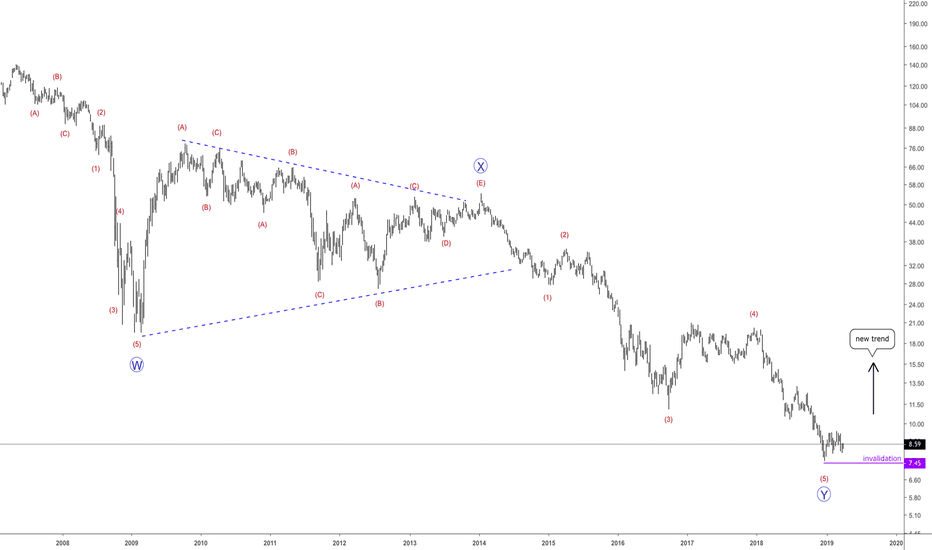

DB in long term downtrendThis is one to watch, as it's in a multi year downward spiral, and has reached all time lows. If the downward trendline can be broken, there could be a reversal. but more fundamental research is needed to see what kind of state the finances are at. In 2018 the first profit in years has been recorded, but criticism persists about management and many other issues. At some point, issues will get resolved and a new bubble will form.

DBK trade ideas

Deutsche Bank - long on 1H - breakout trade - target 7,10Market shows good support in drawn area and moves within down trend wedge and is near trend resistance line.

My setup is valid if candle break above trend line and close above.

RSI indicates first up trend signals and MACD showing an soon up correction.

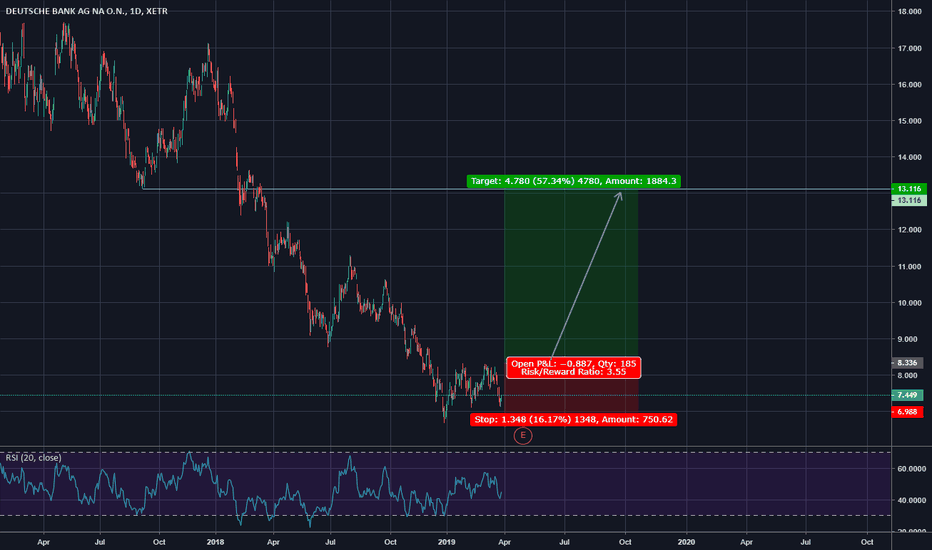

Deutsche Bank - swing trade - buy on 1 HTechnical view

- RSI is heavy over selled on 1 to 4 hour chart

- MACD baselines going to cross bullish soon

- market price near important support 6,91

- possible double bottom on 1 H is confirmation for long entry

Fundamental view

without Deutsche Bank, Donald Trump would never have become US President. At least that is what experts and journalists who have been dealing with the relationship between the entrepreneur and the financial institution for years believe. What was a sober business relationship for Deutsche Bank subsequently turned out to be a key success factor for Trump. Now this relationship is apparently taking revenge for Deutsche Bank. The institute is threatened with immense damage to its reputation.

At a time when all other banks had turned their backs on Trump due to several bankruptcies, Deutsche Bank gave him repeated loans. Even after he went bankrupt six times. According to reports, it has been more than two billion US dollars in the past two to three decades. When Trump became US President in January 2017, he still had 340 million US dollars (305 million euros) in debt to Deutsche Bank. At the moment it's still 130 million dollars.

Now Trump is suing the bank together with his children, the Trump organization and the Trumps trust company. The aim is to prevent the bank from being summoned to Congress. This would also involve the investigation of Trump's finances and tax returns. Deutsche Bank has been caught in a crossfire that is likely to continue for several months. But the question also arises why Trump so vehemently wants to prevent his finances from being disclosed to Congress.

One thing is clear: Deutsche Bank is not accused of any legal misconduct. Corresponding reports that Trump is suing Deutsche Bank are factually correct, but they still convey a false picture. Because in the process it is not at all the object of interest. If Deutsche Bank made mistakes in the Trump case, it might be business ethics. If Deutsche Bank could be accused of something, it might be a lack of risk assessment or deliberate ignoring of financial warning signals. From a legal point of view, however, there is currently no suspicion that the bank acted illegally by repeatedly granting loans

Deutsche Bank becomes a US election campaign theme for 2020

The bank itself takes itself out of the legal firing line in a statement. "As the plaintiffs themselves have stated, Deutsche Bank is named in this case for technical reasons in order to bring the facts to court,"; it says at the request of Business Insider. "Deutsche Bank is therefore not the subject of interest in this dispute, nor is it accused of misconduct. " Now the bank wants to "support all official investigations with adequate information and follow the court decision";.

However, it should be in Deutsche Bank's interest to get the matter over with as soon as possible. The more often Deutsche Bank is mentioned in the campaign of US opposition politicians against Trump, the more its image suffers. Among the democrats there are still individual voices hoping for an impeachment procedure. If that doesn't happen, Trump's relations with Deutsche Bank will become a campaign issue next year

Deutsche Bank - head and shoulder formation - target 6,60market price is in up trend after confirmed double bottom on daily chart. I expect up movement to 7,65 - 7,7 where is first strong resistance. Deutsche Bank has lost fuel after confirming the broken fusion with Commerzbank which was a boost for the price in the last weeks. If price reacts as expected we can expect confirmation of drawn formation which implements down movement to 6,60. Head and shoulder formation confirmation would be an daily close under trend line as drawn in the chart.

RSI implements further up movement

MACD baselines going to cross bullish which implements further up movement but only small one because baselines are in down and bearish MACD area

entry at 200D moving average resistance

Wait for confirmation before entering this trade. Setup is confirmed if daily candle close under 200 day moving average and within drawn sell area.

Deutsche Bank - strong up movement incoming-price in down trend switching to sideways / near first strong support

-RSI indicators showing soon up movement - RSI´s are already heavy over selled

-MACD showing soon crossing of baselines and with that up movement

-expect at least test of triangle up trend line

-take profits and stop loss is drawn into the chart

- open long after confirmation / confirmation = daily candle close within or above support area

Good luck to all

Deutsche Bank Commerzebank Merger Good for EquitiesThe fundamental analysis of this is fairly easy. Mergers are good for stocks. Why? Because it usually means increasing profitability. Why? Because it oftentimes leads to reducing inefficiencies and eliminating two teams that could be consolidated into one whether its with commercial banks, foreign exchange desks, etc. This merger would lead to the cutting of 30,000 jobs in Germany which would clearly help push the mega bank in a positive direction towards profitability. If talks progress positively, expect both Deutsche Bank (bars) and Commerzebank (pink) to edge up. But let's not forget, these two banks' stocks have been in the gutter since the 2008 Financial Crisis and both greatly underperformed the DAX (dark blue) and the Eurostoxx 50 (light blue). More words on this here: anthonylaurence.wordpress.com

Why Deutche Bank is NOT GOING TO ZEROI have read an article today about the possible merger between Commerzbank and Deutsche Bank, few people seem to be reading up on it! Very soon we will hear about how EU banks are a zero and Deutsche will be the first to collapse. A backdoor bailout is likely to change that.

DB momentum, Up Close, line.I don't understand how all that buying does not raise the price 01 Feb '19 14:30

'have to lable SIB long.

Parabolas can and should be fit to as high a resolution as available. that is what permits the quadratic extension of 3 points to be extrapolated precisely into the future , or past . the accuracy of the scaling depends of the actual distance tween the three points . very small differences is triangular relationship have large consequences in the quadratic extension of local parabolas.

I still think the efforts to float prop the stock needs vigor.

Deutsche Bank - time to sellCurrent trend structure: bearish in down trend channel

Currently testing important resistance

How bad is the European banking sector? New statements from the ranks of the European Central Bank suggest that the financial institutions on the home continent may once again hope for the help of the ECB. Whether they depend on it is another matter. There are signs for bearish trend continuation and that is not really reassuring.

The latest news from the European banking scene suggests that the money houses are not doing very well. This is also stated by ECB chief economist Peter Praet. According to him, the banks are not profitable in the euro area. There is a danger that they could increase the downward trend of the economy through pro-cyclical behavior. One solution could be new long-term refinancing operations (TLTROs). "The discussion will soon take place in the Council of the ECB."

Duetsche Bank Has The Potential To Advance From Current LevelsDB has the potential to advance from current levels. The key drivers are as follows:

- Bull flag breakout

- Bullish Engulfing Candle formation seen on 14-Feb-2019.

- RSI attempting a breakout

- Momentum indicator turning up

- 20-day EMA being regained

Current levels: €7.75

Stop-loss: €7.25

Take Profit Target: €8.93

NYSE:DB XETR:DBK