Key facts today

On July 29, 2025, Novo Nordisk cut its 2025 sales growth forecast from 13-21% to 8-14% and operating profit from 16-24% to 10-16% due to slower growth for Ozempic and Wegovy.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.145 EUR

13.50 B EUR

38.82 B EUR

3.16 B

About NOVO NORDISK B A/S

Sector

Industry

CEO

Lars Fruergaard Jørgensen

Website

Headquarters

Bagsværd

Founded

1931

ISIN

DK0062498333

FIGI

BBG00KDZJQ50

Novo Nordisk A/S is a global healthcare company, which engages in the discovery, development, manufacturing and marketing of pharmaceutical products. It operates through the Diabetes and Obesity Care, and Rare Disease segments. The Diabetes and Obesity Care segment includes diabetes, obesity, cardiovascular, and emerging therapy areas. The Rare Disease segment refers to rare blood disorders, rare endocrine disorders, and hormone replacement therapy. The company was founded by Harald Pedersen and Thorvald Pedersen in 1923 is headquartered in Bagsværd, Denmark.

Related stocks

$NVO Accumulating long term compounder! - Previously, I have shorted NYSE:NVO when it was in $75-85 when moat was weakening and then went long around $58 to $75 for 40% on the long side. Everything is documented in my two posts.

- People are asking me if NYSE:NVO is cheap or not. After cutting guidance, I believe most of the estimat

Fib resistance + RSI bullish reversal After the bearish news earlier today, it seems like Novo has had its final capitulation.

There's a fib resistance + historical resistance dating back to '21-'22.

On the weekly, the RSI is also presenting a bullish divergence - although we may want to await the closing of this week to confirm this.

T

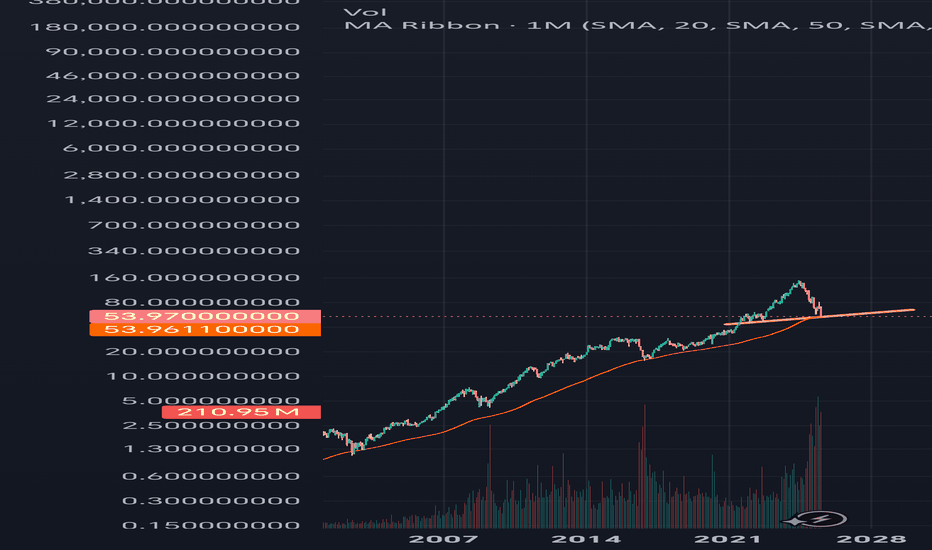

NVO going to zero? Just zoom out V.2While many are panic, just zoom out years and we can dee that it is at 30 years support trend line to the upside.

Weekly RSI printing bullishvergent, monthly at Oversold level.

Still fundamentally strong, If you love this stock, be excited.

(Last post chart didn't appear properly, I couldn't edit

Novo Nordisk, generational buying opportunity? Novo Nordisk is currently experiencing one of the largest drawdowns in its history, primarily triggered by a downward revision of guidance for FY25 and FY26.

Focusing strictly on technical analysis:

For the first time, the monthly 200 EMA is serving as a key support level for Novo Nordisk -

Is Novo Nordisk a buy? Novo Nordisk $NYSE: NVO plummets 22% on July 29, wiping out $57.5B in market value!

Here's what's happening and how I see it.

Here’s the breakdown on why the stock hit its lowest since Nov 2022:

Slashed 2025 Guidance: Sales growth cut to 8–14% from 13–21%, operating profit to 10–16% from 16–2

NVO Could Bounce Back Soon ?!NVO dropped hard (over 20%) mainly because of a legal issue. I think this is temporary and will get solved with time. The stock is now super oversold and sitting on strong support around $52–53.

• Entry: $52–54

• Target 1: $56.90

• Target 2: $66.40

• Stop Loss: $50

If the issue clears, we could

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where NNO2 is featured.

Frequently Asked Questions

The current price of NNO2 is 41.700 EUR — it has decreased by −1.76% in the past 24 hours. Watch NOVO-NORDISK AS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange NOVO-NORDISK AS stocks are traded under the ticker NNO2.

NNO2 stock has fallen by −30.28% compared to the previous week, the month change is a −29.57% fall, over the last year NOVO-NORDISK AS has showed a −65.93% decrease.

We've gathered analysts' opinions on NOVO-NORDISK AS future price: according to them, NNO2 price has a max estimate of 100.25 EUR and a min estimate of 40.10 EUR. Watch NNO2 chart and read a more detailed NOVO-NORDISK AS stock forecast: see what analysts think of NOVO-NORDISK AS and suggest that you do with its stocks.

NNO2 reached its all-time high on Jun 25, 2024 with the price of 137.980 EUR, and its all-time low was 17.950 EUR and was reached on Oct 11, 2018. View more price dynamics on NNO2 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NNO2 stock is 7.36% volatile and has beta coefficient of 1.51. Track NOVO-NORDISK AS stock price on the chart and check out the list of the most volatile stocks — is NOVO-NORDISK AS there?

Today NOVO-NORDISK AS has the market capitalization of 183.32 B, it has decreased by −4.87% over the last week.

Yes, you can track NOVO-NORDISK AS financials in yearly and quarterly reports right on TradingView.

NOVO-NORDISK AS is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

NNO2 earnings for the last quarter are 0.87 EUR per share, whereas the estimation was 0.82 EUR resulting in a 6.95% surprise. The estimated earnings for the next quarter are 0.79 EUR per share. See more details about NOVO-NORDISK AS earnings.

NOVO-NORDISK AS revenue for the last quarter amounts to 10.46 B EUR, despite the estimated figure of 10.44 B EUR. In the next quarter, revenue is expected to reach 10.26 B EUR.

NNO2 net income for the last quarter is 3.89 B EUR, while the quarter before that showed 3.77 B EUR of net income which accounts for 3.03% change. Track more NOVO-NORDISK AS financial stats to get the full picture.

NOVO-NORDISK AS dividend yield was 1.83% in 2024, and payout ratio reached 50.28%. The year before the numbers were 1.35% and 50.35% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 76.3 K employees. See our rating of the largest employees — is NOVO-NORDISK AS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. NOVO-NORDISK AS EBITDA is 21.00 B EUR, and current EBITDA margin is 50.95%. See more stats in NOVO-NORDISK AS financial statements.

Like other stocks, NNO2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NOVO-NORDISK AS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So NOVO-NORDISK AS technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating NOVO-NORDISK AS stock shows the sell signal. See more of NOVO-NORDISK AS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.