged, yen weakeningFollowing the July meeting, the BoJ maintained its interest rate at 0.5%, citing prevailing uncertainties from trade tariffs. Concurrently, the BoJ revised its inflation forecast upward to 2.7% YoY from 2.2%. The central bank's language on economic uncertainty has become less pessimistic, downgrading trade policy risks from "extremely high" to "high uncertainties remain," which signals a growing, albeit cautious, confidence in the economic outlook.

In the US, the June PCE surged to 2.6% YoY, surpassing the 2.5% prev. cons. The increase was attributed to tariff impacts, with Goods prices rising 0.4% MoM, the fastest pace since January, while Services prices held steady at 0.2% MoM.

The higher-than-expected US PCE data and the BoJ's decision to hold interest rates have continued to drive further appreciation of the USDJPY.

USD/JPY Technical Analysis

The USD/JPY pair is trading above its EMAs extensions, signaling a continuation of the bullish momentum. The price has successfully breached the ascending resistance trendline. However, the RSI is in overbought territory, suggesting that the current rally may be extended, and a potential pullback could be imminent.

The pair could continue to test the resistance level at 151.367. Should it fail to break this level, a rebound could see the USD/JPY pair test the support at 149.65.

By Van Ha Trinh - Financial Market Strategist at Exness