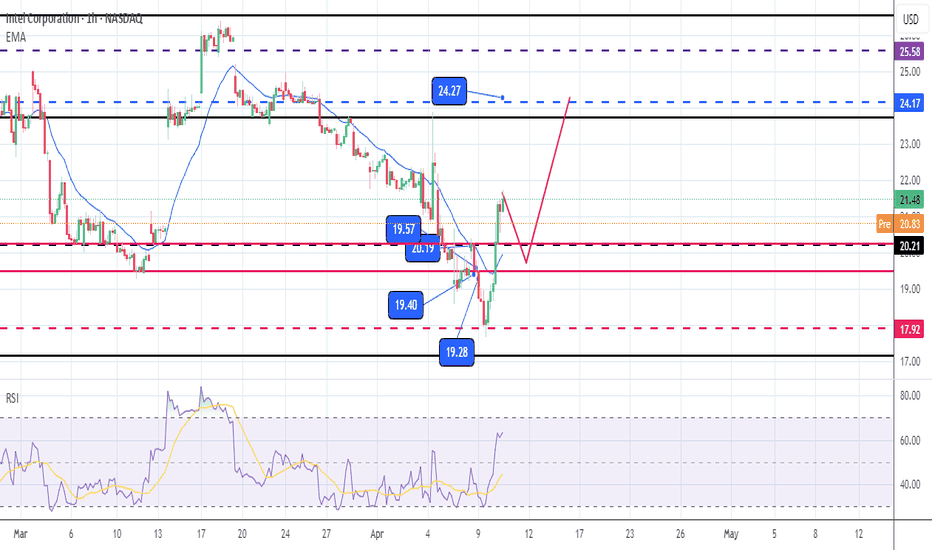

Trade Setup Summary – INTC (Intel Corp)!📈

Current Price: $21.39

Pattern: Symmetrical triangle breakout (neutral-to-bullish bias)

Entry Zone: ~$21.39 (breakout confirmation)

Stop-Loss (SL): $21.04 (below triangle base/support)

Targets:

TP1: $21.91 (resistance – red line)

TP2: $22.66 (major resistance zone – green line)

🧠 Technical Highlights

Price has broken out of a tightening triangle pattern.

Yellow resistance flipped to support.

Volume not shown clearly but breakout candle shows good body.

Risk/Reward: Favorable at ~1:2 if targets hold.

🎯 Bias:

Bullish above $21.04.

Neutral or bearish below this zone.

INTC trade ideas

Intel Corporation | INTCIntel reported second quarter earnings on Thursday, showing a return to profitability after two straight quarters of losses and issuing a stronger-than-expected forecast. the stock rose 7% in extended trading.

Here’s how Intel did versus Refinitiv consensus expectations for the quarter ended July 1:

Earnings per share: 13 cents, adjusted, versus a loss of 3 cents expected by Refinitiv.

Revenue: $12.9 billion, versus $12.13 billion expected by Refinitiv.

For the third quarter, Intel expects earnings of 20 cents per share, adjusted, on revenue of $13.4 billion at the midpoint, versus analyst expectations of 16 cents per share on $13.23 billion in sales.

Intel posted net income of $1.5 billion, or 35 cents per share, versus a net loss of $454 million, or a loss of 11 cents per share, in the same quarter last year.

Revenue fell 15% to $12.9 billion from $15.3 billion a year ago, marking the sixth consecutive quarter of declining sales.

Intel CEO Pat Gelsinger said on a call with analysts the company still sees “persistent weakness” in all segments of its business through year-end, and that server chip sales won’t recover until the fourth quarter. He also said that cloud companies were focusing more on securing graphics processors for artificial intelligence instead of Intel’s central processors.

David Zinsner, Intel’s finance chief, said in a statement that part of the reason the report was stronger than expected was because of the progress the company has made toward slashing $3 billion in costs this year. Earlier this year, Intel slashed its dividend and announced plans to save $10 billion per year by 2025, including through layoffs.

“We have now exited nine lines of business since Gelsinger rejoined the company, with a combined annual savings of more than $1.7 billion,” said Zinsner.

Revenue in Intel’s Client Computing group, which includes the company’s laptop and desktop processor shipments, fell 12% to $6.8 billion. The overall PC market has been slumping for over a year. Intel’s server chip division, which is reported as Data Center and AI, saw sales decline 15% to $4 billion plus Intel’s Network and Edge division, which sells networking products for telecommunications, recorded a 38% decline in revenue to $1.4 billion.moreover Mobileye, a publicly traded Intel subsidiary focusing on self-driving cars, saw sales slip 1% on an annual basis to $454 million and Intel Foundry Services, the business that makes chips for other companies, reported $232 million in revenue.

Intel’s gross margin was nearly 40% on an adjusted basis, topping the company’s previous forecast of 37.5%. Investors want to see gross margins expand even as the company invests heavily in manufacturing capability.

In the first quarter, the company posted its largest loss ever as the PC and server markets slumped and demand declined for its central processors. Intel’s results on Thursday beat the forecast that management gave for the second quarter at the time.

Intel management has said the turnaround will take time and that the company is aiming to match TSMC’s chip-manufacturing prowess by 2026, which would enable it to bid to make the most advanced mobile processors for other companies, a strategy the company calls “five nodes in four years.” Intel said on Thursday that it remained on track to hit those goals.

Nvidia has had an amazing run, but any emerging technology, such as AI, which is bottlenecked by a single company will have issues in growth. Consulting firm McKinsey has pegged the AI market to be worth $1 trillion by 2030, but also that it was in an experimental and in early phases of commercial deployment.

While Nvidia will likely retain its leadership in GPU hardware as applied to AI for the foreseeable future, it is likely that other hardware solutions for AI systems will also be successful as AI matures. While technologist may quibble on specifics, all major AI hardware today are based on GPU architectures, and as such I will use the terms and concepts of AI hardware and GPU architecture somewhat interchangeably.

One likely candidate for AI related growth may be AMD (AMD), which has had GPU products since acquiring ATI in 2006.However, unlike Nvidia, which had a clear vision for of general-purpose GPU products (GPGPU), historically, AMD had largely kept its focus on the traditional gaming applications. AMD has developed an AI architecture called XDNA, and an AI accelerator called Alveo and announced its MI300, an integrated chip with GPU acceleration for high-performance computing and machine learning. How AMD can and may evolve in the AI may be subject of a different article.

Another contender for success in the AI applications using GPU is Intel, who is the focus of this article. Intel has maintained a consistent, if low key focus on GPU hardware focused on AI applications over the last decade. Intel’s integrated HD Graphics is built into most modern processor ICs; however, these are insufficient compared to dedicated GPUs for high-end inferencing or machine learning tasks.

It has 2 primary GPU architectures in production release:

In 2019 Intel Corporation acquired Habana Labs, an Israel-based developer of programmable deep learning accelerators for the data center for approximately $2 billion. Habana Labs’ Gaudi AI product line from its inception focused on AI deep learning processor technologies, rather than as GPU that has been extended to AI applications. As a result, Gaudi microarchitecture was designed from the start for the acceleration of training and inferencing. In 2022 Intel announced Gaudi2 and Greco processors for AI deep learning applications, implemented in 7-nanometer (TSMC) technology and manufactured on Habana’s high-efficiency architecture. Habana Labs benchmarked Gaudi2’s training throughput performance for the ResNet-50 computer vision model and the BERT natural language processing model delivering twice the training throughput over the Nvidia high end A100-80GB GPU. So, Gaudi appears to give Intel a competitive chip for AI applications.

Concurrent with the Habana Labs’ Gaudi development, Intel has internally developed the Xe GPU family, as dedicated graphics card to address high-end inferencing or machine learning tasks as well as more traditional high-end gaming. Iris® Xe GPU family consists of a series of microarchitectures, ranging from integrated/low power (Xe-LP) to enthusiast/high performance gaming (Xe-HPG), data center/AI (Xe-HP) and high-performance computing (Xe-HPC). The architecture has been commercialized in Intel® Data Center GPU Flex Series (formerly codenamed Arctic Sound) and Intel® Arc GPU cards. There is some question on Xe GPU future and evolution. Intel has shown less commitment to the traditional GPU space compared to Gaudi. Nonetheless, it does demonstrate Intel ability to design and field complex GPU products as its business requires.

Intel has many other AI projects underway. The Sapphire Rapids chips implements AI specific acceleration blocks including technology called AMX (Advanced Matrix Extensions), which provides acceleration inside the CPU for efficient matrix multiplications used in on-chip inferencing and machine learning processing by speeding up data movement and compression. Intel has supporting technologies such as Optane, which while cancelled as a production line, is available for their needs of a high-performance non-volatile memory, one of the intrinsic components in any AI product.

Based on the above, Intel appears to have competitive hardware solutions, however if we look at Nvidia success in AI, it is a result of a much a software and systems focus as it is the GPGPU hardware itself. Can Intel compete on that front. Ignoring for the moment that Intel has a huge software engineer (approx. 15,000) resource, it also has- access to one of the leading success stories in perhaps the most competitive AI application – self driving cars.

Mobileye, who was acquired by Intel in 2017, has been an early adopter and leader, with over 20 years of experience in automotive automated driving and vision systems. As such, Mobileye has a deep resource of AI domain information that should be relevant to many applications. Mobileye has announced that it is working closely with Habana, as related divisions within Intel. While Intel is in the process of re-spinning out Mobileye as public company, Mobileye Global Inc. (MBLY), at present Intel still owns over 95% of shares, keeping it effectively an Intel division.

In looking at Intel, we have a company with the history, resources, and technology to compete with Nvidia and infrastructure. They have made significant investment and commitment to the emerging AI market, in times when they have exited other profitable businesses. It should also be understood that AI related product are a small percentage of overall Intel revenues (INTC revenue are more than twice NVDA, even if NVDA has 6x its market cap), and continues to keep its primary business focus on its processor and foundry business.

Hopefully for shareholders, Intel continues to push their AI technology and business efforts. Their current position is that this is strategic, but Intel is in a very fluid time and priorities may change based on business, finances, and of course the general interest and enthusiasm for AI. It is always worth noting that AI as a technical concept is mature, and appears to be cyclical, with interest in the technical community rising and falling in hype and interest once every decade or so. I remember working on AI applications, at the time labeled as expert systems in the 1980s. If we are currently at a high hype point, this may be temporary, based on near term success and disappointment in what AI does achieve. Of course, as always, “this time is different” and the building blocks of effective AI systems currently exist, where for previous iterations, it was more speculative.

3 Day ConfluencesHere we have price residing in close proximity to a downward trendline and right under the 10 EMA and in an old demand zone. If successful break out of these areas we might have price action towards the 22.67 area the 50 EMA, failure to the 18.00 area. Hypothetically speaking. Have a safe day

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.83.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTEL BUY 2030Claro, aquí tienes el texto completamente limpio, sin negritas ni símbolos especiales:

---

Preliminary Projection: Intel's Potential Workforce Transformation (2025–2030)

As Intel continues its restructuring and integrates more AI-driven systems into its operations, significant changes are expected in its workforce distribution. The following outlines an estimate of the potential job displacement or transformation due to artificial intelligence by 2030.

Area: Manufacturing

- Percentage of total employees: 35% (approximately 40,000)

- Percentage potentially replaceable by AI: 70%

- Estimated replaceable jobs: 28,000

Area: Administration

- Percentage of total employees: 20% (approximately 23,000)

- Percentage potentially replaceable by AI: 55%

- Estimated replaceable jobs: 12,500

Area: Engineering

- Percentage of total employees: 30% (approximately 34,000)

- Percentage potentially replaceable by AI: 20%

- Estimated replaceable jobs: 6,800

Area: Sales and Marketing

- Percentage of total employees: 15% (approximately 17,000)

- Percentage potentially replaceable by AI: 40%

- Estimated replaceable jobs: 6,800

Total estimated jobs that could be automated or transformed by AI: approximately 54,000, representing around 47 percent of Intel’s current workforce.

---

Key Intel Facilities Focused on AI-Driven Automation

Ohio, USA – Ohio One Campus

Investment: Over 28 billion dollars

Purpose: To become the world’s largest chip manufacturing hub for AI by 2027

Key technologies: Advanced automation, digital twins, and AI systems to optimize production and operational efficiency

Source: Reuters

Hillsboro, Oregon, USA – D1X Factory

Function: Research and development center for next-generation manufacturing technologies

Key technologies: AI-powered predictive maintenance, computer vision, and real-time analytics to improve efficiency and quality

Source: Intel Newsroom

These facilities reflect Intel’s strategic transition toward leading in both semiconductor innovation and intelligent manufacturing. The company’s integration of artificial intelligence across its industrial operations is expected to drive productivity, reduce costs, and reshape its employment structure.

---

¿Quieres que lo convierta ahora en PDF, en PowerPoint o en algún diseño tipo folleto?

INTEL CORPORATIONIntel’s stock has been falling sharply due to a combination of poor financial performance, strategic challenges, and market pressures, which have shaken investor confidence significantly.

Key Reasons for Intel’s Stock Decline

Weaker-than-Expected Earnings and Profitability Issues

Intel reported disappointing earnings in 2024, with sales declining 2% year-over-year to $53.1 billion and gross margins under pressure. The company’s foundry business, a critical growth area, saw sales fall from $18.9 billion in 2023 to $17.5 billion in 2024. Analysts expect continued margin headwinds and limited revenue growth opportunities in the near term, which weighs heavily on the stock.

Cost-Cutting and Dividend Suspension

To address financial challenges, Intel announced a $10 billion cost-reduction plan, including cutting 15,000 jobs and suspending dividend payments starting Q4 2024. While necessary to preserve liquidity and fund restructuring, these moves have alarmed investors, signaling deeper operational issues and reducing shareholder returns.

Leadership Changes and Strategic Uncertainty

CEO Pat Gelsinger was replaced by Lip-Bu Tan in March 2025 amid ongoing struggles. The new leadership faces the difficult task of turning around the foundry business and improving Intel’s competitiveness in AI chips and manufacturing. However, uncertainty about the effectiveness of these efforts has dampened investor enthusiasm.

Lagging Behind Competitors in AI and Manufacturing

Intel has been slow to capitalize on the AI boom compared to rivals like Nvidia, which has surged ahead with AI-focused chips. Additionally, Intel’s manufacturing technology lags behind Taiwan Semiconductor Manufacturing Company (TSMC), limiting its ability to produce cutting-edge chips cost-effectively. This has led to market share losses, especially in PC CPUs, where AMD is gaining ground.

Geopolitical and Market Risks

Rising US-China tensions and new Chinese tariffs on semiconductor imports pose risks to Intel’s revenue, given its exposure to the Chinese market. Moreover, concerns about the semiconductor supply chain and the viability of Intel’s joint ventures with TSMC add to investor uncertainty.

Valuation and Investor Sentiment

Intel’s price-to-book ratio is near multiyear lows (~0.8), reflecting market skepticism about its asset utilization and future profitability. Its return on equity has declined steadily, contrasting with competitors that have benefited from the AI surge. Despite undervaluation, the stock’s poor recent performance and bleak near-term outlook continue to pressure the price.

Summary

Factor Impact on Intel Stock

Weak earnings and margin pressure Significant negative

Job cuts and dividend suspension Negative, signals financial stress

Leadership change and strategy uncertainty Adds volatility and risk

Falling behind in AI and manufacturing Loss of market share, investor concern

Geopolitical tensions and tariffs Adds downside risk

Low valuation but poor ROE Indicates undervaluation but cautious sentiment

Conclusion

Intel’s stock is falling badly due to disappointing financial results, strategic challenges in manufacturing and AI, cost-cutting measures that unsettle investors, and geopolitical risks. While the company is attempting a turnaround under new leadership, uncertainty about the success of these efforts and continued competitive pressures keep investor confidence low. The stock’s valuation reflects these concerns, and a sustained recovery will depend on Intel’s ability to improve profitability, regain market share, and capitalize on AI and foundry opportunities

Intel on the verge of a 80% plummet to $5** The months ahead **

After decades of semiconductor dominance, Intel faces unprecedented threats to its business model. AI computing revolution, manufacturing missteps, and relentless competition from AMD and NVIDIA have created what some analysts call "a potential death spiral" for the tech giant.

The floor could be much lower than anyone realises, especially as the 2 month candle draws to a close in 14 days.

On the above 2 month chart price action has closed under 30 years of legacy support. A trend line that gave up support on July 2024. That was shortly after publishing the “Incoming 60% correction for Intel Corporation” idea (below).

Buckle up, we’re now looking at a 80% correction to $5.

Why? Market structure has been comprehensively destroyed. For whatever reason, America does not want the rest of the world purchasing its products… internal orders only! This decision coupled with internal demand collapse creates the death spiral. Orders shall resume once the the protectionist experiment has come to pass, but until then, our greatest teacher.. history.. tells us nothing good will come from this experiment on businesses dependant on the world marketplace.

Double tops in price, especially parted by some months, together with a confirmed bear flag are particularly powerful. Take the collapse of the Finnish bank OmaSp (below). Despite the negatively commentary, (really good contrarian confirmation!), the collapse to the floor follows.

Is it possible price action ignores all the hullabaloo and reclaims legacy support? Sure.

Is it probable? No.

Ww

“incoming 60% correction for Intel Corporation”

Finnish Bank OmaSp collapse

INTC Trade LevelsI like this set up for affordable and stable LEAP's. If price can break above the range, we will see a run to 31.

INTC's fundamentals are still a bit iffy, BUT the chip industry is hot. This would make a great sympathy play- I'd lean towards buying equity over options contracts.

For Day Trades- expect price to range between 18-22 going into the 4/25 expiry

Support to Buy Intel-All stocks rallied after Trump declared a pause on tariffs. Intel is showing good momentum and may continue to rise.The support On My chart is a good support to going long if the price make a pullback. Invalid if The Price break the support area. This is not a buy call, just sharing idea. Thanks

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel toward total collapse.

The business is struggling too. Intel missed the AI boom entirely, its Foundry division is faltering, and revenues are shrinking. Before 2020, it posted annual earnings of $10–$20 billion; over the past year, it recorded $10 billion in losses. With $105 billion in net equity—mostly tied to hard assets that are tough to liquidate without losses—Intel’s financial cushion could erode quickly if more problems surface.

Will It Go Bankrupt?

Bankruptcy is possible but improbable. As a critical chip producer, Intel is too vital to U.S. interests to fail outright. I predict a government bailout, though shareholders would likely be wiped out.

TECHNICAL ANALYSIS

Since its bull market ended in 2000—25 years ago—Intel has been locked in consolidation. Now, the price is breaking down on high volume.

It’s trading below the 200-month moving average (MA200 Monthly), a key long-term support level that confirms a bear market.

The consolidation resembles an Elliott Wave ABC correction, with Wave B peaking in 2020. Since then, the price has declined in what appears to be an impulsive Wave C, forming an Ending Diagonal.

When prices break downward from Ending Diagonals—especially alongside a 25-year consolidation breakdown, as is likely here—the move is often swift and severe.

If the price exits both the consolidation and the Ending Diagonal, there’s virtually no support until the $4–$5 range. A market-wide crash could drive it as low as $1.

At it again INTC - LONGGood Morning,

INTC what a fun trade, I have ran 3 profitable runs since December with INTC.

Investors do not seem to want to let go of the 19$ support zone. This is a great sign and as you can see from the many many bottoms, it wants to start moving up again.

Volume is still bearish......however showing bullish divergence since December. This continuous squeeze is building momentum for a nice movement upwards.

As always with SWING trading, aim small miss small.

Enjoy

Intel - This Stock Is A Goldmine!Intel ( NASDAQ:INTC ) perfectly respects all structure:

Click chart above to see the detailed analysis👆🏻

Over the past couple of years Intel clearly established a significant downtrend, dropping about -70% after we saw the previous all time high. This bearish pressure is now ending though and if Intel manages to create a bullish reversal break and retest, a new uptrend is starting to form.

Levels to watch: $25

Keep your long term vision,

Philip (BasicTrading)

Intel Next Scenario MoveIt obvious the stock Rejected at 4h Red Zone which act as Strong Resistance that Intel cant go above despite recent good news.

we have three scenarios:

for sure all require patient the stock at current price may go anywhere its gambling rather than trading at this price.

Scenario One: the stock price go above 4h Red Zone which act as strong resistance, after re-test the zone its "buy signal after confirmation".

Scenarios Two: the stock will re-test the nearest support level at the Previous High (P. High)

@ 22.40$ roughly at this price we wait for "buy signal after confirmation".

Scenario Three: Re-Test the Institutional Candle price level at 19.80$ since the stock is side-ways movement and still not breaking this forever zone this option is highly valid !

Note: "buy signal after confirmation" Means that:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

Long Intel Corporation (INTC) – Long-Term Investment ThesisAs of April 2025, Intel (INTC) is trading around $22, revisiting a long-term multi-decade support zone between $15–$23, last tested during the 2008 financial crisis and early 2010s consolidation.

The chart reflects:

A historic resistance zone from the early 2000s that turned into strong support over the past 15+ years.

Current price action suggests long-term accumulation near a high-probability reversal area.

Technically, Intel is trading at a major cyclical low — a zone that historically preceded extended bull runs.

Why I’m Going Long Intel

Undervalued Levels: Intel has retraced significantly from its 2021 highs (~$68), now trading at nearly 1/3 of its peak, offering attractive value relative to fundamentals and peers.

Strong Historical Support: Price is sitting within a key demand zone not seen since the early 2010s, indicating strong institutional interest in this range.

Long-Term Recovery Potential: With ongoing investments in foundry services, AI chips, and strategic partnerships, Intel is positioning for a turnaround.

Asymmetric Risk/Reward: Limited downside (support holds) versus massive upside if Intel regains relevance in the AI and semiconductor race.

Investment Outlook

This is a long-term hold based on:

Technical conviction from historical support zones.

Belief in Intel’s fundamental turnaround story.

The stock’s undervalued nature relative to industry leaders like Nvidia and AMD.

Intel Golden TimeFundamental and Technical Analysis of Intel (INTC) Stock

Fundamental Analysis

1. Financial Performance: Intel is one of the largest semiconductor manufacturers in the world. However, in recent years, it has faced challenges, including a loss of market share to competitors like AMD and NVIDIA.

2. Industry Outlook: The semiconductor industry continues to grow, but Intel has lagged behind in advanced chip manufacturing, particularly in comparison to TSMC and Samsung in the 3nm segment.

3. Profitability & Revenue: Intel’s revenues have been volatile, and profit margins have been under pressure. Its large investments in manufacturing plants may lead to long-term profitability.

4. Macroeconomic Factors: A slowdown in the tech industry, reduced global demand for personal computers, and rising interest rates could impact Intel’s performance.

Technical Analysis

1. Support and Resistance Levels:

Key Support: Around $22, which is close to the current price level.

Key Resistance: In the $30-$35 range if the price starts to recover.

2. Overall Trend:

The stock has been in a downtrend, having dropped significantly from its all-time high of around $70.

The $22 level appears to be a strong historical support.

3. Indicators:

The RSI is likely in the oversold zone, indicating a possible reversal.

Moving averages probably confirm a bearish trend.

Conclusion

Fundamentally, Intel is in a rebuilding phase, but it still faces stiff competition from AMD and NVIDIA.

Technically, the stock is near a critical support level, meaning a rebound is possible, though the overall trend remains bearish.

For long-term investors, further analysis of Intel’s fundamentals is necessary. For short-term traders, confirmation of a price reversal at this support level is crucial before entering a trade.