DLTR trade ideas

Dollar Tree Bullish in any economy.===Entry level $116 - Profile level $128 ====

Rsi Bullish with room to run higher

MACD and Histogram both very bullish

Volume is a concern

Alert set for breakout above ascending triangle.

Company profile

Dollar Tree, Inc. owns and operates discount variety stores offering merchandise at the fixed prices. It operates through Dollar Tree and Family Dollar segments. The company offers selection of everyday basic products and its supplement these basic, everyday items with seasonal, closeout and promotional merchandise. The merchandise mix consists of three types: Consumable, Variety categories and Seasonal merchandise. The Consumable merchandise includes candy and food, health and beauty care, and household consumables such as paper, plastics and household chemicals and in select stores, frozen and refrigerated food. The Variety categories merchandise includes toys, durable house wares, gifts, party goods, greeting cards, soft lines and other items. The Seasonal goods include Easter, Halloween and Christmas merchandise. Dollar Tree was founded by J. Douglas Perry and Macon F. Brock, Jr. in 1986 and is headquartered in Chesapeake, VA.

$DLTR:NASDAQ - DOLLAR TREE - Will it bounce on earnings?Dollar Tree is at a pretty strong support area at the moment and it has in the past bounced on top of its earnings the last few times so might be one to watch.

Could be 20% opportunity to get back up to its previous highs if it returns to range.

$DLTR MAJOR SUPPORT LOST IS SIGNIFICANT PRE EARNINGS Having Lost support at $98 the stock of NASDAQ:DLTR looks at risk of taking another drop lower if earnings are not superb. Support from the 200MA is not far below for security and the selling should not be very intense as the stock is already in oversold conditions, and the momentum indicator is already turning more bullish signalling a possible reversal. China, margins and supply chain will be to the forefront of everyone's thoughts and will determine the direction for the stock in the weeks to come.

The U.S. dollar extend losses agains safe-haven currencies The U.S. dollar came under strong selling pressure as poor macroeconomic data coupled with rising tensions between the U.S. and China took the gloss off the greenback in investors' eyes.

The U.S. Dollar Index (DXY) collapsed below 98.00 amid growing concerns over the health of the American economy and the side effects of the US-Sino trade war on the global economy. The steady sell-off on the equity markets added weight to the bearish sentiments and send the greenback lower across the board.

The new-home sales turned out worse than expected and registered the most significant month-on-month decline in 2019. The purchases of new single-family homes decreased by 6.9% in April, against the forecasted drop of 2.7%. It means that the housing market is losing momentum despite that a spring is traditionally considered a strong selling season.

The poor data renewed the fears that the U.S. economy might slip into a technical recession and reminded investors that the Federal Reserve might bring the key interest rates down to counter the economic weakness. Additionally, the US-China trade deal seems more like a distant dream than an achievable goal at this stage.

The above-said factors contributed to the dollar's falling, especially against safe-haven currencies like Japanese Yen and Swiss Franc. However, the sell-off may be limited in the long-run as the worries about the state of the global economy and local weakness of the overseas markets are likely to overshadow the dollar-negative factors.

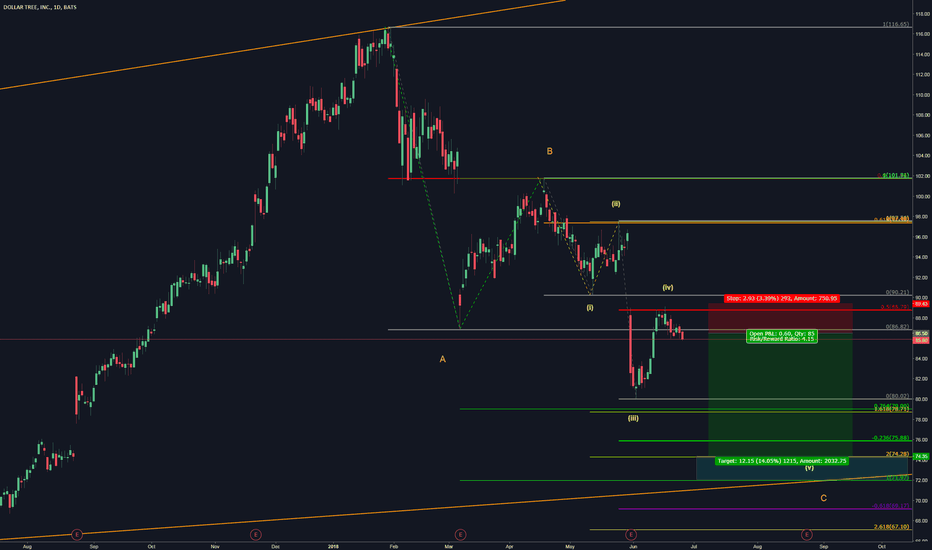

Sell the breakoutOn DLTR stores clear rising wedge in a downtrend,

like mentioned before a breakout can occur upwards or downwards, but in a bearish trend I am looking for more confluence indicators to confirm the trade.

On a large timeframe I will wait until the candle closes below structure to under. Looking for market to rally into the $90-$95 range before a potential breakout.

The initial target is market below around $78

Cheers!