NZD/USD Analysis: Exchange Rate Nears 2025 LowNZD/USD Analysis: Exchange Rate Nears 2025 Low

Less than a month ago, we analysed the NZD/USD chart and:

→ highlighted the key resistance level at 0.5800;

→ outlined a potential scenario involving a decline from that zone.

Now, the NZD/USD pair is trading close to its lowest level of 2025, recorded on 3 February near 0.5525. The latest surge in volatility appears to be driven by President Trump’s widely discussed decision to impose substantial tariffs on trade with multiple countries.

For context, the Australian dollar has fallen to a five-year low amid concerns that retaliatory trade measures could trigger a global recession. The New Zealand dollar, however, has remained somewhat more stable — possibly because traders are anticipating Wednesday’s Reserve Bank of New Zealand (RBNZ) meeting, where the central bank may signal efforts to stabilise the currency. According to Forex Factory, a rate cut from 3.75% to 3.50% is expected.

Technical analysis of NZD/USD chart

Price movements in 2025 have formed an ascending channel (marked in blue), but bears broke through the lower boundary late last week near the 0.5666 level.

This suggests that even if NZD/USD sees a short-term rebound, it may face resistance around that same level — a classic “break-and-retest” pattern often watched by traders.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDNZD trade ideas

Symmetrical triangle.NZDUSD is moving in a downtrend. I tried to draw lines, and it looks like a symmetrical triangle is more likely to be traded today. It's first seen that price attempted to push above the triangle, but it fell straight down again, leaving the upper side with a big wick, also known as a rejection candlestick. Price then continued to move below with a steady movement and steady pullback up again as well. I see that it's currently very deep back into triangle pattern, kind of making the whole pattern more invalid. I think another key factor to think about is that trend lines aren't always straight lines when it speaks to the market, it can also move in zones that extend beyond and below a trend line. At the current moment, price eventually managed to not just push below triangle, but is also gaining momentum down. So here is my trade. Hope you all find success.

NZD USD #0004 Short Position Trading - Passed weeks have shown a sign of a false breakout indicating buyer sentiment is not strong

- a strong signs for reversal may be in place.

- entry limit is placed at the last HIGH of the weekly candles indicating the area with the dense Liquidity Pool.

- SL and TP are as labeled in the diagram.

- biased is strongly short for this pair.

- Estimation of holding time 2-3 weeks the shortest.

#NZDUSDLevels where price reactions are most likely to occur during the day. Naturally, at each level, you can have buy and sell positions and you can freely use the levels for a new order or for TP of your postions. The levels are updated daily!

The results of price reaction to these levels will be shown in the upcoming videos.

NZD_USD RISKY LONG|

✅NZD_USD has hit a key structure level of 0.5520

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD and NZD: WTH? RBNZ now in focusRisk aversion intensified on Friday, sending the Australian dollar down 4.56% and the New Zealand dollar 3.53% lower.

The declines followed a move by US President Donald Trump to impose a 10% tariff on imports from both Australia and New Zealand. Australian Prime Minister Anthony Albanese confirmed there would be no retaliation, noting the US represents less than 5% of Australia’s export market. New Zealand, with a higher 12% exposure, also ruled out countermeasures.

For the New Zealand dollar, markets will now be focused on this week’s Reserve Bank of New Zealand decision, where a 25-basis point rate cut is widely expected. Barring further tariff news, this could be the most important event determining whether this sell-off continues.

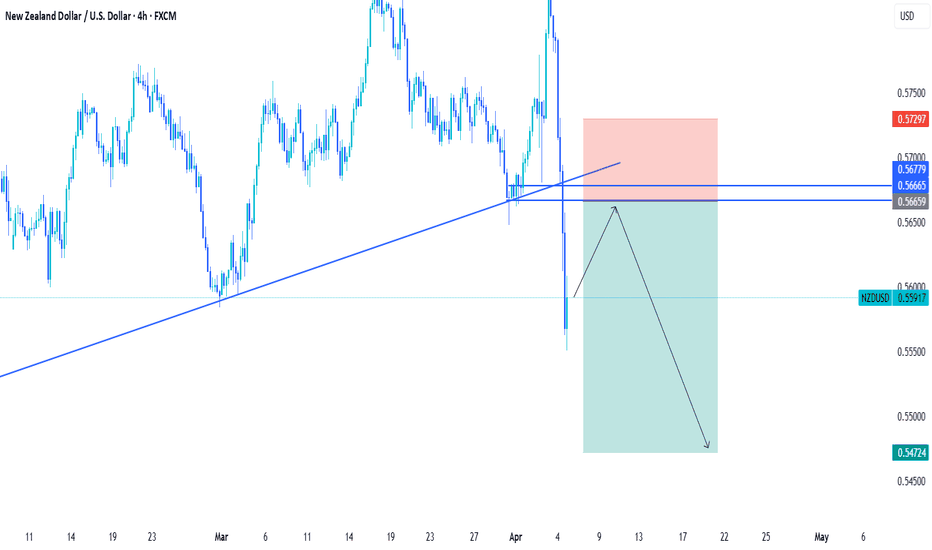

NZD/USD 4H Chart Breakdown – Trendline Breach & Bearish Setup📉 NZD/USD 4H Chart Analysis

1. Trendline Break 🚨

* Price was following a strong uptrend line (↗️)

* Broke below it sharply ➡️ Bearish sign

* Momentum shifted from bullish to bearish

2. Retest Resistance Zone 🔄

* After the drop, price bounced back into a blue resistance box (🧱)

* This was previous support → now resistance

* Classic "break → retest → drop?" setup forming

* Expecting a possible rejection here (✋)

3. Target Point 🎯

* Bearish continuation may push price to 0.55166 zone

* This is your target point (📍)

* Previous key support — might attract buyers again

4. Scenarios to Watch:

✅ Bearish Confirmation:

Price gets rejected at resistance (🧱)

Forms bearish candle (📉)

Continues down to target (🔽🎯)

❌ Bullish Invalidator:

Price closes above resistance zone (🔼)

Breaks back inside trend = Bullish comeback (🟢)

Current Bias:

🔴 Bearish unless price reclaims resistance above 0.5700

👀 Watch that zone closely for a potential entry signal

NZD-USD Strong Support Ahead! Buy!

Hello,Traders!

NZD-NZD is approaching a

Horizontal support level

Of 0.5521 so when the

Market opens we will be

Expecting the pair to retest

The support first and then

Make a nice bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WIDE VIEW ON NZDUSDThe general direction is downward. Buying it is just a pull back.

There are two scenarios, to retesf the weekly supply or respecting the breaker block.

Now, the probability is, selling it, if we observe the closing of candles we see rejection upsidd and the mommentum of sellers is high.

Conclusion: it is well to wait for a pull back in lower TF and join the drops.

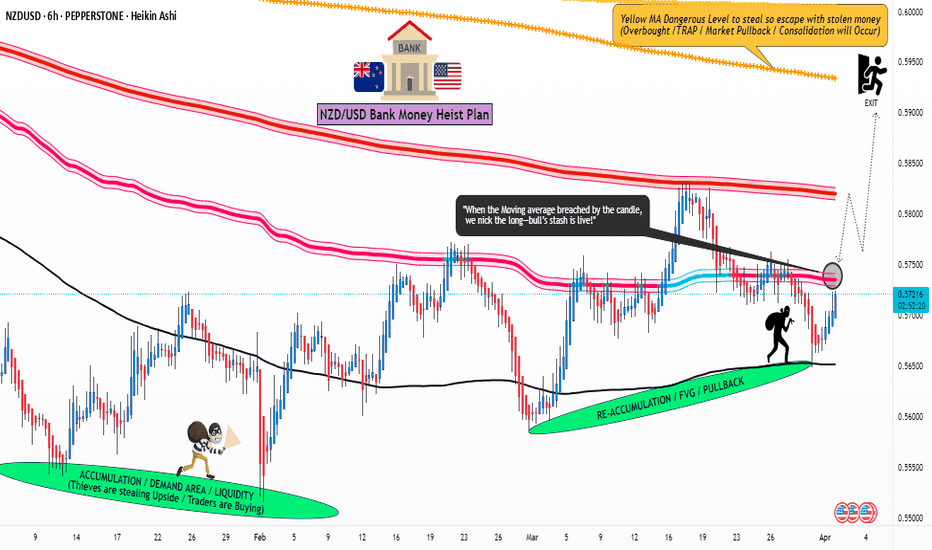

NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/USD "The Kiwi" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Yellow MA Zone. It's Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (0.57500) - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) after the MA breakout Place buy limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing low or high level Using the 6H timeframe (0.56500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.59400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💵💰NZD/USD "The Kiwi" Forex Bank Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Downside Risk Grows for NZD/USD After Structure FailThe NZD/USD pair has broken down from a well-defined rising wedge pattern, signaling a shift in short-to-medium term momentum. After trending within this rising structure for several weeks, price has now decisively violated the lower trendline, confirming a bearish breakout. The move coincides with a sharp rejection near the 200 EMA, which continues to act as dynamic resistance overhead.

Price is now hovering around a key support zone between 0.555 and 0.558 — a level that has historically served as a pivot point. The breakdown is also supported by a clear bearish RSI divergence, where price made higher highs while RSI formed lower highs, indicating weakening momentum. Currently, the RSI sits at around 32.47, approaching oversold territory but not yet showing signs of bullish reversal.

If the current support zone fails to hold, we could see further downside pressure, potentially driving the pair toward the next major support region near 0.548–0.540. On the other hand, if buyers step in and absorb the sell-off at these levels, a relief bounce toward the broken trendline or the 200 EMA could be expected — though such a move may face strong resistance.

NZDUSDwait and see , valid rejection set up to buy.

risky cause all demand above mitigate.

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

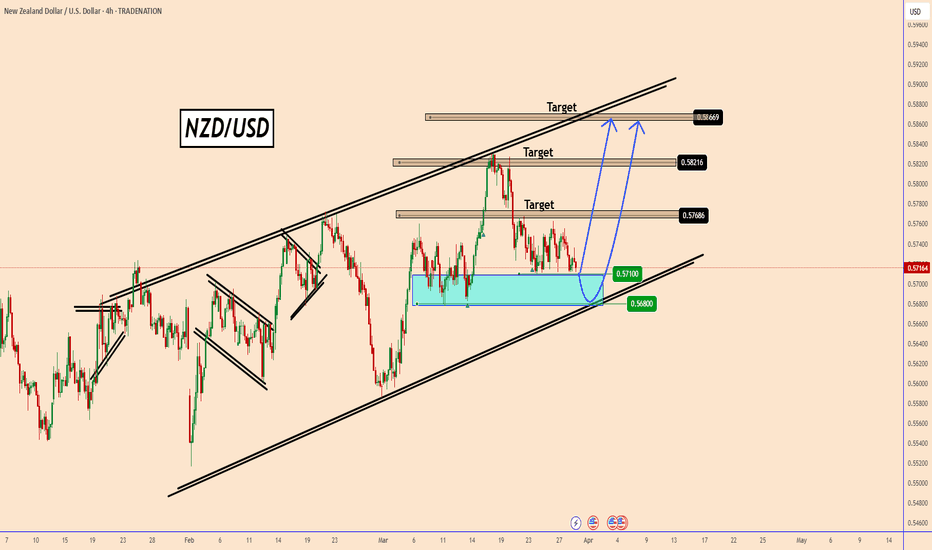

NZDUSD: Trading Within a Narrow 50-pip RangeNZDUSD: Trading Within a Narrow 50-pip Range

The NZDUSD currency pair has been trading within a narrow 50-pip range, stuck between 0.5710 and 0.5760 for about 10 days. It seems likely that this sideways movement will continue in the coming week, as there are no major developments expected.

Next week, two key events could impact the US dollar. The first is the decision on Trump's tariffs, expected by April 2 or 3. The second is the release of Non-Farm Payroll (NFP) data. The U.S. is forecasted to report a decline in job growth to 128,000, down from 151,000 in the previous month.

Market conditions may remain choppy, and even if NZDUSD moves lower, I don't expect it to fall below 0.5680. The reversal zone between 0.5680 and 0.5710 will likely remain critical for the pair to regain upward momentum, as highlighted on the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/USD 4TF Fundamental and Technical AnalysisNZD/USD 4TF Fundamental and Technical Analysis

Fundamental Outlook:

The NZD/USD remains under significant bearish pressure due to weak economic data from New Zealand. Recent disappointing figures, including a slowdown in employment growth and declining consumer sentiment, have added to the negative sentiment surrounding the New Zealand dollar. Additionally, New Zealand's exposure to global trade risks, particularly as the U.S. escalates tariffs on Chinese imports, continues to weigh on the currency.

On the other hand, the U.S. dollar is benefiting from its safe-haven status amid ongoing global economic uncertainties. This has supported the USD, especially as the U.S. economy remains relatively resilient compared to other regions, including New Zealand. The upcoming U.S. Non-Farm Employment Change data (forecast: 137K, previous: 151K) could provide further momentum for the U.S. dollar, potentially pushing NZD/USD lower.

Technical Outlook:

On the 4-hour timeframe, NZD/USD remains in a strong downtrend, with a bearish flag pattern indicating potential continuation of the decline. The pair has formed key resistance at 0.58490 and support at 0.57400, with the next crucial breakout level at 0.56800. Additionally, we’ve noticed a double top pattern within the minor key resistance at 0.58490, further confirming the likelihood of a bearish move.

Our strategy is to wait for a confirmed breakdown below 0.56800, which would trigger a sell limit order at 0.56730. The stop-loss will be set at 0.57530 to manage risk, and the take-profit target is placed at 0.55090, aligning with the next minor support level.

In conclusion, the resistance at 0.58490 is a critical level. If it holds, we could see a reversal; if broken, NZD/USD could continue to dominate, pushing the pair lower.

📌 Disclaimer:

This analysis is for informational and educational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial professional before making any investment decisions.

Kiwi H1 | Falling to overlap supportThe Kiwi (NZD/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 0.5775 which is an overlap support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 0.5750 which is a level that lies underneath a pullback support and the 50.0% Fibonacci retracement.

Take profit is at 0.5819 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.