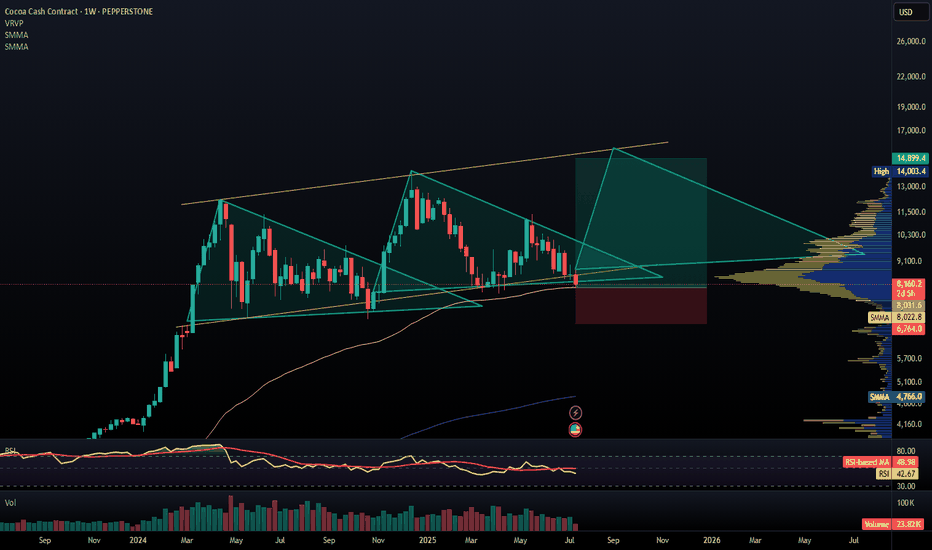

Cocoa futures near a key technical resistance areaMARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accoun

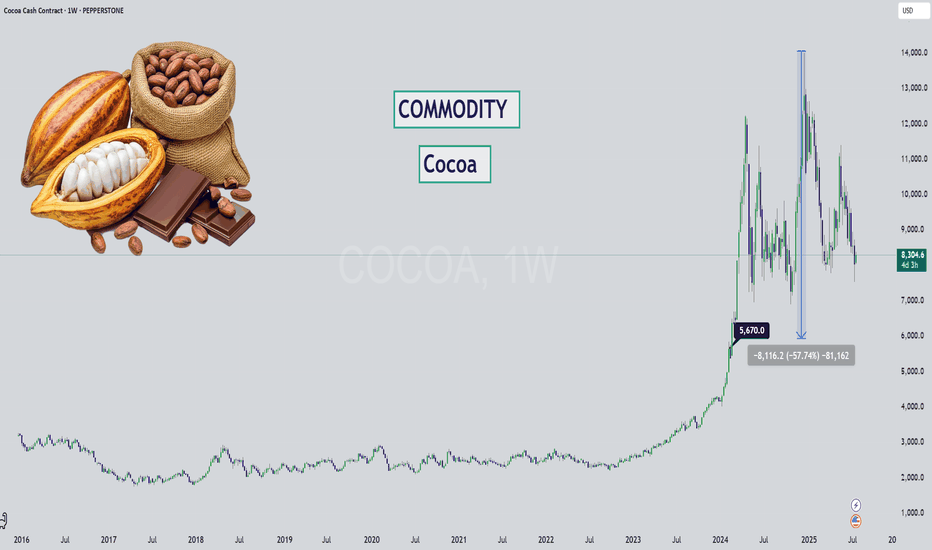

Cocoa - Chocolate is DIPPING (literally)Hello Market Watchers 👀

I bring today an update on your favorite commodity (mine actually)... 🍫

The weekly timeframe from a multi-year perspective is what's on the cover and one thing is clear - cocoa has never increased so much as it during May23' to Dec24'.

Sure inflation brought on by covid h

Cocoa Bull Run over?There’s something brewing in the charts here, and it’s not a hot cup of cocoa. We had a clear rejection at the 0.382 Fibonacci and potentially the start of a C leg in a corrective pattern.

This is lower high after the bull flag breakout pattern. If we lose support here we could break the neckline

Rob the Cocoa Market Before the Trend Escapes🏴☠️Cocoa Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"COCOA"🏉 Commodities CFD market, and now it’s time to launch a high-stakes hei

"COCOA" Commodities CFD Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉"COCOA"🏉 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long ent

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.