VELOUSDT LONGApprox. Current Price 0.015–0.020 USDT per VELO (depending on platform)

Technical Indicators Mixed—moving averages bullish, oscillators neutral

Long Position Rationale Betting on a price increase from current levels

Risk Considerations VELO is highly volatile; prices vary significantly by exchange

VELOUSDT trade ideas

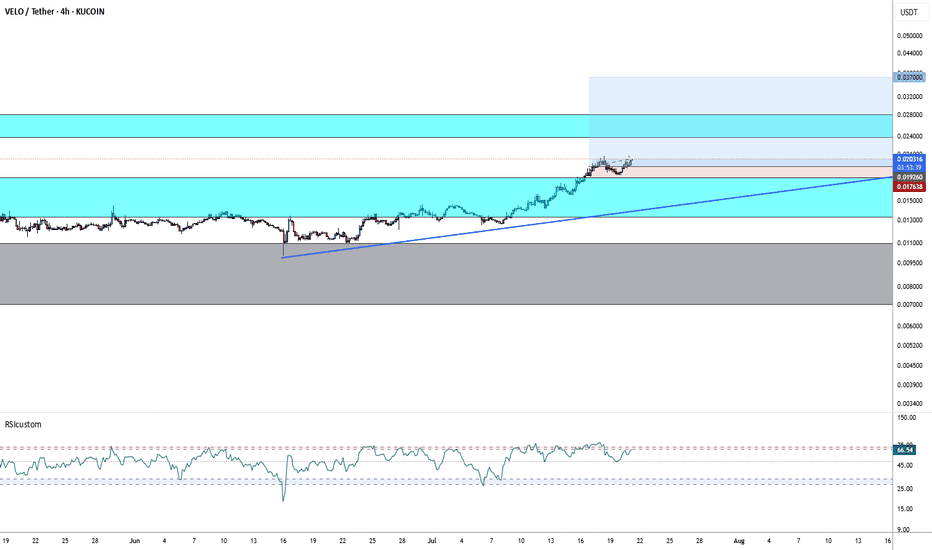

Velo - breakout double bottom confirmed, target 0.04 cents?Velo is approaching a critical breakout.

After a recent break out of a double bottom pattern on the weekly chart, Velo has now successfully retested the neckline as confirmation (as seen in the wick touching the yellow line).

Velo is currently challenging the final resistance zone between $0.018 and $0.020. A clean break above $0.020 would open up the path toward the $0.040 level with relatively little overhead resistance.

Having gone through an extremely deep bear market, Velo still holds significant upside potential. This is clearly visible at the major resistance it’s been testing since early 2023 (marked by the red line), which has now been tested three times.

Should Velo break above this structure, we could begin targeting much higher levels since there is little resistance after, such as the 0.786 Fibonacci retracement level ($1.50) , or even the previous ATH near $2.00 . That said, these remain speculative until a confirmed breakout occurs above the current major resistance.

For now, I’ll be taking partial profits around $0.04 , as it represents a key technical level and a logical area for a pause or rejection.

Let’s reach the summit together!

📝 Note

I'm currently building a portfolio of crypto analyses here on TradingView. Your feedback, tips, or validation are greatly appreciated, especially as I continue developing this skill further!

Velo Update, By Request (PP: Easy 265% - 358%)VELOUSDT is right now moving within a range that I call the "buy zone." This is a good place to buy in anticipation of a major bullish wave.

The chart situation is pretty simple and straight forward. After a multiple years long bottom formation, left side of the chart, we have a classic bullish trend; higher highs and higher lows.

The action is happening now at the lower boundary of this channel which is the time to buy. Smart people, experienced and successful traders buy here. At current prices or lower.

After just a few short days or maximum 2 weeks, we will have the start of the next bullish move, this will produce massive growth.

We can see easily 265% - 358% profits potential within 1-2 months.

Long-term, potential for profits goes many times higher, say 3-5 times higher than the numbers above.

I am keeping it simple.

Thanks a lot for your continued support.

Namaste.

ORDER - #VELO/USDT ShortORDER - $VELO/USDT

Direction: #Short 🔴

Entry Price: 0.013814

Stop Loss: 0.014649

Target 1: 0.013229

Target 2: 0.012645

Target 3: 0.012060

Target 4: 0.011476

Target 5: 0.010891

Reminder: Move the stop loss to breakeven once the 2nd (0.012645) or 3rd (0.012060) target is reached.

I've heard this is this cycles "financial idiot" cult coin. Buy when trash is rising. Short when btc is stalling. Cr alerts set.

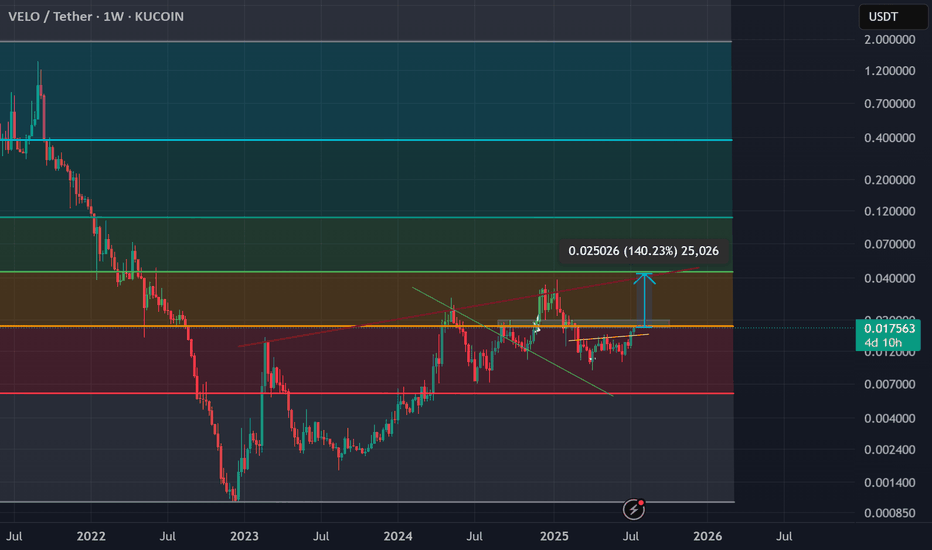

Velo's Final Resistance: Path Toward ATH (1145%, 4080% & 10890%)VELO has been rising continually since December 2022 and is set to move higher. There is one final resistance level to break before we see the production of a very strong bullish wave.

The final resistance is a level that rejected growth back in May 2024 and then in December and also last month. This is marked orange on the chart. This resistance range sits between $0.025 and $0.033. A very strong long-term resistance.

The fact that VELOUSDT has been growing steadily for years producing an ascending triangle is very promising.

This resistance is set to break in the coming weeks. Once it is taken out, conquered, a very strong advance will take place, something not seen before on this pair and this chart. It will be the biggest bull-market VELOUSDT will experience since it started trading on KuCoin.

From December's 2022 bottom to current price, this pair is up by a total of ~1,900%. While this is great, long-term growth, this is only the beginning, a long-term accumulation phase. When resistance breaks, there will be massive growth.

The third target on the chart is likely not the end of the bull-market. VELOUSDT can move much, much higher. Something even nearing 10,890%. A new All-Time High in 2025.

Make sure to follow.

Thank you for reading.

Namaste.

VELO Ready for Its Next Big Move?As the crypto market continues to fluctuate, VELOUSDT is at a crossroads. Currently trading at $0.02188, the asset has retraced -43.85% from its recent peak of $0.038965 set just three days ago. This places it in a prime zone of interest for both bulls and bears. With a low RSI14 at 21.15, VELO is heavily oversold on the 1-hour chart, suggesting a potential rebound is on the horizon. Meanwhile, the 60-period MFI at 26.60 hints at waning selling pressure.

The emergence of consecutive VSA Buy Patterns in the past few sessions supports the hypothesis of a possible reversal. However, a break above the resistance at $0.026136 would provide stronger confirmation for a bullish move.

Could this be your chance to catch a trend early, or will VELO test deeper waters before turning? Keep an eye on these levels, and stay tuned for the next steps in its journey. Are you ready to trade with precision?

Roadmap: VELOUSDT Patterns Unveiled

Dive into the historical path of VELOUSDT to uncover how patterns have shaped its journey. This roadmap highlights confirmed moves, discarding noise to reveal actionable insights for traders.

1. VSA Manipulation Buy Pattern 2nd - January 19, 09:00 UTC

Main Direction: Buy

Opening Price: $0.023559 | Closing Price: $0.023816

Confirmation: The subsequent pattern at 10:00 UTC continued the bullish movement, closing higher at $0.022719 despite minor fluctuations. The direction aligned perfectly, validating the bullish forecast. This move showcased a strong rebound from a previous sell-off, marking a turning point for VELO.

2. VSA Buy Pattern Extra 1st - January 19, 10:00 UTC

Main Direction: Buy

Opening Price: $0.023816 | Closing Price: $0.022719

Confirmation: At 11:00 UTC, the next candle continued the upward push, closing at $0.02188. While the price dipped initially, it tested lower support levels before rebounding in alignment with the bullish signal. This pattern highlighted a retest scenario before breaking out to higher levels.

3. Increased Sell Volumes - January 19, 08:00 UTC

Main Direction: Sell

Opening Price: $0.025608 | Closing Price: $0.023559

Skipped: The subsequent patterns contradicted the bearish outlook, signaling that this pattern failed to confirm its trigger. This inconsistency marks it as a noise event in the roadmap.

4. VSA Manipulation Sell Pattern 2nd - January 18, 08:00 UTC

Main Direction: Sell

Opening Price: $0.02829 | Closing Price: $0.02705

Confirmation: The following VSA Buy Pattern Extra 1st at 07:00 UTC indicated a minor reversal, but the broader trend remained downward. The sell signal was validated as prices continued to respect resistance levels and declined further.

5. Increased Buy Volumes - January 18, 11:00 UTC

Main Direction: Buy

Opening Price: $0.026342 | Closing Price: $0.026624

Confirmation: Subsequent price action upheld the bullish move, rising toward $0.027213. This pattern was instrumental in identifying a shift in sentiment, with buyers reclaiming control after a prolonged sell-off.

Key Takeaways for Investors

Patterns like the VSA Buy Pattern 2nd consistently highlighted key turning points, offering valuable entry points.

Noise events such as "Increased Sell Volumes" underline the importance of trigger confirmation in trading decisions.

The roadmap demonstrates how aligning with confirmed patterns can improve forecasting accuracy and trading confidence.

VELOUSDT's historical patterns showcase the critical role of precise analysis in navigating market volatility. Ready to capture the next move? Follow the roadmap and take control of your trading game!

Technical & Price Action Analysis

Support Levels:

0.026136 – This level has been tested multiple times and shows solid buyer interest. If it breaks, expect it to flip into resistance, paving the way for lower action.

0.029519 – Another critical support zone. If buyers fail to hold this, sellers will likely push through, making it a tough ceiling on the next retest.

Powerful Support Levels:

0.037063 – This is the fortress for bulls. A breakdown here signals a significant shift in sentiment, with the level becoming a prime resistance to watch.

Resistance Levels:

0.034017 – This area has capped recent upside moves. If bulls can break and close above, it could signal a trend reversal. Otherwise, it’ll remain a tough nut to crack.

0.036148 – Another ceiling for the price. Watch how price reacts here; failure to break will likely lead to another round of selling pressure.

Powerful Resistance Levels:

0.013717 – Key battleground for sellers. A clear rejection here strengthens the bearish case. A break could open the floodgates for further bullish momentum.

0.011988 – Strong historical resistance; a failure to close above this confirms seller dominance, turning it into a high-confidence short zone.

0.010637 – This level acts as a line in the sand. A breakthrough could ignite new buying interest, but until then, it’s a key roadblock.

0.00956 – Bottom-line resistance. If bulls can’t clear this, the bears will likely dominate the near-term price action.

Failure to respect these levels can quickly flip them into critical zones for the opposite side of the trade. Stay nimble and keep your risk tight—the market’s watching, and so should you.

Concept of Rays: Trading Strategies Based on Dynamic Levels

Core Idea

My proprietary analysis method revolves around "Rays from the Beginning of Movement," constructed using Fibonacci mathematical and geometric principles. These rays form a system of dynamic levels to predict asset movements, emphasizing interactions rather than static levels. By analyzing price interaction with these rays, traders can infer scenarios of reversal or continuation—but only after confirming dynamic factors and patterns.

Why Specific Levels Are Not Predictable

Financial markets are complex, nonlinear systems influenced by numerous variables such as liquidity, market sentiment, and macroeconomic forces. Instead of pinpointing exact levels, we focus on probabilities at pre-determined zones. Rays provide key insights into the direction and intensity of price movements when these zones are engaged.

How Rays Work

Fibonacci Rays: Each ray aligns with significant angles derived from natural proportions and is anchored at the origin of movement.

Primary Advantage: Unlike traditional methods, rays are constructed from the movement’s starting point, enabling precise adjustments for new trends or corrections.

Adaptability: Rays dynamically adjust with emerging patterns, offering fresh insights into movement boundaries.

Ascending and Descending Rays: These define the movement channel’s limits and highlight interaction zones for potential entries.

Optimistic Scenario

If the price reacts positively to support levels, we expect movement along ascending rays to achieve successive targets:

First Target: $0.026136 (Resistance Level 1)—Price interaction suggests continued bullish momentum after breaking through.

Second Target: $0.029519—A key resistance zone where price momentum will likely face its next challenge.

Third Target: $0.034017—Major resistance that aligns with the upper boundary of dynamic rays and Moving Averages.

Pessimistic Scenario

If the price fails at resistance and interacts negatively with descending rays:

First Target: $0.02188 (Current Price Level)—A probable retest of support.

Second Target: $0.011988—Dynamic interaction with powerful support, marking a critical zone to evaluate bearish persistence.

Third Target: $0.00956—Final support level where sellers may dominate before potential consolidation.

Dynamic Factors

Moving Averages—Levels at MA50 ($0.02873) and MA100 ($0.03257) act as additional dynamic resistance points. Interaction here confirms strength or weakness.

VSA Rays—Key zones on the chart interact with Volume Spread Analysis rays to offer enhanced clarity. Price moves between rays, using each as a potential stepping stone.

Proposed Trades

Trade 1: Long Position from $0.026136 to $0.029519—Enter on interaction with ascending ray and confirmation of bullish momentum.

Trade 2: Short Position from $0.034017 to $0.02188—Triggered by rejection from upper resistance and descending ray.

Trade 3: Long Position from $0.011988 to $0.026136—A high-probability reversal from powerful support.

Trade 4: Short Position from $0.029519 to $0.011988—Dynamic resistance at MA100 confirms bearish continuation.

Price movement along these rays allows traders to predict targets confidently. The beauty of this method lies in its flexibility and reliance on real-time interaction, ensuring adaptability in any market scenario.

Got questions? Let’s discuss! Drop your thoughts and queries in the comments below—I’ll be happy to clarify or dive deeper into the analysis. Don’t forget to hit Boost and save this idea to revisit it later and see how the price follows the roadmap. Tracking key levels and reactions is the cornerstone of trading success.

By the way, my proprietary indicator automatically plots all the rays and levels you see here. It’s available privately, so if you’re interested, feel free to message me directly to learn more.

Need analysis for a specific asset? I’ve got you covered! I’m open to creating detailed markups—some I can share publicly, and others can be tailored exclusively for you. Whether it’s a broad market idea or a private strategy, let’s connect and find a solution that works for you.

Remember, these rays work across all assets, guiding price movements with uncanny precision. If you have assets you’d like analyzed, give this post a Boost and mention them in the comments—I’ll do my best to include them in future updates.

Finally, don’t miss out on more insights and strategies! Hit follow here on TradingView to stay updated with all my latest ideas and detailed analyses. Let’s navigate the markets together!

VELO is moving back to previous levels!VELO has reached a partnership with BlackRock to tokenize assets. From a technical point of view, the chart looks like it is worth at least waiting for a recovery. It's also worth noting that thanks to the partnership with DWF Labs, the price could skyrocket above our plans at the time of tokenization via VELO for Asia.

Horban Brothers.

VELO is holding Very Strong!KUCOIN:VELOUSDT

VeloDrome Finance is behaving very strong with respect to the current slow and bearish market for the low time frame. All other alts had 30-40% dump while VELO is holding it's structure very nicely.

We can expect a break of the resistance very soon with a move of 50-70% bullish move ahead