NZD-USD Short From Resistance! Sell!

Hello,Traders!

NZD-USD is once again

About to retest a horizontal

Resistance level of 0.5840

Which is a strong supply

Area from where a local

Bearish pullback is to

Be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDNZD trade ideas

NZDUSD Will Collapse! SELL!

My dear subscribers,

My technical analysis for NZDUSD is below:

The price is coiling around a solid key level - 0.5786

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 0.5710

My Stop Loss - 0.5830

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDUSD Is Going Up! Long!

Take a look at our analysis for NZDUSD.

Time Frame: 15m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 0.581.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.585 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD/USD 1H Chart Setup – Demand Zone Bounce & Bullish Target1. Chart Overview

Pair: NZD/USD

Timeframe: 1H

Current Price: 0.56961

Indicator Used: 9 EMA (📈)

2. Key Zones & Levels

🔵 Demand Zone

Area: Approx. 0.55933 – 0.56600

Role: Strong support area where buyers have shown interest

Bounce already observed from this zone

🟥 Re-Entry Zone

Slight pullback expected into this minor resistance-turned-support

Potential entry for bulls (🐂)

🎯 Target Point

Price: 0.58434

Gain: +3.59%

Strong resistance above

🛑 Stop Loss

Price: 0.55933

Just below the demand zone for protection

Keeps risk tight (🔒)

3. Trade Idea (Buy Setup)

📍 Entry Plan:

Wait for a pullback into the red zone

Confirm support holds

Look for long position setup

📈 Target:

Aim for 0.58434

High reward potential

📉 Stop Loss:

Below 0.55933 to minimize loss if setup fails

✅ Risk-Reward Ratio:

Attractive (approx. 2:1 or better)

Summary

Demand zone is strong (🛡️)

Market structure supports bullish move (🚀)

Setup favors a pullback buy strategy

Kiwi H4 | Potential pullback opportunityThe Kiwi (NZD/USD) could fall towards a pullback support and potentially bounce off this level to climb higher.

Buy entry is at 0.5783 which is a pullback support.

Stop loss is at 0.5710 which is a level that lies underneath a pullback support and the 23.6% Fibonacci retracement.

Take profit is at 0.5852 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Long trade

1Hr TF overview

✅ Trade Breakdown – Buy-Side (NZD/USD)

📅 Date: Thursday, April 10, 2025

⏰ Time: 9:00 AM (NY Time) – London Session AM

📈 Pair: NZD/USD

🧭 Direction: Long (Buy)

📐 Structure TF: 1-Hour (Directional Bias)

🎯 Entry TF: 2-Minute (Precision Entry)

Trade Parameters:

Entry: 0.57120

Take Profit (TP): 0.57922 (+1.40%)

Stop Loss (SL): 0.56880 (–0.42%)

Risk-Reward Ratio (RR): 3.34

This Thursday AM trade was positioned during London, focusing on the 2m entry capitalizing on a micro-displacement following a liquidity grab for a buy-side trade.

Potential bearish drop?The Kiwi (NZD/USD) is reacting off the pivot and could drop to the 28.2% Fibonacci support.

Pivot: 0.5759

1st Support: 0.5651

1st Resistance: 0.5831

CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the pullback resistance.

Pivot: 102.61

1st Support: 101.62

1st Resistance: 103.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDUSD Wave Analysis – 10 April 2025

- NZDUSD reversed from support zone

- Likely to rise to resistance level 0.5820

NZDUSD currency pair recently reversed from the support zone between the key support level 0.5530 (which has been reversing the price from January) and the lower daily Bollinger Band.

The upward reversal from the support level 0.5530 created the daily Japanese candlesticks reversal pattern Morning Star Doji.

Given the strongly bearish US dollar sentiment, NZDUSD currency pair can be expected to rise to the next resistance level 0.5820.

NZDUSD – Short-Term Bullish Setup (1H Divergence)✅ Market Summary:

Timeframe: 1 Hour

Bias: Bullish (Short-Term)

Signal: Bullish Divergence – Lower lows on price, higher lows on RSI or MACD

Trend Context: Possibly in early stages of a reversal or retracement within a broader range

🔍 Technical Highlights:

Bullish Divergence: Confirmed on 1H (RSI or MACD)

Support Zone: Price reacting from an intraday support level or demand zone

Candle Confirmation: Look for a bullish engulfing, pin bar, or break of structure

📈 Trade Plan – LONG Setup

Entry:

After bullish confirmation candle closes

Or upon break of minor 1H resistance (structure shift)

Stop-Loss:

Below the recent swing low (beneath divergence level)

Take-Profit:

TP1: Previous 1H high or resistance

TP2: Fib 0.618 retracement of the last bearish leg (if applicable)

Risk-to-Reward: Aim for 1:1.5 or better

⚠️ Cautions & Notes:

This is a short-term play, not a higher time frame reversal (unless confirmed later)

Watch for NFP data, Fed commentary, or USD news that may spike volatility

NZDUSD bullish starting?

OANDA:NZDUSD from start of February sentiment is bullish.

In week before we are have strong events like RBA, TRUMP SPEAK, NONFARM.., we all are expect NZD and AUD domination but at end in zone we are see changes and strong fall.

After all of this now from here expecting new bullish starting.

SUP zone: 0.55200

RES zone: 0.57400, 0.58200

NZDUSD Long✅ NZD/USD Long Setup

Entry: 0.5520

Stop Loss (SL): 0.5375 (below historical multi-decade support and spike lows — gives room for volatility)

Take Profits (TPs):

TP1: 0.6000 (psychological + historical S/R level)

TP2: 0.6200 (structural supply level)

TP3: 0.6400 (historical resistance zone + cycle high area)

NZDUSD Long Setup – FVG + Order Block + Macro Bullish BiasI'm looking to go long on NZDUSD based on a strong confluence of fundamentals, seasonal trends, and technical structure.

🔹 Macro bias: USD weakening as Fed leans dovish, while NZD is gaining momentum from rate cuts and improving LEI.

🔹 Seasonality: Historically, NZD shows strength in the first half of April, while USD tends to weaken mid-to-late April.

🔹 Technical setup:

Price left a Fair Value Gap (FVG) on the 4H chart

Pullback into a bullish Order Block (OB)

Entry within imbalance

NZDUSD Faces Resistance After Recent Sell-OffFollowing the significant sell-off last week, the NZDUSD price has retraced to approximately 60% of the previous bearish move. The price appears to have encountered resistance at a zone marked by an upward trendline and the boundary of the channel. Additionally, there is a psychological level at 0.57000. Should the price reject this resistance, it may continue to decline and retest the middle of the consolidation range. On the other hand, if upcoming news releases favour the market, there could be potential for a move higher. The target for the market is a resistance zone near 0.55940

Lingrid | NZDUSD potential PULLBACK Trading OpportunityThe price perfectly fulfilled my previous idea . It hit the take profit level. After last week's massive sell-off, FX:NZDUSD price has pulled back toward 60% of the bearish move. The price appears to have bounced off the resistance zone where we have upward trendline and channel border. Additionally, there is a psychological level at 0.57000 as well. I believe the price may move lower and retest the middle of the consolidation zone if the price rejects the resistance. However, the market might move higher if the upcoming news release favors the market. My target is resistance zone around 0.55940

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

NZDUSD ANALYSIS

### 🔄 **Basic Structure of Point 1-2-3 Setup**:

1. **Point 1 (P1):** The initial move or swing low/high (starting point).

2. **Point 2 (P2):** The opposite extreme – the highest high (uptrend) or lowest low (downtrend).

3. **Point 3 (P3):** A correction that doesn’t exceed P1, followed by a potential breakout beyond P2 to confirm a new trend.

---

### ✅ **Chart Analysis (NZD/USD, Heikin Ashi, 15 Min)**:

#### 📉 **First Major Bearish Move** (Left side of the chart):

- **P1:** Price peaks (Point 2 is marked near 0.571xx).

- **P2:** Swing low around 0.563xx (Point 2 in white).

- **P3:** Retracement (fails to break the initial high, confirming potential trend change).

- Then the price **breaks below P2**, confirming a **new downtrend**.

This bearish structure played out with a **short position**, visualized by the red trade box.

---

#### 📈 **Reversal to Bullish Trend** (Middle to right side):

- After a long downtrend, a shift occurs.

- New **Point 1**: A swing low forms (around 0.558xx).

- **Point 2**: Price pushes up to a local high (confirmed with white lines).

- **Point 3**: Retracement that stays above Point 1 (0.558xx zone).

Then:

- **TST (Test)** occurs: Price revisits P3 zone but holds.

- Break above **Point 2** confirms **bullish trend**.

- We see **multiple fractal P1-2-3 formations** up the rally:

- Smaller structures form within the bigger bullish move (each followed by breakouts).

---

### 📌 **Most Recent Trade Setup (Far Right)**:

- **P1:** Swing low (end of pullback).

- **P2:** Local peak after a bullish impulse.

- **P3:** Pullback that doesn’t break P1.

- **Breakout above P2 confirms long position**, shown by the current green box trade setup.

This trade is still active, with the price hovering slightly above entry.

---

### 🧠 Summary (Das Voigt Logic Applied):

- The chart follows textbook **Point 1-2-3 trend development**, first bearish, then a clean shift to bullish.

- Multiple entries are possible using **sub-structures** within the main trend.

- The key is **waiting for P3 to hold** and then **confirmation via breakout of P2**.

Would you like me to mark up the chart with the Point 1, 2, 3 labels and send it back for clarity?

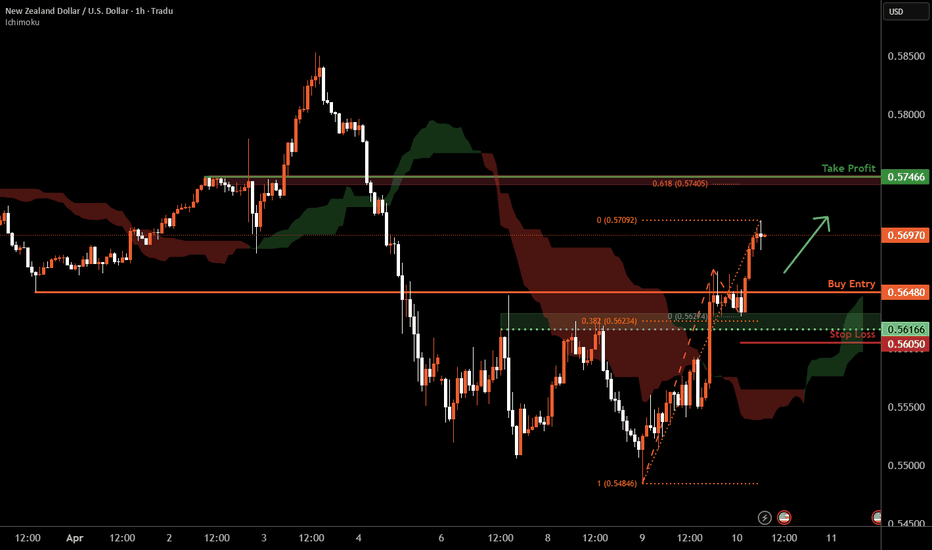

Kiwi H1 | Falling to an overlap suppportThe Kiwi (NZD/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 0.5648 which is an overlap support.

Stop loss is at 0.5605 which is a level that lies underneath a pullback support and the 38.2% Fibonacci retracement.

Take profit is at 0.5746 which is a pullback resistance that aligns close to the 61.8% Fibonacci projection.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.