USDMXN trade ideas

Kamala Harris may win the presidential election - My predictionAfter a decade of trading and studying market patterns, I've noticed trends that have taken years to decipher, and I’m still refining my understanding. I’ve conducted extensive back-testing over the years, and I have yet to see this pattern fail to hit its targets. Based on my observations, there are two key levels likely to be reached. The first target, around 18.27, could be achieved if Trump were in office, but I don’t foresee the second target, approximately 16.56, being met under his leadership due to potential tariffs and trade policies that would likely pressure the Peso.

If Trump wins, I expect a strong dollar and a weak Peso both in the short and long term. Conversely, if Harris wins, I anticipate a weaker dollar and a stable or stronger Peso. Of course, nothing is for certain, and this isn’t trading advice or my stance on who I feel should win or shouldn't win, just my observation.

Mexico in a weaker bargaining power over USAI could be wrong but I think Mexico has a weaker bargaining power over US in the tariffs matter. As such, I would expect its currency to weaken against the USD sooner/faster than the Canadian dollars.

Day chart shows 20.83 resistance level - if this cannot be break up, then I expect it to falter and get shot down fairly soon.

Please DYODD

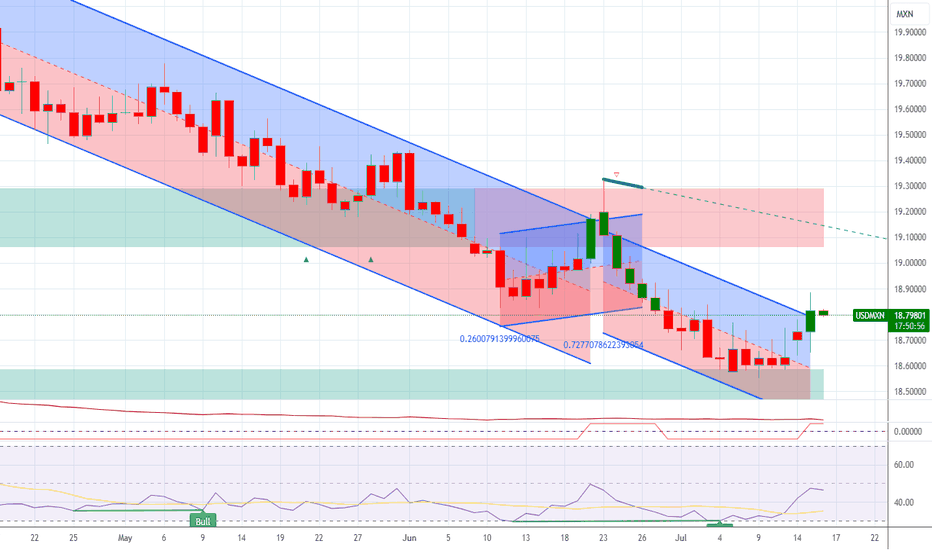

USD/MXN Testing Downtrend Resistance – Bearish Channel Remains IThe USD/MXN pair continues to grind lower within a well-defined descending channel, marked by a series of lower highs and lower lows since April. Although the pair has shown short-term stability near 18.58 support, the broader trend remains bearish.

Price is currently testing the channel’s upper boundary near 18.70, with both the 50-day and 200-day SMAs well above current levels, reinforcing the downside bias. Any bounce is likely to face headwinds unless bulls manage to push the pair back above 19.07 and 19.49 — prior swing levels and confluence zones with moving averages.

Indicators:

MACD remains below zero, showing persistent bearish momentum despite some recent flattening.

RSI sits at 36, indicating mild oversold conditions but with no strong reversal signal yet.

Key Levels:

Support: 18.58 (recent low and channel support).

Resistance: 18.70 (channel top), followed by 19.07 and 19.49.

Conclusion:

USD/MXN remains pressured within a bearish structure. A breakout above 18.70 may trigger short-covering toward the 19.00–19.50 zone, but bears remain in control while price stays beneath key moving averages. Watch for a decisive break of either channel boundary to determine directional bias going forward.

-MW

RSI divergent, suggesting a bounceThe USDMXN has been in a descending channel since spring of this year, but is near channel support with a strongly divergent RSI. Since the MXN has gained about 10% against the US Dollar since the beginning of the year, however rate differentials are tightening, the appetite for MXN at current levels may be waning. It's not time to be outright bullish the USD over the MXN, but a break back above the 18.8500 level may suggest that time may be near.

Is Mexico's Peso at the Crossroads?The recent imposition of U.S. sanctions on three Mexican financial institutions - CIBanco, Intercam Banco, and Vector Casa de Bolsa - has ignited a crucial debate over the Mexican peso's stability and the intricate dynamics of U.S.-Mexico relations. Washington accuses these entities of laundering millions for drug cartels and facilitating fentanyl precursor payments, marking the first actions under new anti-fentanyl legislation. While these institutions collectively hold a relatively small portion of Mexico's total banking assets (less than 3%), the move carries significant symbolic weight and prompts a re-evaluation of the peso's outlook. The Mexican government, under President Claudia Sheinbaum, swiftly rejected the allegations, demanding concrete evidence and initiating its investigations, including the temporary regulatory intervention of CIBanco and Intercam to safeguard depositors.

Economically, the peso faces a nuanced landscape. Before the sanctions, the Mexican peso (MXN) demonstrated remarkable resilience, appreciating significantly against the dollar, bolstered by Mexico's comparatively higher interest rates and robust trade flows with the U.S. However, the recent divergence in monetary policy, with **Banxico** easing rates while the U.S. Federal Reserve maintains a hawkish stance, now presents a potential headwind for the peso. While analysts generally suggest limited systemic risk to Mexico's broader financial system from these targeted sanctions, the action introduces an element of uncertainty. It raises concerns about potential capital flight, increased compliance costs for other Mexican financial institutions, and a possible erosion of investor confidence, factors that could exert downward pressure on the peso.

Geopolitically, these sanctions underscore the escalating U.S. campaign against fentanyl trafficking, now intricately linked with broader trade and security tensions. President Donald Trump's past threats of punitive tariffs on Mexican imports - aimed at curbing drug flows - highlight the volatile nature of this bilateral relationship. The sanctions serve as a potent political message from Washington, signaling its resolve to combat the fentanyl crisis on all fronts, including financial pipelines. This diplomatic friction, coupled with the ongoing complexities of migration and security cooperation, creates a challenging backdrop for the USD/MXN exchange rate. While the U.S. and Mexico maintain a strong intergovernmental relationship, these pressures test the limits of their collaboration and could influence the peso's trajectory in the medium term.

USDMXN OverextendedZooming out to the bigger picture, we can see that we are approaching a strong support level around 18.60 (green zone), with bearish RSI divergence.

There is a high probability that this zone will serve as a catalyst for USD strength, at list in the short term.

Initial targets would be:

minor blue resistance zone around 19.20

major gray resistance zone around 19.75

I will be watching for reversal patterns in smaller timeframes after a test of green support.

USDMXN | 21.06.2025BUY 19.1500 | STOP 18.7500 | TAKE 19.7000 | The Bank of Mexico is expected to continue its rate easing cycle next week, despite recent reports on Mexican inflation suggesting risks are skewed to the upside. Inflation in May exceeded the bank's 3% target, raising concerns that the central bank will continue to cut rates. From a technical perspective, the price is moving upwards within a long-term channel in the medium term and is pushing away from the strong support level of 18.8200.

USD/MXN: Bearish Momentum Persists, Testing Key SupportUSD/MXN continues to grind lower, maintaining a persistent downtrend that has remained intact since mid-April. The pair is currently hovering near a short-term support area just above 19.00, with little sign of bullish reversal as of now.

🔍 Technical Breakdown

Bearish Structure: Price remains below both the 50-day (19.63) and 200-day (20.02) SMAs, with both averages now pointing lower — confirming the strength of the ongoing bearish trend.

Momentum Indicators:

MACD remains firmly in negative territory with a persistent bearish histogram, suggesting downside momentum is not yet exhausted.

RSI is approaching oversold levels, currently at 34. While not yet in extreme territory, it hints that the pair may be nearing a potential short-term pause or bounce.

Support & Resistance:

Price is testing a minor support zone around 19.00, with the next significant level lower coming in near 18.58, a level last seen in early Q3 2023.

On the upside, initial resistance stands at the breakdown point near 19.49, followed by stronger resistance at the confluence of moving averages.

⚙️ Outlook

USD/MXN is trading firmly within a well-defined downtrend, marked by lower highs and lower lows. As long as price remains below the 50-day SMA, the bias remains bearish. While the RSI suggests some caution is warranted as the pair approaches oversold conditions, there is no definitive bullish divergence or reversal pattern yet.

If the current support gives way, bears could target deeper retracements. Conversely, a sustained rebound back above 19.49 would be needed to challenge the bearish structure.

-MW

USDMXN: The Mexican Peso Continues to StrengthenOver the last four trading sessions, the USD/MXN pair has dropped more than 1.5% in favor of the Mexican peso as the U.S. dollar continues to weaken in the short term. The index that measures the strength of the U.S. dollar (DXY) remains consistently below the 100-point level, highlighting the broad weakness of the currency. This has, in part, allowed the current bullish bias of the Mexican peso to persist over the short term.

Downtrend Remains Intact

Since the early days of April, selling pressure has been strong enough to sustain a steady downtrend. However, as the price continues to fall, notable signs of neutrality have started to emerge, which could pave the way for short-term bullish corrections as bearish momentum begins to show signs of exhaustion.

RSI

Lower lows in USD/MXN and higher lows in the RSI have generated a bullish divergence in the short term, suggesting a persistent price imbalance and potential loss of bearish strength in recent sessions. This could open the door for buying corrections to materialize in the upcoming trading sessions.

TRIX

The TRIX line remains oscillating below the 0 level, indicating that the dominant bias over the past few weeks is still bearish. However, if the line continues to flatten, it may signal a possible pause in recent selling momentum.

Key Levels to Watch:

19.24: A near-term indecision zone that may act as a barrier for potential buying corrections.

19.00: A key support level aligned with an important psychological zone. Price movement below this level could provide further room for the current bearish pattern to continue.

19.70: A critical resistance level, corresponding to the highest point of the past two months. A move back toward this area could signal the end of the current downtrend.

Written by Julian Pineda, CFA – Market Analyst

USD/MXN Short Trade SetupA clean rejection is observed from the bearish order block zone between 19.27627 – 19.25936, aligning perfectly with a descending trendline resistance. Price has reacted to this premium level with clear signs of selling pressure.

This setup offers a high-probability short opportunity with the entry positioned at 19.25930, targeting the next support zone near 19.20593. The stop is placed safely above the OB and structural high at 19.27747 to protect against liquidity sweeps.

This trade aligns with recent price action confirming bearish intent at premium supply.

📍 Entry: 19.25930

🎯 Take Profit: 19.20593

🛑 Stop Loss: 19.27747

⚖️ Risk-Reward: ~3R

USD/MXN: The Mexican Peso Faces Strong NeutralityOver the last five trading sessions, USD/MXN fluctuations have shown a variation of barely 1%, indicating the emergence of sustained neutrality in the pair's recent moves. For now, the slight bearish bias in USD/MXN has managed to maintain a steady downward trend, as the Mexican peso benefits from short-term weakness in the U.S. dollar—as shown by the DXY index, which continues to trade below the 100-point mark, highlighting persistent weakness in the U.S. currency.

Potential Downtrend:

Since early April, bearish moves have begun to form a steady downtrend, bringing the price close to the 19 pesos per dollar level. So far, no significant bullish correction has reversed the current selling trend. However, it is important to note that the recent neutral tone could undermine the bearish bias of the past few months. If this neutrality continues, it could give way to a new phase of prolonged sideways trading in the short term.

MACD:

The MACD histogram has been hovering around the 0 line for several sessions, indicating that the moving averages are in a neutral zone, with no clear bullish or bearish dominance. If this pattern persists, the current neutrality could lead to a more defined consolidation range.

RSI:

The RSI line has started forming higher lows while USD/MXN prices have marked lower lows—resulting in a bullish divergence. This could signal room for potential upward corrections in the short term.

Key Levels to Watch:

19.24 pesos per dollar: A current barrier where price action has shown strong neutrality; it could serve as a starting point for potential short-term bullish corrections.

19.70 pesos per dollar: A critical resistance at the highest level the pair has reached in recent weeks. Sustained bullish movement near this zone could mark the end of the prevailing downtrend.

19.00 pesos per dollar: A significant psychological support. Continued bearish moves approaching this level could revive the forgotten bearish sentiment and strengthen the current downtrend line.

Written by Julian Pineda, CFA – Market Analyst

USD/MXN Eyes Breakdown Toward Key Support LevelsThe USD/MXN daily chart is displaying signs of continued weakness:

Downtrend Intact: The pair trades firmly below its 50-day and 200-day moving averages, reinforcing bearish control.

MACD Bearish: Momentum remains to the downside with the MACD line below zero and the signal line.

Key Support Zones: Price is approaching horizontal support at 19.07; a break could expose 18.58 as the next downside target.

Resistance to Watch: Former support near 19.49 now acts as initial resistance.

RSI Holding Lower: The RSI is drifting below 40, showing bearish momentum without reaching oversold territory.

If the pair closes below 19.07, it may accelerate the bearish trend toward the 18.58 handle.

-MW