USDMXN trade ideas

USD/MXN Mirrors 2017 Reversal; Elliott Wave Pointing Lower Back in 2016–2017, we first saw a very sharp recovery on USD/MXN, but when Trump took office in January 2017, the market reversed strongly lower, falling all the way from 22 to 17.60, lost nearly 20% . That very similar pattern is now becoming visible again with 2024–2025 price action. Last year, after Trump won the US election, we saw significant depreciation of the Mexican peso, but since he has officially taken office in January, we’re seeing a complete reversal—just like in 2017.

In fact, the Mexican peso has been gaining nicely over the past few months, likely based on speculation that Trump will find the agreement and trade deals with other countries, particularly related to tariffs. Since no one really benefits from trade wars, it’s not surprising that even Trump’s recent remarks reflect an acknowledgment of the global situation being unsustainable, especially when it comes to CHINA-US trade.

With that in mind, markets in general are likely to recover, and we’re already seeing some nice rebounds. And when stocks are in recovery mode, commodity currencies—including the peso—tend to perform well.

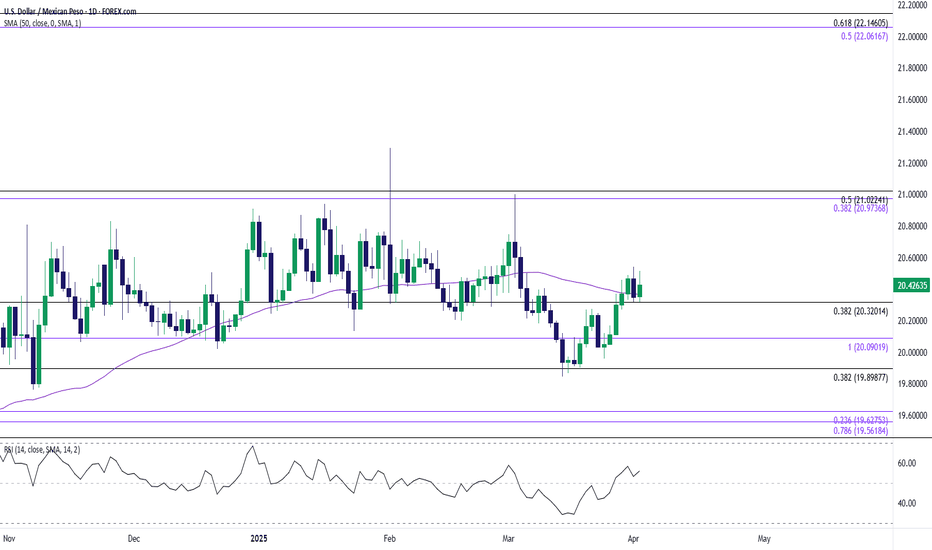

Looking at USD/MXN specifically, we’re seeing a strong reversal down from February highs, just like in 2017. The current drop hasn't even retraced 38.2% of the 2024 rally yet, which suggests more downside is likely—ideally toward the 19.00 area, maybe even 18.00 by year-end.

From an Elliott Wave perspective, it's useful to zoom in on smaller time frames. The structure doesn’t look like completed impulse yet, so technically there can be more weakness coming. Resistance for wave four rally sits around the 19.77–19.84 zone, which aligns with Fibonacci projections for wave four, as well as swing lows from March and April.

This area could serve as a nice resistance of the current bounce, especially if the Fed delivers any dovish remarks this week. No rate cuts are expected, but even a hint at future cuts could send the US yields lower, which would weigh on the dollar and support risk assets—meaning commodity currencies could outperform.

In that case, USD/MXN could ideally fall back below 19.50.

Elliott Wave analysis also helps define clear invalidation levels, very important when it comes to potential trade setups. In this scenario, 20.16 is a key level to watch. A break above it would overlap with the start of the current move and signal that the bears are finished for now, thus I would need to adjust the view accordingly.

Grega

USDMXN Short Trading Plan: Break out Strategy## Entry

- Enter short when price breaks and closes below major support

- Optional: wait for retest of broken support before entry

- Price below moving averages

## Stop Loss

- Swing high above broken support

- Risk maximum 2% of capital

## Take Profit

- TP1: Previous swing low (30% position)

- TP2: Next support level (50% position)

- TP3: Trail stop for remainder

USD/MXN Continues to Fall Below the 20 Pesos per Dollar LevelOver the past five trading sessions, the USD/MXN pair has declined by more than 2%, as the Mexican peso continues to gain ground against the U.S. dollar. This bullish trend in the peso is partly driven by the ongoing weakness in the U.S. dollar, as reflected in the DXY index, which has fallen to 99 points, its lowest level in the past year.

The dollar’s weakness stems from the growing political and economic uncertainty generated by the global trade war, triggering a broad wave of dollar selling as capital exits the U.S. If this trend continues, the Mexican peso could maintain its bullish momentum in the short term.

Lateral Range Breakout

Since November 2024, USD/MXN had been trading within a sideways range, with resistance at 20.94 pesos per dollar and support at 20.00. In recent sessions, bearish pressure broke through this support, and as selling momentum builds, this could mark the start of a more meaningful downtrend.

MACD

The MACD histogram remains below the neutral zero line, indicating strong bearish momentum based on recent moving average trends. If the histogram continues to show deeper negative values, selling pressure could intensify further in the short term.

RSI

Currently, lower lows in price and higher lows in the RSI suggest the presence of a bullish divergence—an imbalance in recent selling momentum. This could create an opportunity for short-term bullish corrections to emerge.

Key Levels to Watch:

20.33 pesos per dollar: A key resistance level, aligned with the 100-period moving average. A return to this area could reactivate the previous range.

20.00 pesos per dollar: Another important resistance, now acting as a potential retest zone after previously serving as support. This could be a target for short-term pullbacks.

19.33 pesos per dollar: A significant support level, aligned with the neutral zone from September 2024. A move toward this level could reinforce the consolidation of a consistent bearish trend in upcoming sessions.

Written by Julian Pineda, CFA – Market Analyst

USD/MXN Outlook Mired by Failure to Test Yearly HighUSD/MXN is under pressure following the failed attempt to test the yearly high (21.2943).

USD/MXN snaps the range bound price action from last week, and a move/close below the 19.8990 (38.2% Fibonacci retracement) to 20.0120 (38.2% Fibonacci extension) zone may lead to a test of the monthly low (19.8362).

Next area of interest comes in around the November low (19.7610), but USD/MXN may track the flattening slope in the 50-Day SMA (20.3418) should it struggle to close below the 19.8990 (38.2% Fibonacci retracement) to 20.0120 (38.2% Fibonacci extension) zone.

A move back above the 20.3200 (38.2% Fibonacci retracement) to 20.4490 (50% Fibonacci extension) brings the 20.8850 (61.8% Fibonacci extension) to 21.0220 (50% Fibonacci retracement) region on the radar, with the next area of interest coming in around the monthly high (21.0812).

--- Written by David Song, Senior Strategist at FOREX.com

USD/MXN Rebound Stalls Ahead of March HighThe recent rebound in USD/MXN appears to be stalling ahead of the March high (20.9997) as it fails to extend the series of higher highs and lows carried over from last week.

In turn, USD/MXN may consolidate over the coming days as it holds below the weekly high (20.5430), and a close below 20.3200 (38.2% Fibonacci retracement) may push the exchange rate towards 20.0900 (100% Fibonacci extension).

Next area of interest comes in around 19.8990 (38.2% Fibonacci retracement), but USD/MXN may further retrace the decline from the March high (20.9997) should it continue to hold above 20.3200 (38.2% Fibonacci retracement).

--- Written by David Song, Senior Strategist at FOREX.com

Banxico Cuts Rates Aggressively In line with market expectations, the Bank of Mexico unanimously decided to implement another consecutive rate cut during its March 2025 monetary policy meeting. The 50-basis-point reduction brought the policy rate down to 9.00%, marking a forceful continuation of the monetary normalization cycle, one that remains behind its regional Latin American peers.

The central bank’s decision mainly reflects a relatively contained inflationary environment and growing concerns about downside economic risks, including the possibility of a technical recession following a visibly weak first quarter. Headline inflation stood at 3.67% in the first half of March, providing Banxico with the necessary room to ease its monetary stance without significantly compromising its 3% inflation target.

The Mexican economic outlook remains clouded by uncertainty surrounding U.S. trade policy. The recent tariff threats from the Trump administration, particularly those targeting imported vehicles and auto parts, could exacerbate Mexico’s economic fragility, given its high dependency on bilateral trade with the U.S. These tariffs, set to take effect in early April, pose a significant threat to the country's economic and monetary stability.

Previously, the foreign exchange market has responded favorably to reversals of initial U.S. tariff announcements, but the persistence and materialization of these threats would place further pressure on the Mexican peso. The automotive sector, a pillar of Mexico’s export structure, is already facing serious challenges, with a significant drop in exports in February, underscoring the country’s vulnerability to external trade restrictions.

Despite these internal and external pressures, Banxico has managed to strike a relative balance, cutting rates to help stimulate economic activity while maintaining a sufficiently tight monetary stance to guard against potential inflation risks. According to the Governing Board, this approach is consistent with the trajectory needed to ensure an orderly and sustained convergence of inflation toward the 3% target by the third quarter of 2026.

For now, one notion circulating in the markets is that the Mexican central bank may keep rates above the neutral level as a safeguard against tariff-related uncertainty and other potential external shocks. This reflects a strategic caution, aiming to balance economic stimulus with financial stability.

Looking ahead, the outlook remains complex. Banxico may continue making similar adjustments in upcoming meetings, always contingent on the evolution of inflation and both domestic and global economic activity. Ultimately, Mexico is facing a critical juncture where monetary policy decisions will play a key role in mitigating current uncertainty and supporting a more stable economic environment.

Mexican Peso Under PressureThe Mexican peso has posted three consecutive sessions of losses against the U.S. dollar, signaling a marked erosion in investor confidence. Particularly striking is the fact that this decline has occurred even as the dollar trades in negative territory on Thursday, highlighting the inherent weakness of the peso during the session.

Two key factors appear to be driving this downward trend: on the one hand, markets are pricing in an aggressive new rate cut by the Bank of Mexico (Banxico), and on the other, emerging external trade risks are further clouding the outlook for the local currency.

Later today, Banxico is expected to cut its benchmark interest rate by another 50 basis points, maintaining its aggressive monetary policy easing cycle. If confirmed, this would mark the second consecutive cut of this magnitude, lowering the cost of money to 9% from the current 9.5%. It's worth recalling that during the last tightening cycle, the rate reached a historic high of 11.25%, meaning the cumulative easing would total 225 basis points with this cut.

This decision comes in a context marked by persistently high inflation observed in March and continued economic weakness. While looser monetary policy aims to stimulate economic activity, it also adds downward pressure on the peso, already weakened by external factors.

Compounding the situation is a challenging trade backdrop. Mexico posted a trade surplus of $2.21 billion in February, reversing January’s deficit. However, this surplus is worrisome, as it was driven largely by a sharp drop in imports rather than a strong rebound in exports, underscoring a structural weakness in domestic demand.

Particularly alarming is the performance of the automotive sector, with exports falling 15.2% in February. Shipments to the United States—Mexico’s main trading partner—declined 10.7%, while exports to other international markets plunged 40.2%. This vulnerability is exacerbated by the recent announcement by President Donald Trump of a 25% tariff on vehicle and auto parts imports, generating renewed uncertainty around the future of Mexico-U.S. trade relations.

The combination of internal factors such as weak domestic demand, Banxico’s monetary easing cycle, and mounting international trade uncertainty—particularly in a key sector like automotive—paints a complex and challenging outlook for the Mexican peso in the coming months.

Thus, markets appear to be anticipating that this storm could continue weighing on the peso, increasing the risk of further depreciation against the U.S. dollar. The Mexican currency is undoubtedly in a vulnerable position, awaiting greater clarity from both domestic and external fronts.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

USD/MXN Remains Neutral Around the 20 Pesos per Dollar ZoneOver the past two trading sessions, USD/MXN has maintained a steady neutral movement, showing barely 1% total variation in price. This growing neutral bias has persisted as the market continues to await how a potential trade war could affect the Mexican peso. Recent comments from President Trump suggested that the tariffs may not officially come into effect on April 2, adding to the uncertainty. Major moves in the pair could resume as new updates on the tariff situation emerge in the coming sessions.

Broad Sideways Range:

The pair continues to move within a clear sideways range, between the resistance at 20.95 pesos per dollar and the key support at 20.00. Recent bearish moves have been insufficient to break through this level decisively, leaving the sideways structure dominant in the USD/MXN market.

ADX Indicator:

The ADX line has remained below the 20 level in recent sessions, indicating that recent movements lack the strength to be considered trend-driven. This continues to point to a neutral market environment in the pair.

RSI Indicator:

A similar situation is seen in the RSI, with the line hovering near the neutral 50 level, suggesting that buying and selling pressure remain in balance. For now, this neutrality is helping reinforce the support barrier currently holding in USD/MXN.

Key Levels:

20.95 pesos per dollar – A key resistance level aligned with the recent highs. Sustained buying above this zone could reactivate bullish momentum and lead to a potential breakout from the current range.

20.00 pesos per dollar – The most important short-term support , matching the lower boundary of the broader sideways channel. Bearish moves below this level could lead to stronger downward pressure in the sessions ahead.

19.33 pesos per dollar – A distant support level , located around neutral price zones seen in September 2024. Selling pressure that reaches this level could confirm the beginning of a new bearish trend in USD/MXN.

By Julian Pineda, CFA – Market Analyst

USD/MXN opportunityThe USD/MXN stabilizes at a price of 19.80/20.

A reduction in this zone can be an opportunity to position it for the store and connect it to the main resistance zone above 21.50.

It is obvious that we will be attentive to the various announcements of customs duties which could significantly change the price.

2 reasons the peso rally may not be over The USD/MXN has fallen over 2.5% in the past five trading sessions, dropping below 19.9 per USD for the first time since November 2024.

Two key factors could be driving this move:

1.

Investor distrust in the U.S. dollar – Market confidence is weakening due to Trump’s inconsistent tariff threats and other unpopular policies.

In contrast, the Sheinbaum government’s kid-glove handling of Trump is securing favourable trade concessions.

2.

Attractive interest rate differential – With Banxico’s benchmark rate at 9.5%, the peso remains appealing for carry trades.

The Federal Reserve’s decision this week could widen this gap further. Last week’s subdued U.S. inflation data is helping to fuel speculation of earlier Fed rate cuts, which may continue to support the peso despite trade uncertainties.

Mexican Peso Shows Resilience Despite ChallengesThe Mexican peso advanced 0.35% during the session, demonstrating remarkable resilience amid negative signals from the Mexican industrial sector and economic uncertainties in the United States. However, the near-term outlook for the currency presents considerable challenges.

In Mexico, recent industrial data has raised concerns among investors. The Monthly Indicator of

Industrial Activity (IMAI) fell 0.4% in January, accumulating an annual decline of 2.8%. The most significant deterioration came from the mining and extraction sector, particularly oil and gas, which saw sharp contractions of 8.8% and 10.7%, respectively. Additionally, the construction sector remained weak with an annual drop of 6.7%, while manufacturing declined slightly by 0.8%, with textiles, machinery, and metal goods suffering the most pronounced losses.

On the international front, the recent moderation in U.S. inflation has provided some support to the Mexican peso. The Producer Price Index (PPI) remained unchanged in February, coming in below market expectations. Additionally, the recent slowdown in the U.S. Consumer Price Index (CPI), which fell to an annual rate of 2.8%, reinforces expectations of a potentially more dovish Federal Reserve. This scenario could benefit emerging market currencies, including the Mexican peso.

However, significant risks remain. Global trade tensions and concerns about a potential U.S. recession could drive an increase in risk aversion, negatively impacting the peso in the short term.

Market attention will be focused on the upcoming Federal Reserve monetary policy decision. A dovish stance would clearly favor the peso, while a more aggressive monetary approach would strengthen the U.S. dollar, putting additional pressure on the Mexican currency. For now, the peso has shown resilience, but it will navigate cautiously while awaiting clarity on these key fronts.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.