TTD Swing Trade Plan – 2025-06-06🐻 TTD Swing Trade Plan – 2025-06-06

Bias: Moderately Bearish

Timeframe: 5–7 trading days

Catalysts: Weak daily trend, below EMAs, oversold conditions may delay move

Trade Type: Naked put option

🧠 Model Summary Table

Model Bias Strategy Strike Premium Target(s) Stop-Loss Confidence

Grok Moderately Bearish $71 PUT $1.00 +50% –25% 75%

Claude Moderately Bearish $67 PUT $0.93 $2.50 $0.65 75%

Llama Moderately Bearish $67 PUT $0.94 $1.13 $0.47 72%

Gemini Moderately Bullish $75 CALL $1.04 $1.55 / $2.10 $0.50 70%

DeepSeek Moderately Bullish $75 CALL $1.06 $1.60 $0.75 75%

✅ Consensus: Short-term oversold, but longer-term bias remains bearish

⚠️ Disagreements: Bounce vs. continuation; call vs. put structure

🔍 Technical & Sentiment Summary

Trend: Daily/weekly charts bearish (below EMAs); 15m shows divergence

Support Zones: $70.34–$70.68

Resistance / Max Pain: $73.90 and $75

Volatility: VIX at 17.6 – supports risk-taking

News: Neutral to slightly negative; no strong catalyst noted

✅ Final Trade Setup

Parameter Value

Instrument TTD

Strategy PUT (SHORT)

Strike $67

Expiry 2025-06-20

Entry Price $0.94

Profit Target $1.40

Stop Loss $0.65

Size 1 contract

Entry Timing At open

Confidence 75%

💡 Rationale: Daily bearish structure supported by three models. Downside continuation setup if oversold bounce fails to hold $71.

⚠️ Key Risks & Considerations

Short-term bounce may occur from 15m bullish divergence

Max Pain at $75 may cause gravitational upward drift

Liquidity Note: $67 put has low OI and volume → wider spreads

Theta decay increases rapidly next week — act fast if trade stalls

Unexpected news could invalidate bearish setup quickly

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: TTD

🔀 Direction: PUT (SHORT)

🎯 Strike: $67.00

💵 Entry Price: $0.94

🎯 Profit Target: $1.40

🛑 Stop Loss: $0.65

📅 Expiry: 2025-06-20

📏 Size: 1 contract

📈 Confidence: 75%

⏰ Entry Timing: Open

🕒 Signal Time: 2025-06-06 13:13:23 EDT

TTD trade ideas

Long on $TTD ; It should test 75-80 range- Many good news have come for NASDAQ:TTD in the last 2 weeks and one of that is Judge ruling against Google Ad business which might lead to relaxed rules by Google which will help other advertisers expand their TAM

- Netflix ads should allow DSPs like NASDAQ:TTD to get more investment dollars flowing through their platform.

- EPS is growing massively in FY 2027/2028.

- I'm not sure if we could get all time high before 2027 but firmly believe NASDAQ:TTD should test 200 weekly SMA.

$TTD Breakout After Earnings | Gapped Up w/ Volume Surge📊 Summary for TradingView Post:

NASDAQ:TTD exploded +11% post-earnings, gapping above key resistance and closing strong with massive volume.

Price cleared multiple supply zones with conviction, now sitting above $79 with eyes on $82.74 and $86.43.

Buyers showed up heavy. This is no random push—structure confirms strength.

Still bullish unless it fills the gap below. Watching for continuation or controlled retest.

$TTD stock has been in a steady uptrend!📊 The Trade Desk ( NASDAQ:TTD ) – Stock Analysis

🔍 Fundamental Analysis

1. Company Overview:

Name: The Trade Desk Inc.

Ticker: TTD

Sector: Technology / Advertising

Business Model: The Trade Desk is a leading demand-side platform (DSP) for digital ad buyers, enabling programmatic advertising across various channels such as display, video, audio, and connected TV (CTV).

2. Key Financial Metrics (as of Q1 2025):

Market Cap: ~ SGX:40B (approx.)

Revenue (TTM): ~$2.2B

Net Income (TTM): ~$180M

P/E Ratio: ~80–100 (varies with market sentiment)

Free Cash Flow (TTM): Strong positive cash flow

Debt: Low, strong balance sheet with over SEED_TVCODER77_ETHBTCDATA:1B in cash

3. Growth Drivers:

CTV Advertising Growth: TTD is a major player in connected TV, which is rapidly growing as consumers move away from linear TV.

Unified ID 2.0 (UID2): A privacy-conscious alternative to cookies, gaining adoption and positioning TTD as a forward-thinking leader in ad tech.

International Expansion: Continues to grow operations in Europe and Asia.

AI and Data-Driven Targeting: Offers better targeting for advertisers, increasing ROI and retention.

4. Risks:

High Valuation: Valued at a premium; leaves little room for error.

Competition: Faces competition from Google, Amazon Ads, and other ad-tech players.

Macroeconomic Sensitivity: Advertising budgets often shrink in recessions or uncertain environments.

📈 Technical Analysis

1. Price Action & Trend:

Current Price (May 2025): ~$88 (hypothetical for this analysis)

YTD Performance: +22%

52-week range: $60 – $94

Trend: The stock has been in a steady uptrend since late 2023, forming higher highs and higher lows.

2. Key Technical Indicators:

200-Day EMA: Bullish crossover occurred months ago; price is trading well above it.

50-Day EMA: Acts as dynamic support; price has bounced off it multiple times.

Relative Strength Index (RSI): ~65 → not overbought yet, but nearing the upper end.

MACD: Bullish divergence; histogram and signal line indicate strong momentum.

Volume: Increasing on green days, suggesting strong institutional interest.

3. Support & Resistance:

Support Levels: $82 (short-term), $75 (medium-term)

Resistance Levels: $94 (recent high), then potential psychological level at $100

🧠 Summary

Factor Analysis

Valuation High, but justified by growth potential

Growth Potential Strong, driven by CTV and UID2

Profitability Profitable, strong FCF, low debt

Technical Trend Bullish, healthy uptrend above key EMAs

Risk Level Moderate–High due to valuation and macro sensitivity

TTD eyes on $54.xx: Major Resistance to be flipped to SupportTTD dumped even before tariffs but trying to recover.

Now testing a major resistance zone at $54.21-54.34

If rejected then watch next support zone $51.26-51.43

Previous Analysis that called the top:

================================================

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the recent rally:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 55usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $6.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Google Ruling Could Be Very Bullish for TTDA U.S. judge has found Google guilty of illegally monopolizing the digital advertising technology markets. The monopolization of both the demand and supply sides has been a long-standing concern for the rest of the digital advertising sector.

This ruling may significantly benefit The Trade Desk (TTD), as it operates as an independent demand-side platform. The digital advertising market is projected to exceed $600 billion in 2025, and Google currently believed to be controls nearly 30% of that. Even a 5% slip in Google’s market share, with TTD capturing just 10% of that shift, could nearly double TTD's revenue. As a result, this ruling is can be considered very bullish for TTD, both in the medium and long term.

Technically, TTD recently tested the $40 level, a key support that has held since Q4 of 2020, indicating the stock is currently in a strong demand zone. With this news, the likelihood of that support holding and a bullish reversal increases.

Analyst consensus reflects an 85.8% upside potential. If the bullish scenario plays out, the horizontal level at $60 and the 200-day moving average could serve as key medium-term targets. From current levels to the 200-day SMA, the potential return is close to 50%.

TTD could return 200% in the next yearsThe Trade Desk is this big American tech company that basically helps advertisers buy digital ads in a super smart, automated way. They run a platform (called a DSP, or Demand Side Platform) where brands and agencies can set up, manage, and optimize their ad campaigns across tons of channels—like websites, mobile apps, streaming TV, audio, you name it. They’re pretty much the biggest independent player in this space, competing with giants like Google and Amazon.

Now, about the stock crash ,things have been rough lately. Their share price tanked, and here’s why:

First off, their latest financial results were kind of a letdown. For the first time in over eight years , they didn’t hit their own revenue targets. Investors hate surprises like that, so the stock dropped hard, almost 30% in a single day.

On top of that, they’ve been rolling out a new AI-powered platform called Kokai, but apparently, there were some hiccups with the launch. The company admitted they messed up a bit on execution, which didn’t help investor confidence.

Another thing: their stock had gone up a ton last year, it more than doubled at one point. So when the results disappointed, people freaked out and started selling. The valuation was super high, and the market just corrected itself, wiping out a huge chunk of their market cap.

There’s also some bigger-picture stuff going on.

The ad industry is getting more competitive, with Google and Amazon pushing hard, and there are worries about the economy slowing down. Plus, new privacy rules and regulations are making things trickier for digital ad companies in general.

All this led to a bit of a panic, with people selling off their shares and the price dropping even more because of technical trading stuff.

Fortunately, the price stopped near the previous lows where there is a major support and this could be a masive opportunity for mid to long term investors seeking a low risk entry with a +200% returns opportunity. A Stop Loss under the supports would be fine to keep your money safe.

In short, The Trade Desk is still a major player in digital ads, but they hit a rough patch because of disappointing results, some mistakes with their new tech, and a reality check on their sky-high stock price. Some people still think they’ll bounce back if they fix these issues, but for now, it’s been a wild ride!

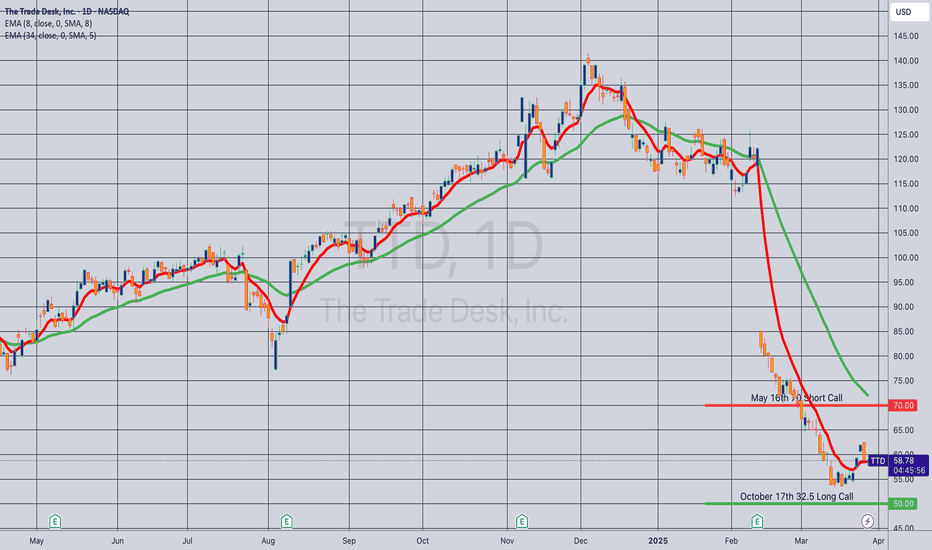

Opening (IRA): TTD May 16th -70C/October 17th 32.5C LCD*... for a 26.10 debit.

Comments: At or near 52-week lows. Buying the back month 90 delta and selling the front month that pays for all of the extrinsic in the long. (The October 17th 32.5C is shown at the 50 strike to fit it on the chart).

Metrics:

Buying Power Effect: 26.10 debit

Break Even: 58.60/share

Max Profit: 11.40

ROC at Max: 43.7%

10% Max: 2.61

ROC at 10% Max: 10.0%

In this particular case, I'll look to take profit at 110% of what I put it on for and/or roll out the short call if it hits 50% max. Earnings are on 5/14, so my preference would be to take it off before then ... .

* -- Long Call Diagonal.

relentless sellingTTD has been taken to the woodshed. I outlined a few levels of interest. My plan of attack it to initiate 35% of my desired position around $60 (59.75 level given). After that i will start a DCA every 2 weeks. I'll add more at the 200 week MA (RED). If price got to the lower range i would ramp up the DCA considerably. Long term i still like this company.

$TTD to go below $60- Investors were paying too much for growth in NASDAQ:TTD

- It operates in a very competitive space.

- Leadership is solid however eps growth and gaap eps tells a different story. EPS growth is impressive but gaap eps is terrible. Stock based comp remain consistent but somehow gaap eps isn't growing as fast as non-gaap eps.

- Nonetheless, here's fair value for NASDAQ:TTD

Year | 2025 | 2026 | 2027 | 2028

EPS | 1.79 | 2.21 | 2.85 | 3.89

EPS growth | 9.54% | 23.13% | 28.92% | 36.66%

For eps growth of 20%+ and company with a moat. Fair forward EPS is 30

Year | 2025 | 2026 | 2027 | 2028

Bear Case ( p/e 20 ) | $35 | $44 | $57 | $77

Base Case (p/e 30 ) | $53.7 | $66.3 | 85.5 | $116

Bull Case (p/e 35 ) | $62 | $77 | $99 | $136

Idea is to buy close to fair value and hold it for period when there is optimism in the market or euphoria and/or valuation expansion where stock is assigned higher forward p/e multiple.

For me, NASDAQ:TTD is a buy under $65. However, I have started with a starter position at 80s because you many times good stocks bottom above its fair value.

I plan to build a position in increments because you never know how much stock will undercut on pessimism. However, the above intrinsic value based on EPS should help to identify the ranges

TTD longNASDAQ:TTD long

(The Trade Desk, Inc. (TTD) is a technology company that provides a demand-side platform for digital advertising. Here's a quick overview:

1. Business: TTD specializes in programmatic advertising, using AI and data analytics to automate and optimize ad placements in real-time across various digital platforms.

2. Financial Performance:

- 2024 Revenue: $2.4 billion (26% year-over-year growth)

- Q4 2024 Revenue: $741 million (22% year-over-year growth)

3. Stock Performance:

- Current Price: $59.34 (as of March 24, 2025)

- Year-to-date performance: Down approximately 36%

4. Growth Drivers:

- Connected TV (CTV) advertising

- Shift to programmatic advertising

- Privacy-friendly advertising model

5. Challenges:

- Recent earnings miss and lower-than-expected Q1 2025 guidance

- Increased competition from major tech companies

- Economic slowdowns potentially impacting ad spending

6. Market Position:

- Leader in the demand-side platform (DSP) market

- Strong presence in CTV advertising

- No reliance on first-party data, unlike competitors like Google and Meta

Despite recent challenges, analysts remain generally bullish on TTD's long-term prospects in the growing digital advertising industry)

Undervalued Stock TTD The Trade Desk buy IdeaDo not believe me when I say this stock is undervalued, do your own research.

Do not believe me when I say this stock has shown very high properbility for good upside moves from around end of March until mid of August for the last 10 years, do your own research.

Good upmove today, I am in.

Leave a like or comment, hit the bell, eat some birthday cake, and love what you are doing!

Cheers!

$TTD - Is it over?NASDAQ:TTD has been in a free fall, and it is currently the most oversold it has ever been. Nothing ever comes close.

One thing to note is that it tends to check back to $41 to $38 range after prolonged sell-offs like this. That support level has not been broken since 2021.

Judging by the extreme oversold levels in the MACD and RSI, it might be close to seller exhaustion. However, I would wait for confirmation.

If it reaches the $41 area, I’d be interested in going long with a stop around $35.

Something to take note of:

NASDAQ:TTD experienced a drawdown of 65% during the 2021 downtrend, which took 122 days to reach that level. If it were to fall a similar amount, it would be around $50. Currently, we are 69 days into the downtrend.

$TTD - The worst sell off in the history of sell offs?NASDAQ:TTD has been in a free fall, and it is currently the most oversold it has ever been. Nothing ever comes close.

One thing to note is that it tends to check back to $41 to $38 range after prolonged sell-offs like this. That support level has not been broken since 2021.

Judging by the extreme oversold levels in the MACD and RSI, it might be close to seller exhaustion. However, I would wait for confirmation.

If it reaches the $41 area, I’d be interested in going long with a stop around $35.

Gap Filled, now what?Election spending sent earnings and the stock price to extremely exaggerated valuations. Now that the stock has been pummeled, what will be the next major driver for growth for this Wall St darling? They need to watch over their shoulder as AppLovin is looking to mount a challenge.

We are approaching an area of support, along with a gap being filled at $77. I'm watching the reaction at support, not trying to catch a falling knife. If the overall market tanks, this could continue to drop like a rock. So if I do trade this, I will keep a tight stop loss.

Not financial advice, do what's best for you.

$TTD - highly oversold here bounce to $85 incoming NASDAQ:TTD stock is down almost 50% since highs hitting 52 week lows on Friday. $70 looks a levels that it needs to hold and looks oversold at these levels. Looking for oversold bounce here as long as $70 holds for a move towards $76 and $85. Stock has a huge earnings gap above it