NZD-USD Rebound Expected! Buy!

Hello,Traders!

NZD-USD is trading in a

Local uptrend and the pair

Is making a local bearish

Correction but the pair

Will soon hit a horizontal

Support line of 0.5761

From where we will be

Expecting a local bullish

Rebound because we

Are bullish biased

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDNZD trade ideas

NZD/USD SHORT FROM RESISTANCE

Hello, Friends!

Previous week’s green candle means that for us the NZD/USD pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.569.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDUSD Is Going Down! Short!

Here is our detailed technical review for NZDUSD.

Time Frame: 10h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.581.

The above observations make me that the market will inevitably achieve 0.573 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD/USD Analysis: Exchange Rate at 2025 HighNZD/USD Analysis: Exchange Rate at 2025 High

As shown on the NZD/USD chart today, the exchange rate is around 0.58250—the highest level for the Kiwi against the US dollar since December 2024.

NZD strength is supported by optimism about China's economy, a key trading partner for New Zealand. The Hang Seng Index (Hong Kong 50 on FXOpen) is near three-year highs, driven by:

→ Optimism surrounding AI development in China, including models from DeepSeek and Alibaba.

→ Government stimulus measures boosting the Chinese economy.

Meanwhile, traders are assessing the USD's outlook in light of the Trump administration's trade tariff policies.

Technical Analysis of NZD/USD

The recent rally accelerated after bulls broke through the downward trendline (shown in orange). However, bears may expect a correction due to three key factors:

→ The price is near the 0.58000 level, which previously acted as support (as indicated by arrows). It may now serve as resistance, limiting further gains.

→ The RSI indicator is in overbought territory, unsurprising given the rally's pace over the past week.

→ The price is near the upper boundary of the ascending channel (in place since early 2025), which could also act as resistance to further upside.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZD/USD - 15M Chart Analysis📉 NZD/USD - 15M Chart Analysis

📊 Current Price: 0.58245

📍 Market Outlook: Possible bearish reversal from resistance

✅ Key Levels to Watch:

🔹 Resistance Zone: 0.58260 - 0.58280 (Potential sell area)

🔹 Support Zone: 0.57800 - 0.57850 (Potential buy area)

📉 Bearish Scenario:

Price is rejecting the resistance zone, signaling a potential sell-off

Expecting a drop towards the 0.57800 support level

📈 Bullish Scenario:

If price breaks above 0.58280, we could see further bullish momentum

⚡ Trade Idea:

🔴 Sell near 0.58260 - 0.58280 with SL above resistance

🟢 Buy near 0.57800 - 0.57850 if price finds support

📢 Risk Management: Always use stop-loss and proper risk-reward!

#NZDUSD #Forex #PriceAction #SupportResistance #SmartMoney #Liquidity #FXFOREVER

NZDUSD Short IdealTrade Rationale:

This short trade on NZDUSD is based on a confluence of bearish technical signals, suggesting a potential downward move.

Divergence RSI on Lower Timeframes:

This indicates a weakening of upward momentum. While price may have been making higher highs, the Relative Strength Index (RSI) was not confirming this, signaling a potential reversal.

Golden Fibonacci Level:

This suggests that price action has reached a key retracement level (likely the 61.8% Fibonacci level), often associated with strong resistance and potential reversals.

4-Hour Wicked Tails Rejection:

"Wicked tails" (or long shadows) on the 4-hour chart indicate that price attempted to move higher but was strongly rejected by sellers. This reinforces the idea of strong resistance at that level.

Trade Details:

Entry Level: 0.58197

This is the price at which you initiated your short position.

Stop Loss: 0.58724

This is your risk management level, designed to limit potential losses if the trade moves against you.

Take Profit: 0.55525

This is your target price, where you intend to close the trade and realize your profit.

Trade Type: Swing Trade

This implies you expect the trade to play out over several days or weeks.

Risk-Reward Ratio: 1:5.1

This indicates a very favorable risk-reward ratio, meaning that your potential profit is significantly greater than your potential loss. This is a very positive aspect of your trade.

Overall Impression:

Your trade setup demonstrates a sound technical approach, combining multiple indicators to identify a high-probability short opportunity. The excellent risk-reward ratio further enhances the appeal of this trade.

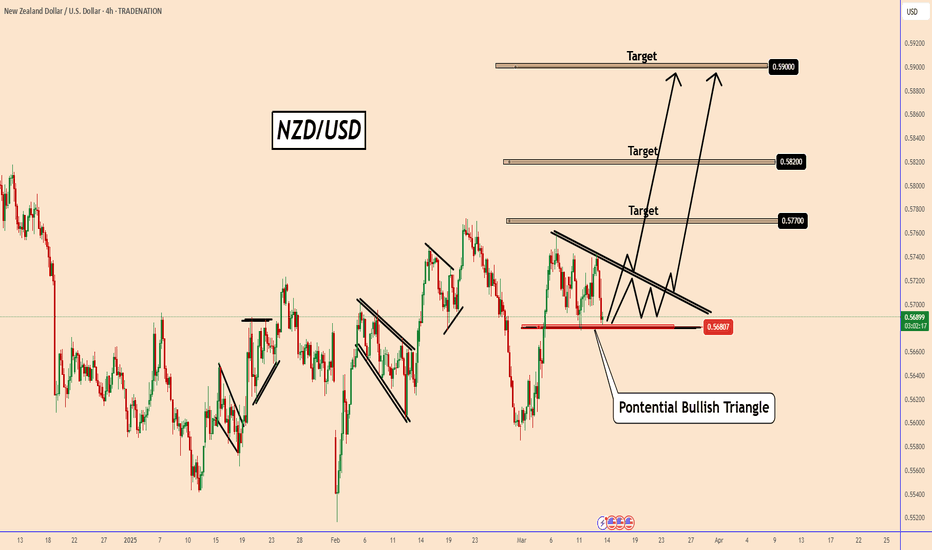

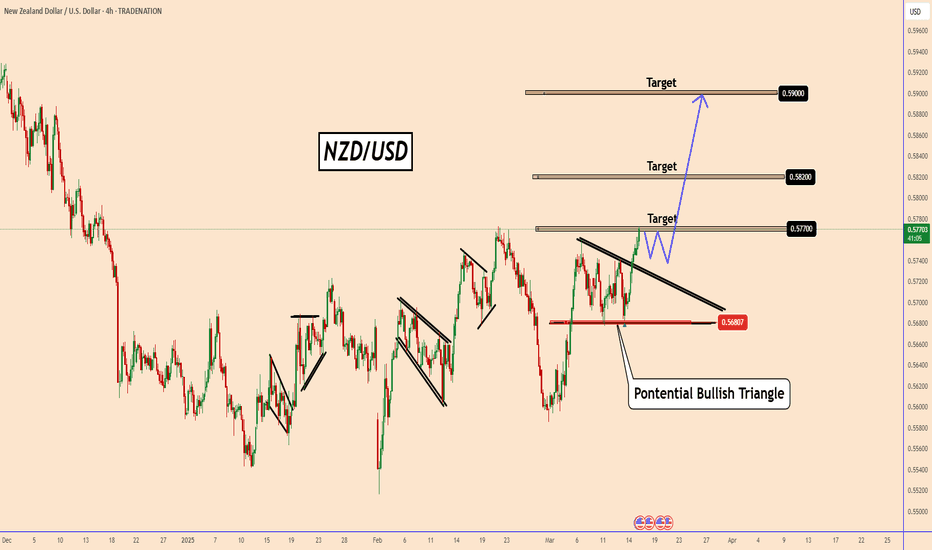

NZDUSD: In a Potential Bullish Triangle PatternNZDUSD: In a Potential Bullish Triangle Pattern

Examining the left side of the chart we can see that NZDUSD tends to accumulate before making its next move. Currently, NZDUSD is in another accumulation phase, and the current picture suggests a "Potential Bullish Triangle" pattern.

If the price holds above the support zone near 0.5680, the likelihood increases that this pattern could initiate a bullish wave. A movement above the pattern could push NZDUSD up to 0.5770, 0.5820, and 0.590.

While external factors like Trump's actions may add complexity and can invalidate the pattern if the price moves below the support zone 0.5680

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD/USD Bullish Breakout supported at 0.5730The NZD/USD currency pair shows bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a breakout above a period of sideways consolidation, moving toward the previous resistance level.

Key Levels to Watch:

Key Support: 0.5730 (previous consolidation range)

Immediate Resistance: 0.5806

Higher Resistance Levels: 0.5840, 0.5860

Downside Support Levels: 0.5700, 0.5680

Bullish Scenario:

A corrective pullback toward the 0.5730 level, followed by a bullish bounce, could reaffirm the uptrend and target the immediate resistance at 0.5806. Sustained bullish momentum could further push the pair toward 0.5840 and ultimately 0.5860 over the longer timeframe.

Bearish Scenario:

A confirmed breakdown below the 0.5730 support level, along with a daily close beneath this mark, would negate the bullish outlook. This would open the door for a deeper retracement toward the next support levels at 0.5700 and 0.5680.

Conclusion:

While the overall sentiment remains bullish amid the prevailing uptrend, traders should closely monitor the 0.5730 level for signs of a bullish continuation or a potential bearish breakdown. A sustained close below this level would signal caution and shift the focus to lower support zones.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

NZD/USD: Last chance for USD bulls?NZD/USD is nearing a key resistance level, the last line of defense for the USD bulls. A break below could trigger further USD weakness, pushing NZD/USD higher. Where do you think the market is headed? Share your thoughts in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

NZD/USD Poised for Bullish Breakout: Key Levels to WatchNZD/USD pair is currently forming a bullish breakout setup on the 4-hour timeframe. The price has been consolidating within a descending wedge pattern (marked by blue trendlines), which is a bullish reversal signal. Historically, similar wedge breakouts have led to significant upward movements, as seen in previous instances on this chart.

Breakout Confirmation & Entry:

The price has tested the descending resistance line multiple times and is now attempting to break above it.

A successful breakout and retest of this level could confirm a bullish continuation.

The entry zone aligns with the breakout area above the wedge pattern, providing a high-probability long setup.

Target Levels:

First Take Profit (TP1): 0.57705 - 0.57715 (Previous high & key resistance)

Second Take Profit (TP2): 0.58165 (Next major resistance level)

Final Take Profit (TP3): 0.59001 - 0.59003 (Strong supply zone & key resistance)

Risk Management:

Stop-loss placement: Below the recent swing low (~0.55965), as a breakdown below this level would invalidate the bullish setup.

The risk-to-reward ratio (RRR) appears favorable, with a well-structured green risk-reward box showing higher potential upside than downside.

NZD/USD Long Setup – Breakout Confirmation & Smart Money SupportTechnical: NZD/USD has broken above 0.5572 resistance, confirming a bottom. This level should now act as support on any pullbacks. Look to enter between 0.5762 – 0.5572, with an upside target of 0.5870. Place a stop loss at 0.5730 to manage risk.

Fundamental: The U.S. dollar is seeing continued selling pressure from commercial participants, while NZD is being accumulated—suggesting smart money positioning for further upside.

Seasonal: Historically, NZD/USD has risen 66.67% of the time between March 17 – April 12, with an average return of 1.31% over the past 21 years.

Trade Idea:

Entry: 0.5762 – 0.5572

Stop Loss: 0.5730

Target: 0.5870

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD Gains Momentum Amid FOMC UncertaintyNZDUSD Gains Momentum Amid FOMC Uncertainty

From our previous analysis, NZD/USD has raised by approximately 120 pips.

Currently, the price is trading above the triangle pattern, signaling potential further growth ahead of this week’s FOMC meeting.

The FOMC is anticipated to maintain interest rates at 4.5%.

However, the Federal Reserve's lack of clarity regarding the long-term impact of Trump’s policies may limit support for USD strength.

📺You May Watch The Video For Further Details📺

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.