Key facts today

Exxon Mobil's stock rose 2.2% to 3.7% as oil prices surged nearly 9% due to geopolitical tensions, raising concerns about global energy supply disruptions.

ExxonMobil and partners have extended a production sharing contract for Block 17 offshore Angola, vital for maintaining oil output above one million barrels daily in the region.

ExxonMobil is partnering with BP and Pertamina to advance carbon capture and storage projects in Indonesia, boosting low carbon electricity trade between Indonesia and Singapore.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.01 EUR

32.53 B EUR

328.34 B EUR

4.30 B

About Exxon Mobil

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

FIGI

BBG00GQ6S341

Exxon Mobil Corp engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Downstream and Chemical. The Upstream segment produces crude oil and natural gas. The Downstream segment manufactures and trades petroleum products. The Chemical segment offers petrochemicals. The company was founded by John D. Rockefeller in 1882 and is headquartered in Irving, TX.

XOM - Bearish in 4 months more DOWNTREND

The price of XOM has gone too far with the MA200. It will have to return to the MA200 as soon as possible if it does not want to crash.

Let's take a look at its price on the WEEK frame. MA50 and MACD support bearish.

On the DAY frame, the volume decreased, the price movement was low, the c

Oil Prices Rise on Middle East Tensions, Exxon Mobil Corp. SurgeExxon Mobil Corporation (NYSE: NYSE:XOM ) closed at $103.14 on April 11, gaining 3.21% in a single session. The rise comes as oil prices surge, driven by renewed tensions in the Middle East. Ongoing friction between Israel and Iran has heightened concerns over potential supply disruptions. These de

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—coul

EXXON FORECAST Q2 FY25My targets are clear anyways...

Exxon Mobil's stock performance is closely tied to global oil prices, which are influenced by various geopolitical events and policy decisions. Recent developments involving President Trump's administration and OPEC have introduced factors that could exert downward

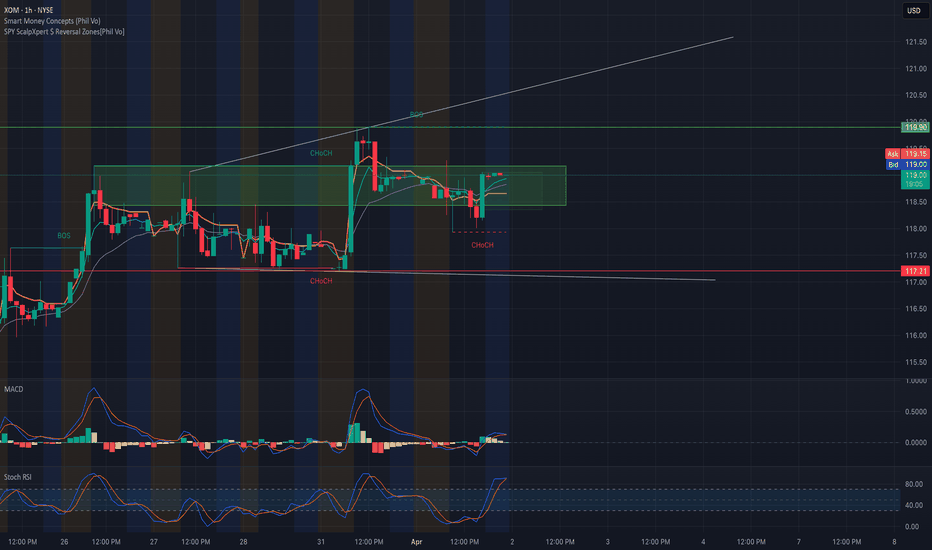

XOM Coiling Under Resistance: Gamma Breakout or Rejection Setup?1. Market Structure Analysis: XOM has formed a balanced range after printing a Break of Structure (BOS) and two notable CHoCHs on the 1H timeframe. Price is consolidating inside a green supply zone between 118.50–119.90, with wicks tapping the top of the zone but no clean breakout yet. The price str

EXXON MOBIL: This strong rally won't end any time soon.Exxon Mobil is about to turn overbought on its 1D technical outlook (RSI = 67.390, MACD = 2.260, ADX = 52.087) as for the 4th straigh week it is posting gains. This rally started on the first week of March when the stock almost touched the bottom of the 2 year Channel Up. This is a similar bullish w

ExxonMobil: Toward the ResistanceExxonMobil: Toward the Resistance

As planned, XOM recently continued to rise with the magenta wave . We give this movement a bit more room, but another smaller corrective movement of wave should start below the resistance line at $126.34 before XOM ultimately surpasses this mark. Once the upwa

XOM - Good Shot to Hit 150Reverse Head and Shoulders seems to have building out for some time. The Major Right shoulder appears to be completing the head of yet another reverse head and shoulders pattern. When this formation resolves, no reason that XOM can't easily pass 150.

My gut is telling me that the inflation is g

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

PXD5112423

Pioneer Natural Resources Company 2.15% 15-JAN-2031Yield to maturity

4.95%

Maturity date

Jan 15, 2031

See all XOM bonds

Curated watchlists where XOM is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Related stocks

Frequently Asked Questions

The current price of XOM is 96.53 EUR — it has increased by 1.97% in the past 24 hours. Watch EXXON MOBIL CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange EXXON MOBIL CORP stocks are traded under the ticker XOM.

XOM stock has risen by 5.47% compared to the previous week, the month change is a −3.18% fall, over the last year EXXON MOBIL CORP has showed a −6.03% decrease.

We've gathered analysts' opinions on EXXON MOBIL CORP future price: according to them, XOM price has a max estimate of 124.12 EUR and a min estimate of 84.22 EUR. Watch XOM chart and read a more detailed EXXON MOBIL CORP stock forecast: see what analysts think of EXXON MOBIL CORP and suggest that you do with its stocks.

XOM stock is 4.06% volatile and has beta coefficient of 0.48. Track EXXON MOBIL CORP stock price on the chart and check out the list of the most volatile stocks — is EXXON MOBIL CORP there?

Today EXXON MOBIL CORP has the market capitalization of 408.14 B, it has decreased by −0.38% over the last week.

Yes, you can track EXXON MOBIL CORP financials in yearly and quarterly reports right on TradingView.

EXXON MOBIL CORP is going to release the next earnings report on Jul 25, 2025. Keep track of upcoming events with our Earnings Calendar.

XOM earnings for the last quarter are 1.63 EUR per share, whereas the estimation was 1.61 EUR resulting in a 0.80% surprise. The estimated earnings for the next quarter are 1.29 EUR per share. See more details about EXXON MOBIL CORP earnings.

EXXON MOBIL CORP revenue for the last quarter amounts to 76.84 B EUR, despite the estimated figure of 79.82 B EUR. In the next quarter, revenue is expected to reach 68.70 B EUR.

XOM net income for the last quarter is 7.13 B EUR, while the quarter before that showed 7.35 B EUR of net income which accounts for −3.02% change. Track more EXXON MOBIL CORP financial stats to get the full picture.

Yes, XOM dividends are paid quarterly. The last dividend per share was 0.88 EUR. As of today, Dividend Yield (TTM)% is 3.57%. Tracking EXXON MOBIL CORP dividends might help you take more informed decisions.

EXXON MOBIL CORP dividend yield was 3.57% in 2024, and payout ratio reached 49.00%. The year before the numbers were 3.68% and 41.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 14, 2025, the company has 61 K employees. See our rating of the largest employees — is EXXON MOBIL CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EXXON MOBIL CORP EBITDA is 58.91 B EUR, and current EBITDA margin is 18.76%. See more stats in EXXON MOBIL CORP financial statements.

Like other stocks, XOM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EXXON MOBIL CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EXXON MOBIL CORP technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EXXON MOBIL CORP stock shows the sell signal. See more of EXXON MOBIL CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.