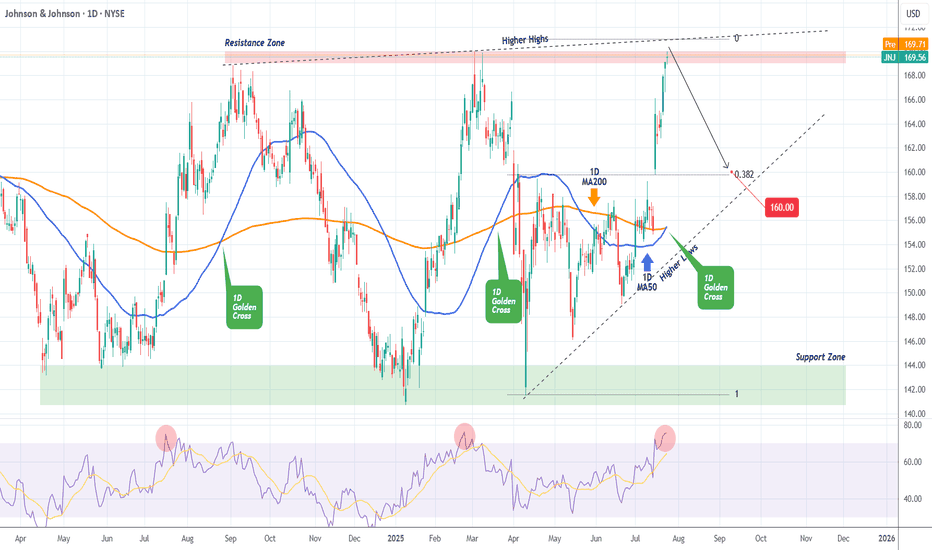

JOHNSON & JOHNSON Sell opportunity on a Double Resistance.It's been 9 months (October 11 2024, see chart below) since our last Johnson & Johnson (JNJ) analysis, where we gave a very timely sell signal that surgically hit our $141.00 Target:

The Channel Down has since broke to the upside and a new Higher Lows structure has emerged but with a clear Resi

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.00 EUR

13.59 B EUR

85.80 B EUR

2.41 B

About Johnson & Johnson

Sector

Industry

CEO

Joaquin Duato

Website

Headquarters

New Brunswick

Founded

1887

FIGI

BBG00GQ6S573

Johnson & Johnson is a holding company, which engages in the research and development, manufacture and sale of products in the health care field. It operates through the following segments: Consumer Health, Pharmaceutical, and Medical Devices. The Consumer Health segment includes products used in the baby care, oral care, beauty, over-the-counter pharmaceutical, women's health, and wound care markets. The Pharmaceutical segment focuses on therapeutic areas, such as immunology, infectious diseases, neuroscience, oncology, pulmonary hypertension, and cardiovascular & metabolic diseases. The Medical Devices segment offers products used in the orthopedic, surgery, cardiovascular & neurovascular, and eye health fields. The company was founded by Robert Wood Johnson I, James Wood Johnson and Edward Mead Johnson Sr. in 1886 and is headquartered in New Brunswick, NJ.

Related stocks

Johnson & Johnson Wave Analysis – 31 July 2025 Johnson & Johnson reversed from the resistance zone

- Likely to fall to support level 160.00

Johnson & Johnson recently reversed down from the strong resistance zone located between the long-term resistance level 168.15 (upper border of the weekly sideways price range from 2023) and the upper week

JNJ - Macro View 🌐Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 JNJ has exhibited an overall bullish trend, trading within the ascending wedge pattern outlined in blue. It is presently nearing the lower boundary/blue trendline.

At present, JNJ is undergoing a correction p

JNJ - 2 scenariosHi traders,

JNJ is currently consolidating inside a symmetrical triangle.

We can expect two scenarios:

Bullish scenario:

Open a long position if the price breaks the downsloping resistance line.

SL: below $153.50

Potential TP: $164

Bearish scenario:

Open a short position if the price breaks down a

JOHNSON AND JOHNSON: Re-accumulation is targeting $175.JNJ is neutral on its 1D technical outlook (RSI = 49.991, MACD = -1.040, ADX = 18.184) as it's only trading around its 1W MA50 but having made an impressive rebound 4 weeks ago inside the Demand Zone. This is the 4th time this Demand Zone provided a rally and the last one even crossed over the 3 yea

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US478160CS1

JOHNSON&JOHN 20/50Yield to maturity

6.87%

Maturity date

Sep 1, 2050

US478160CT9

JOHNSON&JOHN 20/60Yield to maturity

6.81%

Maturity date

Sep 1, 2060

US478160CR3

JOHNSON&JOHN 20/40Yield to maturity

6.21%

Maturity date

Sep 1, 2040

US478160CM4

JOHNSON & JOHNSON 17/48Yield to maturity

6.04%

Maturity date

Jan 15, 2048

US478160BV5

JOHNSON & JOHNSON 16/46Yield to maturity

5.86%

Maturity date

Mar 1, 2046

JNJJ

JOHNSON & JOHNSON 17/47Yield to maturity

5.85%

Maturity date

Mar 3, 2047

US478160CX0

JOHNSON&JOHN 24/54Yield to maturity

5.36%

Maturity date

Jun 1, 2054

US478160CL6

JOHNSON & JOHNSON 17/38Yield to maturity

5.30%

Maturity date

Jan 15, 2038

JNJ4077469

Johnson & Johnson 4.5% 05-DEC-2043Yield to maturity

5.20%

Maturity date

Dec 5, 2043

US478160CF9

JOHNSON & JOHNSON 17/37Yield to maturity

5.18%

Maturity date

Mar 3, 2037

US478160BA1

JOHNSON & JOHNSON 11/41Yield to maturity

5.15%

Maturity date

May 15, 2041

See all JNJ bonds

Curated watchlists where JNJ is featured.

Frequently Asked Questions

The current price of JNJ is 143.86 EUR — it has decreased by −1.24% in the past 24 hours. Watch JOHNSON & JOHNSON stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange JOHNSON & JOHNSON stocks are traded under the ticker JNJ.

JNJ stock has fallen by −0.28% compared to the previous week, the month change is a 8.56% rise, over the last year JOHNSON & JOHNSON has showed a −1.60% decrease.

We've gathered analysts' opinions on JOHNSON & JOHNSON future price: according to them, JNJ price has a max estimate of 163.50 EUR and a min estimate of 133.38 EUR. Watch JNJ chart and read a more detailed JOHNSON & JOHNSON stock forecast: see what analysts think of JOHNSON & JOHNSON and suggest that you do with its stocks.

JNJ stock is 1.95% volatile and has beta coefficient of 0.15. Track JOHNSON & JOHNSON stock price on the chart and check out the list of the most volatile stocks — is JOHNSON & JOHNSON there?

Today JOHNSON & JOHNSON has the market capitalization of 353.00 B, it has increased by 5.11% over the last week.

Yes, you can track JOHNSON & JOHNSON financials in yearly and quarterly reports right on TradingView.

JOHNSON & JOHNSON is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

JNJ earnings for the last quarter are 2.35 EUR per share, whereas the estimation was 2.28 EUR resulting in a 3.29% surprise. The estimated earnings for the next quarter are 2.41 EUR per share. See more details about JOHNSON & JOHNSON earnings.

JOHNSON & JOHNSON revenue for the last quarter amounts to 20.16 B EUR, despite the estimated figure of 19.40 B EUR. In the next quarter, revenue is expected to reach 20.78 B EUR.

JNJ net income for the last quarter is 4.70 B EUR, while the quarter before that showed 10.17 B EUR of net income which accounts for −53.77% change. Track more JOHNSON & JOHNSON financial stats to get the full picture.

Yes, JNJ dividends are paid quarterly. The last dividend per share was 1.15 EUR. As of today, Dividend Yield (TTM)% is 3.00%. Tracking JOHNSON & JOHNSON dividends might help you take more informed decisions.

JOHNSON & JOHNSON dividend yield was 3.40% in 2024, and payout ratio reached 84.80%. The year before the numbers were 3.00% and 84.93% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 139.8 K employees. See our rating of the largest employees — is JOHNSON & JOHNSON on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JOHNSON & JOHNSON EBITDA is 24.81 B EUR, and current EBITDA margin is 31.71%. See more stats in JOHNSON & JOHNSON financial statements.

Like other stocks, JNJ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JOHNSON & JOHNSON stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JOHNSON & JOHNSON technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JOHNSON & JOHNSON stock shows the buy signal. See more of JOHNSON & JOHNSON technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.