$EA Are all the skeletons out of the closet in EA ?It is hard to imagine how sentiment could get much worse in EA and the entire gaming space. The last earnings report was a roller-coaster ride of heavy selling then heavy buying, bad news then good news. We think that the stock has finally been flushed out, investors who remain have very low expectations. Tuesdays earnings report may be the opportunity EA needs to readdress this negativity and put the analysts and investors in a better frame of mind. We have the opinion that anything positive in the earnings could give the price a very strong bounce to above $100. It is a risky trade but will hedge with puts.

Company Description

Electronic Arts, Inc. engages in the provision of digital interactive entertainment. The firm develops and delivers games, content, and online services for Internet-connected consoles, mobile devices, and personal computers. It operates through the North America and International geographical segments. Its product brands include The Sims, Madden NFL, EA SPORTS FIFA, Battlefield, Need for Speed, Dragon Age, and Plants vs. Zombies.

EA trade ideas

EA- BEARISH SCENARIOOutlook: (bearish)

- Currently in big Wave (3) with MA200 held as support.

- Break down through MA200 will look for the low of Wave (3)

- Wave (3): 86.90 , Wave (4): 94.05 , Wave (5): 78.20

Trade plan: Go SHORT on Monday, Stop Loss: Above 95.31

HIT THE FOLLOW BUTTON TO GET MORE FOR THE FUTURE ANALYSIS. THANK YOU FOR SUPPORTING ME.

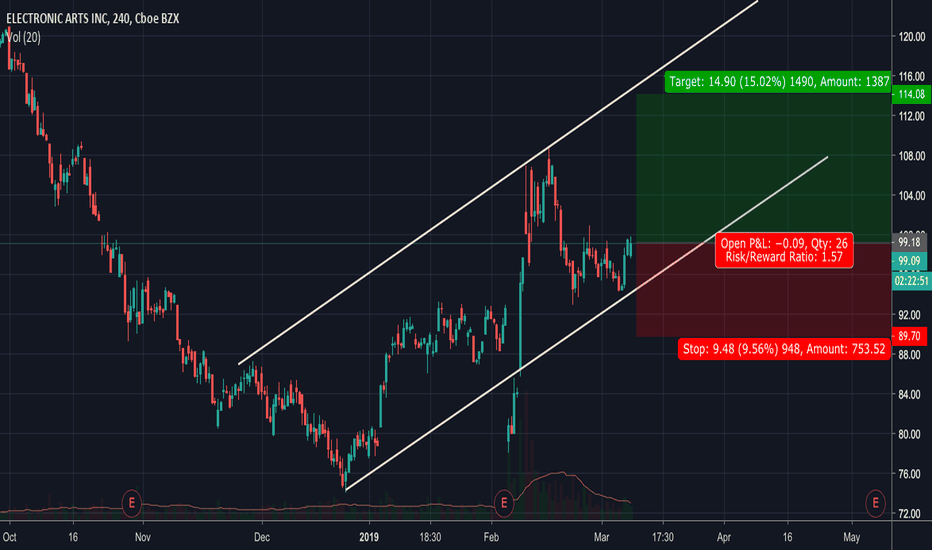

Bull flag on EA. Could look to rally higher.EA is currently consolidating within a clean bull flag pattern, and could look to break out soon. EA is coming up to the top of the bull-flag, which is in the vicinity of the 200 day moving average, so it will really need some volume and conviction to break through these resistance levels. EA has the 50 day moving average acting as support, along with the bottom support line of the bull flag, and we could be setting up for a golden daily MA cross (50 MA crossing the 200 MA) if price can break to the upside here. As a side note, if my technical analysis (or analysis in general) is helpful and informative, I accept BTC donations ( my BTC address is in the Signature box below.) I'm a full time student in college, so any donations are greatly appreciated! Thank you!

Moving average guide (All daily for this post):

50 day moving average in Green.

100 day moving average in Yellow.

200 day moving average in Red.

Entry: $98.40-$103.20

Target 1: $111.30 (Prior consolidation zone.)

Target 2: $116.00 (Prior consolidation zone.)

Target 3: $121.60 (Prior resistance zone.)

SL: $95.50 (Below the 50 day moving average, below the bottom support line of the bull-flag, and below the previous wick which hit $95.66.)

-This is not financial advice. Always do your own research and own due-diligence before investing and trading, as for investing and trading comes with high amounts of risk. I am not liable for any incurred losses or financial distress.

$EA Electornic Arts better get its game face on, FASTThe news that APPLE is entering the gaming market is not what a already fragile EA ARTS needed. Less than impressive earnings and growth was strike 1, Google was strike number 2, now APPLE is strike 3 and out. We can onle see this as a short trade unless things change drastically.

Does EA will Be Stock of the week? [a geek opinion]technically looks greate,under 94$ in trouble

This monday they are launching a new Game Mode in thier biggest franchsie "Battlefield".

battle royale such as fortnite&pubg made a huge fortune to their publisher in the past 2 years.

A month ago, a game named "apexlegends" made the stock skyrocket 25% in 3 days after the game as launched and bypassing 30 millions players in a week. will "firestorm"

in battlefield will crush the numbers again? everything could happen, keep an eye& stay tuned.