XAGUSDK trade ideas

Silver Holds Near $33.60 as Fed Signals 2025 Rate CutsSilver hovered near $33.60 after the Fed held rates at 4.25%-4.5%, signaling 50 bps cuts by 2025. Despite trade-war fears and Trump’s policies, silver remains near a five-month high.

Lease rates surged as stockpiles shrank, especially in London, with silver flowing to the US for higher prices, widening market price gaps. Spot silver is up 17% this year, outperforming other commodities.

Tariffs strain silver transfers from Canada and Mexico, tightening supply and fueling fears of a prolonged “silver squeeze.”

If silver breaks above $34.05, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Bullish continuation?The Silver (XAG/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 32.93

1st Support: 32.10

1st Resistance: 34.88

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

SILVER Free Signal! Buy!

Hello,Traders!

SILVER is trading in an

Uptrend but the price

Made a bearish correction

And will soon hit a horizontal

Support of 33.35$ from where

We can go long with the

TP of 33.93$ and SL of 33.13$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

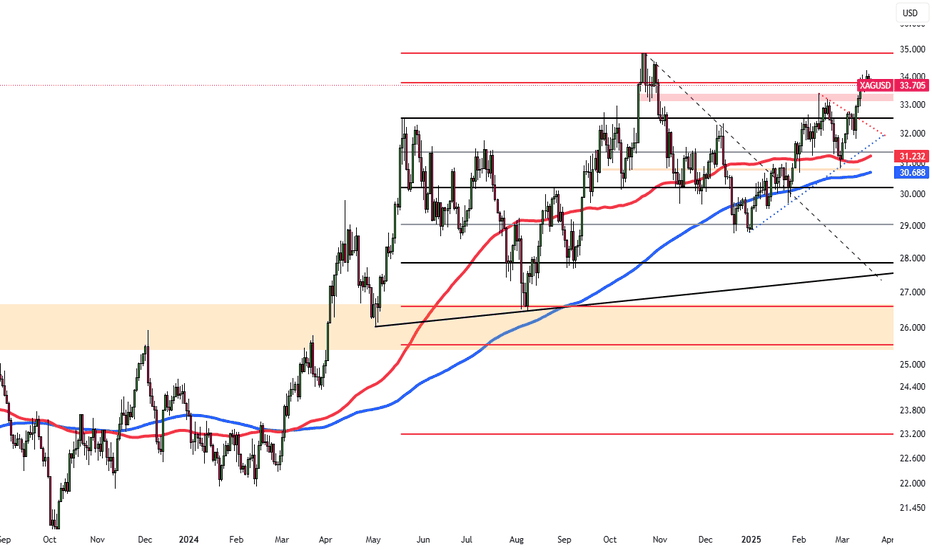

Silver – Lagging but Still Strong!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 SILVER has been bullish, trading within the rising wedge pattern marked in red.

Following the latest aggressive bullish movement, XAGUSD has formed a demand zone, marked in blue.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups, as it represents the intersection of demand, support, and the lower red trendline, which acts as a non-horizontal support.

📚 As per my trading style:

As #XAGUSD approaches the blue circle, I will be looking for bullish reversal setups, such as a double bottom pattern, a trendline break, and so on.

Additionally, for the bulls to maintain long-term control, a break above $3,500 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

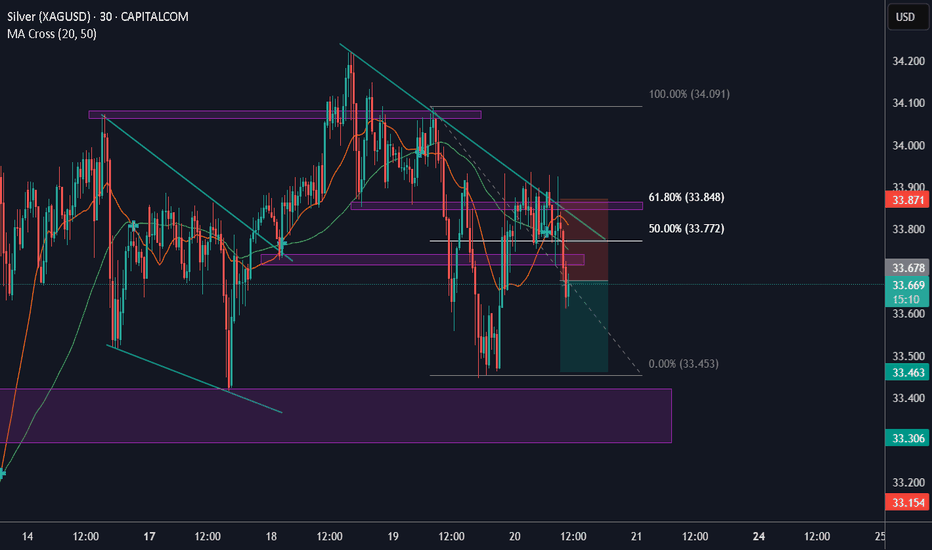

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish ContinuationTechnical Analysis & Market Outlook

The Silver (XAG/USD) 1-hour chart presents a clear rising wedge formation, a well-recognized bearish reversal pattern. This formation develops when price action creates higher highs and higher lows within a contracting range, signaling a potential exhaustion of bullish momentum.

Currently, Silver has broken below the lower trendline of the wedge, confirming a bearish breakout. This move suggests that the recent uptrend is weakening, and sellers are beginning to take control. A retest of the broken support level as new resistance could provide an ideal entry for a short position.

Key Technical Levels & Trading Plan

1️⃣ Resistance & Supply Zone: 34.00 - 34.20

Price has struggled to break above this region multiple times, confirming strong selling pressure.

The market rejected this level sharply, leading to the current downside movement.

A stop-loss can be placed slightly above this zone to protect against unexpected reversals.

2️⃣ Support Level & Retest Zone: 33.50

Previously, this level acted as a strong support, but the breakdown confirms a shift in market structure.

If price retests this level and faces rejection, it could serve as an optimal entry point for short trades.

3️⃣ Short Entry Confirmation

Traders should look for price rejection from the 33.50 zone before entering a short position.

A bearish candlestick pattern (e.g., bearish engulfing, pin bar, or a lower high formation) would further validate the entry.

4️⃣ Bearish Target: 31.90 - 32.00

The projected downside move aligns with the measured move of the wedge breakdown and previous support zones.

If price maintains bearish momentum, further downside potential exists beyond this target.

5️⃣ Stop-Loss Placement: Above 34.20

Setting a stop-loss above the recent resistance ensures protection against invalidation of the bearish setup.

This placement accounts for potential price spikes or false breakouts.

Trade Execution Strategy:

📌 Entry: Short on a retest of the 33.50 level, ensuring confirmation via price rejection.

📌 Stop-Loss: Above 34.20 to avoid premature stop-outs.

📌 Take-Profit: Targeting the 31.90 - 32.00 zone for an optimal risk-to-reward ratio.

Conclusion & Risk Management:

The breakdown from the rising wedge signals a shift in market sentiment, favoring a bearish move. Traders should remain patient for a retest of broken support to confirm the validity of the trade. Proper risk management with a well-placed stop-loss and a defined target ensures controlled exposure to market fluctuations.

📊 Overall Bias: Bearish 📉

🔍 Key Watch Areas: Retest of 33.50 for Short Confirmation

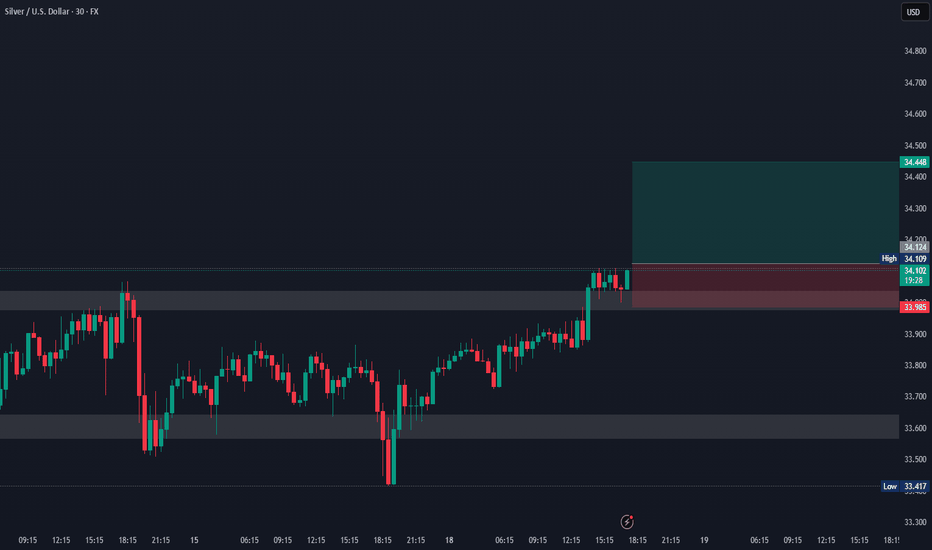

Silver is bearish setup, with Resistance Support and Demand zoneHello Trading view family, hope you are doing well and making desired profits.

My analysis about silver is bearish key levels are given below..

What do you think about it share in comment section.

Key Level;

Sell from 34.045

SL at 34.250

TP at 33.720

Note: This for educational purposes, trade at your own risk.

Kindly support me like and comment your thoughts.

Silver Analysis – March 19, 2025#Silver Analysis – March 19, 2025 ✨📈

Silver continues to attempt staying close to the upper line of the ascending channel for another retest in yesterday's trading but failed to break the resistance point intersecting with the upper line of the channel. Will silver break higher, or is a correction approaching? 🤔

🔹 Bullish Scenario:

✅ Holding above 34.25 on a daily close will trigger a strong upward move towards 34.90, the highest level reached in several years! 🚀

✅ If it breaks above 34.90, silver could extend towards 35.50 and 36.20.

✅ Silver is still close to the upper channel line, supporting the continuation of the bullish trend.

🔹 Corrective Scenario:

❌ Any corrective pullback must stay above 31.65, or breaking below this level and closing below it will make it difficult to return to higher prices! 📉

❌ The Relative Strength Index (RSI) suggests that the upward movement is nearing its end—are we due for a correction soon? 😯

❌ If 31.65 is broken, silver could fall towards 30.80 and 29.95.

🔍 Conclusion:

🔹 Holding above 34.25: Supports further upward movement towards 34.90 and possibly higher! 📊

🔹 Breaking below 31.65: Could trigger a downward correction towards 30.80 and 29.95.

🔹 Will we see a breakout to the upside or is a correction imminent? 🤨📌

📢 What do you think? Will silver break 34.90 soon, or is a correction on the way? 👀🚀

#Silver 🥈 #Trading 📊 #XAGUSD 📉📈 #Markets #Forex #Investing 🚀

Silver updateHow are you my friends

Last time we updated silver around entry points from 29,700 and 28,600 areas

And the points are as you see in the chart as targets

And today we see a very good rise with the rise of gold

We will monitor and update again but we must be careful of the decline of gold which poses a risk to silver as well with a sharp decline

But any decline does not mean a collapse, but on the contrary it will be a new and good buying opportunity

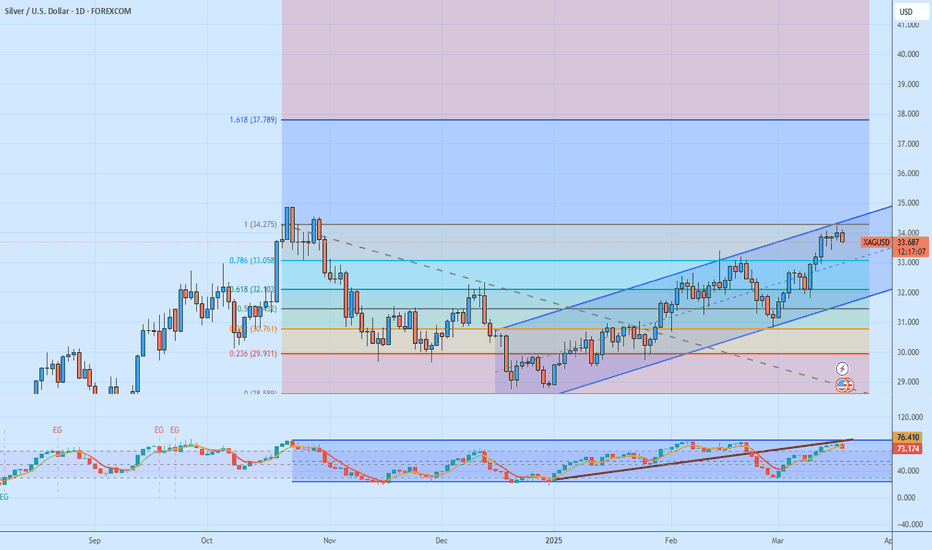

Silver - 6-month analysis and resultsThe strength of the price movement in silver has continued to increase since the 6-month analysis was sent for it, because this price analysis was done at the stop of the price movement, and with this increase in the price of silver and all metals in the financial markets, the price will increase.

Sasha Charkhchian

SILVER BEARS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,408.6

Target Level: 3,244.3

Stop Loss: 3,517.4

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver next move (expecting bullish move)(18-03-2025)Go through the analysis carefully, and do trade accordingly.

Anup 'BIAS for the day (27-02-2025)

Current price- 33.90

"if Price stays above 33.55, then next target is 34.30, 34.80 and above that 35.00 "

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk more than 1% of principal to follow any position.

Support us by liking and sharing the post.

Silver Surges to $33.90 as Safe-Haven DemandSilver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military action in Gaza. Supply constraints and record industrial demand, especially in solar, 5G, and automotive sectors, further fueled the rally.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.