Let’s break it down for my Pakistani Friends! 🇵🇰

PKR/USD isn’t just a forex pair it’s practically a slow-burning political memo dressed up as a currency chart!!! But make no mistake: there’s structure underneath the mess.

PKR/USD: The Controlled Descent with Scheduled Interventions

📉 Every bounce is negotiated. Every dip is deliberate.

Welcome to the Pakistani Rupee vs. US Dollar saga, where the story isn’t volatility it’s managed chaos.

The trendline says: lower highs and lower lows.

Since the 2023 low at 0.003212, we’ve watched a modest climb attempt.

Price flirted with 0.003663, only to slide into indecision.

The descending trendline? Untouched. Like a ceiling made of bureaucracy.

Pivot Zones: They Matter Here

P = 0.003710: The big magnet no one touches.

R1–R6? Let’s be honest — those are optimistic dreams unless something drastic happens, like IMF money rain.

S1 = 0.003451 is already flashing yellow.

A slip below here, and we might revisit the S3–S5 cluster (0.0034–0.00342).

What’s Actually Moving It?

This isn’t about economic data. It’s about:

- External debt obligations

- Foreign reserves praying for remittances

- A central bank trying not to panic

Playbook for Traders

Trend Followers: Don’t hope for a breakout. Watch the trendline rejection and play the glide down.

Range Traders: Use pivot zones like landmines — carefully, with tight stops.

Macro Traders: Track geopolitical winds. This chart moves on news, not numbers.

📌 Conclusion:

PKR/USD isn’t dead it’s tranquillised.

The slow, calculated descent may look boring, but boredom is often where consistency hides in forex.

Don’t trade the drama. Trade the pattern.

Please keep in mind.. the economy in Pakistan is growing since 15 years more than 8% in average!

USDPKR trade ideas

PKRUSD"Bullish Head and Shoulders" is a term used in technical analysis in financial markets. It's a reversal pattern that can indicate a potential change in the direction of a price trend.

The pattern consists of three peaks, with the middle peak (the "head") being higher than the two surrounding peaks (the "shoulders"). The line connecting the lows of the two troughs between the peaks is called the "neckline."

In a bullish head and shoulders pattern:

- The left shoulder forms as the price reaches a high, then declines.

- The head forms as the price rises higher than the previous high, then falls back.

- The right shoulder forms as the price rises again but fails to reach the height of the head, followed by another decline.

- The neckline connects the lows of the troughs between the peaks.

Traders often see the completion of a bullish head and shoulders pattern as a signal that a downtrend is losing momentum and that an uptrend may be forthcoming. However, like all technical analysis patterns, it's not foolproof, and other factors should be considered before making trading decisions.

USD/PKRPossibility of USD drop against PKR are really high its not only due to technical where goods prices are higher to curb the food inflation and stop other type of imports but also fundamentals as need of Pakistan's support is really necessary in the region to calm the situation down in middle east and stop the intelligence outflow.

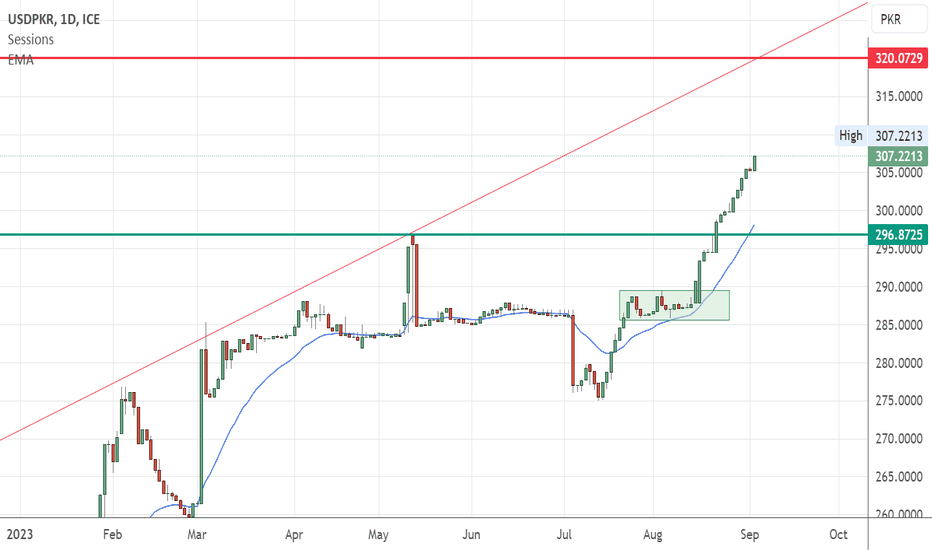

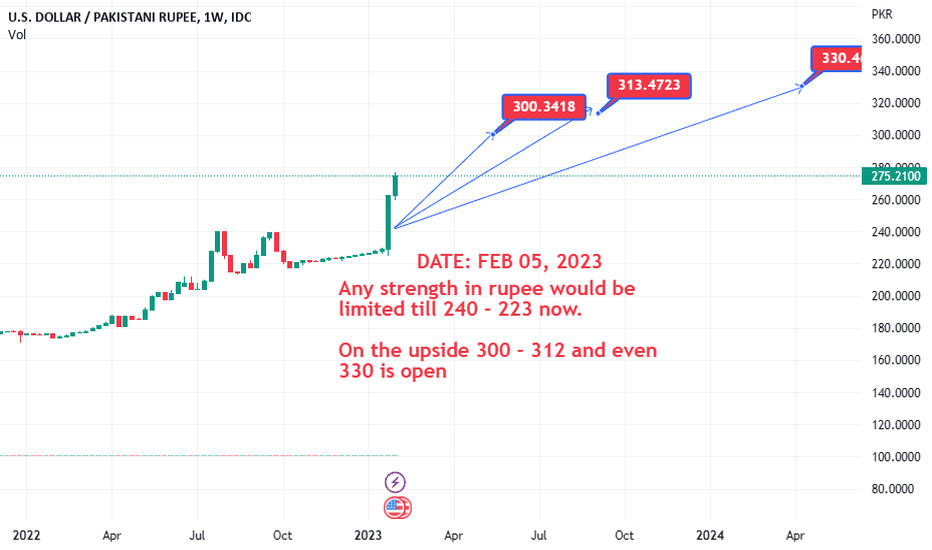

USD PKR expectation350 likely in the near term

--------------------------------------

--------------------------------------

Technical (Behavioral) factors (short term to medium term)

------------------------------------

- Consolidation period become shorten (rectangles)

- Historical correction range (10 to 11%) which has been completed in the current correction phase

- Tested current support upward support and resumed upward journey

- Extreme oversold momentum and trend indicators

Macro finance factors (medium term)

---------------------------------------------

- Increasing real interest rate differentials comparing with developed markets (portfolio channel)

- Increasing inflation differentials with developed market (Current account channel)

- Current account equations are in elastic to FX rates (current account channel)

- High risk premiums of equities, long duration bonds and real estate (Portfolio channel)

Macro finance factors (long term)

---------------------------------------------

- Lower productivity levels and potential GDP growth (reduced from 6% to 4% in recent years)

- Expected lower natural real exchange rate (long run equilibrium exchange rate - NATREX)

Market Micro structure factors (short term)

-----------------------------------------------------

- unwinding short forward position by exporters

- unwinding of short positions by importers

- unwinding of short positions by small investors due to crack down (investor sentiments)

Rising USDPKR Exchange Rate Sparks Highest Inflation in PakistanIn this video, I have taken into account a comprehensive technical analysis of the USDPKR exchange rate and its significant impact on inflation within Pakistan. The Price action will provide you with a detailed understanding of the factors driving this upward movement.

Stay informed and make data-driven decisions in the financial markets by watching our in-depth analysis.

USDPKR about to hyperinflate? Pakistan will default?USDPKR is closely following USDLKR before the Sri Lankan Rupee hyperinflated in April 2022.

Below USDLKR can be seen creating a pattern in 2020 and 2021 very similar to what FX_IDC:USDPKR has been doing in the last year.

Here is what happened after Sri Lanka defaulted, and FX_IDC:USDLKR went from 200 to 360 in a matter of days

Given the above fractals, is it possible that Pakistan can defailt soon? If it does and it follows through on the pattern, USDPKR can jump from from the 280s to the high 400s very quickly.

USDPKR Bearish Divergence (Analysis.1)Whenever bearish divergence appears on the monthly chart of USDPKR, it took a 5-6% correction in first instance and if the divergence appeared again successively the instrument took a correction of 9-10%. Currently one bearish divergence was appeared and price action got corrected. Lets wait for another Bearish divergence to witness a good fall in USDPKR.

Usdpkr analysisDue to inflation in pakistan the pkr get weak against dollar and other currencies but there are some countries which commited to pay for pak, specialy most of them as i hear news they mentioj the march i will effect the price. The price range is about 240 and 290 the price hold for some times in this range.