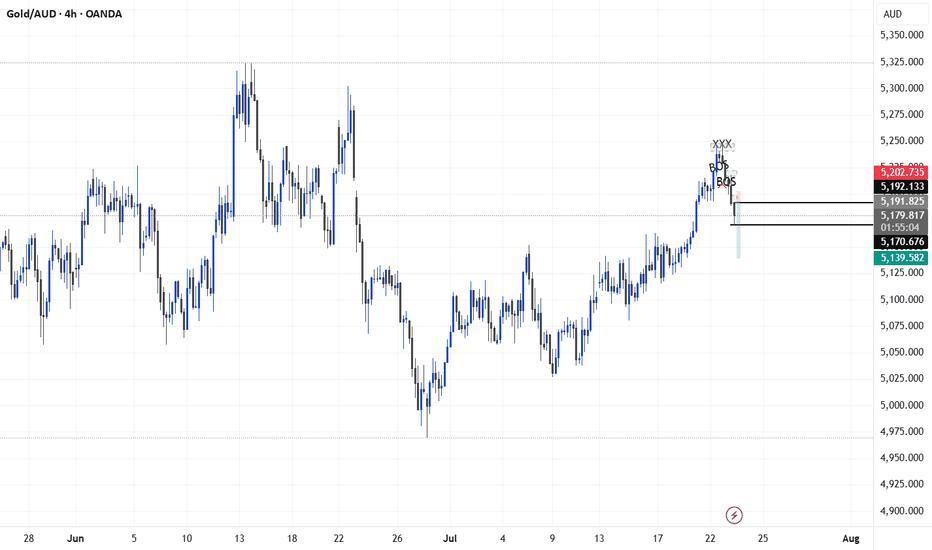

XAU/AUD Trade Setup – Order Block Rejection Play🟡 XAU/AUD Trade Setup – Order Block Rejection Play

Pair: XAU/AUD

Direction: Sell

Type: Pullback to Order Block → Continuation Down

Timeframe:15min

🔍 Analysis:

After a confirmed Break of Structure (BOS) to the downside, price is currently pulling back. I'm anticipating a bullish retracement toward a

XAUAUD XAUUSD / GOLD short big moveIm seeing Both GOLD USD and GOLD AUD Falling, its because the way this last Push up has developed, Looks like an expanding Flat correction in the making Right now

Entry is at the very Top its a ery High Risk to Reword Trade Worth to take the shot

Leels in the chart

GG

XAUAUD - Short SetupMy main trading principle is that the price always moves from swept liquidity levels to untouched liquidity levels.

In particular case we clearly can see the following context: price swept 1D key liquidity level and left untouched level lower.

But to take more statistically probable trades we shou

C*ck & B*lls formationSummery: Typical bullish hyped market activity which rises too quickly. Followed by quick bearish pullbacks. Gold/silver will forever be bullish.

Breakout from pink ascending thingy with pullback, retest, breakout and finally confirmation for hyperbolic run. Given how the reserve currency has dup

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.