Taiwan currency and USD assetsImagine you are based in Taiwan, never mind if you are a local or foreigner there. You probably have to exchange TW dollars to US dollars in order to invest in the US markets.

From the forex perspective, you are already in a loss position of more than 13% from April onwards, never mind if your SPX or QQQ ETF has outperformed.

Say it has gone up by 20% , your net return is actually only 7% if you convert it back to TW dollars.

In a way, these people are stuck as they can't sell or if they do, they probably suffered a loss or breakeven assuming they entered early into the market. And if the bull run continues, there is no way they can participate unless the TW dollars starts to depreciate which imo will take a long time.............

Options ?

Get out asap of the US assets and buy gold (physical ones) that are sold in TW dollars. I am lucky to be in SG and the SG dollars has been strong against the USD thus far.

USDTWD trade ideas

People are dumping US dollars in Asia , how about you?The sudden appreciation of the Taiwan Dollars recently has sparked much debate about the value of the US dollar. Is it still the world number 1 currency ?

Could this be Trump's strategy ?

If US dollar weakens, that makes the Asian countries currencies stronger which is what he wants. This will help in US imports as importers in Asia will use less of their own currency to buy the same US dollar goods. This of course boost US exports which is what Trump wants.......

Also, with a stronger Asian currency, people are more likely to travel (think SGDJPY when it was 1 SGD to 120 JPY in July 2024. That was the peak and thousands of Singaporeans flock to Japan and buy , shop , eat , OMG !!!!

Not to forget there are many Asian students studying in US universities and that will prompt parents to exchange more US dollars and perhaps upgrade to a better accommodation for their kids.

Some say Trump is mad and not smart , what do you think ?

Is this an Asian currency crisis in reverse? The Taiwan Dollar surged more than 5% against the U.S. dollar on Monday, briefly pushing USD/TWD below the 29.00 mark.

The two-day rally—totaling nearly 10%—is the sharpest in over three decades. But Taiwan isn’t alone. A broader wave of U.S. dollar selling has lifted several Asian currencies, including the Singapore Dollar, South Korean Won, Malaysian Ringgit, Chinese Yuan, and Hong Kong Dollar.

Goldman Sachs reported on Tuesday that investor positioning has shifted significantly, with clients moving from short yuan positions to long ones—suggesting a growing expectation of continued U.S. dollar weakness.

Trade Like A Sniper - Episode 47 - USDTWD - (18th June 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing USDTWD, starting from the 4-Month chart.

If you want to learn more, check out my profile.

God bless East AsiaIt used to be unrealistic to think that there was a war at home. But now this concern is becoming increasingly real. Especially in 2024, with November 2024 being the most likely month for a war to occur. If the new Taiwan dollar depreciates by more than 10% in an instant in November, then my biggest concern means it will happen. Although the Ukrainian war sympathizes with them, to be honest, there is no real feeling, but now the real danger seems to be about to begin. I sincerely hope for peace across the Taiwan Strait.

Even like the K-line, the future, like the past, is destined, and time is likely to have no sequence. But when war truly occurs, the pain and torment, even if destined, are unbearable.

Taiwan's export orders performed well in FebruaryTaiwan's export order totaled US$42.59 billion in February, with an YOY increase of 48.5%. The export order is estimated to grow even more by US$54.5 ~ US$56 billion in March, according to the ministry.

MM analysis

ICT ( +88.4% ), electronic products ( +52.4% ) and optical equipment industries ( +59.4% ) became the main driving force, drove up huge amount of demand.

Export regions mainly comes from the US ( +50.2% ), China & Hong Kong ( +48.6% ), and Europe ( +73.4% ), implying strong inventory replenishment demand by companies and overall a strong economic rebounds!

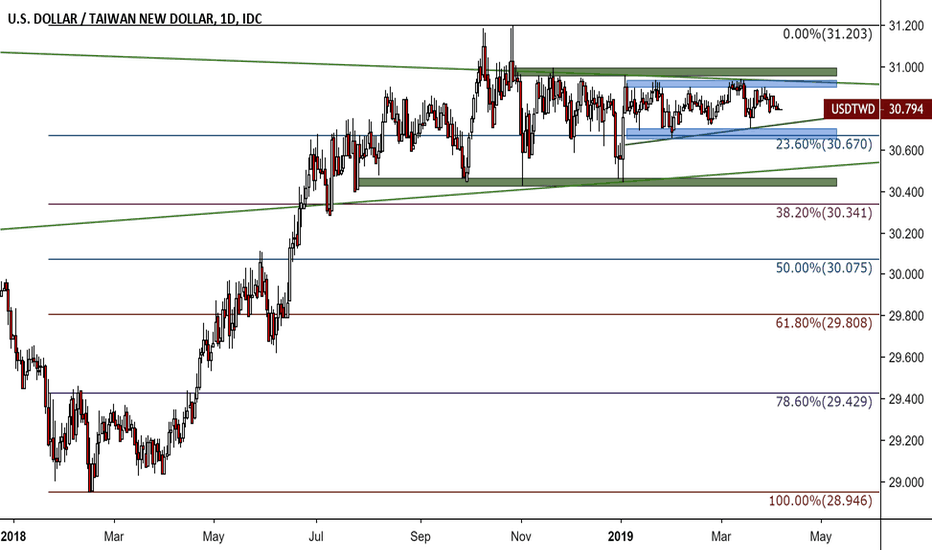

The Low Volatility Taiwan Dollar Is Now Less VolatileThe already incredible low volatility of the US dollar to the Taiwan dollar somehow over the past few weeks managed to drop volatility even lower than before. The range trading has tightened further from 30.42 to 31 by a tighter range of 30.65 to 30.94. This is truly incredible, even for the foreign exchange market which has suffered (or enjoyed given your financial position) from extremely low volatility compared to other asset classes such as commodities or equities. The question remains if this volatility can be sustained and if so for how long. Clearly, this pair suffers from low liquidity which can be seen by long tails of the candlesticks indicating short-term volatility. Less clear is the fact that this pair is still manipulated by the central bank. Either way, USDTWD is a fairly stable pair to invest in with foreign exchange risk extremely low, at least for now.

USDTWD Continues Sideways, will do so for the immediate futureThis forex pair suffers from a number of problems including manipulation, low volume, lack of interest, etc. The technicals are not on the side of those expecting divergence from these trends. Overall, expect a continuation of this sideways move.

Taiwan Dollar (TWD) maintaining its bearish strength vs the USDTaiwan Dollar is maintaining its strength versus the US Dollar since the beginning of 2017 and holds the longer term bearish trend. A head and shoulders pattern has formed on the weekly chart but is as yet complete. The 30 level could prove significant resistance and if it can break here, then 28/29 could be a potential further resistance level. Upside support may be found at 30.75 then 31.42.

INTERMARKET | USDCNH vs USDTWD DeviationWhat is a meaningful relationship between the currencies of two very interlinked and substitute export-led economies appears to have broken down - at least directionally in this case.

I think they reconverge, so my bias here is long USDTWD... So now I shall look for an entry.