XAUUSD.F trade ideas

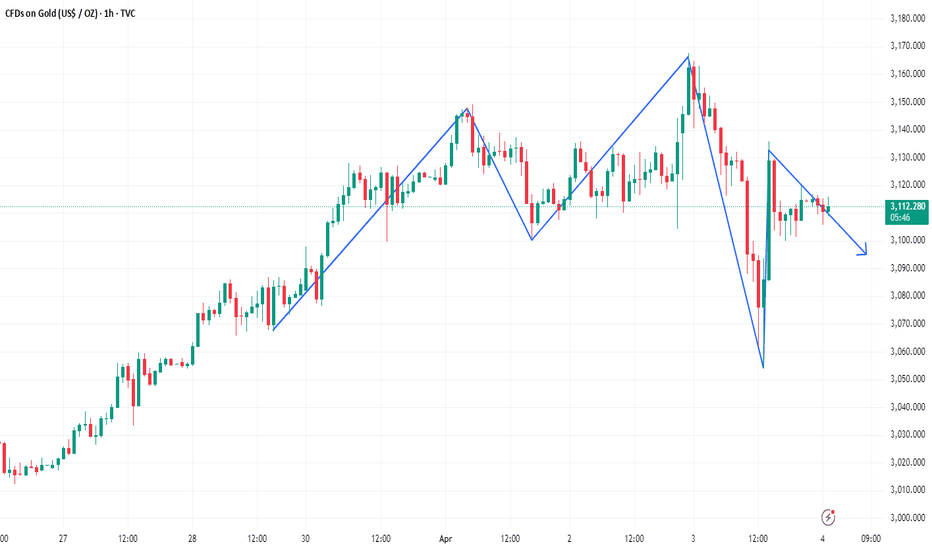

**"Gold Market Bullish Setup – Potential Breakout Ahead"** here are the key insights:

### **1. Key Support and Resistance Levels**

- **Support Level:** Around **3,054** (lower boundary).

- **Resistance Level:** Around **3,136** (upper boundary).

### **2. Trading Plan & Potential Breakout**

- The chart shows an **ascending trendline**, indicating a **bullish movement** in the market.

- The price is approaching a **resistance zone**, suggesting that if a breakout happens, the market may move higher.

### **3. Trading Setup**

- **Buy Entry:** If the price **breaks above 3,136**, a **buy trade** can be considered.

- **Stop Loss:** Around **3,083** (below key support).

- **Take Profit Target:** Next major resistance, around **3,160 - 3,180**.

### **Conclusion**

- The current setup appears **bullish**, but confirmation is needed through a **breakout above resistance**.

- If the price fails to break the resistance, a **bearish reversal** may occur, pushing the price downward.

We will continue to hold a bearish viewToday, the XAUUSD market is mired in extraordinary volatility. The uptrend in prices has continued unabated, with values rocketing to $3086. This powerful rally has inflicted heavy losses on bearish traders, leading to a mass liquidation of their positions.

Currently, the market is in a “double - whammy” situation, where both bulls and bears are feeling the pinch. This is the result of large - scale capital inflows. Savvy institutional investors and market players are deploying capital strategically, aiming to maximize profits.

Despite this current upward surge, we remain unwaveringly bearish. Our comprehensive analysis, which encompasses long - term economic trends, geopolitical developments, and technical indicators, further validates this stance. Many fundamental indicators suggest that the ongoing rally is merely a short - lived market anomaly. As the market digests various macroeconomic data, we anticipate increasing downward pressure that will eventually reverse the current uptrend.

We must not let these large - scale capital operators achieve their objectives. By staying true to our bearish view, maintaining strict risk management, and making well - informed trading decisions, we can counteract their market - manipulating tactics.

💎💎💎 XAUUSD 💎💎💎

🎁 Sell@3085 - 3080

🎁 TP 3040 3030 3020 3010 3000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

How to spot the right timing?XAUUSD has reached 3148.9 and is currently testing the upper resistance levels. Technical analysis indicates that the 3150 - 3170 range serves as a resistance zone. Given the robust bullish sentiment surrounding XAUUSD recently and the typically high trading volume and ample liquidity during the US trading session.

The 3100 level is a strong support area. Right above this support area,buying opportunities present themselves. At price points in this range, a significant amount of buy orders tend to flood the market, offering a buffer against further price decline.

It’s crucial to note that the XAUUSD market is characterized by high volatility. Thus, investors should avoid chasing rallies or engaging in short - selling at high levels. Chasing rallies exposes investors to substantial losses during short - term price retracements. Similarly, short - selling at high levels risks missing out on further upside potential. Stay vigilant to market dynamics, set stop - loss and take - profit levels rationally, and safeguard against potential risks.

💎💎💎 XAUUSD 💎💎💎

🎁 Buy@3100 - 3105

🎁 TP 3120 3130 3140

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

XAUUSD: 2/4 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 3150, support below 3053

Four-hour chart resistance 3150, support below 3113

One-hour chart resistance 3120, support below 3100

Gold news analysis: On Tuesday (April 1), spot gold continued to rise to new highs, reaching a high of $3148.94/ounce, and then dived 50$. On Monday (March 31) this week, the price of gold ushered in a new breakthrough, breaking through $3100/ounce, and rose by $100 in just one week. Multiple factors such as trade concerns, a weaker dollar and falling bond yields have driven the price of gold to rise, making it one of the most eye-catching commodities in 2025. So far this year, the price of gold has risen by 18.3%. Gold has received further support amid a sharp drop in the Nasdaq index, as investors are nervous about the tariff policy that the Trump administration will release on April 2. Trump recently announced that he would impose new tariffs on Russia and Iran. These policies are expected to have a wide impact on the global economy, causing investors to increase their allocation to safe-haven assets such as gold.

Gold operation suggestions: Gold fell back on the daily line and finally closed slightly lower. The sharp rise in the Asian session did not have a strong continuity. After the pressure near the high of 3148.50, the European and American sessions were mainly corrected by the decline. The market has fluctuated violently recently, and the adjustment space is large.

From the current trend analysis, the short-term support below focuses on the four-hour level near 3113, focusing on the 3100-3053 line. The daily level stabilizes above this position and continues to buy at a low level, waiting for the support to buy. Selling can only be entered at key points, short-term trading.

Buy: 3053near SL: 3049

Buy: 3100near SL: 3095

Sell: 3120near SL: 3125

GOLD - single supporting area , holds or not??#GOLD. well guys now we have 3112 as immediate supporting area and upside we have 3125 as immediate resistance area so keep close and if market hold 3112 then we can expect another bounce towards upside next targets.

keep in mind that 3112 is our single supporting area so if market clear that level then we will go for short means cut n reverse but on confirmation.

good luck

trade wisely

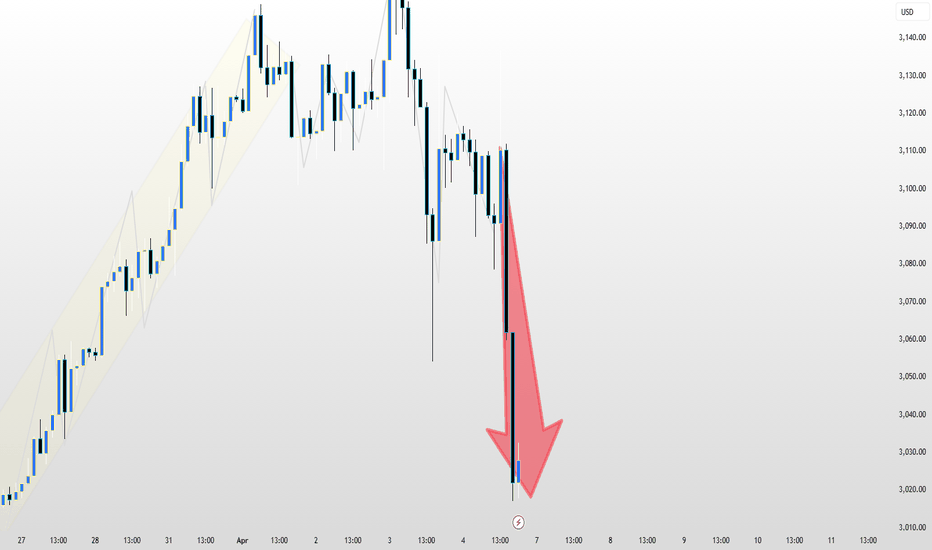

How will gold perform after the super rollercoaster market?Gold's 1-hour moving average still shows signs of turning downwards. Although gold bulls have made a strong counterattack, it is also because of the risk-aversion news that stimulated a retaliatory rebound. However, gold continued to fall after rising, and gold began to return to volatility. In the short term, gold is supported near 3100. If gold falls below the support near 3100 again, then gold shorts will still have an advantage in this war. Overall, the impact of today’s non-agricultural data is expected to be dim. What is more important is the stimulation of the news. However, it may be noted that if gold holds the 3100 mark for a long time, then gold is expected to fluctuate upward above 3100.

Trading idea: short gold near 3115, stop loss 3125, target 3100

The above is purely a sharing of personal views and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

The tariff hammer helps bulls rise stronglyTechnical analysis of gold: Affected by fundamentals, gold rose sharply again. The daily line finally closed in the positive zone and maintained a strong high at the opening. Pay attention to the upper and lower support of 3148 during the day. If it holds, it will have the momentum to continue to rise. The 4H cycle will strongly break through the upper Bollinger Band. , moving higher around the moving average support, there is no doubt that it is strongly bullish. At the same time, the middle rail has recovered, and the middle rail is still a key watershed. The lower support is around 3148 and 3138. We will go long according to the strength of the decline during the day, and then gradually look at 3170 and 3200!

Operation suggestion: Gold is long near 3138-40, stop loss at 3130, and look at 3150 and 3170!

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. The market is changing rapidly. There is no general who always wins in this market. Therefore, it is important for us to make corresponding adjustments according to market changes. We must do a good job of protection. There will always be some ups and downs in the market, but there will be a rainbow after the rain. We must not forget our original intention and forge ahead.

Gold trend analysisGold prices strengthened again, with spot gold prices rising by more than 1.5% during the week. This upward trend was mainly affected by the tariff policy that the United States is about to implement. Trump will announce reciprocal tariff measures against all countries. The cautious market sentiment has driven funds to flow to safe-haven assets. At the same time, the market will usher in the release of a number of important economic data. Before the release of the non-farm payrolls report, market traders are paying close attention to various economic indicators. Richmond Federal Reserve Barkin said that the current economic situation is shrouded in thick fog, and it is difficult for policymakers to clearly judge the trend of interest rates, while concerns about economic recession have not dissipated.

From the daily level, the daily line closed with a small cross Yin line after three consecutive positive lines. There is selling pressure on the upper side, and it is necessary to pay attention to the continuity of the bulls. If the daily line closes another real Yin line, gold will further expand the adjustment in the short term, and the support near 3060-57 may be tested on the lower side. From the current form, yesterday's small Yin line is temporarily regarded as a bull's stepping back. Investors are currently waiting for Wednesday's ADP and detailed tariff plans. The market avoids the cautious mentality of uncertainty. Technically, gold is still in a bullish trend, and the main idea is to buy more after a pullback.

Short-term 4-hour chart, the current support below is around 3100-3095, which is the key to whether a short-term short position can be formed. If it falls below, it will enter a short-term short trend. The short-term upper resistance focuses on the two positions of 3027-3038, which is the recent top and bottom conversion position. If it goes up, it is around 3150. According to the recent market trend, it is all rising. Therefore, today we continue to buy more at a low level and look at the cycle of rising, and then combine the strength and weakness layout. US market and other data.

Gold strategy: It is recommended to buy more at 3108/09, stop loss at 3100, and target around 3123-3127 and 3137.

H12 Key Insight – XAUUSD Structure Shift?🧭 H12 Key Insight – XAUUSD Structure Shift

The 12H chart confirms a clear CHoCH (Change of Character), printing a Lower High after the massive rejection from the premium supply zone at 3135–3145.

Here’s the refined breakdown 👇

🔹 What’s Happening:

After tagging a strong premium OB, price formed a Lower High and Lower Low — initiating bearish 12H structure.

A small bearish OB was left unmitigated around 3042–3052, now acting as potential sell interest.

Price is currently ranging just above that, showing indecision — any break and retest may fuel continuation down.

🔻 Key Bearish Target Zone:

🟦 Demand zone at 2896 – 2860

🧠 Why:

Clear imbalance from previous rally

Aligns with EQ level + strong H4 OB

Final mitigation zone before bigger trend decision

✳️ Scenarios from H12 POV:

🟥 If 3050–3060 acts as supply again → continuation toward 2950 then 2890

🟩 If price reclaims 3080+ and holds → structure may shift again bullish

📉 H12 confirms bearish bias, but lower timeframes will give the actual sniper entry triggers.

💬 Drop your thoughts below – Are you still buying dips or flipping bearish?

Stay confident. Stay structured. Let the charts guide you! 🧠💥

The impact of non-farm payroll data on XAUUSDImpact of Non-farm Payroll Data on the US Dollar

The increase in non-farm payroll employment in the United States in March far exceeded expectations, indicating the strength of the U.S. labor market and, in turn, suggesting that the overall U.S. economy is relatively healthy.

Strong economic data will boost market confidence in the U.S. dollar, attract global capital inflows into the United States, increase the demand for the U.S. dollar, and drive the appreciation of the U.S. dollar.

After the release of the non-farm payroll data in March, the U.S. dollar index rose sharply in the short term, laying the foundation for the bearish sentiment of XAUUSD.

Impact of Non-farm Payroll Data on Gold

On the one hand, a stronger U.S. dollar makes gold priced in U.S. dollars more expensive for investors holding other currencies, thus suppressing the demand for gold and leading to a decline in the gold price.

On the other hand, the slowdown in the annual rate of average hourly earnings alleviates the inflation risk driven by wages, weakening the attractiveness of gold as a tool for hedging against inflation.

In addition, the rebound of U.S. Treasury bond yields due to favorable economic data also reduces the attractiveness of gold as a non-yielding asset.

Considering these factors comprehensively, the gold price has been under pressure after the release of the non-farm payroll data, and XAUUSD shows a bearish trend.

Without professional guidance, the fluctuations in the market, whether in terms of its downward or upward movements, are truly remarkable. If you manage to pick the right direction, there's a great chance for you to reap substantial profits. However, what if you make an incorrect choice? Are you genuinely capable of shouldering the resulting consequences? Rather than getting involved in such trading that resembles gambling, I'd much prefer that you hold off and wait until the market stabilizes before making a comeback to the trading scene.

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

XAUUSD Today's strategyAt present, Trump has announced that the United States will impose a comprehensive 10% tariff on all goods. This tariff policy will lead to an escalation of global trade tensions and an increase in economic uncertainties. Investors' concerns about risky assets have intensified, and they will flock to safe-haven assets such as gold, thus driving up the price of gold.

The increase in tariffs will cause the prices of imported goods to rise, which in turn will trigger inflation expectations. Under the inflation expectations, as a store-of-value asset, the value of gold will be enhanced, and its price will rise correspondingly.

These impacts are merely based on an analysis of general situations. In reality, the market conditions will also be influenced by a combination of various factors, such as the countermeasures taken by different countries, other macroeconomic factors, market expectations, and so on. Therefore, the price trends are likely to be more complex and changeable.

XAUUSD Today's strategy

buy@3115-3125

tp:3140-3150-3160

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

Gold accumulated motivation for promising increasing!Today, gold continues to attract some buyers after yesterday's retreat from record highs amid persistent safe-haven demand, driven by concerns about a global economic recession due to tariffs. Furthermore, expectations of Fed rate cuts and lack of interest in buying USD provide additional support for XAU/USD.

Currently, the metal is moving around $3,130 and upside potential remains highly rated as the EMA 34 and 89 lines continue to act as dynamic support levels. Additionally, historical bullish patterns are repeating themselves, suggesting that after this period of retreat and consolidation, an impressive upward movement is expected.

A REPORT ON GOLD TODAY 02/04/02025Price eased after a prolonged bullish run in the first quarter of the year 2025. gold traded an all time high of $3150 per ounce and later dropped from the high. What next do we expect from the market next? A further decline to 3065 is possible. Or we may see a rebound to the all time high

GOLD/XAUUSD SWING UPDATESHello folks, Gold are on a trend right now. Waiting for this zone for shorts? 3180 might be the high or 3200.

The Initial targets at 3066 zone.

This idea base on my previous idea on fibonacci, Full updates once price goes 3066 zone.

Idea on the new highs maybe later on High impact news.

The idea here is short.

Trade at your own risk.

Follow for more.

I will update once this zones mitigated. Good luck! pewwpeww

Gold (XAU/USD) Bullish Breakout – Next Targets in SightThis chart of XAU/USD on the 2-hour timeframe shows a strong bullish trend, characterized by break-of-structure (BOS) confirmations and accumulation phases. The price previously found support in an order block, leading to a breakout above key resistance levels. The market has continued to ma ke higher highs, with multiple accumulations fueling the uptrend.

Currently, gold is trading around 3,143 and appears to be targeting the 3,160–3,180 zone. A potential pullback or consolidation may occur before the next leg higher. The bullish momentum remains intact unless a strong reversal signal appears.

TP1: 3,160 (short-term target)

TP2: 3,180 (next resistance zone)

TP3: 3,200+ (if momentum continues)

Watch for a possible pullback before continuation, but as long as the structure holds, the trend remains bullish.

Gold (XAU/USD) Intraday Buy Setup – Demand Zone Reversal with 3.Timeframe: Appears to be intraday (possibly 5-15 minutes).

Indicators:

EMA 30 (red): Showing recent bearish momentum.

EMA 200 (blue): Positioned above, indicating a longer-term bearish trend.

Candlestick Pattern: After a steep drop, price shows signs of consolidation and potential reversal.

📌 Trade Setup (Long/Bullish Bias)

Entry Zone: Around $2,963.2

Price is expected to pull back into this purple demand zone before moving up.

Stop Loss (SL): $2,956.1

Placed below the support zone to limit downside risk.

Take Profit (TP / Target Point): $2,988.2

A previous supply zone near the EMA 30, where selling pressure could return.

📊 Risk-Reward Ratio

Risk: $2,963.2 - $2,956.1 = $7.1

Reward: $2,988.2 - $2,963.2 = $25

RRR (Reward-to-Risk Ratio): ~3.5:1

This is a solid ratio, suggesting a high-potential trade if the setup plays out.

📈 Bullish Scenario

Price pulls back into the demand zone (entry).

A bullish candlestick confirmation or wick rejection could trigger a buy.

Target is the previous structure + EMA zone.