WTI trade ideas

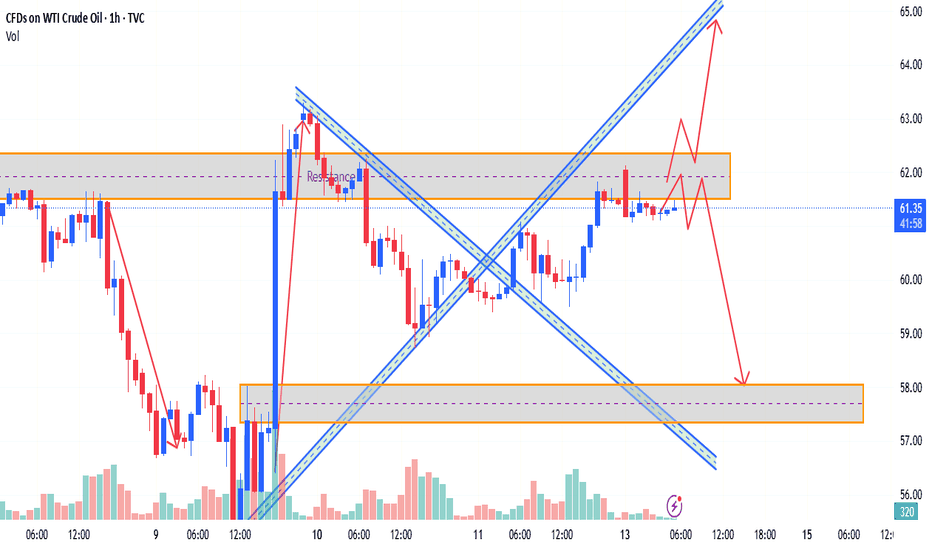

USOIL Chart Overview:

WTI Crude is trading around 61.44, consolidating inside a key resistance zone near62.00. After a strong bullish impulse, price has stalled under this resistance, forming both bullish and bearish paths, highlighting a conflicting market structure

Key Discrepations Identified:

1. Bullish Momentum vs. Resistance Reaction

- Expected: Continuation to 64+ after breakout.

- Reality: Price is struggling below resistance, rejecting upper boundary multiple times.

- Discrepation: Bullish momentum is slowing, and repeated rejections are exposing potential reversal pressure.

2. Volume Strength vs. Breakout Potential

- Volume d…

- Visually this implies strength, but price is hovering in indecision, neither breaking up nor down convincingly.

- Discrepation: Chart setup shows both bullish continuation and bearish breakdown possibilities, confusing structure

4. Double Scenario Projection

- The projection shows both:

- A bullish breakout to 64.

- A rejection and selloff to 58.

- Discrepation: Market is giving mixed technical signals, suggesting traders should wait for confirmation before committing

Discrepation Summary Table:

| Element | Expectation | Observed Reality | Discrepation | Projection Conflict | Clear trend continuation | Dual projection shown | Market indecision + low conviction |

📉 Conclusion:

While WTI remains inside a short-term bullish structure, the presence of conflicting breakout signals, resistance rejections, and declining volume point toward a discrepation. Traders should watch the 62.00 resistance zone closely. A clear rejection or breakout will resolve this divergence, with downside targeting 58.00, and upside toward $64.00.

Let me know if you'd like a summarized version for a caption or post!

USOIL D1 I Falling from the 61.8% Based on the D1 chart, the price is approaching our sell entry level at 65.24, a pullback resistance that aligns with the 61.8 Fibo retracement.

Our take profit is set at 58.08, a swing low support.

The stop loss is set at 70.39, a pullbac resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

WTI Oil D1 | Approaching a swing-high resistanceWTI oil (USOIL) could rise towards a swing-high resistance and potentially reverse off this level to drop lower.

Sell entry is at 62.71 which is a swing-high resistance.

Stop loss is at 66.00 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 58.18 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Heading into 61.8% Fibonacci resistance?WTI Oil (XTI/USD) is rising towards the pivot which has been identified as a pullback resistance and could reveres to the 1st support which is a pullback support.

Pivot: 65.90

1st Support: 54.96

1st Resistance: 71.31

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Strategic Analysis of Crude Oil for Next WeekBehind the current fluctuations in international oil prices lies the market's deep anxiety over the extreme uncertainty of global trade policies. Trump's "suspension + escalation" approach has, in the short term, stabilized relations with non - Chinese economies, but it has also dealt a blow to the global supply chain and energy consumption confidence.

In terms of the trading ideas for crude oil next week, it is recommended to mainly go short at high levels during rebounds and go long at low levels during pullbacks as a supplement. In the short term, pay attention to the resistance level in the range of 62.8 - 63.2. In the short term, focus on the support level in the range of 60.5 - 59.5.

Oil trading strategy:

sell @ 61.90-62.10

sl 62.80

tp 61.70-61.40

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

USOIL may continue to decline due to tariffsRestricted Economic Growth : The United States imposes tariffs, and other countries take countermeasures, intensifying global trade frictions and greatly increasing the risk of economic recession. NIESR predicts that if Trump imposes a 10% tariff on the world and a 60% tariff on China, the global GDP will shrink by 2% and the trade volume will decrease by 6% within five years 😕. The weak economy causes the demand for crude oil in various industries to decline, leading to a drop in the price of USOIL 📉.

Changes in Crude Oil Supply and Demand :

Demand Side: China imposes tariffs on U.S. crude oil, raising the import cost and reducing the import volume. The United States imposes tariffs on energy imports from Canada and Mexico, affecting the crude oil exports of these two countries to the U.S., reducing the demand for crude oil in the United States and putting pressure on the price of USOIL 😟.

Supply Side: After China reduces its imports of U.S. crude oil, it increases imports from other exporting countries, changing the global crude oil supply pattern and possibly strengthening the expectation of a supply surplus. The decrease in U.S. crude oil exports may lead to an increase in domestic inventory, exerting downward pressure on the price of USOIL 😣.

Influenced Market Sentiment :

The uncertainty of tariff policies and the escalation of trade frictions trigger market panic and speculation, intensifying the volatility of the crude oil market. Investors, being pessimistic, sell futures contracts, further driving down the price of USOIL 😨.

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 USOIL💰💰💰

🎯 Sell@61.0 - 61.5

🎯 TP 59.0 - 58.0

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

WTI Crude Oil Bearish Reversal Setup – Short from Resistance ZonEntry Point: 62.66 USD

Stop Loss: 65.26 USD

Target Point (Take Profit): 55.09 USD

Indicators:

EMA 200 (blue): 60.92 USD — long-term trend indicator

EMA 30 (red): 60.75 USD — short-term trend indicator

Analysis:

1. Bearish Setup:

The price is approaching a key resistance zone marked by the purple shaded area near 62.66.

The strategy is to short from this level, anticipating a drop to the 55.09 target area.

2. Risk/Reward:

Risk (SL - Entry): 65.26 - 62.66 = 2.60 USD

Reward (Entry - TP): 62.66 - 55.09 = 7.57 USD

Risk-to-reward ratio: ~1:2.9, which is favorable.

3. Support/Resistance Confirmation:

Multiple touches at the resistance zone (or

USOIL BULLISH BIAS RIGHT NOW| LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 61.45

Target Level: 73.89

Stop Loss: 53.11

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

oil and gold prices are divergingsince 2022, the price of oil and gold

have been diverging but they mostly

will shadow each other. Commodities

reflect the inflation of the money supply.

This is the simple reason why they move

together.

they also diverged in 2018 but then

realigned. this is a good

time to buy oil companies.

WTI - buy here or wait for 68$ My analysis of WTI in early December was good and it did wat I expected, but a stupid stop kicked me out it wave 2.

Then got the perfect entry for the short at 80.5 but didn't hold long enough...

So what to do next ? Could buy it here at the 0.236 retracement but I'd rather buy at 68.5 with a stop at 67.

Always keep in mind there is also politics involved here. Oil producers need higher prices to be profitable but on the other hand they want the price of oil to drop so Russia cannot sustain their war in Ukraine.

USOIL Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for USOIL below:

The price is coiling around a solid key level - 61.43

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 60.40

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK