USDX trade ideas

DXY Is Still Bearish; Final Leg Of The Wedge Pattern?DXY Is Still Bearish, but it can be trading in final leg of ending diagonal a.k.a. wedge pattern from technical and Elliott wave perspective.

US Dollar Index – DXY made only a three-wave rise from the lows, which indicates for a correction within downtrend. So recovery can basically still be a fourth wave rally, just a bit deeper one that can still belong to an ending diagonal a.k.a. wedge pattern. Final wave “v” of 5 can be still missing, so be aware of a continuation lower within a new three-wave abc decline, especially if breaks below the lower side of the corrective channel near 97.70 level.

future of the DXYHi to every one

In the DXY we are in the middle of the decisioning area which means

we should wait for the market to show its hands

First sensitive level that i am looking for is the C.E of the weekly candle(Prev.week)

IF we get resistance at that level we can wait for the price to deep into the SSL M level

Other wise i don't see any indication and obstacle for the DXY to reach the OB level above the 0.5 mid level of the range

this is my the first low hanging fruit objective which is high probability

after that my ultimate objective is the SiBi to be rebalanced

This was the technical perspective

BUT

things are happening around the world the most important one is the

USA central bank Interest Rate Cutting Decision which can leads the DXY to go lower without retracting to the 0.5 of the range

this factor also should be considered BUT overall i am bullish for DXY

US Dollar Index (DXY) Technical Analysis:The DXY is currently moving sideways near the 98.65 support zone after a sharp drop from the 100.25 resistance, which marked last week’s high.

🔹 Bearish Scenario:

If the price breaks below 98.65 and holds, a continuation toward 97.90 is likely, with potential to reach the 97.50 support area.

🔹 Bullish Scenario:

If the price reclaims 99.00 and confirms support above it, we could see a retest of the 99.50–100.25 resistance zone, which remains key in the short term.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

US Dollar Index (DXY) Plummets Following Labour Market DataUS Dollar Index (DXY) Plummets Following Labour Market Data

The US Dollar Index (DXY) fell by approximately 1.4% on Friday after the release of disappointing US labour market figures. According to Forex Factory:

→ The unemployment rate rose from 4.1% to 4.2%;

→ The Nonfarm Employment Change figure came in at 73K, well below the forecast of 103K. This is the lowest level of job creation in the nonfarm sector in 2025 and is roughly half the previous month’s reading (prior to revisions).

→ Furthermore, revisions for May and June were significantly more severe than usual. The May figure was revised downward by 125,000 — from +144,000 to +19,000. Similarly, the June figure was revised down by 133,000 — from +147,000 to +14,000.

These results point to a weakening labour market, which increases the likelihood of a rate cut aimed at supporting economic growth. In turn, expectations of a Fed rate cut are acting as a bearish driver for the US dollar.

Technical Analysis of the DXY Chart

Six days ago, we highlighted two U-shaped trajectories (A and B), which together formed a bullish сup and рandle pattern on the US Dollar Index chart.

Following this, price action generated a notable upward impulse (as indicated by the arrow), breaking through the upper boundary of the pattern.

However, Friday’s news triggered the following developments:

→ A new top (4) was formed on the chart, accompanied by a false bullish breakout above the psychological level of 100.00;

→ The price declined to the 98.80 area. The downward move slowed here, as this zone had previously seen strong bullish activity during the breakout from the pattern’s upper boundary — likely explaining why the market is finding support here on Monday morning.

Overall, the technical picture has shifted towards a bearish outlook. Friday’s peak continues the summer sequence of lower highs and lows: 1 → 2 → bottom of pattern (A) → 4. This structure is part of a broader downtrend that has defined the market in 2025.

Should bearish sentiment persist, fuelled by Friday’s data, we can assume a further decline in the US Dollar Index towards the median line of the descending channel (shown in red), which has been drawn through the aforementioned price extremes.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

DXY Just Broke Through the Lock… Where’s the Market Headed Now?🌅 Good Morning, Friends!

A few days ago, I marked 98.950 as a key threshold for the DXY index. As of today, that level has officially been broken—and the bullish momentum we anticipated is now kicking in. 📈

The next target? 101.000.

That said, it’s crucial to remember: DXY is heavily influenced by fundamental data. Stay alert and keep a close eye on key economic developments—they’re essential for navigating this move.

This breakout validates the analysis I shared with you all. And it wasn’t just about charts—it was about discipline, precision, and timing.

Every single like from you is a huge boost to my motivation. Thanks from the heart—your support drives me to keep sharing these insights! 💙

US Dollar Index: Was Friday the Start of a Pullback Or Reversal?Welcome back to the Weekly Forex Forecast for the week of Aug 4 - 8th.

In this video, we will analyze the following FX market:

USD Index

The DXY had a strong week, but turned bearish Friday on weak jobs numbers. Was this just a retracement from the impulsive move up? Will price now find support for another bullish leg?

It all comes down to the +FVG, whether it holds or folds.

Look for price to continue down to discount prices early in the week... and then find it's footing on support.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DXY: USD Flexes Muscle - Pairs SlideFriday, July 25, 2025

The foreign exchange markets are experiencing a pronounced USD bullish session this morning, with the US Dollar Index (DXY) showing robust gains of +0.35% while simultaneously pressuring all major currency pairs into negative territory. The Japanese Yen (JPY) is bearing the brunt of this dollar strength, currently registering losses between -0.4% to -0.66% across JPY pairs. This market behavior suggests traders should pay particularly close attention to DXY dynamics, as its movements will likely dictate price action across all major currency pairs in today's session.

Technical Perspective: DXY at Critical Inflection Point

A detailed examination of the Dollar Index reveals several compelling technical factors that market participants should consider:

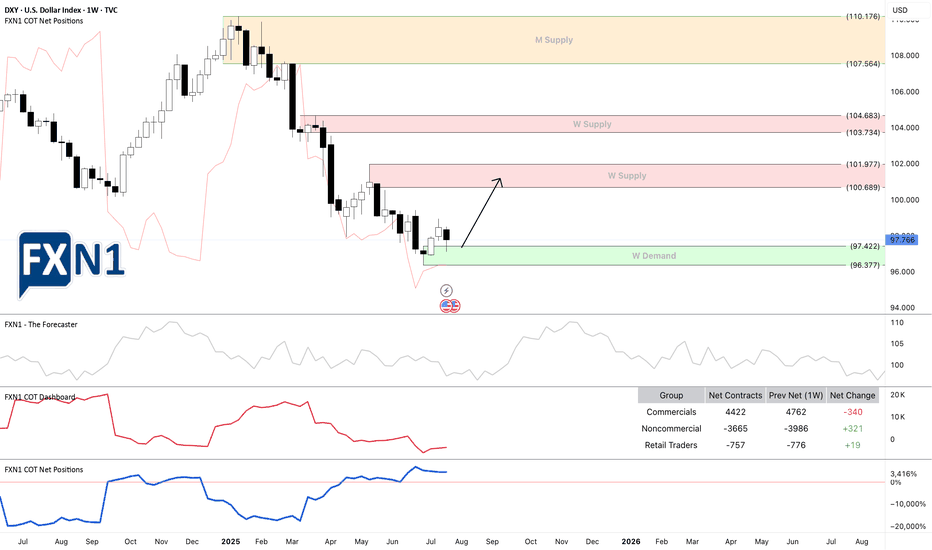

1. Weekly Demand Zone Reaction

- The DXY has demonstrated a strong rejection from a significant weekly demand area

- The subsequent bullish spike indicates potential continuation of upward momentum

- This price action suggests institutional buyers are defending this key level

2. Commitment of Traders (COT) Report Insights

Non-commercial traders (typically hedge funds and speculators) have increased their positions from a bottom level not seen since June 2021 meanwhile the Commercial traders (often corporations hedging FX exposure) show opposing extreme positioning. This stark divergence between trader categories often precedes significant market moves

3. Seasonal Patterns Favor USD Strength

- Historical seasonal analysis indicates the current period typically supports dollar appreciation

- The combination of technical and seasonal factors creates a potentially powerful bullish setup

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

NFP Volatility Ahead – Is the Dollar Ready to Break Higher?🟢 DXY Outlook – A Key Day for the Dollar Index

Yesterday’s monthly candle closed with strong bullish momentum, marking a powerful start to August. Today, on the first trading day of the month, we’re expecting three major U.S. economic releases:

NFP, Average Hourly Earnings (m/m), and the Unemployment Rate.

As discussed in last week’s outlook, DXY has successfully broken above the key 100 level and confirmed a monthly close above it — a significant technical development. With no major order blocks or visible resistance in the way, the path toward the 102 target appears technically clear.

That said, I anticipate mixed data from today’s releases — which means we could see both sides of liquidity being taken during the initial reaction. Price might dip toward lower zones temporarily to collect liquidity before resuming its bullish move toward 102.

📌 In summary:

From a swing perspective, I believe the direction remains bullish for the Dollar Index as long as we hold above the 100 level.

When I say the data might be “mixed,” I mean the market could show an initial drop toward lower zones at the time of release — not because of a reversal, but to grab liquidity before continuing higher toward the 102 target.

Unless we see something unexpectedly extreme in the numbers, I expect the DXY to remain on track to reach the 102 level in the coming days or next week.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

More Downside in the Greenback?The U.S. Dollar Index began 2025 with a dramatic slide. Now, after a period of consolidation, some traders may see further downside risk.

The first pattern on today’s chart is 99.443, the closing price for both a week and the entire month of May. DXY tested above the level between July 30 and August 1. It got rejected after the Labor Department revised payroll data lower. Has resistance been confirmed?

Second, the reversal occurred at the falling 100-day simple moving average. That may reflect bearishness over the longer term.

Third, stochastics have dropped from an overbought condition. Notice how those turns have occurred at other short-term peaks (marked in yellow).

Finally, traders may focus on news flow and catalysts with the White House expected to announce a replacement for Federal Reserve Governor Adriana Kugler this week.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Dollar Index Update – Holding Gains After NFP Data📈 DXY Outlook – Ready for the Next Leg Up?

Last Friday, as NFP data hit the market, I published an analysis highlighting this exact move—and so far, price has respected the roadmap perfectly.

Now, with momentum building and structure aligning, the Dollar Index looks poised to continue its bullish run—first toward the 101 zone and potentially higher toward 102.

But here’s the key point for swing traders and risk-conscious setups:

🔍 If we’re aiming for higher targets with minimal drawdown, tonight’s daily candle close will be crucial.

A bullish close above yesterday’s high would not only confirm strength, but significantly reduce entry risk for long positions.

So, whether you’re already in the trade or waiting for confirmation, patience tonight could pay off.

Let’s see if the bulls can seal the deal with a strong daily close.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

What now for the dollar after a poor NFP report?It is difficult not to link the bad US data to the impact of tariffs. Indeed, it certainly looks that way, especially given that the slowdown in jobs started in early Q2 when reciprocal tariffs were announced. Companies expecting margins to be squeezed by higher duties probably thought twice about hiring workers in order to keep costs down. So, the US labour market has been losing steam fast, undoubtedly due to tariff concerns. Unless the data surprises on the upside soon, the Fed may have no choice but to cut—and cut again. Against this backdrop, the recovery in the dollar is going to a long bumpy road.

We noted the area around 100.00 to be resistance in the previous update, and that level has held, thanks to the weak jobs report (and ISM survey that was released later). The DXY was testing potential support around 98.95 at the time of writing. Will it be able to bounce there? Break that on a closing basis and next week could bring more technical dollar selling.

By Fawad Razaqzada, market analyst with FOREX.com

DXY Locked & Loaded: Robber's Gameplan for Profit Pullout💸💼 "DXY Market Heist Blueprint – The Thief's Bullish Escape Plan" 💼💸

Rob the Market, Not the Rules – Trade Smart, Trade Sharp, Trade Thief Style™

🌍 Hey Money Makers, Risk Takers & Market Robbers!

Hola! Ola! Bonjour! Hallo! Marhaba! 🙌

Let’s break into the DXY vault and swipe those profits with precision. 💼💸

🧠💡This Thief Trading Style™ Master Plan is a high-stakes operation backed by technical setups, macro-fundamentals, and robbery-level insights. Follow the blueprint laid out on the chart. Our target? The High-Risk Yellow ATR Zone – where the real treasure is buried.

💼 ENTRY: "The Vault Is Open – Grab the Bullish Bags!"

Enter long as price approaches key pullback levels within a 15–30 min timeframe. Use the most recent candle wick’s swing low/high for sniper-style DCA entries.

🔑 Layer multiple limit orders like a thief stacking getaway bags (aka the DCA / Layering Method). Be patient and precise.

🛑 STOP LOSS: "Don’t Get Caught by the Market Police"

📍 Place SL just below the nearest 4H swing low (example: 97.300) depending on your strategy (scalping/swing).

⚖️ Your SL should reflect your risk appetite, lot size, and how many limit orders you’re running. Thieves don’t risk it all on one job. 🎭

🎯 TARGET: 101.800 (or Escape Before the Sirens)

Once the target zone nears, decide whether to collect full loot or exit before resistance hits. We trade smart, not greedy. 🧠💰

📈 Why This Heist Makes Sense: Market Conditions Breakdown

Bullish momentum supported by macro drivers and intermarket forces

COT report and sentiment leaning in favor of USD

Dollar Index structure showing signs of reversal + trend confirmation

Consolidation trap zones hinting at institutional accumulation

💡 This is not just a blind entry—it's a well-researched and time-tested plan. Check the chart details and refer to:

🔗 Fundamentals | COT Reports | Sentiment Score | Quantitative Outlook

🚨 NEWS & POSITION MANAGEMENT ALERT

Before jumping in, beware of high-impact news!

🗞️ To keep your trades safe and stress-free:

Avoid opening new positions during major news releases

Use trailing SLs to protect gains

Monitor volatility triggers (economic calendar is your best friend!)

🏴☠️💥 BOOST THE ROBBERY – Hit That Like/Boost Button

The more you boost, the stronger the heist crew becomes! 💪🚀

Help fellow traders steal opportunities with the Thief Trading Style™ – calculated, bold, and sharp.

🔥 Let's continue to outsmart the markets and make each trade count. Stay tuned for the next heist update – fresh trades, deeper insights, and bigger bags. 🤑💼

🔔 Disclaimer: This plan is not financial advice. Use it for educational and entertainment purposes. Always conduct your own analysis and manage risk accordingly.

📌 Markets shift quickly. Stay adaptable, informed, and always ready to pivot.

Bullish bounce off?US Dollar Index (DXY) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 97.96

1st Support: 97.18

1st Resistance: 98.73

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US Dollar Bottom: Don’t Rush InSince the beginning of the year, the US dollar (DXY) has been the weakest currency in the floating exchange market (FX). However, since mid-July, a technical rebound has begun, fueled by several fundamental factors, notably the Federal Reserve’s monetary hawkishness. But can this upward move be interpreted as a true annual bottom?

Or is it merely a temporary short squeeze before a return to the lows? As high finance fundamentals swing back and forth, let’s assess the technical outlook for the US dollar (DXY).

1) Rate cut expected on Wednesday, September 17 – fundamentals in flux

The recent rebound in the US dollar coincides with the Federal Reserve's firm stance in refusing, for now, to resume rate cuts, which have been on hold since late 2024. In its latest monetary policy decision on July 30, the Fed reaffirmed that no tangible factors justify a rapid rate cut. Disinflation appears paused, and the institution prefers to wait until fall to assess the impact of tariff measures on the core PCE index (inflation excluding food and energy).

However, a major red flag emerged with the release of a very poor Non-Farm Payrolls (NFP) report on August 1, reflecting a significant weakening in the labor market — a fundamental red alert!

The Fed has made it clear that the evolution of employment will be a key factor in its September decision. A weaker labor market could accelerate a monetary policy shift, renewing downward pressure on the US dollar.

2) Technical analysis of the US dollar (DXY): short-term rebound... but no medium-term trend reversal yet

From a technical standpoint, July's rebound is based on medium/long-term support levels that have so far acted as potential reversal bases. Can we legitimately speak of an annual low for the DXY? Has a major resistance been broken? The answer remains NO for now.

Weekly and monthly charts do not yet show a clear bullish reversal pattern. Some bullish divergence signals are emerging, notably on the RSI and LMACD, but they remain insufficient to confirm a lasting regime shift. A comparison with the 2018 and 2021 lows is telling: at those times, technical divergences were far more pronounced and bullish reversal structures had been confirmed.

The Elliott wave approach suggests a rebound is plausible within a corrective structure, but it does not yet guarantee a major trend reversal.

Data from the CFTC’s Commitments of Traders (COT) report and ETF flows tied to the dollar indicate some hesitation among institutional investors. While short positions have declined, there’s no clear evidence of large-scale buying.

In summary, the US dollar rebound since mid-July is real but fragile. As long as technical signals remain unclear and the labor market is flashing red, betting on a sustainable trend reversal remains risky. The annual low may be in place, but it is not yet confirmed from a technical, macroeconomic, or behavioral standpoint.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.