COIN trade ideas

COINBASE (COIN) | 3W Outlook

Price just closed above $209.64 — reclaiming the 0.236 Fib level with a +19.77% candle! We're now watching to see if this breakout has the momentum to continue toward the 0.382 ($221.54) and eventually retest the 0.5 zone ($245.99).

🟣 Previous High at $349.75 remains a major target — but notice how price respected that $142.58 support and launched with force.

🔄 Market structure still favors bulls in this mid-term reversal setup. A break and hold above $221 could be the confirmation many are waiting for.

🚀 Next stops: $245.99 → $270.43 → $305.24 🎯 Long-term goal: $349.75 and beyond.

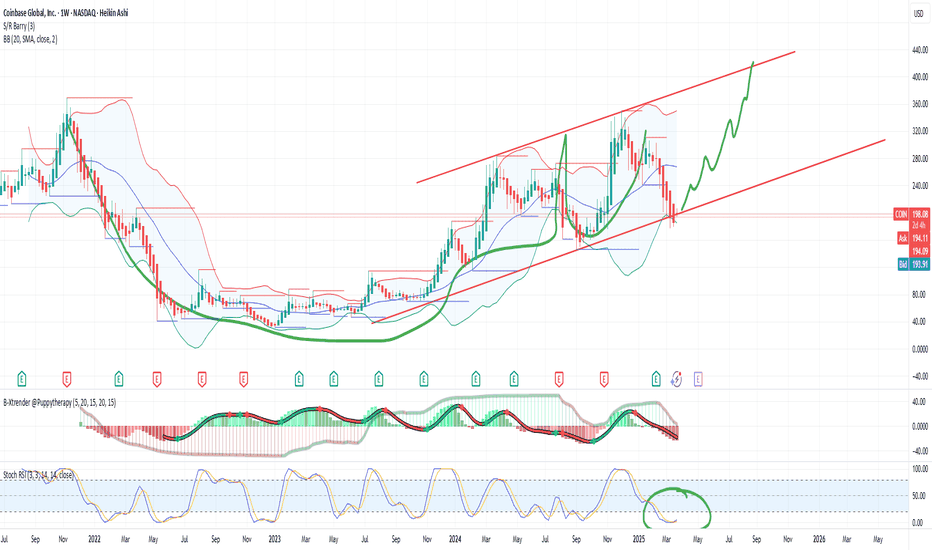

$COIN $83-100 before $500+NASDAQ:COIN is still in the process of correcting down to it's target at $100 (with a possibility of a wick down to $83) and after we get there, I think we'll start our next leg up which will take us past $500.

Why do I still think we have another leg down? Well if you look at the chart, you'll see that we've only had 3 waves down on the downside and the 5th wave looks to be coming soon here.

After we bottom, I think it's likely that we'll see a 5-7x, with the most likely target of the move being $770, which is likely to come in 2026-2027.

Why Coinbase (COIN) Shares Are RisingWhy Coinbase (COIN) Shares Are Rising

As the Coinbase (COIN) stock chart shows, trading closed yesterday above the $200 mark — for the first time since March.

Since the beginning of April, COIN's share price has risen by nearly 20%, while the S&P 500 index (US SPX 500 mini on FXOpen) has declined by approximately 2%.

Bullish Drivers Behind COIN’s Price Rise

According to media reports, several factors are contributing to the bullish momentum:

→ Yesterday’s announcement that Coinbase and PayPal are expanding their partnership in the areas of crypto payments and decentralised finance (DeFi). The collaboration aims to increase the adoption of the PYUSD stablecoin and integrate it into merchant settlements.

→ The anticipated adoption of US stablecoin legislation, designed to establish a regulatory framework for the use of stablecoins. This is being supported by the Trump administration’s progressive stance on cryptocurrencies, including the appointment of crypto-friendly officials, the creation of a strategic crypto reserve, and other pro-crypto initiatives.

Technical Analysis of COIN Stock

The psychological level of $150, which served as strong support in 2024, has proven resilient again in April 2025. However, despite the rapid rise in price from $150 to $200 in under three weeks, there are reasons to believe that bullish sentiment may begin to fade:

→ The COIN share price remains within a downward trend, highlighted by a channel originating in early 2025.

→ The upper boundary of the channel may act as a resistance level.

→ Bears have previously demonstrated control in the $225–240 zone, where the price declined sharply (marked with a red rectangle).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Long Coinbase as a proxy bet on Crypto until end of yearUntil proven otherwise I must be under the assumption that the worst is behind us for the time being. That being said, more debasement is infinitely more likely than less, so long risk assets.

-looking for a lovely retest of the broken downtrend, coinciding with a nice support level within the next 30 days. This has to be a buy for me (in the green box).

-looking to close position late this year (likely December)

Coinbase Global, Inc. Goes Bullish —The Correction Is Over!COIN's bearish volume peaked November 2024. Ever since this date, peak bearish volume continued to drop. As we approached today, the lowest price since February 2024, COIN ended up closing with a green bar rather than a red one; the bears are gone.

I am giving you technical analysis in a very simple way. When volume and price produce a divergence, it means that we are on the verge of a change of trend.

Coinbase found support just below the September 2024 low. This support is also a long-term higher low compared to February 2024.

The correction was big and strong. Lasting more than 4 months and reaching almost 60%. A huge drop, but the market never drops forever, it never moves in one single direction, it moves in waves.

Did you enjoy the bearish wave? Did you suffer through this wave?

No problem, after a bearish wave comes a bullish wave. The good news is that the bearish wave lasted 4 months but the bullish wave will go for 8-12. That's a great deal. Go down 4 months and then growth for 8 months straight.

Coinbase is preparing to grow, together with Bitcoin, NVIDIA and the Stock market.

The bears are out. We will gain control of the market. It is the bulls turn. We are going up.

Namaste.

i missed the target before -30% i'd like to offer you The Bottomt's awkward when 'all models are wrong, some are merely useful' when i called 'the fear is in the streets' with a buy action forward. boy was i wrong (and so paid the price for that call)

but with -30% additional downside i've been stalking this patiently.. and +/- 5% diff i think This is it a good bottom as any now (you cant ever time them right) but merely highER probability of the bottom

Here is why.

Overall Price Action

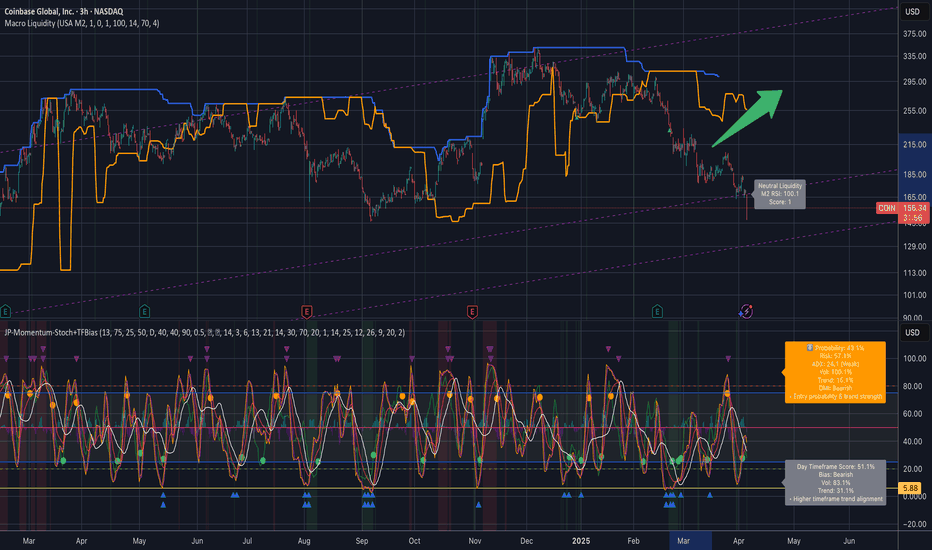

• COIN appears to be trading within a broad upward‐sloping channel since last year’s lows, though recent sessions show a pullback from the high‐$300s down to the mid‐$100s.

• The stock has been staging multi‐month rallies followed by pronounced corrections, indicating that volatility remains high.

Short‐Term (Days to ~2 Weeks)

• Current Bias: Bearish/Consolidation - stay cautious

Reasoning: Momentum indicators (e.g. the stochastic overlays) are in lower ranges or rolling over from mid‐levels, and the daily timeframe readout references a bearish tilt with relatively weak trend strength (low ADX, sub‐50% probability).

Key Levels:

• Immediate Support: Around ~150–145 (a break below opens room toward ~130–125).

• Short‐Term Upside: A rebound and close above ~165–170 would help neutralize the immediate downtrend and could invite a bounce toward ~180.

• Confidence: Moderate (about 50%) given the mixed signals on momentum and the broader market volatility.

Near‐Term (2–6 Weeks)

• Current Bias: Cautiously Bullish if support holds; risk of deeper pullback if ~145 fails

Reasoning:

• The purple channel on the chart suggests that price may still be in a rising structure overall.

• If COIN defends that lower‐channel region near 130–150 and momentum begins to turn, a bounce toward the mid‐$180s or even low‐$200s is plausible.

• Conversely, if broader crypto markets or equities weaken further, the stock could see a retest of the lower trend boundary around the low‐$100s.

Key Levels:

• Upside Targets: ~185, then ~200–210 as a bigger pivot.

• Downside If Support Breaks: ~120–130.

• Confidence: Moderate (around 60%) on a bounce scenario, but keep watch for major support to confirm.

Long‐Term (6+ Weeks to Multiple Months)

Current Bias: Constructive but Volatile

Reasoning:

• The broader up‐channel hints COIN may be in a longer‐term recovery cycle from 2022 lows, but large swings remain likely due to the stock’s sensitivity to crypto sentiment.

• Sustained closes above ~$200–210 would solidify the bullish structure and open the door toward the mid‐$200s, possibly higher if the channel holds.

• A breakdown below ~$120 would negate the broader uptrend and suggest a return to deeper support in the double‐digit zone.

Key Levels:

• Main Resistance: ~250–270 (top portion of the channel if momentum truly resurges).

• Deep Support: ~100–120, critical to maintain a longer‐term bullish outlook.

• Confidence: Moderate‐Low (roughly 50%) given macro uncertainties; confirmation of trend strength would come from multiple weekly closes above or below these key thresholds.

So what do i think? its about Time-in-The-Market, not Timing-The-Market

The Bottom Line

Short Term : Leaning bearish unless price reclaims ~165–170.

Near Term : Watch ~145 and ~130–135 as critical support—if those levels hold, a push toward the high‐$100s is plausible.

Long Term : The up‐channel remains in play, but a break below ~120 would undermine the bullish structure. Upside targets could extend into the mid‐$200s if broader momentum and crypto sentiment remain supportive.

Opening (IRA): COIN March 21st 220 Covered Call... for a 215.96 debit.

Comments: High IV + weakness. Selling the -85 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Going lower net delta due to the shorter duration (35 DTE).

Metrics:

Buying Power Effect/Break Even: 215.96/share

Max Profit: 4.04

ROC at Max: 1.87%

50% Max: 2.02

ROC at 50% Max: .94

Will generally look to take profit at 50% max, roll out short call if my take profit is not hit.

COINBASE GLOBAL - Technical Analysis Key Observations:

Elliott Wave Structure: COIN has been trading within a clear Elliott Wave pattern across the timeline shown. The chart displays a complete 5-wave impulse followed by a corrective phase. Currently, we are observing the development of another impulse wave which could be signaling the start of a new bullish cycle.

Fibonacci Levels: The stock finds significant support and resistance at key Fibonacci levels. Notably, after touching the 0.618 Fibonacci retracement level at approximately $239.3, COIN shows signs of a bullish reversal, initiating the potential formation of a 3rd wave which often is the strongest and longest.

Channel Trading: COIN has respected a rising channel, bouncing off the lower bounds and facing resistance at the upper. The interaction with these channel lines provides crucial entry and exit points.

Technical Indicators:

Volume: Trading volume appears to corroborate the wave counts, with spikes in buying volume at the start of impulse waves and increased selling pressure during corrective phases.

RSI: The Relative Strength Index shows fluctuating momentum, with recent readings heading towards overbought territory, which aligns with our observation of the beginning of a potentially strong upward wave.

Future Projections:

If the bullish momentum continues, and COIN respects the Elliott wave pattern, the next significant resistance is expected at the 1.618 level around $575.70. However, a break below the current support at the 0.618 level could invalidate this bullish outlook and may lead to a retest of lower support levels.

Trading Strategy:

Long Position: Traders might consider taking a long position near the 0.618 Fib level with a stop-loss just below it. The target would be the 1.618 Fib level, aligning with the peak of the projected 3rd wave.

Short Position: A break below the 0.618 Fibonacci level could be used as a signal to initiate a short position targeting the next key support level.

Conclusion:

COIN exhibits a strong technical structure that offers potential for both bullish and bearish trades depending on key levels. Monitoring these levels along with volume and RSI can provide valuable signals for entry and exit points.

COIN - what to expecthi traders

COIN stock looks bad.

Monthly close is upon us and it looks like it's gonna be a bearish engulfing candle.

In the next few weeks I expect a bounce and retest of the previous support around 245$ where we should get a rejection and the continuation of the downtrend.

We can see a bearish divergence in the monthly time frame.

COIN's chart looks pretty similar to the BTCUSDT chart that we analyzed today:

Recommended strategy:

1. Short around 245$ area and take profit near 180$.

2. Play the bounce from 180$

Good luck

COIN is the Goldman Sachs of CryptoTitle says it all. Coinbase is the OG exchange that has led the US crypto space for well over a decade. COIN has over 9 Billion in cash that can be deployed on ANY crypto project in the US. With the Trump admin interested in creating a Strategic Bitcoin Reserve, the policy of smaller government, then the logical private sector partner/leader of this effort is COIN.

Add to the above that COIN is silicon valley elite, you will find that COIN stands the to gain significantly as the government moves forward with their plans.

COIN has developed a moat and there are no other crypto enterprises that can compete.

Target price is $300+ in 9months a minimum 50% gain by the end of 2025. Good luck to all.

COINBASE This is the time to buy and target $400Coinbase Global (COIN) has been trading within a Channel Up pattern since the March 25 2024 High, so effectively a whole year. In the past 10 days it has been consolidating on top of the 1W MA100 (red trend-line), which is the natural long-term Support of the market.

During the same time it entered the Mayer Multiple Bands (MMB) Buy Zone, consisting of the 3 SD (green trend-line) and 2 SD (blue trend-line) below levels, which has given the ultimate buy signals since the January 2023 market bottom. Practically, the stock is consolidating within the 2 SD below and 1W MA100, a tight buy range.

Given the symmetry of the Channel Down Bearish Legs (both -48.39%), we expect a similar symmetry on its Bullish Legs too. Since the previous one reached the 1.236 Fibonacci extension, we are confidently targeting $400 before this Cycle tops. That would also make a perfect entry within the MMB Sell Zone that consists of the Mean MM (black trend-line) and 1 SD above (grey trend-line).

Notice also how the 1W RSI touched the Support of the September 06 2024 Low.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Coinbase -- Still expecting another lowAs the title suggests I am still expecting another low before we move higher again. Looking at the prior price action, a drop to the 1.382 @ $163.02 looks like the ideal place for this intermediate (A) wave to terminate. Afterwards, if this is the correct count, we should begin moving higher with a target of $260-$300. There is always the chance that it extends a little further to the 1.618 @ $137.31, but as of now I do not anticipate that. Should we drop to the area of the 1.382 I plan on acquiring another 20 shares. If we end up coming into the 1.618 that'll be another 20 shares I pick up. I have entered into this position in layers with a plan long before I started. This is the only way to trade based on data and not emotions. Currently I only have 40 shares at an average price of $187. Another 20 shares at say $165 (the price I will buy more) would lower my avg cost to $179. If my thesis is correct, and we do target the $260 range at a minimum, that will be almost $5K in profits with the potential of $8K. Again, this is not guaranteed, but the probability of it happening is higher than it not.

Last thing I want to leave you with, crypto as a whole IMHO, has hit its high. I believe we have started the next corrective phase that will last for quite some time. We do NOT yet have confirmation of this, but I deal with probabilities. As of right now, the probabilities favor a larger consolidation phase for the foreseeable future.