DBK trade ideas

Bank is only leveraged 1800:1 What an investment opportunity!!Zombie bank.

With a market capital value of $25 billion and a $45 Trillion dollar derivative book it's leveraged 1800:1 against it's derivative contracts..

When the interviewed the Finance Minister of Japan in 2016 noted that when DB goes it will disappear 15-20 European banks overnight.

Will the ECB bail out $5 Trillion to the counter-party if it's Goldman Sach that has to be paid back in America when DB defaults? Forgettaboutit...

DB could trigger a world wide default when it fails (not if) as counter-party after counter-party defaults on a world-wide $1200 TRILLION in world-wide derivative exposure.

Deutsche Bank - Till Short IIThe short Aupmove should have been part of the circled II and now a heavy sale should start soon, so that the media company can focus after Wirecard the next topic.

I'm curious whether there will actually be a merger with the "Deutsche Commerzbank", or let the Deutsche Bank just go down?

Greetings Stefan Bode from Hannover,

Lower Saxony

Z-DB -ingThe new hum-ing?

There are 60 points points between the last bottom and the current 'parking top' at 7.00 USD. I estimate it took 717.88 k shares bought between Aug 15 15:30 and 16 15:30 to lift the price 60 points. Then it took buying 342.31 k shares to keep the stock price level at USD 7.00 through Aug 20th 15:30

Somewhere between 380 and 420 million USD a year to keep the great Deutches Back a zombie, a float on $7:00/share. Z-DB, zimb, zihmb ( that uses onomatopoeic spelling ( a reference to ancient poetry )

is it doable? probably, compared to central bank QE forever, it almost rimes,

Better to park and defend than to let it drop 'al la' Ai Weiwei

www.futurelearn.com

that was a mixed language and cross cultural joke. Snicker or snivel , its almost funny.

The irony is that Ai Weiwei insist on keeping ones eyes wide open; AND making a mockery of the old as 'foe holly'.

Germany appears to be preparing give away money to keep the consumer economy rolling through their imminent slowdown and contraction.

Never mind, i'm a poetic hack observing the market with parabolas and curious, tremendously curious about the nature of consciousness: wake striding or sleep walking.

DB increses rate of declineDangerous systemically important bank on the edge of collapse? .

This has been pushed forwards before. Can it be don again? for how long? The inflection points have grown closer together.

'und' everything else going down, around this bank . . . collateral damage?

DB curves, today, point to the last week in August or the first week of September as zero point.

Deutsche Bank - disaster or restartDeutsche Bank is now in the buying zone already announced last year. Not that I would be able to beat myself, I am not convinced of the sustainability of the business model here, especially with the steady negative interest rate, but you can see first reactions at € 5.80 in June and € 5.77 last week.

Bullish Signals will come in my opinion only with a weekly and a monthly close above €6,87!

Greetings from Hannover

Stefan Bode

DBK Deutsche Bank SHORT Trendline Break EDUCATION 1 DAYHello to all watching my charts

Here the next example to trade a trendline brake

in DBK / German Bank

1. Break the black suppport line at 7.00 SHORT

2. Break the blue short trendline at 6.20 /6.30 LONG

3. Break of the next supoort line RED and break of the Long trendlne SHORT 6.70

Only a few trades to made profit.

Good trades

If you want to support my work and my charts, please like ethem

Renktrade

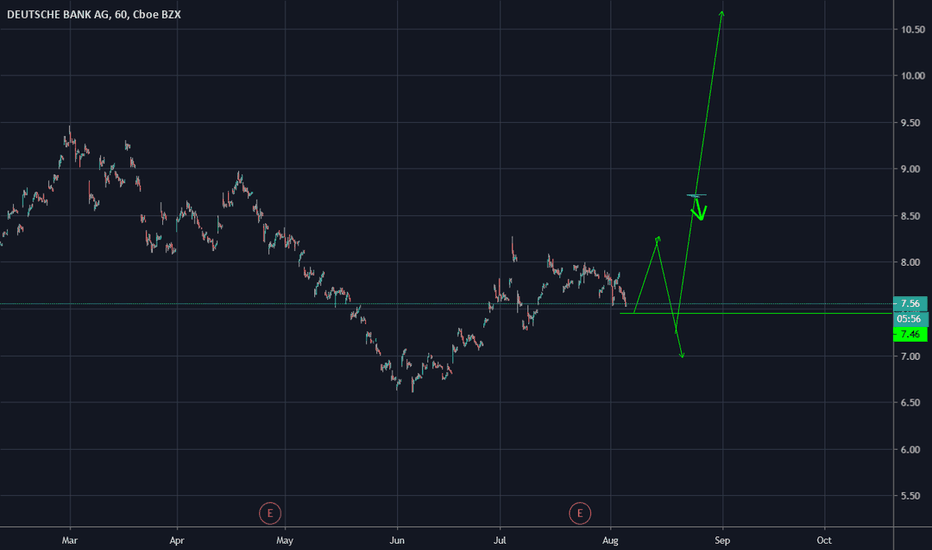

Deutsche Bank - is a bad bank enough to rescue the EU banking?market is within strong up trend structure and near two important resistance areas and need to break this up for another bigger up movement. Otherwise we will see correction movement to at least 7,46 which is first bigger support area. Wait for clear breakout above or under trend line before entering this trade.

1. down trend line resistance from end of May need to break up for another up wave

2. RSI line is near triangle formation resistance and need big volume to break above

3. MACD baselines going to cross bearish which brings sellers into the market within short term

After it was announced that the Deutsche Bank will establish a bad bank department to shift the outstanding debts there, the share price has risen strongly. In 2012/2013 this was already carried out successfully and saved the DB from bankruptcy. I expect that the bad bank will also be the last rescue for the DB this time, because a bankruptcy of the DB could be the starting signal for a European banking crisis and the EU wants to prevent that with all means. In fact the DB is already bankrupt if all open criminal proceedings with a high probability to the debit of the DB fail and outstanding payments are totaled.

In the second quarter, the radical restructuring and the elimination of thousands of jobs put Deutsche Bank even deeper in the red area than expected.

The consolidated loss amounted to 3. 15 billion euros after a profit of 401 million euros a year earlier. In addition, the bank felt the impact of its exit from stock trading ahead of schedule. CEO Christian Sewing doesn't want to lose any time. We're not just starting the transformation - after just two weeks we're already in the middle of it,"; he wrote in a letter to the employees on Wednesday when he presented the interim results.