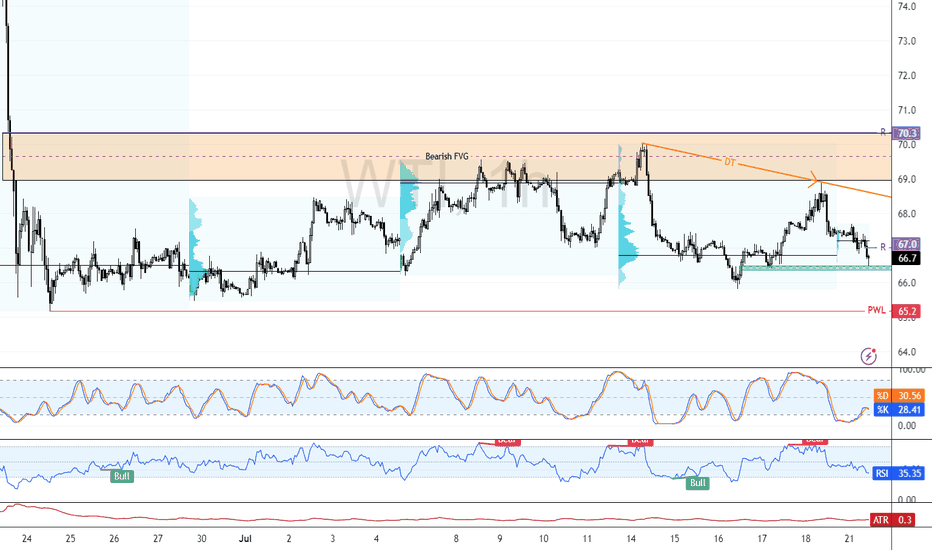

USOIL RISKY LONG|

✅CRUDE OIL is trading along

The rising support line

And as the price is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 70.20$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL trade ideas

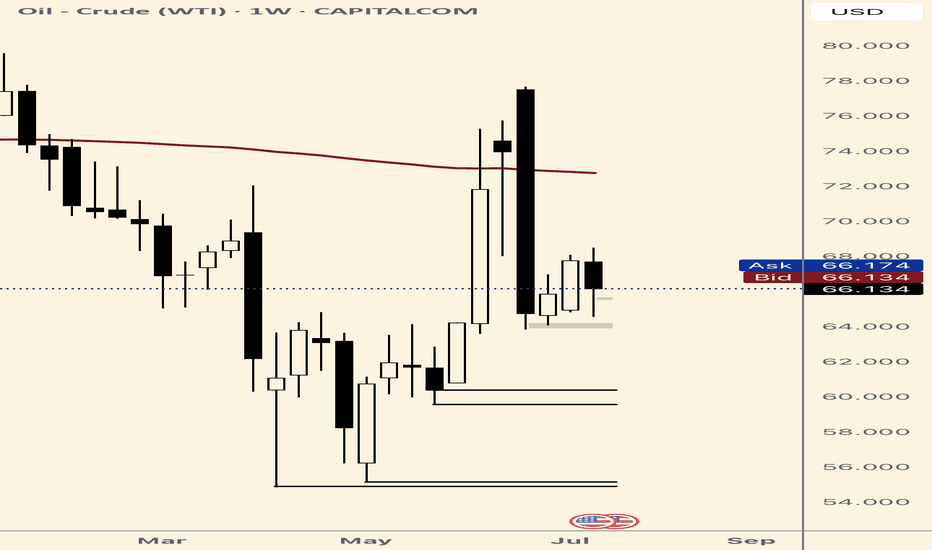

CRUDE OIL Risky Long! Buy!

Hello,Traders!

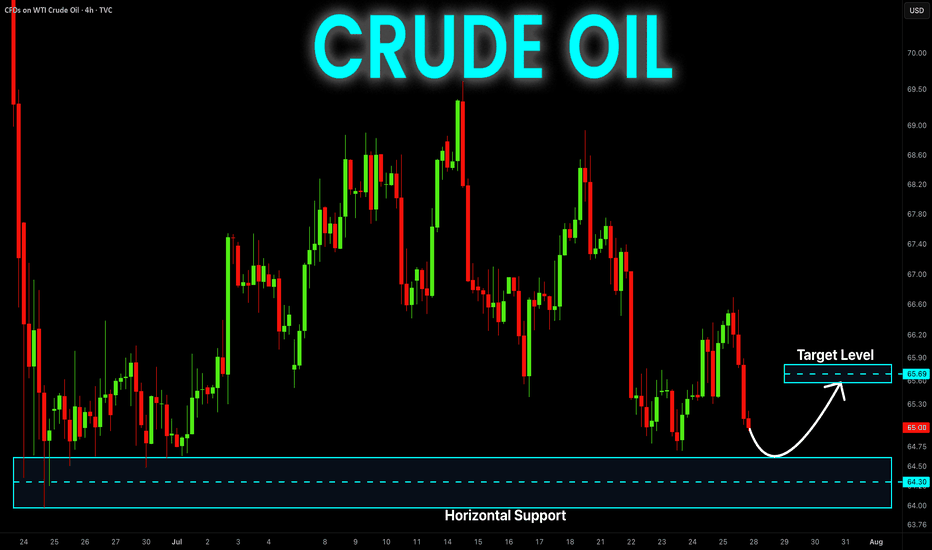

CRUDE OIL will soon hit

A horizontal support

Of 64.50$ and as it is

A strong level we will be

Expecting a local bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

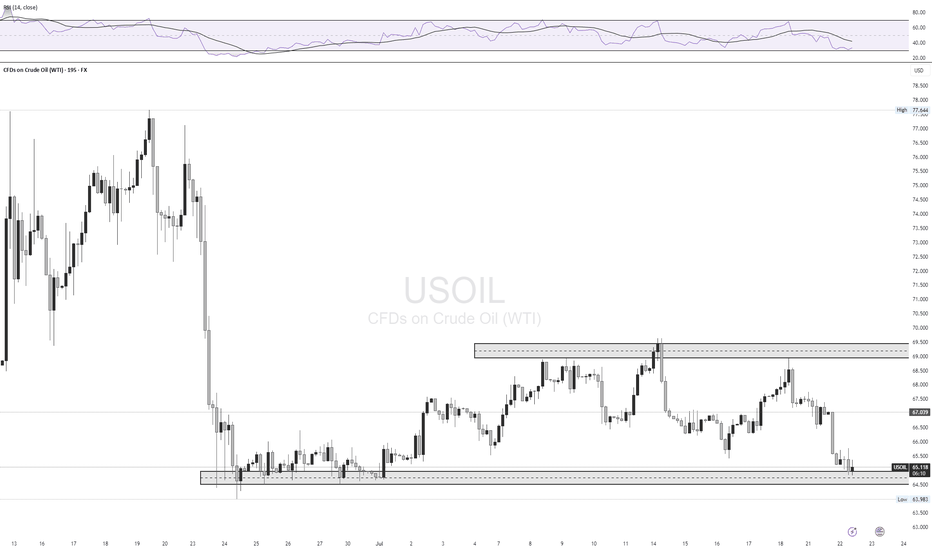

OILUSD Range Between 60–64.26 – Will Support Hold or Break?WTI Crude has been in a sideways range after the sharp drop in early April. Price recently tested resistance at 64.260 but failed to break higher, pulling back into the 60.000 support zone. This level has held multiple times, forming a key pivot.

Support at: 60.000 🔽, 55.931 🔽

Resistance at: 64.260 🔼, 67.000 🔼, 71.101 🔼

🔎 Bias:

🔼 Bullish: A strong rejection from the 60.000 zone followed by a breakout above 64.260.

🔽 Bearish: A daily/12H close below 60.000 opens the path to retest 55.931, and potentially lower.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

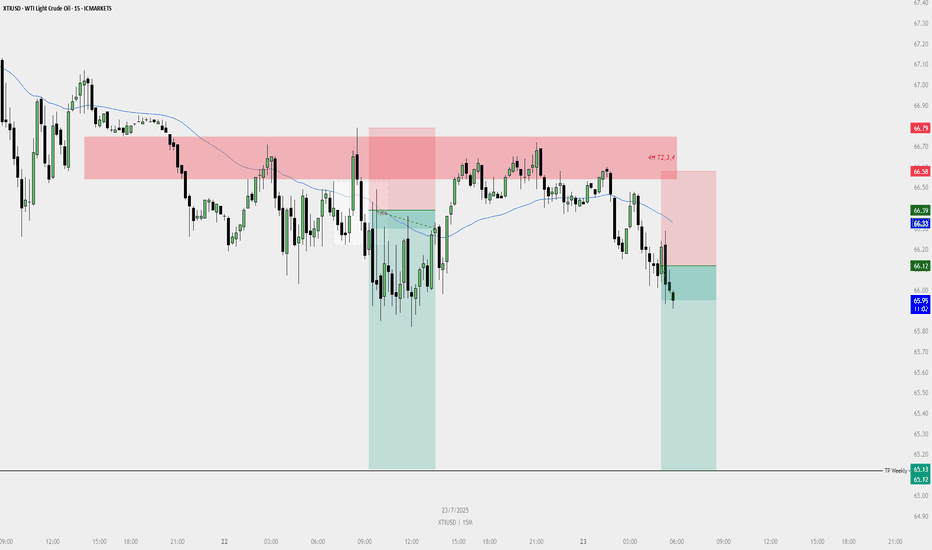

SELL PLAN – XTIUSD (15M)📉 SELL PLAN – XTIUSD (15M)

🗓️ Date: 23 July 2025

⏱️ Timeframe: 15-Minute

🔍 Context & Reasoning:

HTF Supply Zone (Red Zone)

Price entered the red HTF zone (noted as “4H T2,3,4”) and showed rejection.

This zone aligns with potential 4H Fair Value Gaps / Supply.

Sweep & Rejection

Liquidity sweep above previous highs followed by immediate bearish reaction.

Entry Confirmation

Bearish engulfing candle formed inside the HTF zone.

Price closed below 15M EMA (blue line) showing bearish momentum.

Dealing Range Valid

DR formed after rejection of the HTF zone.

Short-term bullish FVG created and violated.

Bearish FVG confirms continuation.

🎯 Entry Details:

Entry Price: ~66.12

Stop Loss: ~66.58 (Above HTF rejection zone)

Take Profit: ~65.12 (Near Weekly TP level)

🧠 Confluences:

Rejection from 4H Supply

Price closed below EMA

Clear swing failure / liquidity grab

DR confirmation on 15M

Multiple FVGs and breaker structure supporting the move

📌 Risk Management:

Risk-to-Reward: 1:2+

Risk per trade: Max 1%

If in drawdown: Use 0.5%

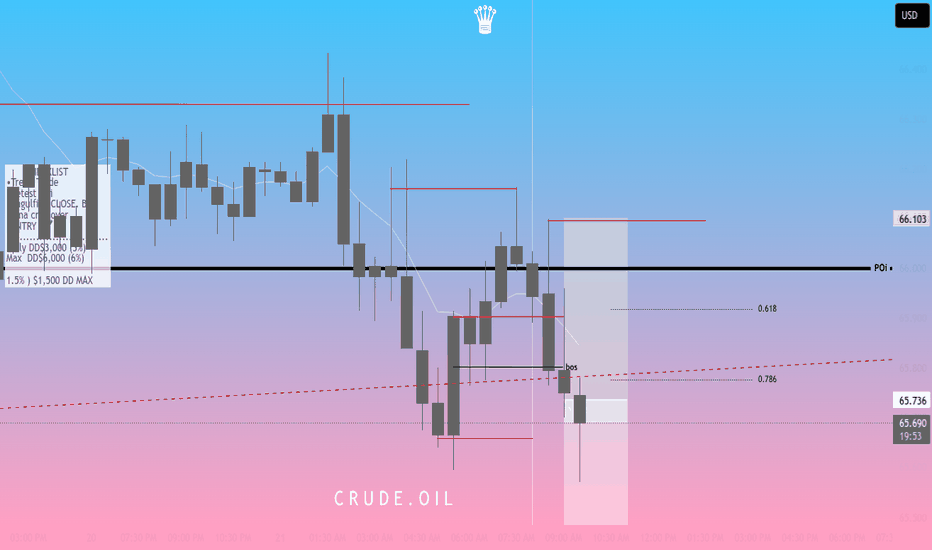

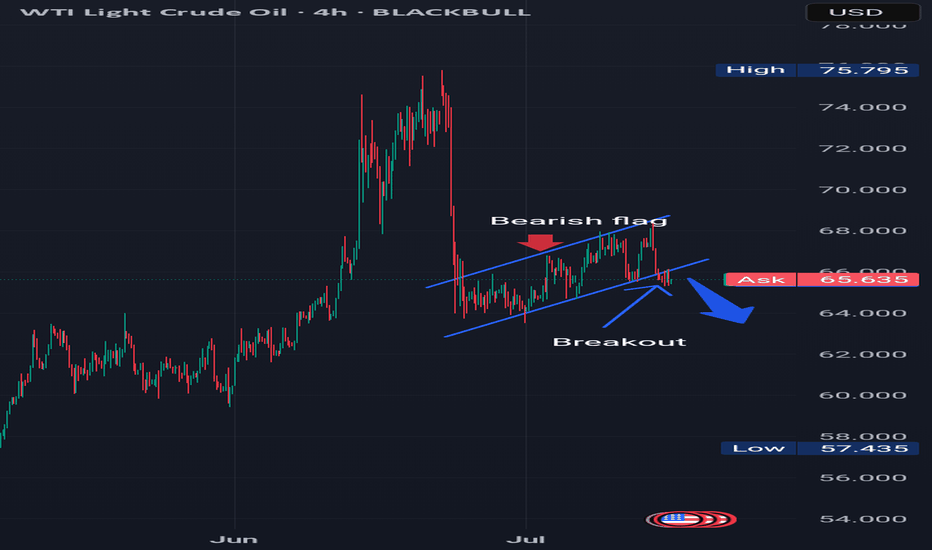

OIL - Likely development on the 4hr/daily scenarioThis looks like the likely scenario that will now develop on oil on the 4hr/daily timeframe.

In other words, we will look for an upside from now on first, back to the 0.618 re-tracement of the huge downside impulse that occurred in the last week of June.

So all buy setups we will be able to take until price hits the $72 area, then we will start looking for sells.

Oil Bulls Watch $67.0 for Breakout ConfirmationFenzoFx—Crude Oil trades slightly above the bullish FVG at $66.5, showing sideways momentum on the 1-hour chart. The $65.5 support is backed by volume interest and could drive prices higher.

If this level holds, bulls may target a retest of the descending trendline. For confirmation, a close above the $67.0 resistance is needed.

Please note that a close below $66.5 would invalidate the bullish outlook.

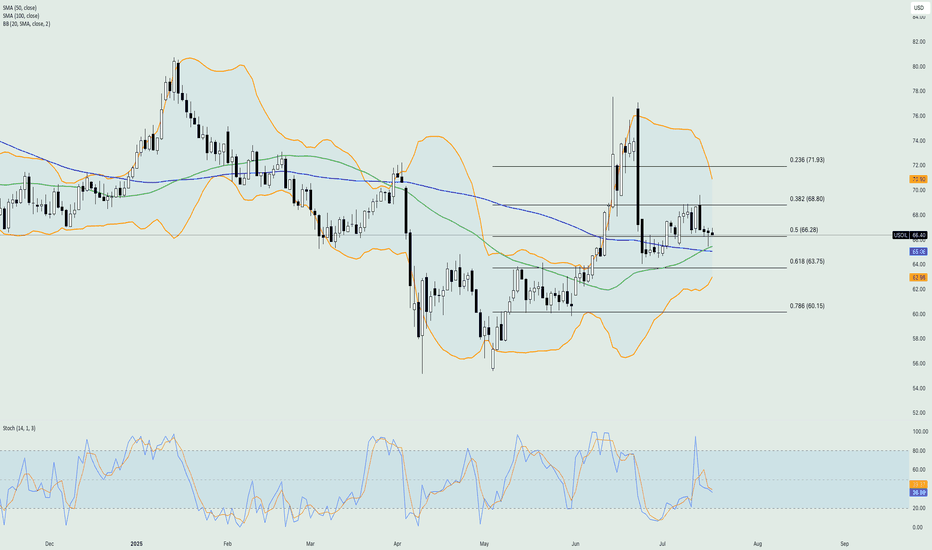

Crude Oil -DAILY- 21.07.2025Oil prices were steady after their first weekly decline this month, as attention shifted to U.S. trade negotiations and the European Union’s push to tighten restrictions on Russian energy exports. The EU is preparing new sanctions, including a lower price cap on Russian crude, limits on fuel refined from Russian oil, banking restrictions, and bans targeting an Indian refinery and Chinese firms. Despite western sanctions, Russian oil continues flowing to China and India. Meanwhile, diesel margins in Europe remain strong, signaling tight supply.

On the technical side, the price of crude oil has failed to break below the major technical support area, which consists of the 50-day simple moving average and the 50% of the weekly Fibonacci retracement level. The Stochastic oscillator has been in the neutral level since last week hinting that there is potential for the price to move to either direction in the near short term. On the other hand, the Bollinger bands have contracted rather massively showing that volatility has dried up therefore, the recent sideways movement might extend in the upcoming sessions.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

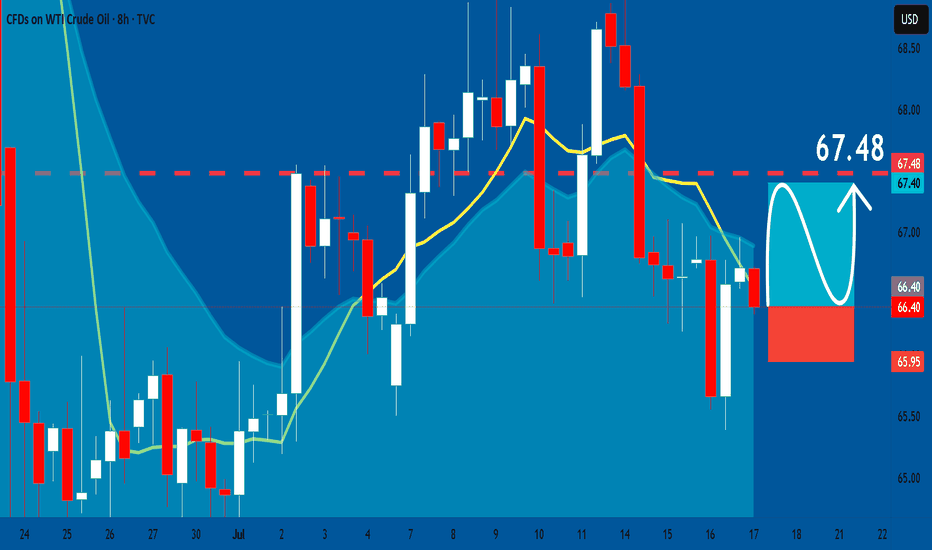

USOIL: Bullish Continuation & Long Trade

USOIL

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry - 66.40

Stop - 65.95

Take - 67.48

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Crude fall - short termI am anticipating crude to fall these marked levels because:

1. Strong Opening Gap which usually closes after some time

2. Liquidity levels are at the same place as the Opening Gap.

3. Oil price has to fallback a bit more and consolidate a bit more to have a healthy patterns to rise until potential 90.

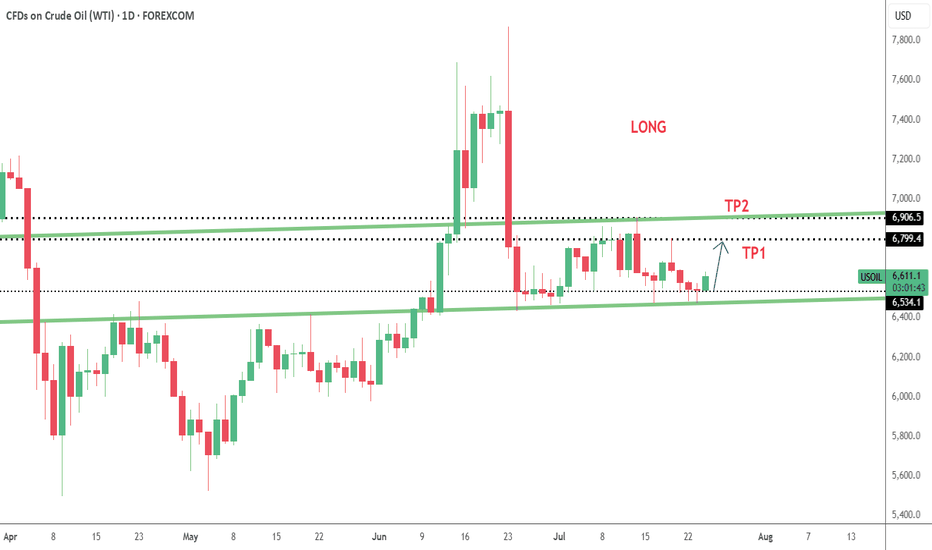

break above 6866.1 may push prices toward the second resistance break above 6866.1 may push prices toward the second resistance at 6911.3 (TP2).

Confirmation of bullish continuation would occur if price closes above 6981.0 on a 4H or daily chart.

Volume and momentum indicators should be monitored near 6866–6911 to assess breakout strength.

This trade setup offers a favorable risk-reward ratio with a tight SL at 6522 and layered targets.

Ideal buy entries can be placed between 6630–6660, as this range shows price stability and potential reversal signs.

Traders should stay alert for fundamental news (inventory reports, geopolitical events) that could accelerate momentum past resistance levels

is currently trading at 6648.3, positioning itself within an attractive short-term buy zone.

This level sits just above strong support at 6522, which acts as the logical stop-loss (SL) zone.

The price action suggests bullish potential as it forms a base near the support level.

Immediate resistance lies at 6866.1, which could be the first profit target (TP1).

WTI Support & Resistance Levels🚀 Here are some key zones I've identified on the 15m timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

USOIL: Bearish Continuation & Short Trade

USOIL

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short USOI

Entry Point - 68.66

Stop Loss - 69.40

Take Profit - 67.23

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

WTI USOIL WTI oil ,watch oil inventory and opec data report for clear directional bias . if the monthly candle closes above the supply roof,it will be a long confirmation if demand holds .the probability of rejection is high, because the current candle is coming as a retest candle to broken demand floor that served as bench mark oil price level 65$-68$ zone for long time .

#oil #opec #usoil #wti

WTI US OIL US Oil (WTI Crude) Price Context

Price: WTI crude oil futures settled at approximately $68.66 per barrel close of friday.

Prices rebounded after a prior decline, supported by strong summer travel demand, high refinery utilization, and supply management efforts by major producers like Russia and Saudi Arabia.

Outlook: Despite near-term supply tightness, the International Energy Agency (IEA) and OPEC forecast a potential surplus later in 2025 and slower demand growth through 2026–2029, especially due to slower Chinese economic growth.

The DXY measures the USD strength against a basket of major currencies and often moves inversely to commodities priced in USD like oil.

When the DXY strengthens, oil prices can face downward pressure due to higher USD value making oil more expensive in other currencies.

Conversely, a weaker DXY tends to support higher oil prices.

Current Dynamics:

If geopolitical risks or supply constraints push oil prices up, the USD may weaken as markets price in inflationary pressures.

Conversely, if the USD strengthens due to safe-haven demand or monetary policy, oil prices may soften.

#usoil

USOIL: Local Bearish Bias! Short!

My dear friends,

Today we will analyse USOIL together☺️

The market is at an inflection zone and price has now reached an area around 68.669 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 67.925..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

USOIL Will Collapse! SELL!

My dear subscribers,

USOIL looks like it will make a good move, and here are the details:

The market is trading on 68.66 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 67.95

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK