USDMYR trade ideas

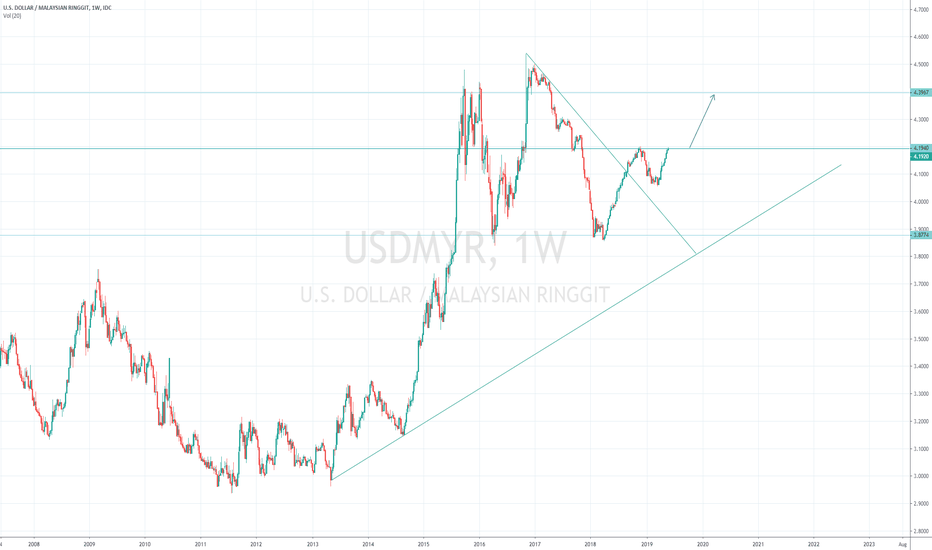

Will Asia Break Lower In August 2019?Extended price weakness appears to be pushing Asian currencies below historical price channels. A breakdown from this support channel could mean a complete breakdown in currency values going forward. This may be the beginning of much lower price exploration in an attempt to fund support.

Hold onto your heads and profits folks. The crap may begin to fly soon.

Malaysia - Still Waters Run DeepAs Q2 2019 is underway, global financial markets have experienced a melt-up in assets prices, with some markets up over 20 percent year-to-date. However, despite the run in global asset prices, there is one country that has missed out on the rally, and that is Malaysia.

Malaysian equities ( EWM ) (INDEX:KLSE) have declined -3.77% in 2019, taking the mantle as the worst performing equity market this year so far. To further complicate matters, the yield on the Malaysian 10-year government bond has risen to 3.932% as of this post, up from 3.81% in March. Lastly, the Malaysian Ringgit has weakened by 1.92% percent in April 2019, loosing 0.08% against the US Dollar for the year, and forecast to fall further.

Under-performance in Malaysian assets in recent trading sessions can be attributed to the fact that global investors are worried that Malaysian bonds may be removed from the FTSE Russel, a key global bond index for international investors. If this were to occur, Malaysian credit markets would see billions of dollars in outflows, in conjunction with a spike in yields, as investors flee the market en masse.

However, the under-performance of Malaysian assets in 2019 can be attributed to recent downgrades in Malaysian gross domestic product (“GDP”) by the International Monetary Fund (“IMF”). The IMF downgraded the country’s GDP to 4.5% for 2019, down from 4.7% as stated in their prior forecasts. Growth is expected to slow this year as uncertainty stemming from the US-China trade war is expected to put further pressure on Malaysian exports. Furthermore, on a micro level, the threat of elevated household debt among Malaysian households is also lurking in the background. With household debt-to-GDP levels hovering around 83% in 2018, some of the highest in South East Asia, there is worry that leveraged households who have taken large sums of debt for real estate investment and consumption may have difficulty servicing their existing debt. This is especially worrisome in the midst of a slowing economy. Thus, there is risk that elevated household debt could add further pressure to future economic growth, and threaten economic stability within the Malaysia, if it continues on its current trajectory.

As a result, due to these ongoing internal macroeconomic and financial headwinds, we are bearish on Malaysian assets and caution investors to tread lightly within this space.

A stronger MYR/Ringgit recovery against USD?Currency: USD / MYR

Screener: -

Observation date: 20 Feb 2019

Observation:

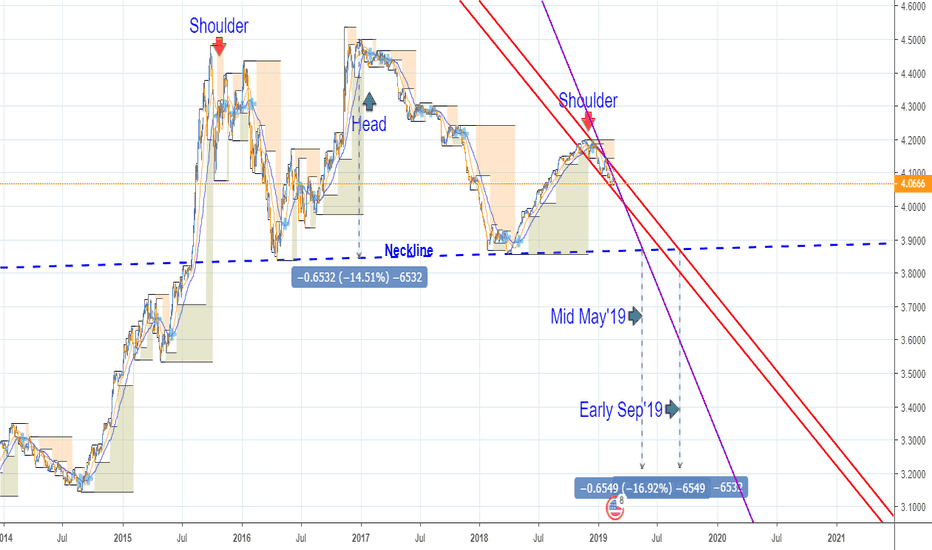

a) Chart pattern:

- Price is forming a Head & Shoulder (HNS) pattern with support above the Neckline.

- We can see that the formation of the 2nd Shoulder which has already peaked.

- The distance between the Head and Neckline is around MYR0.6532 (or 6532 pips).

b) Trend:

- As priced has already peaked on the 2nd shoulder, we now see it is entering into a Downtrend.

Remarks:

- Based on the above observation, we can expect the Ringgit to go below MYR4/USD (between end March - end May'19).

- Further to that, we can expect MYR to grow even stronger once it breaches the Neckline (between mid May - early Sep'19).

- We shall continue to monitor the USD/MYR performance two (2) weeks from now.

Malaysia Ringgit Relating to The Prime ministerAssalamualaikum dan Salam Sejahtera.

Malam ini terasa sangat menjemukan lalu saya terfikir mengenai nilai ringgit semasa dan selanjutnya terfikir untuk mengkaji perkaitan antara nilai Ringgit sejajar dengan Perdana Menteri Malaysia.

Dapatan saya amat mngejutkan dan sangat menarik perhatian saya untuk mengupas lebih lanjut mengenai perkara ini.

Pada awalnya saya mendapati bahawa terdapat kejatuhan nilai Ringgit mendadak pada masa pemerintahan Tun Dr Mahathir, namun setelah saya mengkaji lebih lanjut, saya mendapati bahawa ianya harus di pecahkan kepada 3 jarak masa dalam pemerintahan Tun Dr Mahathir.

Seperti yang kita ketahui, pada era Tun Dr Mahathir berlakunya Krisis matawang dan boleh di katakan semua Negara-negara di Dunia terkena tempias dek peristiwa ini. Dengan itu saya pecahkan peristiwa ini sejajar dengan kadar matawang ringgit kepada 3 jarak masa, yaitu sebelum, semasa dan selepas berlakunya krisis ekonomi.

Pendapat saya mengatakan bahawa 3 jarak masa ini perlu di maklumkan untuk melihat keadaan dan kadar Ringgit yang sepatutnya terjadi untuk mengelakan dari salah faham dan pertimbangan yang berat sebelah. Dalam usaha mendapatkan data-data yang tepat kita memerlukan beberapa tapisan dan lazimnya impak fundemental ke atas matawang perlu di tapis bagi mendapat data yang tepat.

Dapatan saya lebih menjurus ke Era Tun Dr Mahathir kerana Perdana menteri semasa ini adalah beliau, dan bagi mendapat jajaran kadar yang mungkin berlaku.