USD/RUB: Russian Banking Sector Faces Default CrisisIon Jauregui – Analyst at ActivTrades

The ruble is under the spotlight as Russian banks prepare to request a bailout amid a growing wave of loan defaults.

1. Russian banks falter behind the scenes

Although the Central Bank of Russia maintains a narrative of stability, the actual state of the financial system could be far more fragile. According to Bloomberg, several senior executives at major banks privately acknowledge that default levels are much higher than what is reflected in official data. This discrepancy has led at least three systemically important banks to consider requesting a bailout in 2026.

The concern is significant: these institutions are so large that their collapse could trigger contagion across the entire Russian financial system—just as it did in 2017 with the collapse of Otkritie, Promsvyazbank, and B&N Bank, which required a rescue exceeding one trillion rubles.

2. Secret meetings and emergency plans

Since late June, leading banks in Russia have held discreet meetings to explore how they might jointly approach the Central Bank with a formal request for assistance, should defaults continue to rise. The progressive deterioration of their balance sheets and mounting macroeconomic pressure are accelerating the preparation of this potential rescue plan. Although no official request has been made, the very fact that such discussions are taking place underscores the growing urgency within the sector.

3. The impact of war: inflation, high rates, and delinquency

The roots of this new crisis lie in the ongoing military conflict. The war effort has triggered uncontrolled inflation, forcing the Central Bank to raise interest rates above 20% in an attempt to stabilize the economy. However, this restrictive monetary policy has sharply increased borrowing costs for businesses and consumers alike, leading to a surge in loan defaults.

This domino effect has undermined the credit quality of banking assets. While official figures do not yet reflect the full extent of the problem, insiders describe the situation as both “concerning and structural.”

4. Nabiullina caught between the official narrative and containment measures

Elvira Nabiullina, Governor of the Central Bank of Russia, has sought to calm markets by stating that “the banking system is well capitalized.” However, recent actions by the central bank partially contradict this stance: it has temporarily allowed banks to operate with lower capital ratios—a relief measure that implicitly acknowledges serious vulnerabilities in the sector.

5. Sberbank acknowledges a challenging environment

Even at Sberbank, the country’s largest and state-controlled bank, CEO Herman Gref admitted that “it’s clearly not going to be easy.” While he expressed confidence in the sector’s ability to weather the storm, his remarks reflect the mounting tension among Russia’s top financial players.

USD/RUB Analysis: Between Apparent Stability and Systemic Risk

Fundamental Outlook

The deterioration of Russian bank balance sheets—combined with an economy under stress from the war effort, elevated inflation, and interest rates above 20%—creates a fragile backdrop for the ruble. Although the financial system appears stable on the surface, the potential for a bailout in 2026 points to deeper structural issues that may eventually surface in the currency market.

So far, the ruble has shown relative strength, trading around 77–78 RUB per dollar—well below the weakest levels seen in the aftermath of the war’s onset. However, this apparent stability could be short-lived if the market begins to price in the fiscal and monetary impact of large-scale bank bailouts. Moreover, the ruble remains isolated from international markets, with low liquidity and volatility artificially suppressed by capital controls, preventing a true market-based valuation.

Technical Outlook

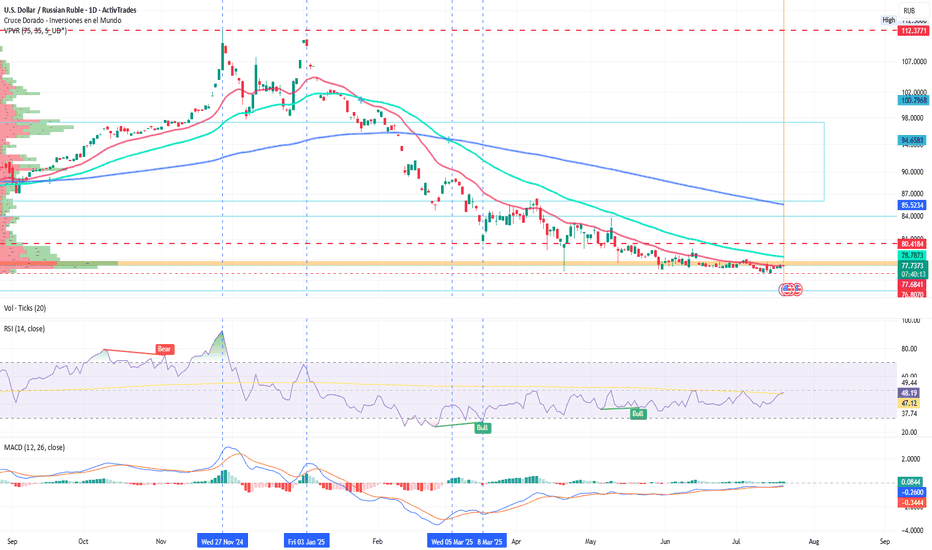

The ruble has regained ground against the US dollar over the past year, currently trading within a range between 76.80 and 79 RUB/USD. The point of control lies near the current price at 77.73, with a heavily concentrated volume area.

Resistance: 80.4184 RUB

Support: 76.7918 RUB (May 2023 low)

A trend reversal would require a clear break above the first resistance and a move toward the 85 RUB zone. The RSI is currently neutral, slightly oversold at 48.19%. Meanwhile, the MACD and its signal line remain below the histogram but are nearing a crossover, suggesting a possible bullish movement for the dollar against the ruble—especially if the aforementioned fundamentals materialize.

Conclusion

Russia’s banking sector is facing a silent crisis, marked by rising defaults and deteriorating balance sheets, while behind-the-scenes meetings multiply in preparation for a potential bailout in 2026. Although the Central Bank maintains a stable narrative, its actions reflect growing stress in the financial system.

Against this backdrop, the ruble—currently trading around 77–78 per dollar—may come under pressure if the situation worsens. The currency’s apparent stability masks systemic risks that have yet to be fully priced in by the market.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

USDRUB_TOM trade ideas

USDRUB - Hourly chartTrading Idea:

Short from 79,50-79,80!

Support & resistance:

🔴 Resistance Levels:

79.8360 — the nearest key resistance level, previously acted as a pullback and profit-taking zone.

80.1531 — strong resistance from which the last downward impulse originated.

80.4933 — the upper boundary of the range; serves as a potential target if the price breaks higher.

🟡 Support Levels:

79.5086 — local support level, where price may consolidate after breaking the descending trendline.

77.1250 — a confirmed level where downward momentum previously halted.

76.7750 — important support zone from which the current bullish impulse started.

🔍 Additional Notes:

Price has confidently broken above the descending trendline and is testing the 79.50 level — a potential setup for consolidation and continuation upward.

RSI has exited the oversold zone, confirming bullish momentum.

Volume increased on the upward impulse, supporting the probability of further upward movement.

The Ruble's Unlikely Triumph: What's Driving It?The early months of 2025 have seen the Russian Ruble emerge as the world's top-performing currency, achieving a significant appreciation against the US dollar. This unexpected rally is largely attributed to robust domestic economic measures. Faced with persistent inflation exceeding 10%, the Central Bank of Russia implemented a stringent monetary policy, raising the key interest rate to a high of 21%. This aggressive stance not only aims to curb price growth but also makes the Ruble highly attractive to foreign investors seeking elevated yields through carry trade strategies, thereby increasing demand for the currency. Furthermore, a healthy trade surplus, marked by increased exporter conversion of foreign earnings, has bolstered the Ruble's supply-demand dynamics.

Beyond internal economics, shifting geopolitical perceptions have played a vital role. Growing market anticipation of a potential ceasefire in the Ukraine conflict has notably reduced the perceived political risk associated with Russian assets. This improved sentiment encourages some international investors to return cautiously to Russian markets. Concurrently, a weakening trend in the US dollar, influenced by evolving US trade policies, has amplified the Ruble's relative strength on the global stage.

Strategically, Russia's ongoing efforts to decrease its reliance on the US dollar are also providing underlying support for the Ruble. Initiatives promoting trade settlements in national currencies, such as recent agreements enabling Ruble payments with Cuba, reflect a long-term pivot towards establishing alternative financial channels. However, this Ruble strength presents challenges, particularly for the state budget heavily dependent on converting dollar-denominated oil revenues. A stronger Ruble yields fewer domestic funds, potentially straining finances, especially amidst volatile global oil prices. The balancing act between maintaining high rates to control inflation and mitigating their impact on domestic credit and investment remains a critical consideration for policymakers.

[USD\RUB] Enter email subjectHi Ivan, good day again.

I’ve had a look at your idea regarding the ruble. I'm afraid you still didn’t quite catch my sense of humor.

And unfortunately, you haven’t fully absorbed the program either.

But hey—you’re doing well! Your efforts show. And your ideas aren't the worst ones I’ve seen on LLC "Trading View". I can say that for sure. I've seen some crazy forecasts there.

You’ve already used a kind of Elliott approach and added RSI. I’m glad you picked that up quickly.

Now, back to the critique - there’s a lack of innovation, some fresh perspective, and generally, a bit more realism is needed.

I get that on TW everyone copies each other. But you need to develop new methods and theory, which means you need to form a clearer vision.

Ivan, drop by my office. I’ll help you, maybe we can brainstorm together.

I sketched a rough draft of an idea. I want to tell you about it-don’t get scared, just take a look at the attachment.

Subject: "Forming Long-Term Forecasts on Global Timeframes Using Transparent Overlay Method."

Check out the screenshots - you’ll see that by overlaying semi-transparent bars at the 1M level, we can estimate the chart’s behavior on 3M, 6M, and 12M timeframes.

It helps assess the realism of the forecast and the fluctuation levels within a given range.

Like, surely you understand that we’re unlikely to see seven consecutive red 3M candles at this stage. When building long-term forecasts, that sort of thing matters—even if no one seems to care.

Anyway, we’ll talk about it in person. Call me if anything.

Also—do you by any chance know how Oleg’s doing? I haven’t heard from him in a while. Has he at least figured out how to switch to 3M, 6M, and yearly candles yet?

Come together, both of you. I’ll go over everything again.

By the way, could you help me reinstall Outlook? For some reason all my settings vanished, the shortcut’s gone, and I can’t find any contacts. Or maybe bring over a tech person - maybe that’s why I’m not getting any emails.

Best regards,

Riva Trick

USDRUB: Ruble Recovery and the Lagarde AppearanceThe outlook for the currency market has been radically transformed. After a period in which the ruble hit record lows, today marks the start of a bullish rebound. The dollar's loss of value has allowed the ruble to strengthen significantly, while attention is focused on the appearance of Christine Lagarde, president of the European Central Bank (ECB).

Lagarde's Appearance and ECB Policy

At the same time, the focus in Europe is on the appearance of Christine Lagarde, who could shed new light on the ECB's monetary policy strategy. Investors are hoping that her statements will provide clarity in a complex global context, as any hints about adjustments to the bank's policy could influence capital flows and thus USDRUB performance. This situation adds another layer of uncertainty and opportunity in a market already marked by sharp movements.

Other Relevant Market Factors

In addition to the dynamics between the dollar and the ruble and the expectations around the ECB, other elements that are influencing the day should be considered:

- Cryptocurrencies and Commodities: volatility in the cryptocurrency sector and fluctuations in assets such as Brent, coffee or gold act as thermometers of risk appetite, complementing the USDRUB analysis.

- Global Markets: Asian indices and Wall Street continue to offer mixed signals. While some Asian markets show slight rises, optimism in the United States translates into green closes, contributing to an environment of uncertainty and, at the same time, opportunities.

Technical Analysis

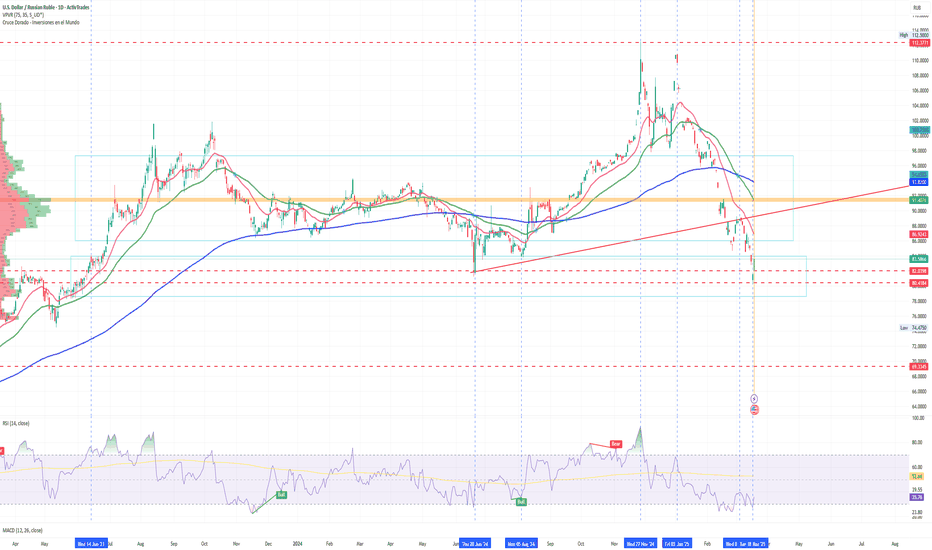

With the Ruble in Recovery the dollar has lost ground and has fallen to a price similar to the one recorded on June 20, 2024, when the momentum zone led the ruble to reach its lows at 112.37 rubles per dollar. Today, the market has reacted with a remarkable bullish rebound, and the Russian currency currently stands at 80.26 rubles to the dollar. This recovery is evidence of a significant turnaround in market sentiment, reflecting renewed investor confidence amid a backdrop of geopolitical and economic changes. Since the January 3 highs, the ruble has been recovering in price to $80.26, reinforcing the idea that Russia is gaining strength over the US from an economic strength standpoint. Several banks have reported their new offer on access to Forex trading on USDRUB due to this growing interest in the ruble and its apparent strength in the markets. A triple contact is occurring (June 14, 2023, June 20, 2024, and yesterday March 18) which is marking the possibility of seeing if this value is a passing thing and will return in the direction of the checkpoint (POC) located at $91.40 given that this is the area of the price bell with the highest average trading volume. Everything suggests that the price will not continue to fall as RSI is highly oversold from yesterday's 23.80% to today's 35.26%, which could signal a return to the range between $97.31 and $86.01. Increased interest in this currency could generate more volume and volatility in the market than usual.

Conclusion

In summary, the USDRUB's performance is determined by the conjunction of critical elements reshaping the market outlook. On the one hand, the surprising recovery of the ruble - driven by the remarkable depreciation of the dollar from levels as extreme as 112.37 rubles - signals a turnaround in investor sentiment and reinforces Russia's economic strength. On the other, Christine Lagarde's imminent appearance before the ECB adds a component of uncertainty and opportunity, as any hint of adjustments in European monetary policy could trigger further moves in this pair. In an environment marked by high volatility, investors will need to rigorously assess each variable and combine technical and fundamental analysis to identify opportunities and manage the risks inherent in such a dynamic and constantly evolving market.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

Russia after peace 2: an idea for a moral tradeOn December 22 we were long on the inevitable peace deal, while the rest of the world was salivating at the idea of a ruble collapse.

3 out of 4 take profits hit. this was a free trade and 30% is a lot in forex. speculators bit concrete, peace wins along with my followers. trade remains open but we closed already the big sizes.

Russia after peace: an idea for a moral tradeIf you do forex, there is huge speculation going on against Russia since the Pluto transit occurred. The barbaric world of speculation is currently betting on the total collapse of the Ruble, which has lost yet another key level since the November 22 attacks. The attacks that followed the Ukraine bombing of Russia in Nov 18.

A Russian collapse means a single thing: Nuclear holocaust, which is why it won't happen. And if it does, then money will be the last of your problems.

A long here with a tp at 0.9060 and 0.9534 was a free trade I gave on other platforms. A long for the Ruble if the current 0.95 level holds can lead to higher targets in the mentioned dates. It would be both a smart and morally correct thing to do, in order to fight in GME style those reckless speculators.

Life for 100+ RUB for 1 USDPlease note that life for the majority of RF residents will begin in the new year with an incredible increase in the price of the dollar. The ruble is very weak, in addition to all this strengthening of the ruble will decrease in February 2025. At the moment 60% of export profits go to the strengthening of the ruble, from February this value will fall to 20%. Get ready!

Horban Brothers.

Trump-Putin Ukraine Deal: Impacts on Forex

Hello, I am Professional Trader Andrea Russo and today I want to talk to you about an important news that is shaking up the global markets: Donald Trump has apparently reached an agreement with Vladimir Putin to end the war in Ukraine, with an agreement that includes Ukraine's exit from NATO. The historic meeting between the two leaders will take place in Saudi Arabia and this move is expected to have a profound impact on the global geopolitical and financial landscape, especially on the Forex market.

Geopolitical and Economic Impact:

The announcement of a possible agreement between Trump and Putin could mark a significant turning point in the war in Ukraine. If Ukraine were to actually leave NATO, it would open a new phase of stability for the region, but at the same time it could create uncertainty on the geopolitical borders. This decision will directly affect the currency markets, in particular the currencies of the countries involved, the main European currencies and the US dollar.

In the current context, the war in Ukraine is one of the main causes of economic instability worldwide. Any end to hostilities could lead to a reduction in economic sanctions and a revival of trade flows between Russia, Europe and the United States. These changes will be closely monitored by traders, as any geopolitical fluctuations could affect the dynamics of currencies globally.

Implications for Forex:

A possible agreement between Trump and Putin could have a direct impact on Forex, especially on the following currencies:

Russian Ruble (RUB): A peace agreement would lead to a possible revaluation of the ruble. International sanctions against Russia could be gradually removed, boosting the Russian economy and supporting demand for the ruble in global markets.

Euro (EUR): Ukraine's exit from NATO could lead to greater stability for European countries involved in the conflict, but it could also reduce the risk associated with energy and military security. In the short term, the Euro could appreciate against riskier currencies, but the situation could vary depending on the political reactions in Europe.

US Dollar (USD): The dollar could react positively if the Trump-Putin deal is seen as a stabilization of international relations, but it will also depend on how the Federal Reserve responds to evolving economic conditions. A slowdown in the conflict could reduce the uncertainty that has pushed markets towards the dollar as a safe haven.

British Pound (GBP): The pound could benefit from a possible de-escalation of the crisis, but again, domestic political factors in the UK, such as its post-Brexit negotiations, will continue to influence the currency.

What to expect in the coming days:

News of the Trump-Putin meeting in Saudi Arabia will be watched closely by the markets. If the details of the deal are confirmed, we can expect an immediate reaction in the currency markets. Forex is likely to see increased volatility in the currency pairs tied to the nations involved, with shifts in capital flows that could reflect a new perception of risk or stability.

Conclusions:

In summary, the Trump-Putin deal could be a turning point in the war in Ukraine and have a significant impact on financial markets, especially Forex. Investors will need to carefully monitor geopolitical developments and prepare for possible currency fluctuations. With the end of hostilities, stability could return to favor some currencies, but the situation remains delicate and constantly evolving.

Long-term forecast for the pair of $USDRUBAggressive enough a long-term forecast for the pair $USDRUB.

90->70->105->80->165->105->135->23-35 (in perspective of 2027 year and further)

Does not constitute a recommendation.

#investing #stocks #idea #forecast #furoreggs

Please, subscribe and challenge my point of view )

Russian Ruble CRUSHED! Lost The War!Russian Ruble FX_IDC:USDRUB is getting destroyed! Russia with an economy half the size of California can never go up against 60% of the global GDP while killing off nearly 1 million able-bodied men out of their economy. Corruption is out of control, 35% of the economy is allocated to the war, not future investment.

Russia is suffering from Dutch Disease

As usual #MMT gets it wrong again! As highlighted.

So did the "sanctions don't work" crowd

Gap is clearly going to be filled! 1 USD is soon 160 RUBWe saw this momentarily at the beginning of this atrocious and uncalled for invasion into Ukraine by russians in 2022 February.

Right then russian central bank started to "fix" the situation, but You cannot keep putting makeup on a pig and call it priced cow! russian economy is collapsing due the soon 30% interest rate and in 2% unemployed workforce in a situation where You need couple of million qualified workers still. Not to mention all the GDP rise is coming from military companies and oil selling. That soon will end as the oil gets cheaper still when Trump comes to power in 2025!

I think in mid 2025, we can see the russian economy crash in spetacular way. I think USD/RUB aorund $250 is not a work of fiction anymore.

The Russian Ruble Collapses: Sanctions & ExportsFundamentals :

Russia's exports fell sharply after the invasion in 2022.

Russian trade surplus continues between exports and import has fallen in the last 18 months.

"...the limited number of potential buyers for Russian crude and refined products increased their bargaining power, allowing purchasers to demand greater discounts to the global market" (www.dallasfed.org).

"Russia’s export revenue from crude and refined products fell 30 percent from the first half of 2022 to the first half of 2023, while volumes were largely stable."

"Price discounts for crude oil will likely persist because of the bifurcation of buyers and the extended distance exports must travel to their destination. Piped gas volumes to Europe continue to remain low. While Russia aims to increase exports of natural gas to China, it will take many years to build new pipelines." (www.dallasfed.org)

"With measures targeting Russian exports likely to persist, the country’s balance of payments will remain under pressure, leading to continuing currency weakness ." (www.dallasfed.org)

Technicals :

Weekly and Daily HHHL

USD/RUB weekly retracement to 91 or 92 38% fib support

Weekly uHd developing

Projection:

USD/RUB will rise to 125 by February or March 2024.