XAUUSD.F trade ideas

Gold Market Sweeps to 3060, Eyes Mitigation at 3120Gold market recently made an imbalance sweep through the 3060’s, but now it’s on a pullback to mitigate the 3120 level. This could set the stage for the next big move, with market sentiment poised for a possible shift. follow for more insights , comment and boost idea .

Countdown to the implementation of tariffs - long-short game1. Real-time market and core drivers

Core driving factors:

Countdown to tariff policy: The 10% base tariff signed by Trump on April 2 will take effect on April 5. Combined with the impact of automobile tariffs (25%) on the global supply chain, market concerns about inflation (expected to rise to 3.5%) and economic recession continue to ferment. The EU has launched a retaliatory tariff plan, which may further boost the safe-haven demand for gold.

Geopolitical escalation: The situation in the Middle East continues to be tense. The US military deployed 6 B-2 stealth bombers to the Diego Garcia base and formed a double aircraft carrier strike group in the Red Sea; the Shandong ship of mainland China confronted the USS Carl Vinson in the Taiwan Strait, and the geopolitical risk premium provided support for gold prices.

Central bank gold buying wave: Global central banks will net buy 1,045 tons of gold in 2024. SPDR Gold ETF holdings increased to 931.94 tons, a three-year high, indicating that institutional funds continued to inflow.

2. In-depth analysis of technical aspects

Trend and structure:

Monthly level: After gold price hit a record high of $3167, it formed a "head and shoulders bottom" pattern, and the measured increase pointed to $3200-3300. The Fibonacci extension level shows that $2250/2480/3200 constitutes a golden channel, and it is currently in the third wave of main rise.

Daily level: The Bollinger band opening expanded to $120 (upper rail 3175, lower rail 3055), the RSI indicator is overbought (72) but no top divergence has occurred, and the MACD green column continues to expand, indicating strong bullish momentum.

Key points:

Support level: $3050 (Daily Bollinger band middle rail + Fibonacci retracement level).

Resistance level: $3170 (historical high), $3200 (integer mark + weekly RSI critical value).

3. Long-short strategy and risk control

Swing trading strategy:

Entry: If the gold price breaks through $3170 and then falls back quickly, you can place a short order in the 3160-3150 range, with a target of $3130.

Stop loss: $3180 (admit the mistake and leave the market after breaking through the historical high).

Win-loss ratio: 4:1.

Entry: Relying on the support of $3050, build positions in batches, first position (US$3155) + additional position (US$3165), the total position does not exceed 40%.

Target: US$3130 (first stage), US$3150 (second stage).

Stop loss: $3,135

4. Institutional views and outlook

Goldman Sachs: Raised its gold price forecast for the end of 2025 to $3,300, emphasizing that central bank gold purchases (1,000 tons per year) and the Fed's rate cuts (58% probability in May) are the core driving forces.

UBS: Maintains a target price of $3,200, pointing out that gold ETF fund inflows (net inflows of $23 billion in the first quarter) and geopolitical risks (Taiwan Strait, Middle East) will push prices to break through historical highs.

Geopolitical risks: After the tariffs take effect on April 5, the EU may initiate retaliatory measures, coupled with the escalation of the situation in the Middle East, and the safe-haven demand for gold may further explode.

5. Key events

April 5: Tariffs take effect, pay attention to EU countermeasures;

April 7: US non-farm data (forecast to increase by 180,000);

April 10: Federal Reserve meeting minutes.

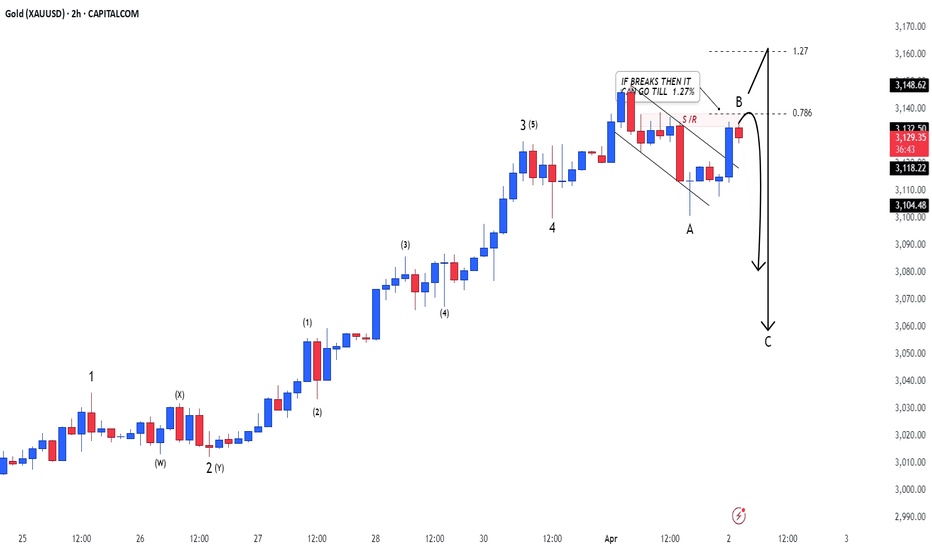

Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

Gold price hits a new all-time high!Market news:

In the early Asian trading on Thursday (April 3), spot gold continued to rise, once refreshing its historical high to $3,168/ounce, as US President Trump declared a national emergency on Wednesday to enhance the competitive advantage of the United States, protect US sovereignty, and strengthen US national and economic security. He will impose a 10% benchmark tariff on all goods imported into the United States and impose higher tariffs on some of the largest US trading partners. This move will lead to an intensification of the trade war launched after his return to the White House, and the market risk aversion sentiment has risen sharply. After the news of large-scale tariffs came out, the market risk aversion sentiment rose sharply in the early Asian trading on Thursday, US stock futures plummeted, and Dow futures plunged more than 1,100 points. London gold prices soared, and international gold prices soared after US President Trump announced reciprocal tariffs on global trading partners. Gold is traditionally a safe-haven asset in times of geopolitical and economic uncertainty. When people's concerns about the global economy intensify, investors regard gold as a safe haven. Such concerns have helped gold prices rise 19% so far this year after a strong rally in 2024, driven mainly by massive central bank purchases and strong demand in Asia. The dollar index fell after Trump's tariff plan was announced, making gold more expensive for buyers holding foreign currencies. Investors need to pay attention to the number of layoffs in challenger companies in the United States in March, the number of initial jobless claims in the United States for the week ending March 29, and the ISM non-manufacturing PMI data in the United States in March. In addition, investors need to pay attention to the market's further interpretation of Trump's tariff policy and the response measures of various countries, and pay attention to changes in national stock market performance and risk aversion.

Technical Review:

At the daily level, gold started the downward adjustment mode on Tuesday, breaking the previous continuous rise in one fell swoop. However, the current moving average system still maintains an upward divergent trend. The 4-hour trend of gold temporarily maintains a high range of oscillation repair. At present, the short-term moving average is basically in a state of adhesion and flattening, and tends to continue to maintain a high-level oscillation repair trend during the day. The 1-hour moving average of gold is still a golden cross with upward bullish arrangement. Although gold fell below the moving average support yesterday, the strength of gold bulls to bottom out and rebound is still relatively strong, and with the support of gold safe-haven, gold bulls are still better. As long as it does not break 3100, it will continue to be strongly bullish.

Today's analysis:

The news of gold early in the morning upgraded the risk aversion, and gold broke upward again. Then the previous resistance of gold has now become support again. The previous platform support of gold at 3135 has broken upward, so gold has now formed support at 3135. Gold fell back in the Asian session and continued to buy. Since after the shock, gold bulls have exerted their strength again under the stimulation of risk aversion, the trend continues to belong to bulls, and gold fell back in the Asian session and continued to buy.

The 1-hour moving average of gold turned upward again, and gold bulls regained control of the home court. Gold fell back in the Asian session and continued to buy on dips on the previous platform support of 3135. Now risk aversion stimulates gold to rise. Don't chase it directly at high levels for the time being, and wait patiently for the opportunity to fall back. As risk aversion is upgraded, gold buying will continue to be strong and gold is expected to rise to a higher level.

Operation ideas:

Short-term gold 3132-3135 buy, stop loss 3124, target 3160-3170;

Short-term gold 3174-3177 sell, stop loss 3185, target 3140-3130;

Key points:

First support level: 3140, second support level: 3133, third support level: 3120

First resistance level: 3166, second resistance level: 3174, third resistance level: 3187

XAUUSD Technical Breakdown (1H + 4H Combo)

gold can spike briefly in early Tokyo session if BOJ doesn’t act immediately.

NO, it won’t last if BOJ hits the market or USD/JPY reverses.

1. Price Action – Tension’s High

• 4H: Classic Evening Star showing up. That’s a solid bearish reversal — sellers are circling.

• 1H: Weak bullish candle trying to break out, but it’s soft. Feels like bulls are exposed.

• Inside Bar on 1H: Tight, coiled range. Something’s about to pop — either a breakout or a flush.

2. Range Game – Price is Trapped

• Right now, we’re chopping between 3,154 – 3,160.

• Price is teasing strength but keeps rejecting resistance.

• Trap zone is active — don’t chase a late bull move here, that’s how you get clipped.

3. Indicator Signals – Read Between the Lines

• VWAP on 1H: Flat. Price is just above, but there’s no real conviction.

• Volume:

• 1H: Dropping off — sellers may be setting the bait.

• 4H: Climbing — looks like big money is getting ready to pull the rug after drawing in late buyers.

4. Trend Check – Short-Term Pullback Brewing

• 1H: Price is pushing into resistance — feels toppy.

• 4H: Overbought vibes, and bearish divergence is starting to creep in.

5. Volume – Telling the Real Story

• 1H: Weak follow-through. Buyers are drying up.

• 4H: Volume’s picking up, but it could be climax buying — one last push before it rolls over.

6. Key Zones – Support & Resistance

• Resistance: 3,160 – 3,175. Price hit it and bounced like it ran into concrete.

• Support: 3,132 – 3,122. That’s where buyers show up with bags of cash.

• A clean break below 3,154 opens the trapdoor.

7. Momentum – Running Out of Gas

• Bulls tried. They’re tired.

• No solid follow-through = bears lining up to take control.

8. Elliott Wave – The Final Push

• This looks like a stretched-out Wave 5. It’s spent.

• Correction Wave A likely on deck — target: 3,132.

9. Harmonics – Pattern Breaking Down

• Bearish AB=CD pattern forming, but the D-point never reached 3,172.

• It’s rejecting early — could be a heads-up for reversal traders.

10. Volatility – Calm Before the Storm

• Nikkei’s dropping — that’s risk-off. Could give gold a short-term pop.

• But if the BOJ steps in and the yen strengthens, USDJPY drops, and gold might not hold gains.

• No major moves out of Cambodia/Vietnam yet, but keep an eye on JPY volatility.

⸻

Trade Setup – Asia Session Plan

• Order: Sell Stop @ 3,153.00 (wait for the breakdown)

• Take Profit: 3,132.00 (targeting the demand zone)

• Stop Loss: 3,163.00 (tight stop just above resistance)

• Confidence: 88%

⸻

Why This Trade Makes Sense:

• You’ve got a bearish reversal on the 4H and no real volume to support a bullish breakout.

• A breakdown from this range opens up a clean downside run.

• Asia’s risk-off, but gold already reacted — the juice might be gone.

• 2.1 R:R setup — tight, sharp, and efficient.

=========

SHORT-TERM: Gold’s Got a Window – But It’s Narrow

• Nikkei’s drop = risk-off vibes.

• Tariff tension = safe haven demand rises.

• Asian traders might push XAUUSD up a bit early, sniffing fear in the market.

• If BOJ stays silent, gold pumps toward 3,162 - 3,170.

Gold market trend analysisGold risk aversion pushed up gold prices, but the bulls failed to continue, and gold prices fell after rising. From a technical perspective, the 4-hour gold price remained above the moving average, and the bullish trend remained unchanged. Structurally, the rise in gold prices was symmetrical in time and space, and the early decline was in line with expectations. The hourly chart showed a weak short signal and diverged. At present, the upper resistance is at 3137-3141, and the lower support is at 3111-3106. In terms of operation, I suggest that the callback is mainly long, and the rebound is supplemented by high short.

Operation strategy 1: It is recommended to pull back to 3105-3100 long, stop loss 3092, and the target is 3130-3150.

Operation strategy 2: It is recommended to rebound to 3139-3144 short, stop loss 3150, and the target is 3120-3105.

Mid-day trend downCAPITALCOM:GOLD

Time Frame 15 Minutes Gold Chart

Look at the volume on the chart, the price once moved towards the volume resistance but could not move forward and now we are seeing the price return to the high volumes

From the sellers' point of view, this is a sell level for the gold trend and our target targets are 3093 and 3073

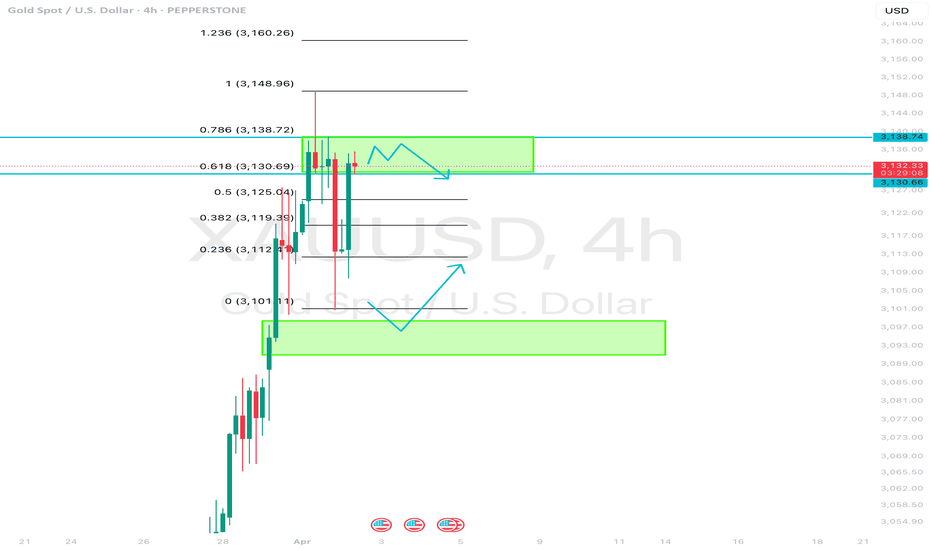

Daily Analysis- XAUUSD (Wednesday, 2nd April 2024)Bias: No Bias

USD News(Red Folder):

-ADP Non-Farm Employment Change

Analysis:

-Strong rejection from ATH 3148

-Looking for bearish structure on lower timefram

-Potential SELL if there's confirmation on lower timeframe

-Pivot point: 3140

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: 3RD MARCH 2025

Hello Everyone,

Since October 2023, our gold price analyses have been consistently accurate. In the past week, gold reached our initial target of $2,877 and achieved a new all-time high (ATH) of $2,956, before retracing to the Gold Turn Level at $2,875. We previously noted that a bullish trend would be confirmed if the 5-period Exponential Moving Average (EMA5) crosses and holds above $2,877.95; otherwise, a reversal toward the Gold Turn levels was anticipated.

* We also stated The key level at $2,735 remains a critical zone. Active Gold Turn levels at $2,875 and $2,735 suggest that the price may revisit these areas before advancing to TP1 and beyond again.

* We also stated Fair Value Gap (FVG) provided strong support at $2,850, with the EMA5 approaching the first take-profit (TP1) level at $2,877, leading to a bullish surge that touched the all-time high. However, the EMA5 has yet to cross and stabilize above $2,877.

This worked to be perfectly as anticipated.

- This situation persists, with the EMA5 still not locked above $2,877, which is necessary for further bullish confirmation. If the EMA5 fails to cross and hold above this level, the price may reverse to test the KEY level at 2735 before potentially bouncing back upward.

Recommendations & Strategy:

* Focus on EMA5: Watch its behavior around 2877 for key signals on short- and long-term trades.

* Support Levels: GoldTurn levels at 2735 is vital for identifying reversal points and prime dip-buying opportunities.

Our ongoing analysis will continue to focus on these technical indicators to navigate the current market conditions effectively.

For precise entry and exit points, check our daily, 12H, 4H, and 1H analyses for clearer market guidance.

We’ll continue to provide daily updates, insights, and strategies on our TradingView and YouTube channels every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

Gold 1H Intra-Day Chart 31.03.2025Gold has hit $3,100 like I said it would! So what's next?

Option 1: Gold starts dropping back down now towards $3,060 for a much needed correction.

Option 2: If Gold closes above the $3,100 resistance zone, it'll be bullish towards $3,140!

Which scenario do you find more likely?

"Gold Spot / U.S. Dollar - 45 - OANDA"**Key Features of the Chart:**

1. **Resistance Zone (~3,150 - 3,170):**

- A highlighted area where price is expected to face selling pressure.

- The projection suggests price may test this zone before reversing downward.

2. **Support Zone (~3,056 - 3,066):**

- A critical level where price may find buying interest.

- The projection suggests a bearish movement towards this level after reaching resistance.

3. **Projected Price Movement (Bearish Outlook):**

- The black zigzag line forecasts a price rejection from the resistance zone.

- A series of lower highs and lower lows indicate a downtrend.

- The price is expected to decline towards the support level.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.