XAUUSD.F trade ideas

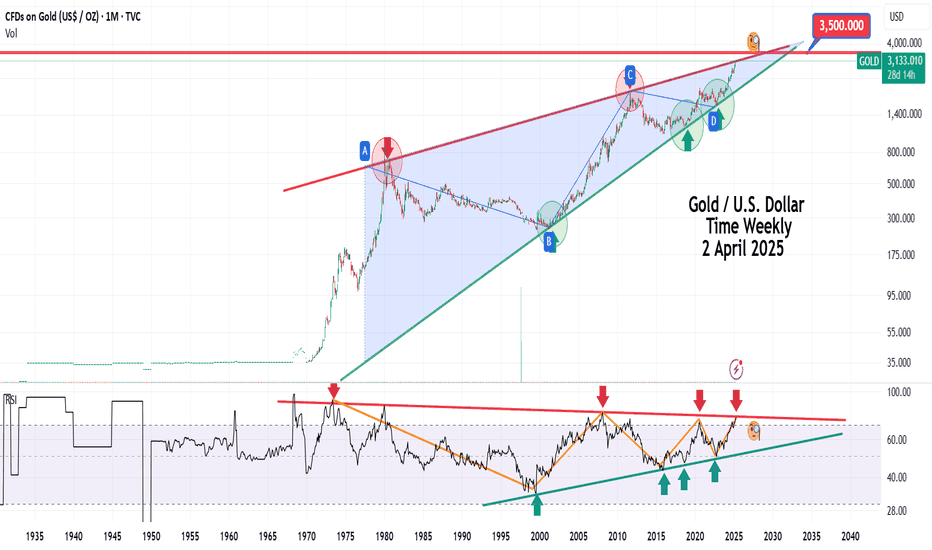

Gold Elliott AnalysisHello friends

As predicted, we expected a 5-wave formation, which happened, and with the formation of a divergence between waves 3 and 5, the price of gold fell.

Now a small wave with 5 parts has formed, which could be wave A of a zigzag.

We expect the price to grow by 61.8% of the decline that occurred in the main wave B.

Now, considering the psychological support of $3,000, this price reversal may happen right now or it may fall to the $2,960 range and then the price will grow.

In general, we will have a growth in the main wave B and then another sharp decline in the main wave C.

Meanwhile, the RSI indicator has also reached the oversold limit.

Good luck and be profitable.

Price Reacts to Every Zone I Mark – No Coincidence.Every level you see on this XAU/USD chart is mapped based on institutional moves, order blocks, and real market intent. These aren’t just random zones—each one is backed by experience and a deep understanding of how smart money operates.

Price respects precision. I deliver it every time.

Let the chart speak.

XAUUSD 15M Analysis: A Potential Reversal for Gold Prior to NFPGold (XAUUSD) is approaching a key demand zone, which could offer a potential buying opportunity. Here’s a breakdown of my analysis and trade expectations:

1️⃣ Market Structure & Trend Analysis

• Price is currently in a short-term downtrend, creating lower highs and lower lows.

• However, a Monitor Buy Zone has been identified, where price previously found strong support and liquidity.

• A reaction from this level could trigger a bullish reversal.

2️⃣ Expected Price Movements

• Bullish Scenario: If price reaches the Monitor Buy Zone (3,067 - 3,047) and shows bullish confirmation (e.g., wicks, engulfing candles), we could see a rebound toward 3,095 - 3,100 as the first target.

• Bearish Scenario: If price breaks below the 3,047 support level with strong bearish momentum, it could invalidate the buy setup and push lower toward new demand levels.

3️⃣ Key Levels to Watch

• Resistance Levels:

• 3,095 - 3,100: Initial target zone for a bounce.

• 3,120: Potential extended target if momentum continues.

• Support Levels:

• 3,067: First reaction level in the Monitor Buy Zone.

• 3,047: Last level of defense before a deeper drop.

4️⃣ Trade Plan & Risk Management

• Entry: Looking for bullish confirmations at the Monitor Buy Zone before entering a long position.

• Stop Loss: Below 3,047, ensuring minimal risk if the trade setup fails.

• Take Profit Levels:

• First TP at 3,095 - 3,100 (safe target).

• Extended TP at 3,120 (if bullish momentum continues).

5️⃣ Confluences for a Long Setup

• Liquidity Grab Possibility: Price could sweep below previous lows before reversing.

• Historical Support: Price has bounced from this region before, adding strength to the buy zone.

• Fibonacci Levels: Possible alignment with key retracement zones for added confirmation.

Final Thoughts:

I’ll be closely watching price action at the Monitor Buy Zone before entering a trade. If price respects this area and bullish momentum builds, we could see a strong rebound.

What’s your bias on XAUUSD? Drop your thoughts in the comments!

XAUUSD SHORTXAUUSD short again, 9yr high for Gold and still holding on to my shorts. another day, another entry. Setting my position at 3138 // TP 3000 SL 3238

A lil discouraged with the current rallies, however, this is what trading is like, you take your L's, gather your emotion, recalculate and execute again(when you're less emotional). Sticking to my Short positions because I believe that this will reverse, it may take a while but im willing to wait. Setting my TP to my previous target to cover previous losses and SL a lil bit further to secure my positions. This isnt a trading or financial advice but my personal trading plan. Let's see how this trade rolls.

Day 14of100

L:5

W:1

XAUUSD:Trading strategiesThe current upward speed of gold has somewhat slowed down, yet the upward trend hasn't come to an end. After testing the support around 3100, it has risen again and is currently trading within the range of 3100-3140.

Today, we need to focus particularly on the US ADP data, as well as the details of Trump's announcement regarding the implementation of tariffs. These will have a significant impact on the market when they are released.

This week is destined to be full of risks and opportunities. Before the upward trend of gold concludes, we should continue to maintain a long position strategy. For a safer buying area, pay attention to the range of 3100-3010.

I will continuously send out accurate signals, and all signals have been profitable. If you need accurate signals, please click the link below the article.

GOLD is in buy zone!XAUUSD has just drop to daily support with strong price action formation on the lower timeframe with an inverted head & shoulder showing possible bounce off the daily support level. As long term trend is up, we may see a sudden bounce to neck line where daily resistance is.

A possible buy trade is high probability.

Can gold be shorted today?Last week, the gold market fluctuated at the beginning of the gold week, rose on Thursday and Friday, and closed near the high on Friday. The weekly line closed with a bald positive line with a lower shadow. The overall market trend was very strong. The price of gold rose for four consecutive weeks and set a new high. Driven by factors such as trade, economy, and regional conflicts, and the influence of Trump’s remarks at the weekend, provided support for the gold price. Gold also rushed directly to 3100 as soon as it opened in the morning, setting a new high again at 3127.9.

Gold operation strategy: Go long when gold falls back to 3100-3095, defend at 3090, target at 3115-3120;

GOLD Bounces from Key Demand Zone – Is a Bullish Reversal? Gold has just tapped into a strong demand zone around $2,959 - $2,968, a level that previously acted as a base for a major move up in late March.

This current price action aligns with a potential bullish reversal setup, especially after a sharp sell-off into this demand area. Here's the breakdown:

Key Zones to Watch:

Demand Zone: $2,959 - $2,968 (marked in orange)

Price is reacting here again. A bullish engulfing or strong bullish candle here could signal a reversal.

Mid-Level Resistance: $3,061

A break and close above this level will likely confirm strength in buyers and open the path to the next zone.

Supply Zone/Target: $3,120 - $3,141

Major supply area with heavy seller interest. This is the final upside target if bulls maintain momentum.

Bullish Confluence:

Oversold conditions after a rapid sell-off

Strong historical demand zone tested

Clean risk-to-reward setup for long positions

Bullish divergence forming on lower timeframes (check RSI/MACD)

Fundamentals to Watch:

We’ve got several major USD-impacting news events this week (highlighted at the bottom). Watch closely for any Fed-related statements or CPI data that could trigger volatility in gold.

Trade Idea (Not Financial Advice):

Entry: Around $2,960 - $2,970

SL: Below $2,945

TP1: $3,061

TP2: $3,141

Are you buying the dip or waiting for confirmation? Drop your comment

XAUUSD - Short Trade Confirmations :

1. Strong Bearish structure

2. 1H Strong resistance

3. AMD Cycle (Accumulation, Manipulation, Distribution)

4. Liquidity Sweep in 15m

5. CHoCH

6. Targeting the Demand

7. BE at FVG 50%

8. Expecting a bullish move from the demand zone or the FVG zone

Thanks for your time..

XAUUSD TECHNICAL & COT ANALYSISOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will fall to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

XAUUSD Strategy Analysis for Next WeekThis week, Trump launched a global "tariff war", causing the international financial market to experience successive "Black Thursdays" and "Black Fridays". The gold, silver, oil, stock, bond and foreign exchange markets all witnessed sharp drops or volatile market conditions, with no market being spared.

From the perspective of the 4-hour market trend, the support level below should be paid attention to around the range of 3010-3020. The short-term resistance above is focused on the range of 3055-3060. Technically, a rebound and correction are needed. It is advisable to mainly go long on the pullback and supplement with shorting on the rebound.

XAUUSD trading strategy

buy @ 3020-3025

sl 3010

tp 3030-3035

Preserve capital, manage risk, generate returns, achieve sustainable long-term profitability, and continuously learn and develop through trading. Access the link below the article to obtain more information.