USD/KZT Long-Term Forecast Using Elliott Waves and Fibonacci TimDescription:

In this analysis, we apply Elliott Wave theory and Fibonacci time zones to forecast the long-term movement of USD/KZT. This approach reveals critical price levels and timelines that could shape the future trend of the currency pair.

Chart Overview:

• Current Price: 473.32 KZT/USD (as of June 29, 2024)

• Key Levels:

• High: 525.30 KZT

• Low: 374.92 KZT

Elliott Wave Analysis:

1. Wave 1: Identified from the significant low in 2020 to the high in early 2022.

2. Wave 2: Corrective phase from 2022 to 2023, retracing to the 0.618 Fibonacci level.

3. Wave 3: Projected to extend to the 2.618 Fibonacci level, around 749.91 KZT, reaching its peak in 2027.

4. Wave 4: Expected corrective phase, retracing to key Fibonacci levels (0.382 at 636.87 KZT or 0.5 at 593.54 KZT).

5. Wave 5: Final upward wave, potentially reaching the 1.618 Fibonacci extension at 953.11 KZT by 2031.

Fibonacci Time Analysis:

• The Fibonacci time zones highlight significant dates for trend changes:

• 28 Jun 2027: A crucial date marking the anticipated peak of Wave 3. This aligns with the 2.618 Fibonacci time zone, suggesting a major trend reversal or significant market event around this time.

Conclusion:

The confluence of Elliott Wave and Fibonacci time analysis indicates a strong bullish trend for USD/KZT, with critical price levels and dates to watch. The date of June 28, 2027, stands out as a pivotal moment where the market could experience significant shifts.

Trade Strategy:

• Long Positions: Consider entering on retracements during Wave 2 and Wave 4 corrections.

• Short Positions: Watch for signs of a trend reversal around June 28, 2027, to capitalize on the potential start of Wave 4.

Disclaimer:

This analysis is based on historical data and technical analysis principles. Always conduct your own research and consult with a financial advisor before making trading decisions.

USDKZT trade ideas

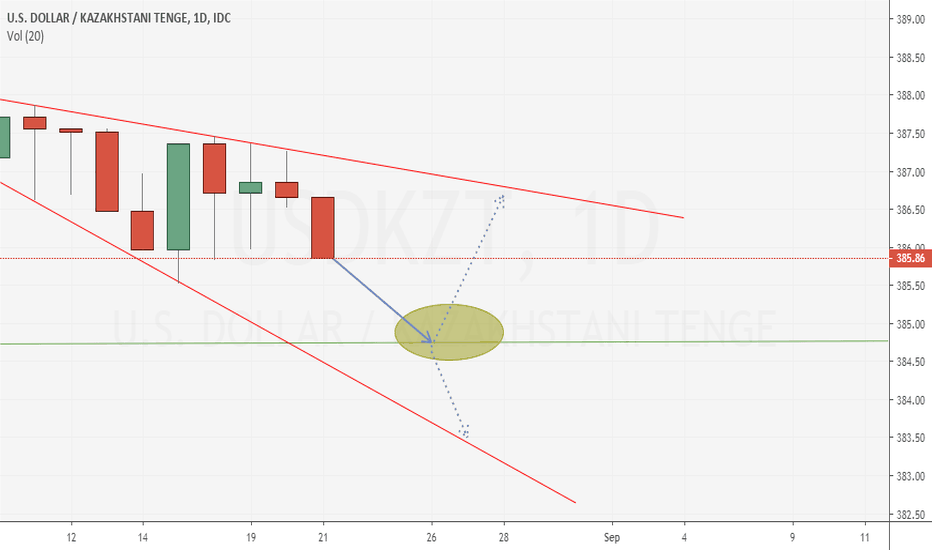

USDKZT achieved a bottom of the channelNot a popular symbol for today, but I would like to highlight my idea in terms of self-development an possibility of tracking results in the future.

MOEX:USDKZT_TOM starts growing trend, which has a potential to get 28% during 6 months.

$USDKZT::436->560::28%::Sep 2023

Does not constitute a recommendation.

#investing #stocks #idea #forecast #furoreggs

Correlation between USD-KZT with oilHey traders and investors! Just curious anyone ever thought if there is any correlation between the USDKZT rate with oil prices or indices? Looking at other petrocurruncies I am flabbergasted how the USD-KZT can have its own trend and story to stride up and down when there is no reason for that. Have you suspected there is an interference of the clumsy state hand in manipulation of rates?

USDKZT to hit between 474 and 485This oil-related pair is going to complete the wave 4 down reaching minimum area of retracement at 38.2% Fibonacci of wave 3 at 430.

The next support is at 50% at 420.

I see the USDRUB should reverse soon so this pair then is going to follow.

The target for wave 5 is located within 474-485 range.

ridethepig | KZT Spot Commentary 2020.02.12I will keep this one very quick as not much interest in KZT. On the technical side we have a very clean and simple legs to track here, nothing to change my view of the gravitational pull back towards normality circa 310 in the coming weeks. Heavy USD sells continue from locals nad in my books a matter of time before we are -18% from the original entries:

Continuing to remain long Tenge here.

ridethepig | KZT 2020 Macro Map A fresh and new instrument to the @ridethepig Tradingview portfolio. Tenge finding a strong bid with a lot of air below to the next target area. Tenge is definitely oversold and cheap compared to other valuations in EM FX space, the attractive carry is worth playing if you have Oil or RUB in the playbook.

A quick recap of the Oil Macro chart:

From a strictly technical perspective, KZT highs are now capped above 380 and downside pressure is acceptable. Target-wise ==> I am looking for a test in the lows of this range at 310 (a -18% swing!!). Remember macro trades do not trade for pips, these are for pipsqueaks.

As usual thanks for keeping your support coming with likes, comments, charts and etc!