XAUUSD.F trade ideas

Analysis of gold price trend next week!Market news:

This week, the international gold price staged a "roller coaster" market. Spot gold continued to rise from Monday to Thursday, and on Thursday (April 3), it hit a record high of $3,167/ounce, but on Friday (April 4), it plummeted by more than $75 in a single day, falling to a low of $3,015, a drop of 2.44%, and finally closed at $3,038/ounce, narrowing the weekly increase to 1.2%. Precious metals such as silver and platinum fell simultaneously, among which spot silver fell by 7.2% in a single week, the worst performance since September 2020. This sharp fluctuation stems from two key events: Trump's tariff policy has caused global concerns to heat up, and Federal Reserve Chairman Powell's unexpected turn to hawkish monetary policy. The market liquidity crisis caused investors to sell gold to make up for stock market losses, and the US dollar index strengthened by 0.9%, further suppressing international gold prices. The better-than-expected non-farm payrolls report released by the United States on Friday was another reason for the blow to gold prices. The U.S. Department of Labor reported that after seasonal adjustment, non-farm payrolls in March recorded 228,000, an increase higher than the market expectation of 135,000. Non-farm payrolls data will help the Federal Reserve postpone interest rate cuts. International gold usually performs well in a low interest rate environment. Looking ahead to next week, investors need to focus on the verification of inflation expectations by the U.S. CPI data in March (April 10), the market reaction after the tariff measures are officially implemented, and whether the speeches of Fed officials will release more policy signals.

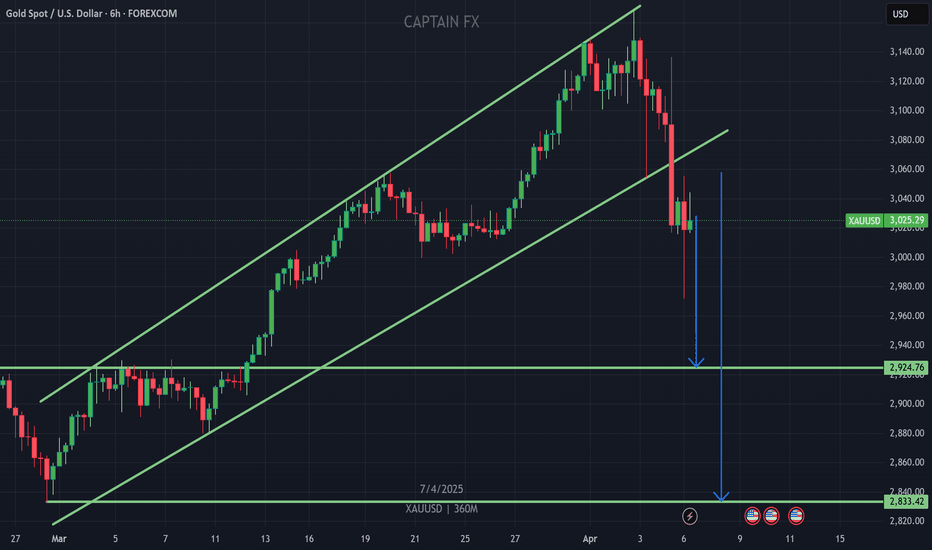

Technical Review:

After a series of large negative declines, gold is currently in a short-term trend that is bearish. The daily line has a large negative downward trend, breaking the short-term moving average and piercing the middle track, leaving a lower shadow below. The pattern shows a bearish signal of Yin Bao Yang engulfing. In the short term, it may rely on the middle track support to confirm the 10ma resistance and fall again. The 4-hour Bollinger Bands open downward, and the K-line continues to decline. The trend is bearish and downward. The gold market on Thursday and Friday this week can be described as thrilling, with a rise and fall of more than 200 points in two days! The gold market has changed suddenly, and there has been an extremely violent sweep. First, it rose rapidly to 3136 without any signs, and then fell back quickly at lightning speed, and fell below the intraday low. At present, the daily gold line has risen and fallen. The sharp rise in the early trading did not continue. It was under pressure at the high of 3168 and quickly entered an adjustment, with a downward adjustment space of more than 100 US dollars. After the high-level fluctuations of gold in the past two days, gold finally broke down on Friday night. In fact, the market was too active in the past two days, and the overall volatility was large. In fact, it was still a little difficult to operate. Although the overall outlook was bearish, the rebound amplitude was not small each time. Now sometimes it rebounded by more than 20 US dollars in a few minutes, so it may appear that it will continue to fall after a just loss. Now the high level of the gold daily line is covered by dark clouds, so how to operate next week?

Next week's analysis:

From the overall trend, the weak pattern of gold is beyond doubt, and it is reasonable to continue to be under pressure and downward. Therefore, it is recommended to pay attention to the 3050-3054 area next week, and continue to look at the 3060-3070 area above. The support that needs to be focused on is the 3000 mark shown by the weekly 5-day moving average slightly moving down. Above it, it will rebound, and breaking it will open a new round of downward space. The gold 1-hour moving average has formed a dead cross downward, so the gold bears still have power. The short-term gold can only rebound. After the gold rebounds, it will continue to sell, and then gold will enter a shock. After the gold falls sharply from a high level, it is more advantageous to sell in the short term. Unless there is a big profit to buy, it is difficult for gold to rise directly. The last physical K-line box of gold in the 1 hour will form a short-term suppression. The gold rebound resistance is 3076. If it is under pressure, then the gold rebound will continue to sell at highs.

Operation ideas:

Buy short-term gold at 3013-3015, stop loss at 3004, target at 3050-3060;

Sell short-term gold at 3063-3065, stop loss at 3075, target at 3020-3030;

Key points:

First support level: 3015, second support level: 3000, third support level: 2988

First resistance level: 3048, second resistance level: 3056, third resistance level: 3074

Gold Soars to New Heights: Staying Bullish Amid VolatilityGold surged overnight, marking its third consecutive day of gains and breaking through key resistance levels. Early trading saw prices hit a fresh high of 3220, driven primarily by safe-haven demand. After stabilizing near the 10-week moving average support, bullish momentum accelerated with favorable news catalysts, swiftly reclaiming lost ground and pushing to new highs.

On the 4-hour chart, Bollinger Bands are widening upward, with steady support from moving averages reinforcing the uptrend. Corrections remain brief, underscoring the strength of the current rally. While we maintain a bullish outlook for intraday trades, caution is advised as Friday’s close may trigger profit-taking. Key support levels to watch are 3185 and 3165—consider scaling into longs on pullbacks. With no clear resistance in sight and heightened volatility, tactical entry points should align with real-time price action.

Stay nimble, stay long.

This 3 Step System Say Gold Is A Good BuyWhen you look at this chart you will notice that

the price of Gold has crossed down the parabolic SAR.

This is a very important thing for you to take note of

--

Because this indicator shows you that Gold TVC:GOLD

is in a good buy.When you understand this system,

you will begin to see buy opportunities.

--

This opportunities will work together.When you

see this collaboration, it will show you that

you are on the right path.

--

Another thing you see on this chart

are 3 steps:

1-The price is above the 50 EMA

2-The price is above the 200 EMA

3-The price has gapped up on the Parabolic SAR

--

That last step is very important for you

to remember.

Rocket boost this content to learn more

-------------------------------------------------------------------

Disclaimer: Trading is risky please learn risk

management and profit taking strategies.

Also feel free to use a simulation trading account.

Gold top long and short structure conversionThe gold market has recently shown a clear bearish-dominated pattern, with the weekly closing high and long upper shadow negative line, combined with the gap of $50 opened lower this week, the technical bearish signal is strong. Although there was a violent rebound to 3055 during the Asian session, filling part of the gap, it encountered strong suppression near the 5-day moving average of 3030, which happened to be the resistance level transformed from the previous key support, forming a typical technical "top and bottom conversion".

Key technical analysis

Large cycle structure:

Weekly level: Long upper shadow negative line with low opening, confirming the top pressure

Daily level: Moving average system short arrangement, 3030 becomes the long-short watershed

Key support system: 3030-3000-2980 (downward layer by layer)

Core resistance: 3055 (gap filling position), 3030 (top and bottom conversion)

Trend evolution characteristics:

Support levels are lost one after another (3030→3000→2980) and short momentum continues to increase

The market enters a high volatility shock repair stage

Current market characteristics

Volatility characteristics:

Single-day volatility exceeds 100 US dollars

Quick conversion of long and short (violent rebound after a sharp drop in the Asian session)

Repeated testing of technical positions (3030 key position)

Trading environment:

High volatility makes stop loss more difficult

Technical position effectiveness is enhanced

Need to be vigilant against false breakthrough risks

Professional trading strategy

Short opportunities:

Entry Point: Near 3055 (top and bottom conversion suppression zone)

Risk control: Strict stop loss above 3060

Target level: 3035→3030 (take profit in batches)

Applicable conditions: Maintain validity before breaking through 3060

Long position layout:

Ideal position: 2958-2960 (weekly moving average support)

Stop loss setting: below 2953 (previous low protection)

Target outlook: 2980→3000 (step profit)

Core logic: grasp the opportunity of oversold rebound

Key risk control points

Position management:

Single risk control at 1-2%

Adopt batch position building strategy

Trading timing:

Asian session is mainly observed

U.S. session focuses on breakthrough opportunities

Emergency plan:

Short position immediately stops loss after breaking through 3060

Long position layout is temporarily suspended after breaking through 2950

Focus on the future market

3030 key position competition:

Continued pressure maintains short position thinking

Effective breakthrough requires re-evaluation

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 2772.38 is broken.

OANDA:XAUUSD TVC:GOLD

Technical analysis:

A trough is formed in daily chart at 2832.55 on 02/28/2025, so more gains to resistance(s) 3100.00, 3150.00, 3200.00 and more heights is expected.

Take Profits:

2833.00

2879.11

2955.00

3000.00

3057.40

3100.00

3150.00

3200.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

Gold Shaking Hands with All-Time HighsSafe-haven assets caught a strong bid in recent trading, directing Spot Gold to all-time highs of US$3,220/troy ounce versus the US dollar (XAU/USD). The shift towards safe-haven markets was fuelled by softer demand for the USD as markets fled dollar assets, as well as escalating trade tensions between the US and China. Unsurprisingly, the Swiss franc (CHF) and Japanese yen (JPY) also attracted substantial bids, with the USD/CHF pair notching up losses of nearly 4.0% – its largest one-day drop since 2015!

Monthly Resistance and Oversold Conditions

Several desks are reportedly eyeing US$3,500 as the next upside objective for Gold; however, the monthly chart reveals it is considerably overbought according to the Relative Strength Index (RSI). You will note the RSI has remained within overbought territory since mid-2024 and recently touched gloves with familiar resistance between 87.31 and 82.20. This area boasts historical significance from as far back as 2006, and each time the Index has approached the resistance, a correction/pause typically followed in the yellow metal. Consequently, it raises the question about whether buying is set to moderate/pause at the monthly resistance area between US$3,264 and US$3,187 (made up of 1.618% and 1.272% Fibonacci projection ratios, respectively).

Daily Demand Zone; Dip-Buying?

Meanwhile, on the daily chart, price action came within a stone’s throw of testing support from US$2,942 at the beginning of the week before rallying to all-time highs noted above. What is interesting from a technical perspective is that the move left behind a demand area at US$3,000-US$3,058, which, in my opinion, represents a key technical zone.

With Gold firmly entrenched in a strong uptrend, dip-buyers could emerge from the daily demand area if a correction occurs. That said, given technical indicators on the monthly chart suggesting buyers could pump the brakes, any dip-buying activity would likely be approached with caution. Confirmation – such as a bullish candlestick signal or supporting price action on lower time frames – might be required before pulling the trigger. However, any movement below the mentioned demand area signals bearish strength from the monthly resistance zone, and potentially opens the door to short-term selling opportunities, targeting daily support at US$2,942, closely followed by support at US$2,865, and possibly US$2,790.

Written by FP Markets Chief Market Analyst Aaron Hill

Gold's trend has too many friendsThere’s a well-known saying in trading: “The trend is your friend.”

I firmly believe in this principle. However, when price movements become too extreme—too fast and too far—it’s wise to exercise caution, even if you’re not ready to take the opposite side of the trade.

And right now, I believe that’s exactly the case with Gold.

________________________________________

Why a Major Gold Correction is Likely

As I’ve been repeating like a broken record since Monday, Gold’s price is severely deviated from the mean, signaling that a brutal correction is on the horizon.

After reaching a new all-time high of 3,150, Gold retraced yesterday, dropping to 3,100—a support level formed earlier in the week. A rebound followed, but as I’ve explained in an educational article, this price action looks more like a stepwise distribution rather than true buying strength.

The key point?

➡️ Support isn’t holding because buyers are stepping in—it’s holding because big sellers have paused selling.

________________________________________

Still Bullish, But a Drop is Coming

There’s no doubt that Gold is in a strong uptrend. But even if it drops 1,000 pips, the overall bullish trend would still be intact.

Key Technical Signs of Weakness

📉 Trendline Break – Yesterday, Gold broke below the rising trendline, marking the first sign of weakness.

📉 Failed Rebound – Despite a short-term bounce, the price is now more likely confirming the break rather than invalidating it.

📉 Lower High in Progress? – The next minor support sits at 3,120. If Gold breaks below this level, we’ll have confirmation of a lower high, which strengthens the bearish case.

________________________________________

Targeting the Correction

If Gold breaks below 3,120, I expect a move below 3,100, targeting:

🎯 Soft target: 3,080

🎯 Likely target: 3,030 – 3,040

I believe it’s only a matter of time before this brutal correction plays out.

Let’s see how it unfolds! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

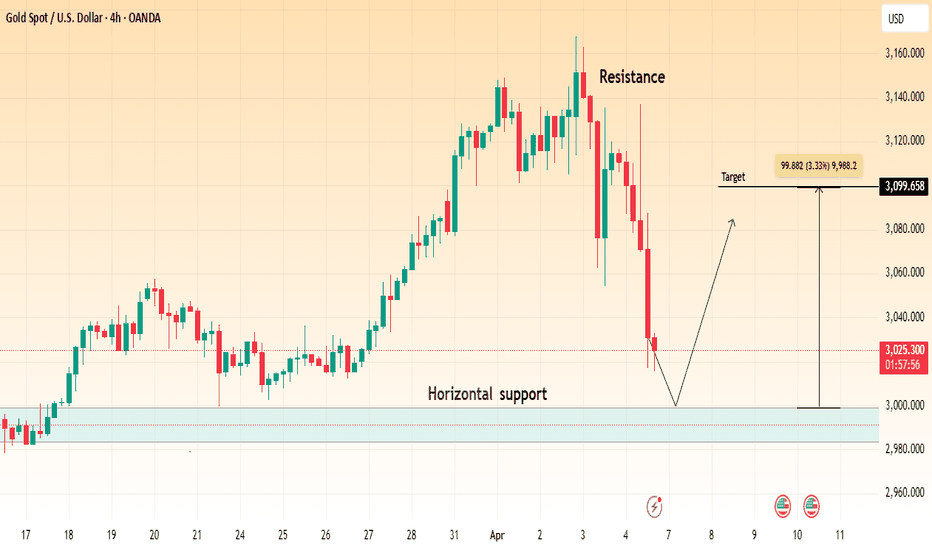

"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

Non-agricultural gold is expected to fall sharply. On Friday (April 4), at 20:30 Beijing time, the U.S. Bureau of Labor Statistics released the highly anticipated March non-farm payrolls report, which put pressure on gold.

Fundamentals: Today, gold is expected to fall sharply. The market continues to short at resistance points.

Market volatility is expected to increase during the period. The long-short game of the US dollar index near the 102 mark will determine whether it can continue to rise. If it breaks through 103, it may further suppress gold and non-US currencies. Gold is looking for direction in the range of 3080-3100 US dollars/ounce. If risk aversion picks up, it may retest the 3100 mark; on the contrary, if the US dollar continues to strengthen, breaking through 3080 will open up downside space. The decline in US stock futures may continue until early next week.

4.5 Gold falls off a cliff and waits to stabilize! ! !Gold 4-hour level: The last wave of pull-up started from the low point of 2999 to 3167. Yesterday, it fell back and tested the 618 split position 3063. The current support is still valid, which is also the MA66 day position; From the perspective of macd, it is still short-selling and has not been fully repaired. Wait until it crosses below the zero axis, and then slowly stabilizes and tends to golden cross in the future market, then a wave of trend pull-up will gradually form, and it will take time; if 3063 cannot be maintained, the two split positions below are 3035 and 3018, and attention should be paid to stabilization.

Intraday support: 3035 3018 3005

Resistance: 3045 3070 3100

Gold returns to a sharp decline?Dear friends!

Gold has a downward trend today, with the current price fluctuating around 3,097 dollars. The main reason is due to the tax measures of U.S. President Donald Trump, which help clarify the market trend but raise concerns about economic recession, thereby boosting the demand for USD, leading to an increase in its value, which affects gold.

From a technical perspective, it is not advisable to buy at this moment, as the risk is high, and for selling, we should wait for the price to establish a clear trend.

At present, it is most worth waiting for consolidation on the basis of a downward trend, as the market will sharply hit important milestones that you can build your trading strategy upon.

If you find this information useful, don't forget to like and follow Gary to receive the latest updates!

Hellena | GOLD (4H): SHORT to 38.2% Fibo lvl 3050.Dear colleagues, the price has been in an upward movement for quite a long time and I believe .that it is time for a correction in the “2” wave.

I think it is possible that there may be a small update of the maximum of the top of wave “1” to 3176.771, then I expect a correction to the area of 38.2% Fibonacci level 3050.

As usual there are 2 possible entry options:

1) Market entry

2) Entry by pending limit orders, if the price updates the maximum.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

XAU / USD 4 Hour ChartHello traders. Happy Friday. I am not taking any trades today. I caught 2 good scalp trades this week and being Friday, and with all the volitility I am going to sit this one out. Saying that, I have marked the area of interest for a push down or another push up to take out anyone who caught the short trade from the overnight sessions. Let's see how things play out over the next hour or so as Pre NY volume comes in. Be well and trade the trend. Big G gets all my thanks and a shout out.

GOLD - Price will make correction movement to support levelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some time ago price started to grow inside a rising channel, where it soon reached $2940 support level and broke it.

Then it some time traded near this level and then continued to grow in channel and soon reached resistance line of channel.

Soon, Gold reached the $3055 level and then corrected to the channel's support line, after which it turned around.

XAU reached $3055 level again and broke it, aftr which continued to grow and recently, it reached almost resistance line.

But soon, it turned around and started to decline, so, in my mind, Gold can continue to decline to $3055 level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Tariffs and large-scale non-agricultural affairs are comingGold experienced violent fluctuations yesterday, and technical analysis faced challenges. Luck factors were prominent in extreme market conditions. However, from the perspective of multi-period technical analysis, the gold price is still above the weekly, monthly and daily support, and the long-term bullish pattern has not changed. In the future, we need to focus on the 3054 support level, and the gains and losses of this position will directly affect the future market trend. The 3115 area resistance on the four-hour chart is significant, which is a key watershed in the short-term market. If the gold 1-hour moving average forms a dead cross, the short position will be more dominant. The current upper resistance is 3105-3111, and the lower support is 3054-3046. The operation is recommended to rebound short.

Operation strategy: It is recommended to rebound 3097-3105 short, stop loss 3115, target 3065-3046.