About U.S. Dollar / South African Rand

The U.S. Dollar vs. the South African Rand. The Rand was and became legal tender in the late 50’s to early 60’s for South Africa, Swaziland, Lesotho and Namibia after moving away from the Pound. After the apartheid era sanctions the Rand experienced a great deal of volatility and depreciation.

Related currencies

Bearish drop?USD/ZAR has reacted off the pivot and could drop to the 1st support which acts as a multi-swing low support.

Pivot: 17.8949

1st Support: 17.4852

1st Resistance: 18.0406

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can

USDZAR-BUY strategy 6 hourly chart GANNThe pair has not been able to sustain the higher levels, and came down sharply. Now we are basing I feel and this may be a BUY opportunity this time around. Indicators are starting to look positive, and supports the likely hood for a move higher again.

Strategy BY @ 17.6875-17.7350 and take profit

Bearish reversal?USD/ZAR is rising towards the pivot which is a pullback resistance and could reverse to the 1st support.

Pivot: 17.8394

1st Support: 17.4852

1st Resistance: 18.0390

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can affo

USDZXAR-NEUTRAL BUY strategy 3 hourly chartThe pair has moved lower as expected, however the decline has not been severe, and besides, other currencies show slightly oversold status, and this provide a good basis for BUY entry instead now.

Strategy BUY @ 17.9000-17.9300 and take profit near 18.0875 for now.

USDZAR-SELL strategy 12 hourly chart Reg.ChannelThe pair has been moving lower, and recovered this morning to 18.1200 area and came down quickly there after. the picture suggest we are negative territory and it feels we may test 17.9500 again going back 17.8150 area.

Strategy SELL @ 18.0500-18.0975 and taker profit near 17.8350 for now.

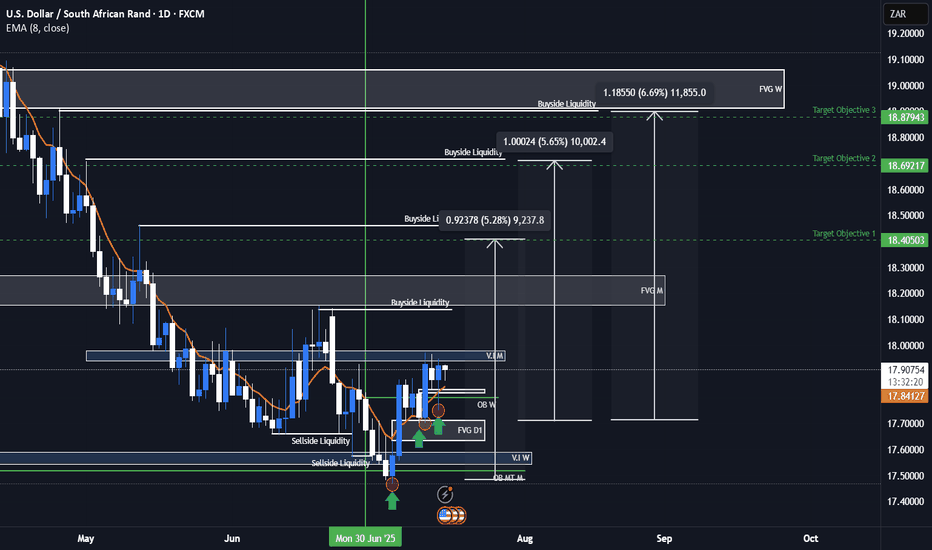

USDZAR Bullish ideaAs we can see this is our USDZAR quarterly shift idea were we are anticipating price to rally to the upside toward our draw on liquidity objectives. We had a weekly volume imbalance and monthly mean threshold order block show us support after we took out major liquidity points. We also showed more s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDZAR is 17.48353 ZAR — it has increased by 0.11% in the past 24 hours. See more of USDZAR rate dynamics on the detailed chart.

The value of the USDZAR pair is quoted as 1 USD per x ZAR. For example, if the pair is trading at 1.50, it means it takes 1.5 ZAR to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDZAR has the volatility rating of 0.20%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDZAR showed a −1.64% fall over the past week, the month change is a −1.74% fall, and over the last year it has decreased by −3.34%. Track live rate changes on the USDZAR chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDZAR right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDZAR technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDZAR shows the strong sell signal, and 1 month rating is sell. See more of USDZAR technicals for a more comprehensive analysis.