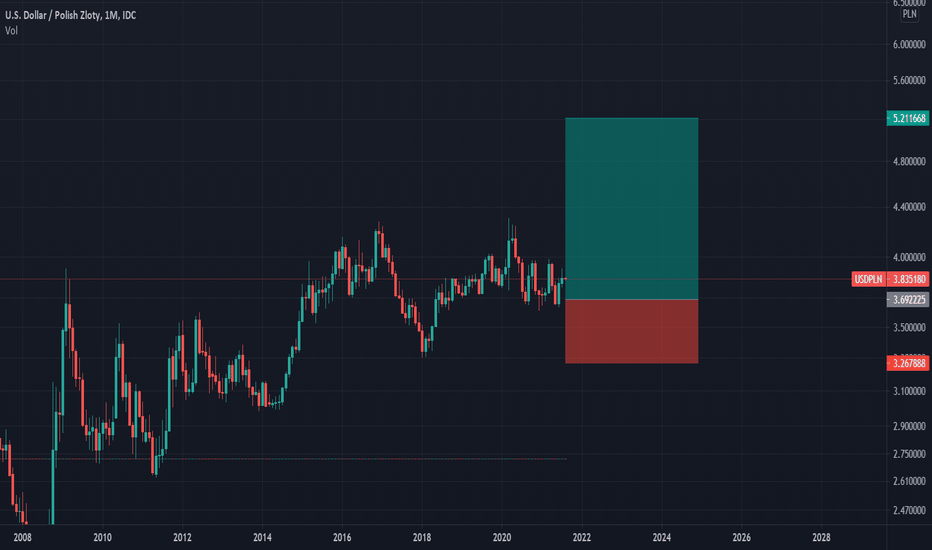

Few Years USDPLN Market phases - Price Action Market phases - Price Action

The market can only go in three directions:

1. up,

2.down,

3. sideways.

With high / low defined, we can use several charts to identify these market phases and start a simple search for our Swing Highs and Swing

Lows.

In short:

• the market rises when price makes higher highs and higher lows.

• the market goes down when the price makes lower highs and lower lows,

• The market goes sideways when price does not make higher highs and higher lows or lower highs and lower lows.

It may sound childishly simple, almost like stating something obvious, but

you will be amazed how often people forget these simple facts. One

the most important question is: "Where is the market going?"

A trend shift to a downtrend occurs when we see the following

sequence:

The change of direction is confirmed when price drops below the last lows

(as seen in the chart above). Otherwise

speaking, this is a 1-2-3 reversal - you go short (sell) after

correction at the level of the blue line. or sell to the level of the blue line (then repeat after correction, and re-sell )

USDPLX trade ideas

USDPLN looks like PLN will get stronger despite inflation scareLong term chart of USDPLN

Charts like to tell the future. That is why i treat them like a magic device.

Despite huge PLN inflation at more than 4% it looks like it will grow stonger against two giants like USD and EUR. Both charts look very similar.

Saving this chart for future reference.

Good luck.

USDPLAN top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis video. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover my next analysis.

Also, let me know your thought in the comment section about what you think about this pair.

USDPLN - Sell Setup Forming!Hello everyone, if you like the idea, do not forget to support with a like and follow.

USDPLN is approaching strong daily resistance in green and round number 4.00 so we will be looking for sell setups on lower timeframes.

on H4: USDPLN is forming a trendline in red, but it is not valid yet, so we will be waiting for a third swing low to form around it to consider it our trigger swing. (projection in purple).

Trigger => Waiting for that swing to form and then sell after a momentum candle close below it (gray zone)

Until the sell is activated, USDPLN would be overall bullish and can still test the 4.00 level or even break it upward.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich