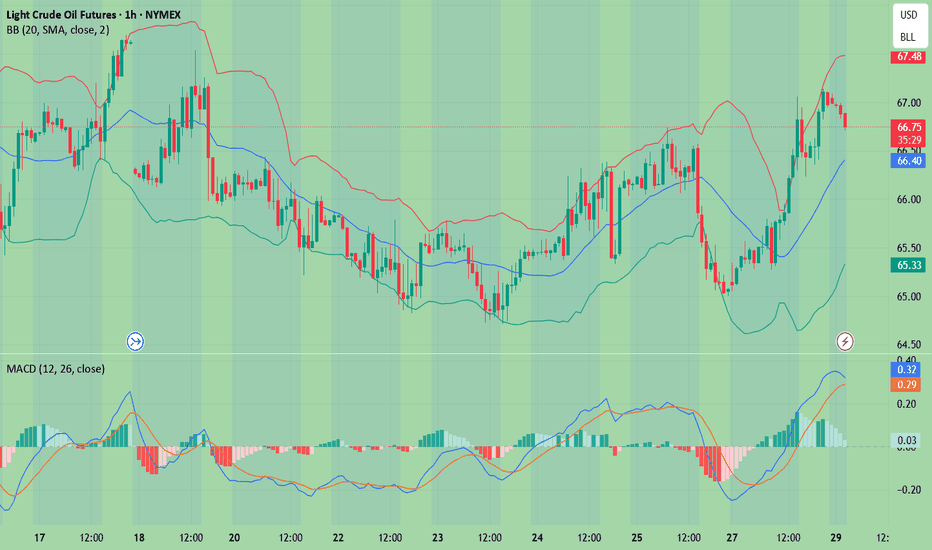

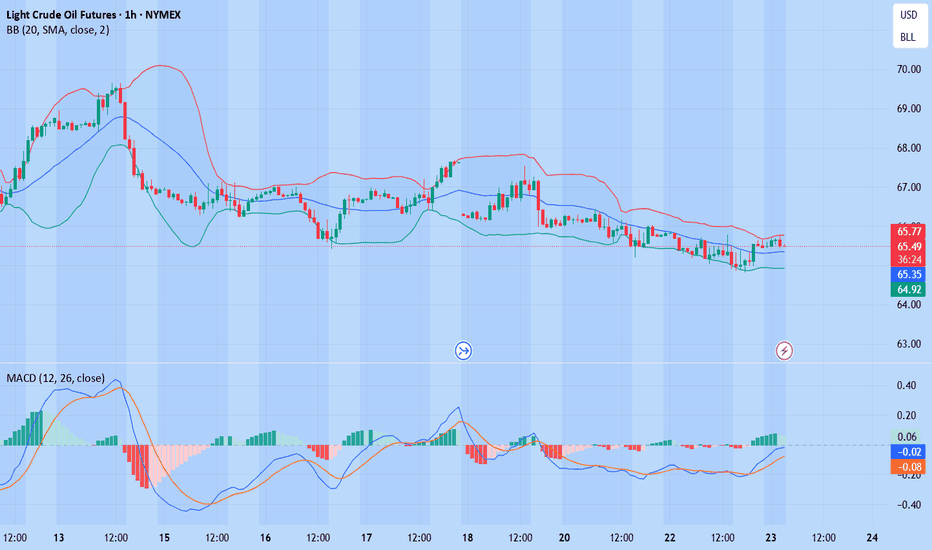

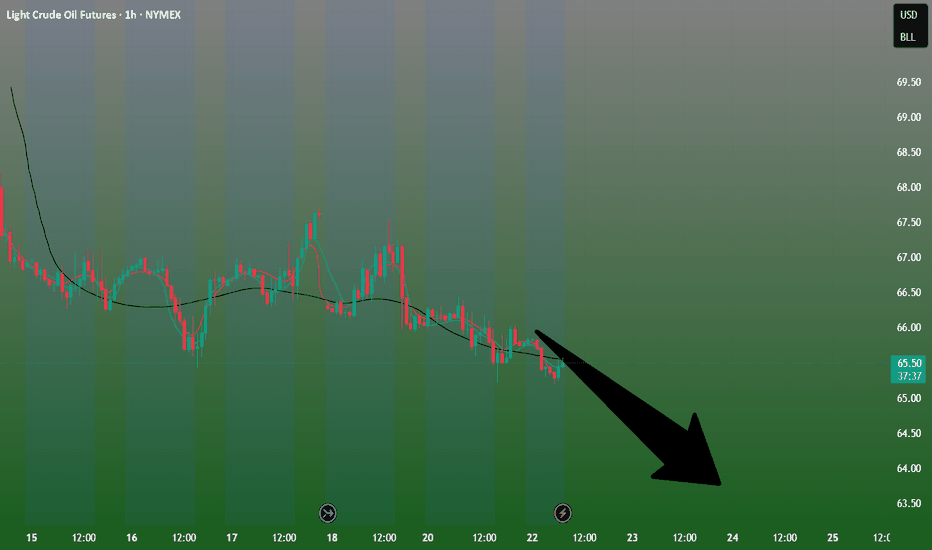

WTI(20250805)Today's AnalysisMarket News:

Goldman Sachs: We expect the Federal Reserve to cut interest rates by 25 basis points three times starting in September; if the unemployment rate rises further, a 50 basis point cut is possible.

Technical Analysis:

Today's Buy/Sell Levels:

65.85

Support/Resistance Levels:

67.97

67.18

66.67

65.04

64.53

63.74

Trading Strategy:

If the market breaks above 65.85, consider buying, with the first target at 66.67. If the market breaks below 65.04, consider selling, with the first target at 64.53.

WTI3! trade ideas

ID: 2025 - 0146.16.2025

Trade #14 of 2025 executed.

Trade entry at 60 DTE (days to expiration).

BULLISH options trade executed on Crude Oil. Once price level of $75.00 gets taken out, this trade will get adjusted to secure a risk-free trade. Targets will be 100% ROI based upon this being a balanced bullish butterfly construct.

Defined risk

Defined reward

Happy Trading!

-kevin

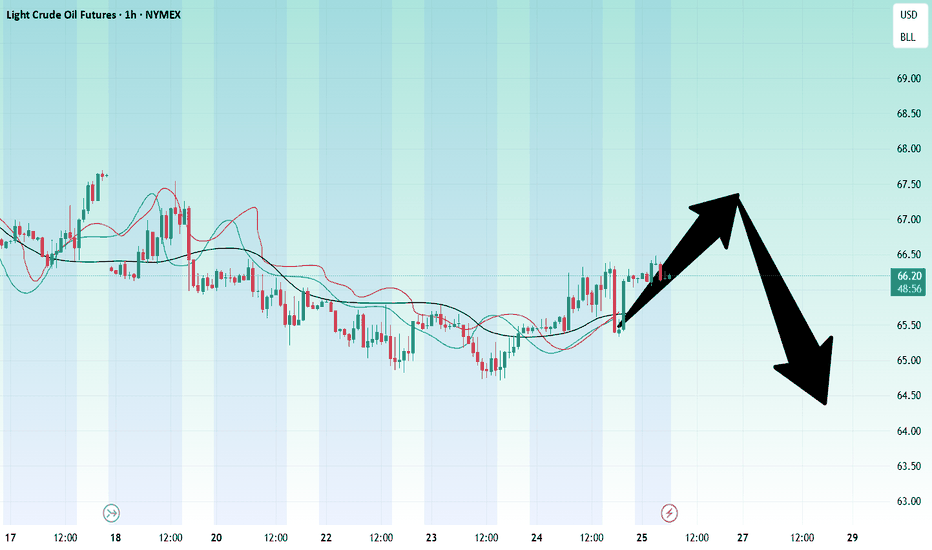

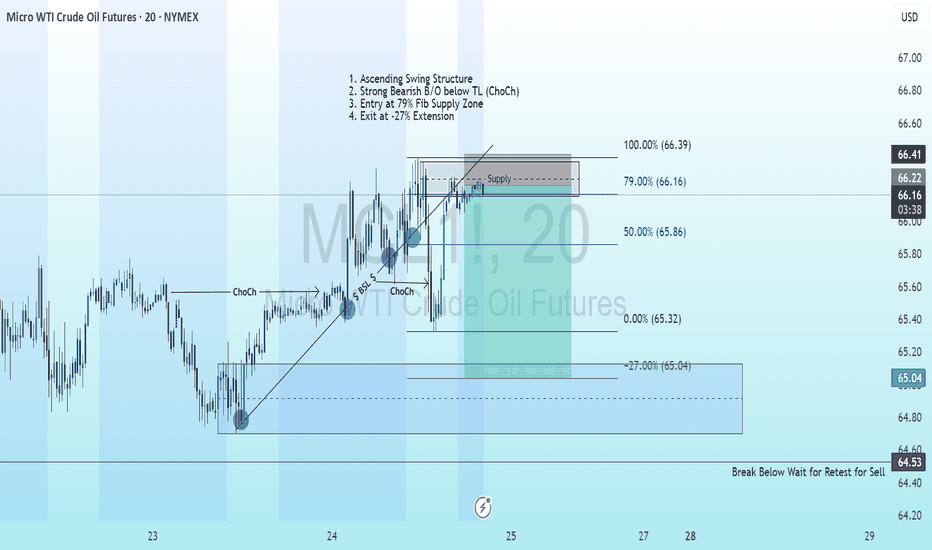

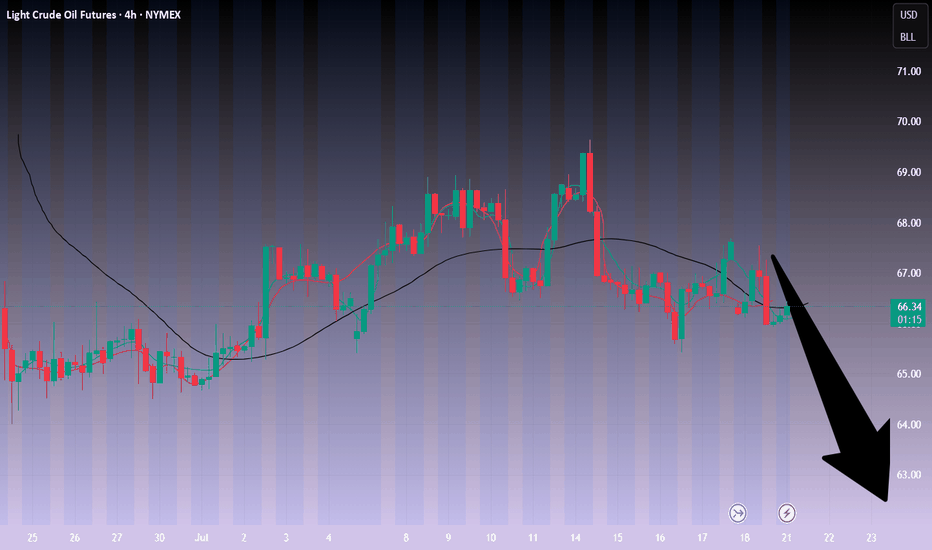

Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

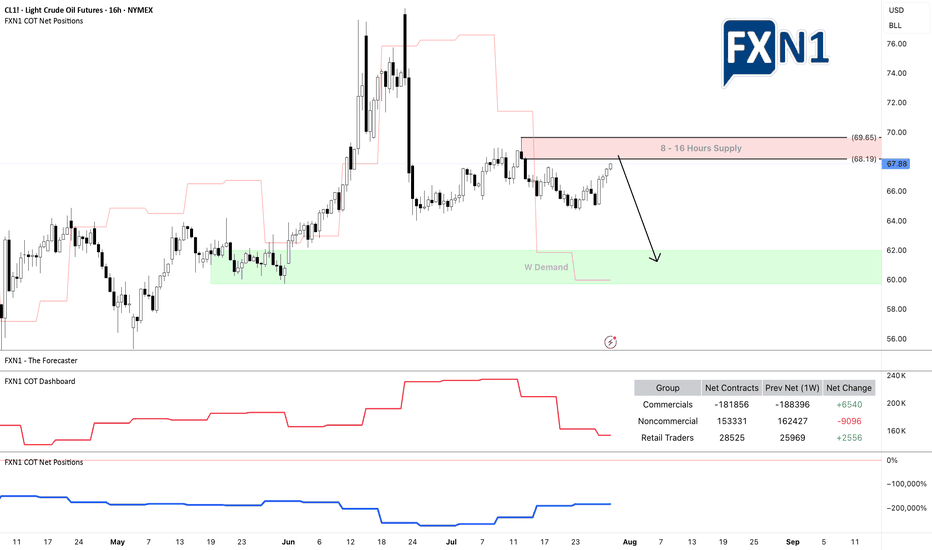

Since his post, oil prices experienced a notable bullish impulse. From both fundamental and technical perspectives, the market is now approaching a 16-hour supply zone, which could serve as a potential resistance area.

Additionally, I’ve observed a divergence in trader positioning: non-commercial traders increased their short positions significantly last week, while retail traders remain long. This divergence between price action and non-commercial positions suggests a possible shift in momentum, and I am currently eyeing a short setup.

As always, I encourage traders to conduct their own analysis. The trader featured below operates on the D1 timeframe and focuses on scalping, which can be useful for short-term entries.

Stay cautious and keep an eye on how the market reacts near the identified supply zone.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

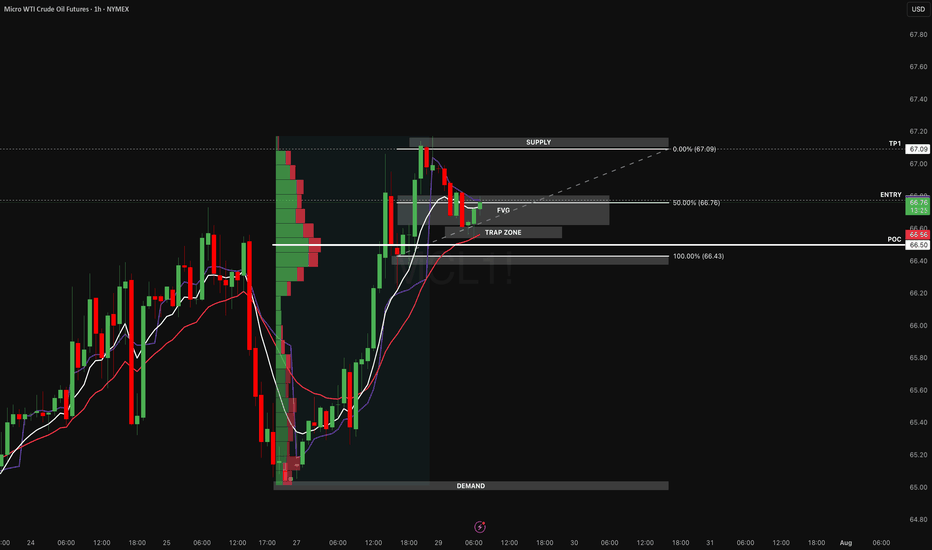

Oil’s Next Bullet: Locked, Loaded, Waiting at ValueOil made a clean move from 66.43 to 67.09 no noise, no hesitation and now it’s consolidating right where we want it: above the most important value zone of the leg. We’re not chasing green candles here. We're setting up for a measured, high-confluence re-entry at the point of balance.

This is the kind of setup we like to take at Staakd value-based, built off structure, supported by data, and always defined by risk.

Why We Like This Long

1. Fair Value Gap (FVG)

There’s a clear imbalance from 66.70–66.76 this is where price moved aggressively and left inefficiency behind. When price pulls back into an FVG with structure still bullish, we treat it like a reload zone not weakness.

2. POC (Point of Control) from Volume Profile

We anchored a Fixed Range Volume Profile from the impulse low to recent high, and the POC sits at 66.56, just under the FVG. That’s where most volume traded meaning institutions likely built their position there. If price reclaims this area after a dip, it’s a strong signal buyers are still in control.

3. Fib 50% Retracement

The 50% level of the impulse move (66.76) aligns with the FVG midpoint. That’s a psychological retracement level where trend traders and mean reversion players often meet.

4. Structure & Momentum Still Intact

- EMAs are stacked bullish: 9 > 21 > 50

- No lower low has formed

- Volume dropped on the pullback (typical in bull flags or controlled consolidations)

Plan of Attack

- Entry Zone: Anywhere from 66.56–66.76 (FVG, POC, fib confluence)

- Trigger: Look for a wick below and reclaim of FVG engulfing candle, ORB break, or VWAP reclaim

- TP1: 67.09 (supply + liquidity sweep)

- SL: Below 66.43 (demand origin + invalidation of trend)

What Invalidates This Trade

A clean break and hold below 66.43 means the structure has flipped. At that point:

- The FVG is fully filled and disrespected

- Demand is broken

- We’d likely reassess for a reversal setup, not continuation

- No egos, no praying. If we’re wrong, we’re out.

Why This Matters

We don’t trade predictions, we trade probabilities based on imbalances, value zones, and participation. When price returns to where the real business was done (the POC), we wait for confirmation and execute without emotion.

This setup aligns with our model:

- Value-based entry

- Tight, clearly defined invalidation

- Measured upside to recent high

- Multiple technical confluences

All that’s left now is patience the setup is built, the levels are mapped, and the edge is clear.

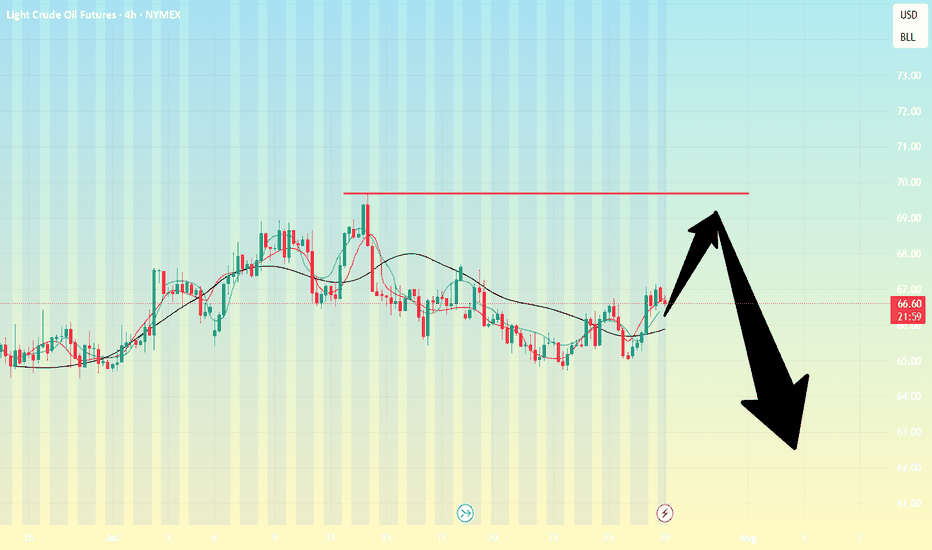

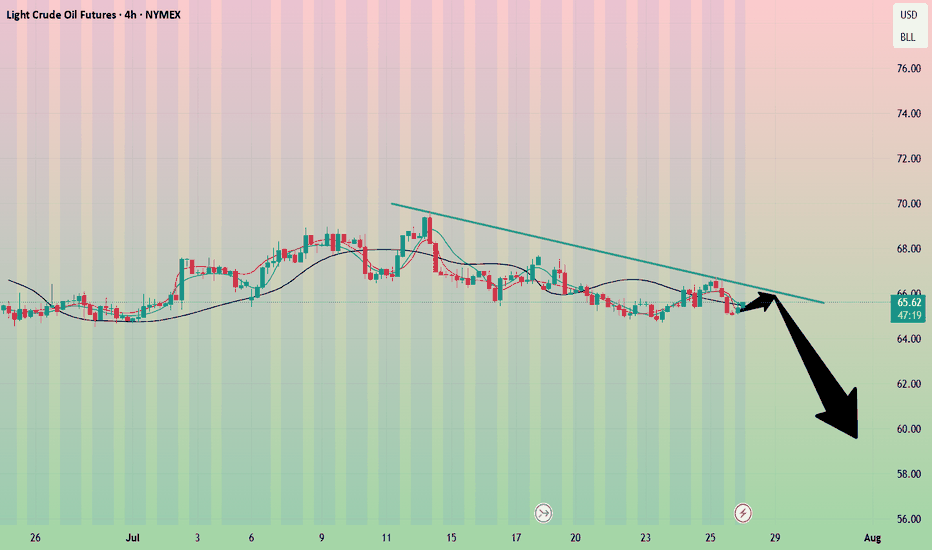

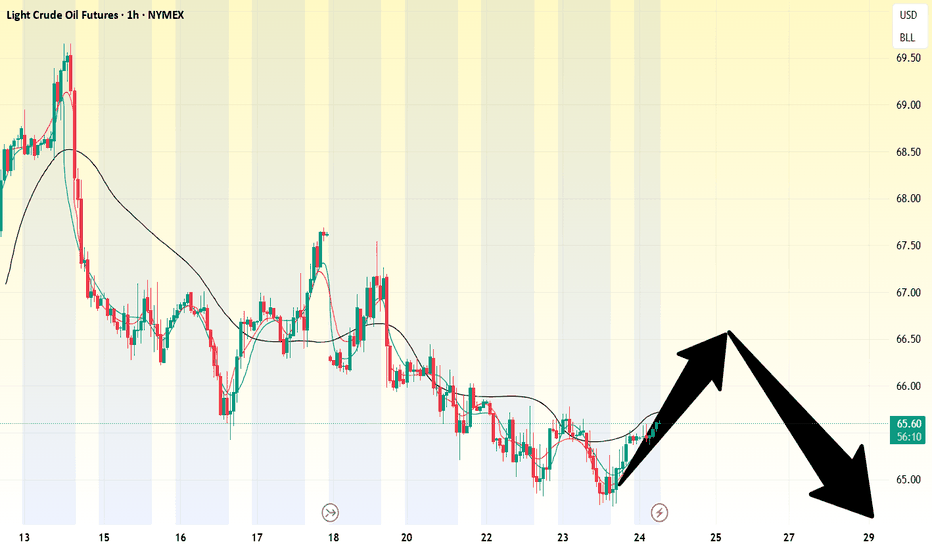

Crude oil-----sell near 67.50, target 65.00-64.00Crude oil market analysis:

The idea of crude oil today is still bearish. Xiaoyang predicts that it will rebound first and then continue to fall. Consider selling near 67.50 if it rebounds. Crude oil is basically weak if it does not stand above 70.00. Crude oil is a repair market after a big drop. In theory, it will continue to fall after the repair. In addition, pay attention to crude oil inventory data later.

Operation suggestions:

Crude oil-----sell near 67.50, target 65.00-64.00

WTI(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

66.09

Support and resistance levels:

68.13

67.37

66.87

65.30

64.80

64.04

Trading strategy:

If the price breaks through 66.87, consider buying, the first target price is 67.37

If the price breaks through 66.09, consider selling, the first target price is 65.30

Price Stability Signals Long OpportunityCurrent Price: $65.45

Direction: LONG

Targets:

- T1 = $67.25

- T2 = $68.50

Stop Levels:

- S1 = $64.15

- S2 = $63.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Crude Oil.

**Key Insights:**

Crude Oil prices are showing signs of stability around the $65.45 mark, creating opportunities for upside potential. Recent consolidation indicates underlying strength in the market, supported by solid demand forecasts and tight global supply, making a long position viable for the near term. However, traders should remain cautious, as any unexpected geopolitical or macroeconomic developments could trigger volatility.

**Recent Performance:**

Crude Oil has seen moderate fluctuations over the past week, with prices swinging between $64 and $66. The commodity appears to be recovering from recent dips, supported by stronger-than-expected inventory reports and OPEC's cautious stance. Overall trade volumes remain healthy, reflecting a gradual return of confidence among investors.

**Expert Analysis:**

Market sentiment among analysts leans bullish for the upcoming week. Experts point to various bullish indicators, including declining global stockpiles and expectations of stronger winter demand across major economies, particularly in the U.S. and China. Meanwhile, technical charts reveal sustained support near $65, suggesting room for an upward breakout.

**News Impact:**

OPEC+ members have reiterated their commitment to production cuts, alleviating fears of oversupply. Additionally, easing recession concerns and a potential rally in the broader commodities market further support the case for higher Crude Oil prices. However, traders should watch for Federal Reserve statements and potential shifts in interest rate policy that could impact demand dynamics.

**Trading Recommendation:**

Considering Crude Oil's current stability and positive outlook, traders should enter a long position targeting $67.25 and $68.50 while placing stop levels at $64.15 and $63.25 to manage downside risk effectively. The interplay of favorable supply-demand dynamics and technical indicators presents an attractive risk-reward scenario for upside participation.

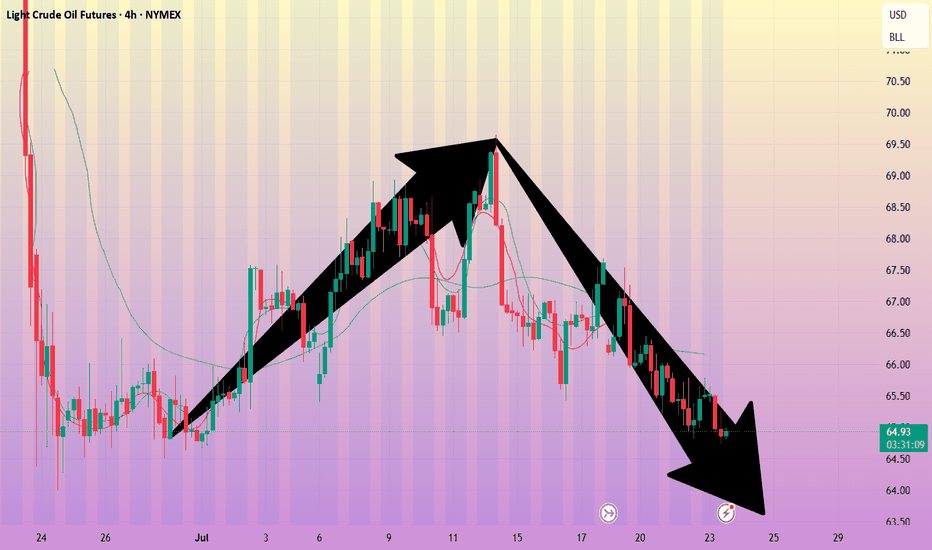

Crude oil-----sell near 67.00, target 65.00-63.00Crude oil market direction:

The recent daily crude oil line has been hovering, and it feels like it is falling or not falling. The daily crude oil line is still bearish. Let's continue to sell it on the rebound. For crude oil today, we focus on the suppression of 67.00. Consider selling it at this rebound position. The daily crude oil line needs to break the 64.00 position to see real selling force, otherwise it is a repair shock with a very small amplitude.

Fundamental analysis:

The latest news is that the United States and the European Union have reached a 15% tariff agreement, which overall supports the US dollar and suppresses gold. In addition, this week, pay attention to ADP employment data, non-agricultural employment data, and the Federal Reserve's interest rate decision and speech.

Operation suggestions:

Crude oil-----sell near 67.00, target 65.00-63.00

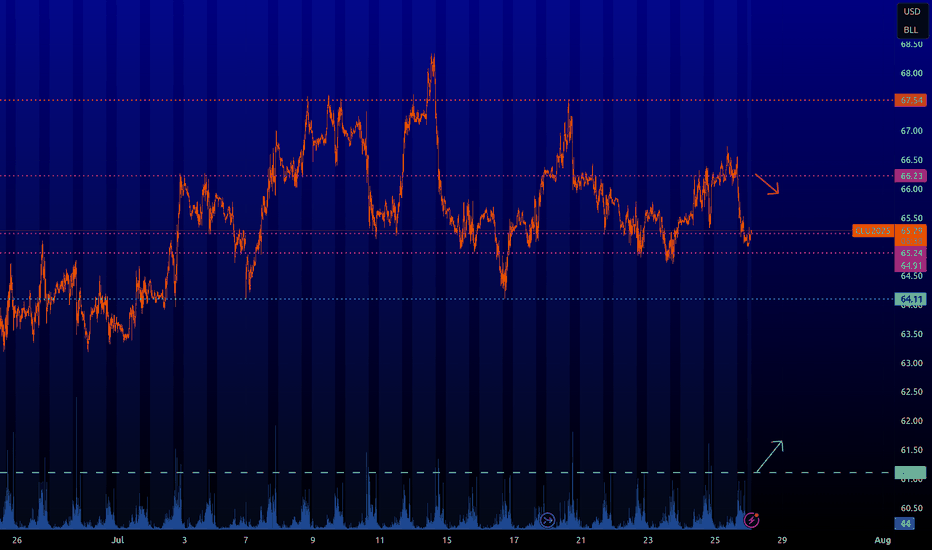

CL : Key levelsFrom the level of 66.23 we can wait for short-term sales.

From the level of 61.12 you can at least buy short-term, and if the price draws certain patterns on it, you can expect a good long position.

The other levels are still inactive, but the market will see them. When they become active, I will inform you.

Crude oil market analysis: Crude oil has not moved much, but it Crude oil market analysis:

Crude oil has not moved much, but it is a good short-term operation opportunity. Sell small when it rebounds, sell big when it rebounds. Crude oil will basically not trap you. It is difficult to end the selling in the short term. It will basically decline in the future. You can sell when it rebounds near 67.00 today. If it breaks 64.00, it will directly dive. The daily line of crude oil has formed a shock pattern. You can sell at the break position of 64.00.

Operation suggestions:

Crude oil---sell near 67.00, target 65.00-63.00

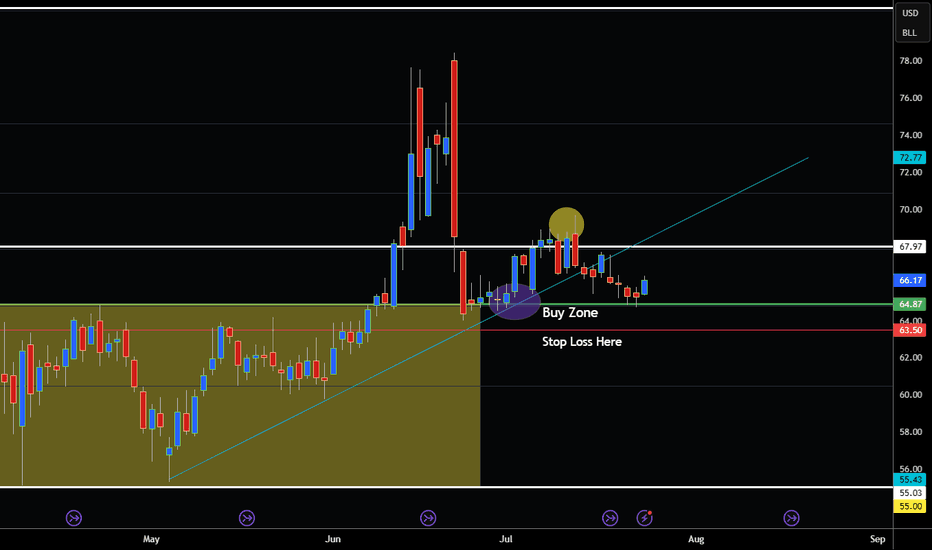

CRUDE OIL PULLS BACK AND RE-ENTERS BUY ZONE!Hey Traders so looking at Crude Oil today still showing signs of strength. I think it's still bullish because Dollar is still showing weakening signs at the moment. Plus a few daily closes above $68.

Also we are still in Summer which is normally a Seasonally Bullish time for Crude and energies. Not to mention still lots of uncertainty as always. 🙄

So I say if your bullish continue to buy in the zone $64.80-$66.00 place stop under support around 63.50 which looks like it could be safe place to not get stopped out.

However if bearish wait for close below 63.50 before selling the rally. Or better wait until September when the Seasonally Weak period begins in energy markets.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

Crude oil ----- Sell near 67.50, target 65.00-63.00Crude oil market analysis:

Crude oil has been falling recently, but the decline is not large, and the rebound will not be large. Consider selling crude oil if it rebounds slightly. The crude oil idea is bearish. It is difficult for crude oil to rise sharply without fundamentals, but we insist on taking losses in operation. If there is no loss, a piece of news will make it take off directly. Crude oil focuses on 64.00 support, and suppresses 67.50 and 69.50. Consider selling opportunities when the Asian session rebounds to 67.50.

Fundamental analysis:

Tariffs have not affected the market recently, and no major news has been announced. The market is relatively calm.

Operational suggestions:

Crude oil ----- Sell near 67.50, target 65.00-63.00

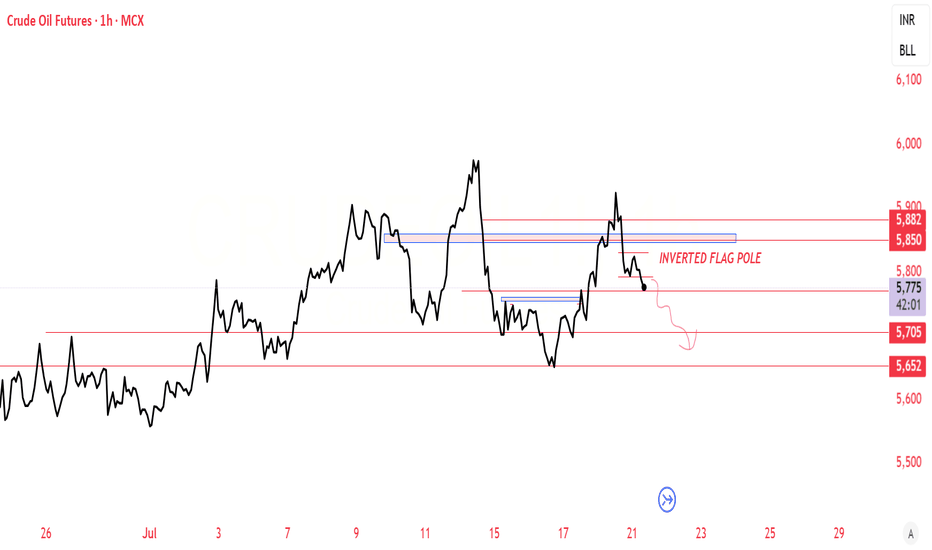

Crude oil-----sell near 66.00, target 65.00-63.00Crude oil market analysis:

The recent daily crude oil line has been fluctuating slightly. It is still bearish to sell at a high price. Crude oil is unlikely to rebound or rise sharply without fundamental support. The hourly crude oil suppression position is 66.40 and 67.50. Today we are close to 66.00 to consider selling opportunities. The daily moving average of crude oil is starting to go down. If 64.00 is broken, it will start to fall sharply.

Operational suggestions

Crude oil-----sell near 66.00, target 65.00-63.00

WTI(20250723)Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

Technical analysis:

Today's buying and selling boundaries:

65.22

Support and resistance levels:

66.22

65.85

65.61

64.84

64.60

64.22

Trading strategy:

If the price breaks through 65.61, consider buying, the first target price is 65.85

If the price breaks through 65.22, consider selling, the first target price is 64.84

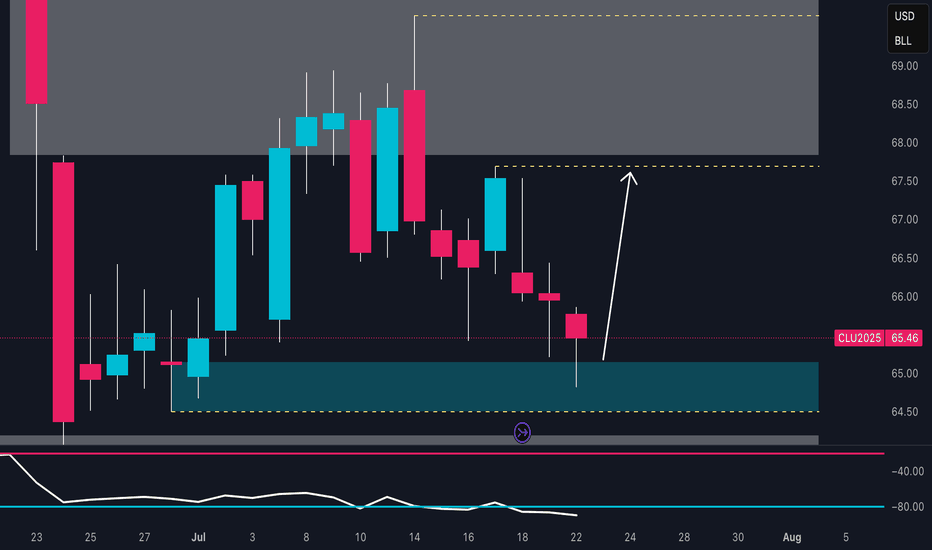

Crude Oil Rebound Incoming? Key Demand Zone 📈 1. Technical Analysis – Daily Chart (CL1!)

The price has returned to a demand zone between 64.60 and 65.30, an area that previously triggered strong bullish reactions.

The July 22nd candle shows a clear lower wick, indicating potential buyer absorption and a possible short-term reversal.

The next key resistance lies between 67.80 and 68.80, which aligns with a well-defined supply zone.

Daily RSI remains weak but shows signs of bullish divergence, suggesting potential accumulation.

Bias: bullish from current levels, targeting 67.50 – 68.00. Invalidation on a daily close below 64.40.

2. Institutional Sentiment – COT Report (CFTC, July 15, 2025)

Non-Commercials (Speculators)

Long: 308,915 (↓ -24,223)

Short: 146,488 (↑ +22,724)

Net Position: sharply declining → bearish divergence in speculative sentiment

Commercials (Hedgers)

Long: 857,803 (↑ +66,342)

Short: 1,046,199 (↑ +18,118)

Net Position: still negative, but improving → reduced hedging = less downside pressure

📉 Interpretation:

Funds are closing longs and adding shorts, showing bearish positioning. However, commercials are slowly reducing their hedging exposure, which could indicate short-term stabilization if the technical support holds.

3. Seasonality

Periods analyzed: 20, 15, 10, 5, and 2 years

July historically shows negative average returns:

-0.71% (20Y)

-1.26% (15Y)

-1.37% (10Y)

The seasonal pattern indicates continued cyclical weakness into August.

📌 Interpretation:

The summer period typically brings seasonal bearish pressure, which aligns with current 2025 performance.

🌐 4. Macro & Fundamentals

EIA inventory builds for 3 consecutive weeks → demand weakness in the U.S.

No additional OPEC+ cuts announced → supply remains ample

Stable inflation data in the U.S. and China → no uptick in energy demand

Overall macro data is neutral with a slightly bearish short-term bias

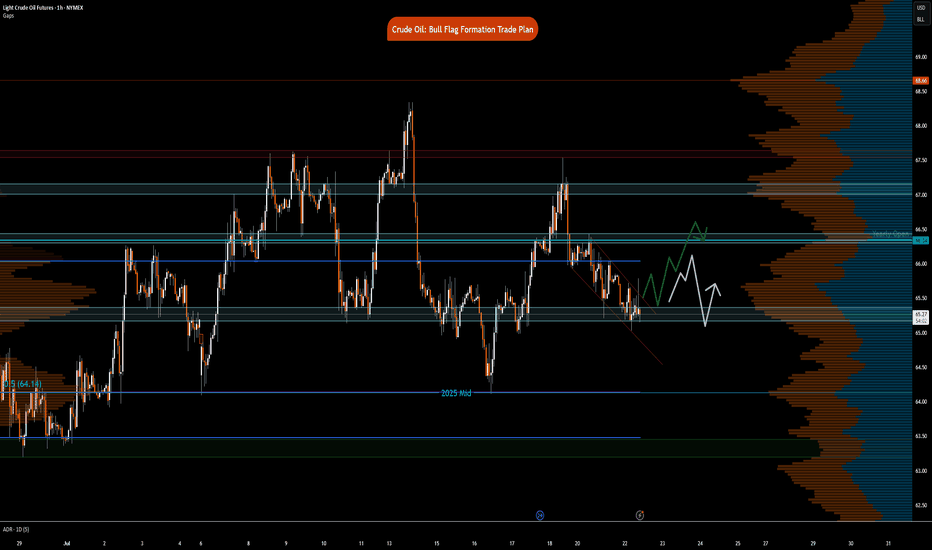

Crude Oil- Bull Flag formation Trade PlanNYMEX:CL1! NYMEX:MCL1!

Big Picture:

Let the price action and market auction be your guide

What has the market done?

The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance.

What is it trying to do?

The market is accepting prices in this range and building value. It has been in price discovery mode with a multi-distribution profile since June 24th.

How good of a job is it doing?

The market is currently forming a bull flag formation and attempting to push higher on the hourly time-frame.

What is more likely to happen from here?

Key Levels:

Neutral Zone 1: 67.16-67

Neutral Zone 2 : 66.45-66.30

Yearly Open: 66.34

Neutral zone 3 : 65.23-65.03

2025- Mid Range : 64.14

Scenario 1: False break, pull back and push higher

In this scenario, we expect prices to attempt to break bull flag formation, fail, however, neutral zone 3, acts as support for buyers to step back in to push prices towards yearly open and neutral zone 2.

Scenario 2: Break but fail to sustain push higher

In this scenario, we expect prices to break out of bull flag formation, however, fail around the 66 zone. Price reverts lower towards neutral zone 3 to further consolidate.

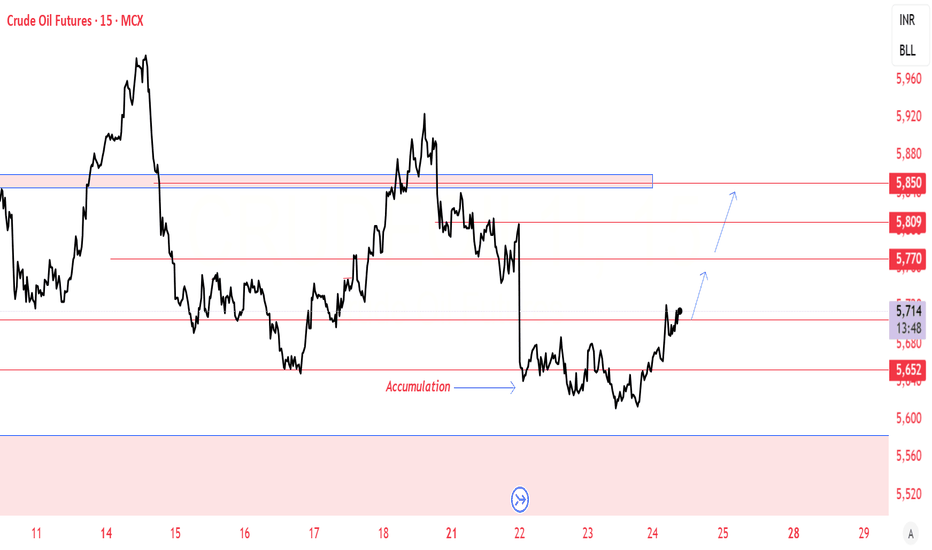

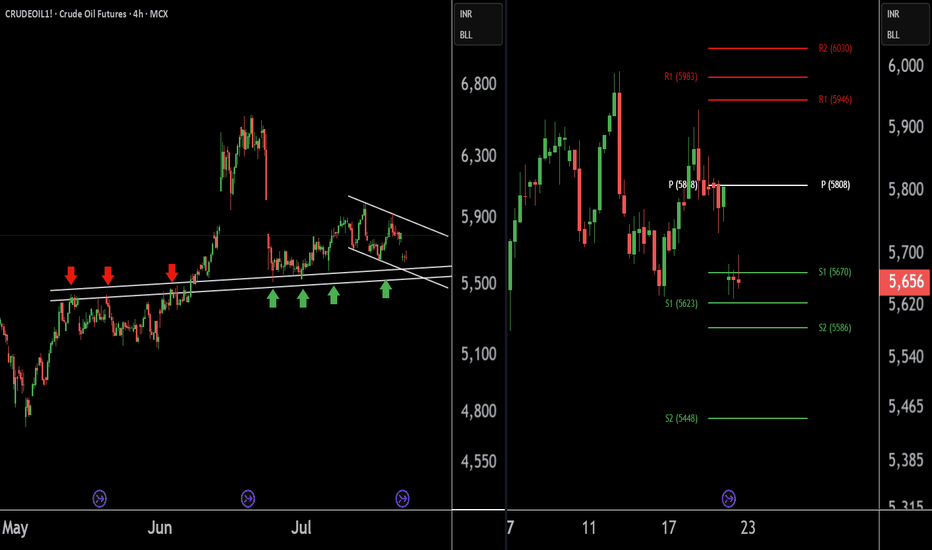

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

Crude oil-----sell near 67.50, target 65.00-63.00Crude oil market analysis:

Crude oil has started a new contract. The new contract is still not moving much at present, and the contract spread is not much. The daily line has begun to decline. Today's idea is to sell at a rebound of 67.50. The suppression position is 67.50 and 69.00, and the support is around 64.00. If this position is broken, there will be a greater room for decline.

Fundamental analysis:

There is no major news in the recent fundamentals. The situation in the Middle East is still relatively stable. There is no new rest on tariffs, and the impact on the market is limited.

Operational suggestions:

Crude oil-----sell near 67.50, target 65.00-63.00

Crude oil------sell near 68.80, target 66.00-62.00Crude oil market analysis:

Recent crude oil is actually very easy to operate. Sell when it rebounds to a high position. Don't worry about the position. In addition, the daily K-line has also begun to decline, and it is difficult to form a large rebound. The new daily moving average begins to sort. If there is no fundamental support in the future, crude oil has a lot of room to fall, and it will fall below 58 in the future. Sell it when it rebounds to around 68.80 today.

Fundamental analysis:

Today is a holiday in Tokyo, Japan. In addition, there is no major data this week. We focus on the fundamentals. Trump's tariffs are still a focus.

Operational suggestions:

Crude oil------sell near 68.80, target 66.00-62.00