US30 trade ideas

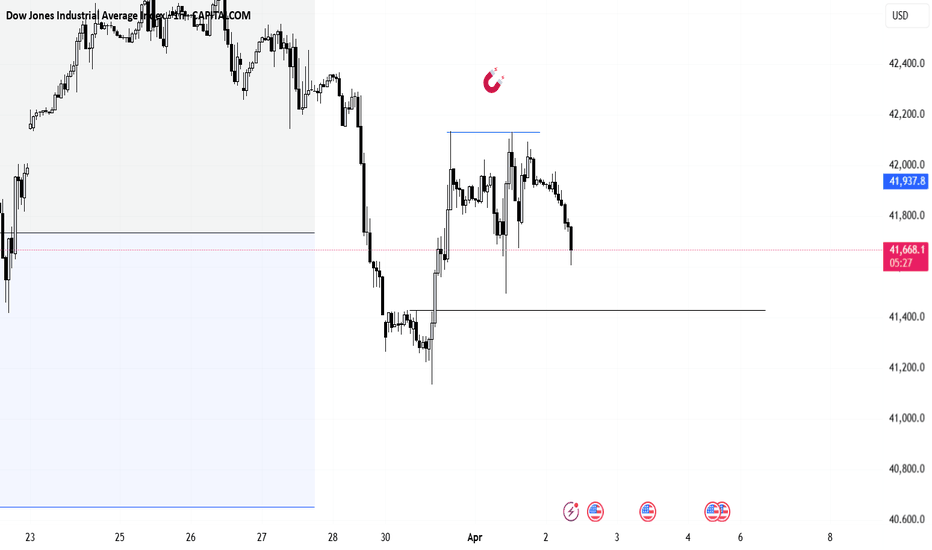

Dow Jones Analysis for the Coming DaysEntering a buy position on the Dow Jones requires confirmation on the 15-minute timeframe after breaking out of the classic triangle, with a risk-free position around the 42,500 level. If the price breaks out of the triangle and then pulls back with strong momentum—most likely intended to shake out retail traders and trigger stop hunts—it is possible to enter with a larger-than-usual position and a very tight stop-loss.

If the support level is broken, the analysis will be considered invalid. The "strong momentum pullback" to the support level refers to the red rectangle. If the price returns to the support zone with very strong momentum, an entry can be taken with a very tight stop-loss.

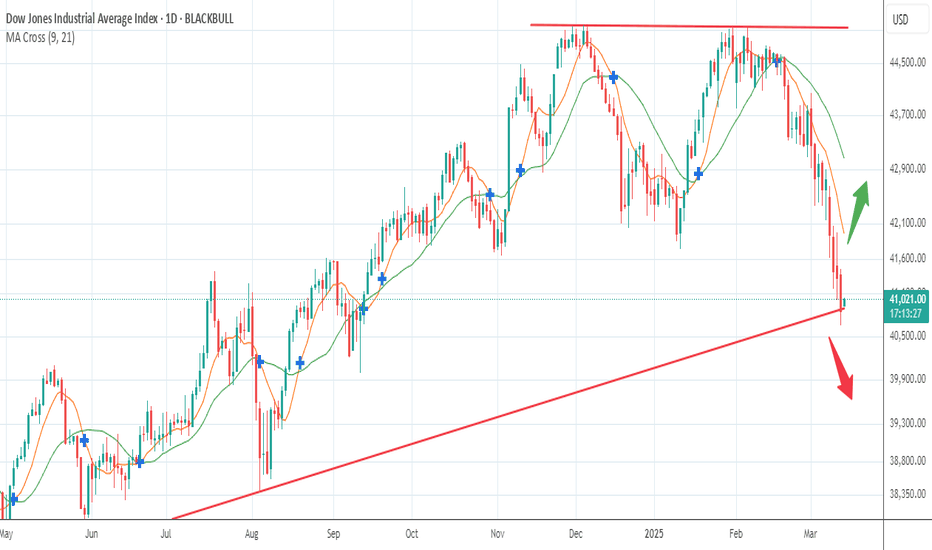

Moustafa! My analysis and view for US 30! on 16.03.2025!- I expected a huge bearish wave would hit the index by end of December and also in January and I sat an idea for it and it was right and that is the new idea

- On the weekly frame, you would notice that the index is in a rising channel

- Formed a double top pattern and even broke the neckline of it and is supposed to go to minimum the Take profit 2 then after the retrace towards the take profit 3

- The index retraced to the upside due to the uptrend line in green and there is a possibility that it could continue the bullish run but I do not expect here that a weekly candle would close above the neckline before reaching to the below TPs

- The lower weekly candles wicks from 15.04.2024 and 05.08.2024 must be filled anyway, which is giving another confirmation to the validation of this idea concept and the continuation of the bearish wave on the weekly chart! we could see on the way some retracements on the daily frame and the lower frames, but that will not have any influence on the bigger bearish image!

- The index had broken already the uptrend line (in red) which was not broken from October 2023! and the last week candle closed under the moving average 50!

- By reaching to the TP3, means that the index would go to the lower line of the rising channel

-- Conclusion is that we are in a bearish market on the weekly chart and the real target is exactly when the index will reach to the line (in yellow)

I sat also another idea for Nasdaq

which I see also there the continuation of the big bearish wave on the weekly chart! so feel free to have a look on too! so all is going in harmony together!

Updates on Our Last US30 analysis Update 🎯🎯

Market Structure

1. Trend: The market has been in a downtrend since mid-February, forming lower highs and lower lows.

2. Recent Price Action: There was a strong drop in mid-March, followed by a recovery attempt.

3. Current Zone: Price is hovering around 42,090, attempting to push higher after a recent low.

Key Levels

• Support: Around 41,500 - 41,800 (recent swing low area)

• Resistance: Around 42,500 - 42,700 (previous supply zone)

Possible Trade Setups

1. Bearish Scenario (Short)

• If price rejects the 42,500 - 42,700 resistance zone with a bearish candle, it could signal a short entry targeting 41,800 or lower.

• Confirmation: Bearish engulfing or rejection wicks.

2. Bullish Scenario (Long)

• If price breaks and holds above 42,700, it may indicate a trend reversal.

• A clean breakout with retest can signal a buy entry, targeting 43,000+.

Feel free to leave a Comment below ⬇️

US30 Trade Outlook – 27/03/2025📊 Market Structure & Key Levels

US30 is showing signs of exhaustion after a strong bullish leg. Price is currently consolidating below 42,787 – 42,872, a key resistance zone. Bulls must break this area cleanly to maintain momentum.

🔍 Key Observations:

✅ EMAs Flipping – Price dancing around EMAs, showing indecision.

✅ Resistance Holding – 42,787 – 43,021 still capping upside.

✅ Support Zones – 42,200 and 41,529 are levels to watch for a deeper pullback.

🎯 Trade Plan:

🔻 Short if price fails to break 42,872 → Target 42,200, then 41,600

🔹 Long if price clears 43,021 with strength → Target 43,400 – 43,600

⚡ Let price lead. No bias. Confirmation is key.

Double-Top Pattern for the Dow Jones Industrial AverageA long-term, double-top formation has emerged from the all-time highs of 45,073 on the weekly chart of the Dow Jones Industrial Average. With the pattern’s neckline breached (derived from the low of 41,844), chartists will likely target the structure’s profit objective, which stands at 38,613.

Dow Jones INTRADAY capped by 42375Resistance Level 1: 42375

Resistance Level 2: 42846

Resistance Level 3: 43288

Support Level 1: 41279

Support Level 2: 41000

Support Level 3: 40562

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The possibility of the upward correction ending and the decline Considering the zone marked on the chart and considering that the price has seen a lower low, it seems that the upward correction in the price will end soon and we should wait for a new downward movement. Targets and stop loss of my position are marked on the chart.

us30This Analysis Can Change At Anytime Without Notice And It Is Only For educational Purpose to Traders To Make Independent Investments Decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView

Dow Jones Industrial Average (DJI) - Technical Analysis🧠 Dow Jones Industrial Average (DJI) - Technical Analysis

📅 Chart Date: April 2, 2025

🔍 Pattern Observations

Previous Uptrend (Left Section of Chart):

The chart shows a classic Head and Shoulders (H&S) pattern that formed after a strong uptrend.

Left Shoulder, Head, and Right Shoulder were clearly formed and confirmed.

The price reversed strongly after completing this H&S, indicating a bearish reversal.

Current Pattern Forming (Right Section of Chart):

A new H&S pattern is now forming, suggesting another potential bearish setup.

The Left Shoulder and Head are already in place.

The price is currently moving upward toward what may become the Right Shoulder.

Expected completion of Right Shoulder around the 40,000 level.

A trendline support from the prior lows aligns with this area, strengthening this level as a possible resistance zone.

📉 Bearish Breakdown Scenario (Pattern Confirmation)

If price reaches ~40,000, forms the Right Shoulder, and then starts to decline, the pattern will be complete.

A decisive breakdown below the neckline (drawn from the lows of Left Shoulder and Right Shoulder base) would confirm the bearish H&S pattern.

In that case, projected target zone would be calculated as:

Target=Neckline−(Head−Neckline)

Target=Neckline−(Head−Neckline)

Depending on exact neckline placement, target could be around 38,000 or lower.

🚫 Invalidation Scenario (Pattern Failure)

If price breaks above the Head region (~42,500 - 42,800), then the current H&S pattern gets nullified.

In this case, the structure becomes bullish again, potentially leading to new highs beyond 43,000+.

📌 Key Levels to Watch

Level Significance

42,500-42,800 Head Resistance / Pattern Invalidation

40,000 Expected Right Shoulder Peak

38,000 H&S Breakdown Target

41,000 Interim Support

39,500 Neckline (approx.)

⚠️ Risk Factors

H&S is a reliable reversal pattern, but like all technical patterns, confirmation is key.

Right Shoulder is still under formation; premature trading before confirmation could lead to false signals.

Market sentiment, macroeconomic news (like inflation data, Fed announcements), or geopolitical events could override technical patterns.

✅ Conclusion

DJI has already completed one H&S pattern post-uptrend and saw a bearish reversal.

Now, it's potentially forming another H&S, and 40,000 is a key level for the Right Shoulder.

If the price rejects at 40,000 and breaks below neckline, bearish trend may resume, targeting 38,000 or lower.

If the price breaks above the Head (~42,800), the bearish structure is invalid, and we may see a bullish continuation.

📢 Disclaimer

This analysis is for educational and informational purposes only and does not constitute investment advice. Trading involves substantial risk and is not suitable for every investor. Please consult your financial advisor before making any investment decisions. The chart patterns discussed are based on historical price action and do not guarantee future performance.

Do Or Die!The past few weeks have caught out many bulls as Trump tariffs wreck the markets.

41K support today may just be the bottom, this area must hold, otherwise we are heading not just for a correction but a bear market.

The falls have been consistent and steady, no real plunges which points to a correction, although we do have a double top from the Dec highs and early Feb highs.

Gold and silver have been the standout performers, 3000 gold will be blown away.

A mix of Trump threats of tariffs and many beginning to wake up to media attention in PM's....a hedge against turmoil.

Any close below the Dow low is a short, from here bottom fishing just may produce a rally of significance, perhaps a rally to sell.

Appreciate a thumbs up and God Bless you all!

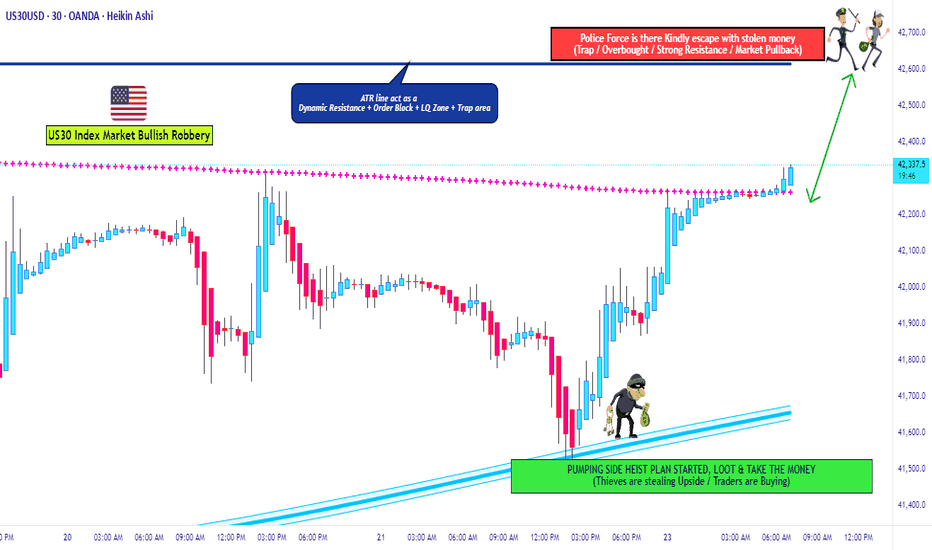

"US30/DJ30" Indices Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJ30 Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30m timeframe (42000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 42630 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DowJones INTRADAY muted reaction to US Economic DataMarket Impact Dow Jones: The better-than-expected GDP and healthy labor market data suggest economic momentum remains intact, supporting corporate earnings and risk appetite. However, persistent strength may delay Fed rate cuts, potentially leading to market volatility.

Key Support and Resistance Levels

Resistance Level 1: 42850

Resistance Level 2: 43162

Resistance Level 3: 43433

Support Level 1: 41830

Support Level 2: 41400

Support Level 3: 40800

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 Trade Outlook – 01/04/2025 🚨 US30 Trade Outlook – 01/04/2025 🚨

📊 Market Structure & Key Levels

US30 is showing signs of bullish recovery after bouncing from the 41,260 support zone. Price is currently testing the 42,000 area with momentum, but faces key resistance ahead.

🔍 Key Observations:

✅ Bounce from Demand Zone – Strong reaction at 41,260

✅ Short-Term Bullish Momentum – Price reclaiming EMAs

🔻 Key Resistance Zones: 42,787 → 43,021

🎯 Trade Plan:

🔹 Long if price holds above 42,000 → Target 42,787 – 43,021

🔻 Short if rejection near 42,800 → Target 41,600 – 41,260

⚠️ April kicks off with volatility – stay reactive, not predictive.