BAYN trade ideas

Is Bayer Going To Need Aspirin For Their Roundup Issues?Bayer is a descending Triangle Chart Pattern

Strong support level has been re-tested several times

Continually lower highs puts pressure on this support level

Best patterns have dropping volume and volatility/ATR

Fewer traders are interested in this consolidatation

At some point expect an explosive breakout

Trade Plan

Wait for a close below the support level

Full trade size if volume is at average atr line

1/2 trade size as long as bar has 75% of average volume

Enter two trade

Both trades SL is 1.5xATR

1st trade TP is 1xATR

2nd trade no TP let profit run

When price hits 1st TP move 2nd trade AL to breakeven

Let profit run

If breakout candle is more than 1 ATR wait for price to retrace back towards 1 ATR level to enter

After break of low around 17 BAYRY retraced to breakout After break of low around 17 BAYRY retraced to breakout down

- broke the 17 low into new low territory

- has retraced to breakout

Note: with all the litigation, the potential damages claims, BAYRY has such a big question around it, it would appear there is only one direction it can move, how big is is anyone's guess? maybe the lawyers can tell us....

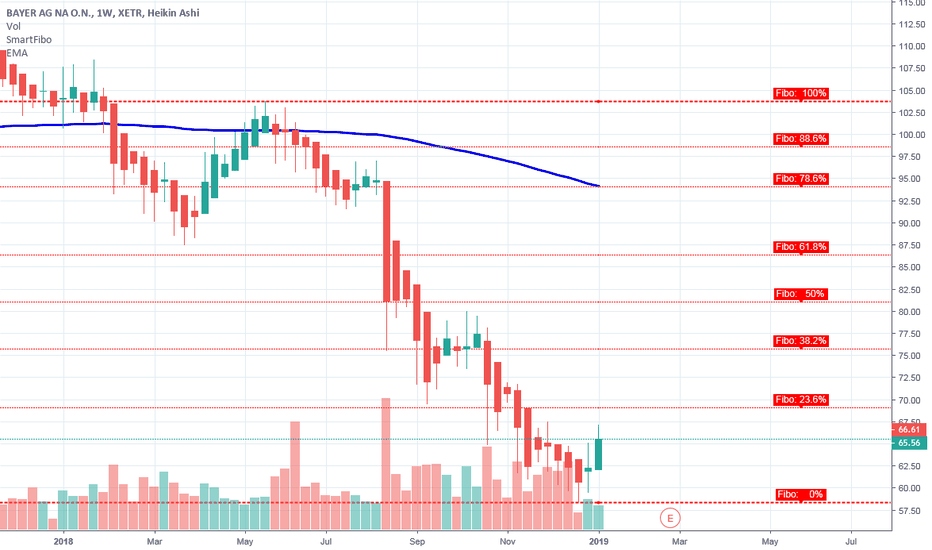

Bayer AG breaking long term downtrendBayer has been going down over 60% since 2015 because of many lawsuits regarding the Round-up debacle for causing cancer and some incidents regarding a blood thinner medication causing fatalities.

Now there are some positive things starting to show for this stock, the lawsuits in the US for the fatalities are bought off.

Speculations are rising that the market, pricing in a 40 bln dollar liability in the Round-up lawsuits is way too high and will be substantially lower after a long drawn out legal process.

The stock bounced of the .786 fib with nice volume, this is the same range where a very solid resistance formed from 2010 till mid 2012 when a s/r flip occured.

A potential Long term winning indexAn own build index for long term investment on European stocks. Lets see if this log(Channel) holds.

Chemistry-Pharma:

1/12 Bayer

1/12 BASF

Semiconductior:

1/12 Melexis

1/12 BE Semiconductor

Environmental-Chemistry:

1/12 Umicore

2/12 Veolia

Brewery Chain:

1/12 AB Inbev

Steel/metal industry:

1/12 Aperam

Index ETF:

3/12 Amundi CAC40 ETF (C4D)

Input Tradingview:

XETR:BAYN*1/12+XETR:BAS*1/12+EURONEXT:MELE*1/12+EURONEXT:C4D*3/12+EURONEXT:VIE*2/12+EURONEXT:UMI*1/12+EURONEXT:APAM*1/12+EURONEXT:ABI*1/12+EURONEXT:BESI*1/12

Bayer AG - in free fall after US judgementToday I am analyzing one of the leading Dax30 companies, Bayer ag. After a US court has found Monsanto guilty (2 of its weed killers are said to be producing cancer by containing glyphosate) and has distributed a fine of over $ 250 million, the course is in free fall. There have already been 2 rebounds from the Fibonacci retracement zones, however, the price will be corrected further in the direction of 55-58 €. More court decisions will follow, increasing the burden on the company. Reserves for this case have not yet been formed, which is why the annual result should be significantly weakened. However, Bayer is a very well-performing group that is very well positioned, and the acquisition of Monsanto has long been the first real mistake of the management (in my opinion). In the long run, the stock will rise again because medicine and pharam articles are always sold. I think a long term entry from 60 € downwards is very safe. RSI and MACD are already looking bullish but the free fall is still not finished.

Bayer AG - time for first long positions - wait for confirmationAfter weeks of price dumps the Bayer AG chart is first time near real support zones (between 57 - 63) which I already analyzed in my first Bayer AG analysis from August 17.

If the next weekly candle is green we can expect the start of a recovery run because Bayer is now fair valued.

But don't forget that further legal proceedings are open and could still be followed by large fines but the fines so far did not really hurt Bayer's result, which argues that Bayer has a very healthy corporate structure and profits are made abundantly.

Bayer AG - head and shoulder incomingAfter bottoming out at € 70, the current chart looks like a head and shoulder formation. RSI and MACD still have room to grow. I expect further price increases up to about 84 € until a first correction begins, then it will show whether the H & S formation holds or a new low for 2018 will be marked.