XAUUSD.F trade ideas

Gold may come under pressure and fall in the evening!How much room is there for gold above 3100? This week, the strong bull market of gold has been rising again and again, with no intention of stopping.

Yesterday morning, the market opened directly and broke through the high. The European market was under pressure at 3130 and corrected sideways. The US market bottomed out and rebounded and closed near the high point.

This kind of strong market closed strongly at a high level, especially the market that rose in the early morning. Generally, there will be a continued rise in the morning of the second day. The same was true yesterday, Monday. Time cycle.

So can we still be bullish today? Tomorrow, the tariff policy will be implemented on April 2. Buy expectations and sell facts. The previous daily line has been three consecutive positive lines. Gold may fall back in the next two days. Unless there is a large gap between the actual implementation and expectations, it may help push gold to continue to rise.

I personally think that gold will adjust at the end of this week, and at worst it will fluctuate. At this price, don't chase more, and don't touch the ceiling.

In the case of gold prices hitting new highs, after all, there is no previous high to refer to, so the risk area can only be judged by the increase.

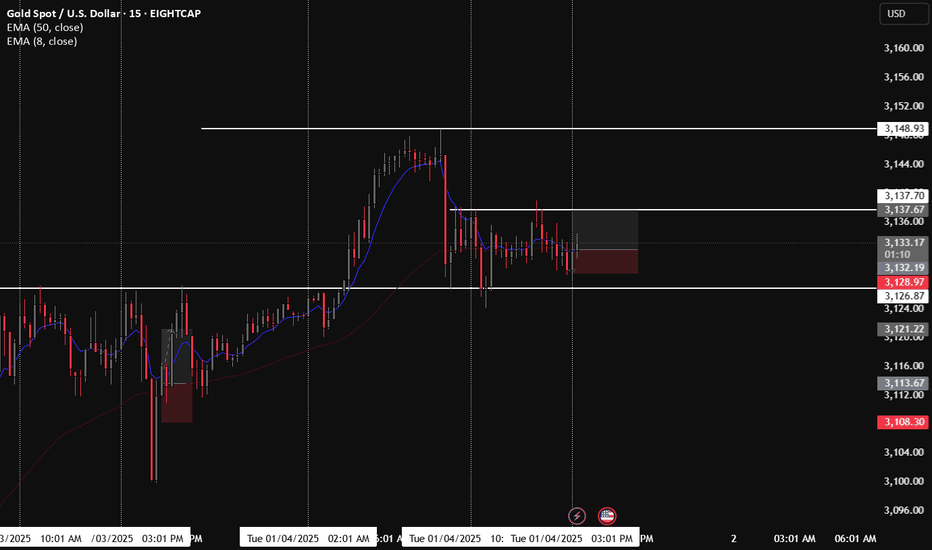

Although the market rose today, it fell back under pressure from 3150, and the lowest price hit 3124. Therefore, the focus of the European session will be on the gains and losses of 3120. If it breaks, the short-term bearish trend may further fall to 3110-3100.

If the European session does not perform well and maintains sideways fluctuations, there may be a decline in the evening, and at most it will only rebound, and there is little hope of breaking the high.

In terms of trading, a total of four orders were operated yesterday, and one order was loss-making:

1. The 3073 long market was not given a slight difference, so I went long aggressively at 3081, and stopped profit at 3110 after reducing the position at 3100;

2. After the rise in the afternoon, I expected a correction, and I went short with a light position at 3112, and stopped loss at 3120;

3. I continued to go short with a light position at 3124 in the European session, and reached the target position of 3100 after reducing the position at 3110;

4. There were many orders at 3100, and I stopped profit at 3124 before the break

Precise gold trading signalsSpot gold opened higher and moved higher in the morning trading on Monday (March 31), breaking through $3,090/ounce and setting a new record high of $3,111.54/ounce. The market was mainly driven by geopolitical risks and market concerns about the global trade war, which attracted investors to safe-haven assets. The market expects the Federal Reserve to cut interest rates by 63 basis points this year, starting in July. Goldman Sachs raised the probability of a US recession from 20% to 35%. Goldman Sachs expects the Federal Reserve to cut interest rates in July, September and November. The market is currently preparing for Trump's plan for reciprocal tariffs on April 2.

This week, the focus will be on the implementation of global trade tariffs on Wednesday and the non-farm payrolls report on Friday, which may strengthen gold's safe-haven appeal. Other important data include the ISM manufacturing PMI and JOLTS job openings on Tuesday, ADP employment on Wednesday, and the ISM non-manufacturing PMI and initial jobless claims on Thursday.

Gold has four consecutive positive weekly lines, and the price has risen strongly based on 5MA. The K-line continues to diverge upward against the upper Bollinger track. Last week, the K-line closed with a real big positive line, and there will be further continuation this week. The upper track has moved up to around 3122, but today's monthly line is closed. After the high, we must also be careful of the risk of retracement. The daily K-line also broke the high after the consolidation last week. The current price has risen to 3111. The bulls are very strong, and there is further short-term growth. Pay attention to the resistance near the upper track 3117 in the short term, but it should be noted that MACD has signs of top divergence, so be careful of the market going up and falling back to wash the market. The 4-hour chart is also in a very strong trend.

Intraday operations still adopt the idea of low-to-long, bullish but not chasing the rise, gold rose and broke the high in the morning, so the European session will continue, the intraday support is 3097-3086, the watershed is the early low of 3076, the European session falls back to around 3097-86 and continues to be long, focusing on the strength of the European session, the European session is strong, and the US session has a second rise, if the European session is weak, the US session will fluctuate.

Gold strategy: It is recommended to buy at 3097-3095, stop loss at 3086, and target 3113-3122-3132

GOLD LongGold has been trending upward for the longest of time and I don't think it's over quite yet.

Price have found some consolidation and is preparing for the next move. I think we have some space to the upside to complete a double top before the bears will start to come in and send the price down.

Strong acceleration to the top? Gold trading analysis strategyGold early layout plan: Long and short strategies in the real market all the way to stop profit, lucrative profits, witnessed by the whole network!

News: On the fundamentals, last week's re-strengthening, in addition to the escalation of tensions in the global economy and trade, there is also support from the Middle East tensions and the optimistic impact of the Ukraine negotiations that are not as expected; and this week will usher in Trump's tariff week, and countries are currently relatively tough and oppose the unilateral imposition of tariffs by the United States. And a comprehensive response is about to be made. This will increase economic concerns and the safe-haven demand for gold. Therefore, although there are some profit-taking and resistance suppression in the gold price at present, under the mutual game of global trade tariffs and the intensification of geopolitical tensions, a temporary retracement is still creating entry opportunities for bulls, and in the short term, it is still expected to refresh the historical high to around US$3,150. In the day, we will pay attention to data such as the Chicago PMI in March and the Dallas Fed Business Activity Index in March in the United States. It is expected that the impact will be limited. According to the trend of last week, there is also momentum for strengthening again. Therefore, the day will still be bullish and rebound-oriented. This week, the focus will be on the implementation of global trade tariffs on Wednesday and the non-farm payrolls report on Friday, which may strengthen gold's safe-haven appeal. Other important data include Tuesday's ISM manufacturing PMI and JOLTS job openings, Wednesday's ADP employment, and Thursday's ISM non-manufacturing PMI and initial jobless claims.

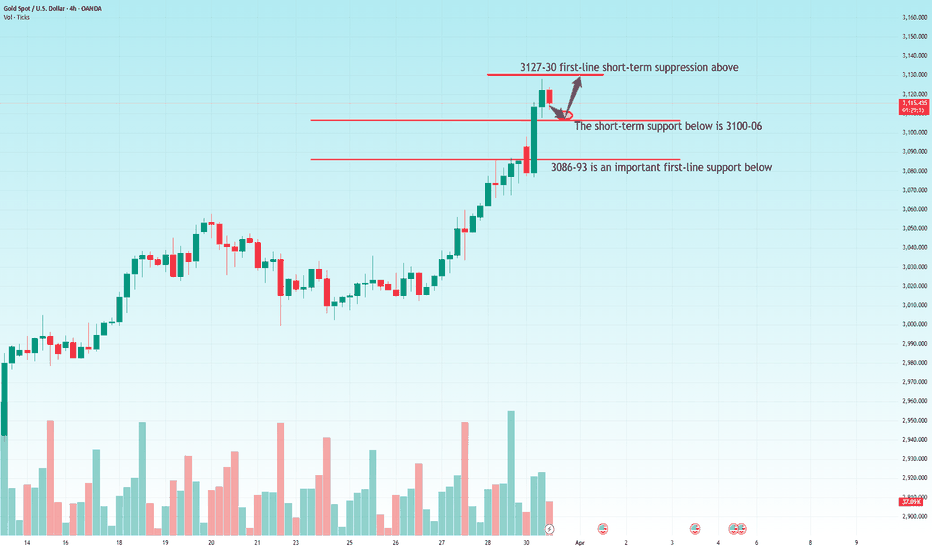

Gold technical analysis: Gold technical analysis: Gold is really simple, you can make money with your eyes closed, and now it has reached the point where everyone can make money. On the contrary, I began to become cautious and timid. Gold jumped high in the early trading, quickly sold off and washed the market, and successfully got many people off the bus with a trick of fishing for the moon in the bottom of the sea, and then pulled up all the way, which was really strong. I emphasized before that gold would not peak if it did not soar by hundreds of dollars, and now this rhythm is getting closer and closer. Today, it rose by 50 US dollars a day. I dare to guarantee that there will be another day of 100 US dollars this week, which means that the top is just around the corner. Go long with the trend, but don't be a long-term investor. Today, we will focus on the breakout of 3127-30. If it fails to break higher, then this point may become a short-term high point. It is best to go long when it falls back to around 3100-3105. Finally, I would like to advise the majority of retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, overall, today's short-term operation strategy for gold is to go long on pullbacks and go short on rebounds. The short-term focus on the upper resistance of 3128-3130 and the short-term focus on the lower support of 3100-3097. Friends must keep up with the rhythm. Maintain the main pullback and go long. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the session, and pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long on the 3100-3105 line of gold.

Trading discipline: 1. Don’t blindly follow the trend: Don’t be swayed by market sentiment and other people’s opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform us in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

XAU/USD (Gold) AnalysisXAU/USD (Gold) 4H Analysis

Gold (XAU/USD) remains in a strong uptrend, trading around $3,128.41, well above the 50-period moving average (blue line). This moving average has been acting as dynamic support, reinforcing bullish momentum.

📈 Bullish Scenario:

As long as Gold remains above the 50-period moving average, the uptrend is intact.

A retracement to the highlighted support zone could provide potential buying opportunities before the next move higher.

📉 Bearish Scenario:

A break and close below the support zone could indicate a deeper pullback.

However, as long as price remains above the 50 MA, the overall trend remains bullish.

⚠️ Risk Disclaimer:

This is not financial advice or a trading signal. Always confirm market conditions using your own strategy before making any decisions.

Gold Wave Analysis – 7 April 2025

- Gold reversed from round support level 3000.00

- Likely to rise to resistance level 3100.00

Gold recently reversed up from the support area between the round support level 3000.00 (which stopped the earlier minor correction iv in the middle of March) and the lower daily Bollinger Band.

This support area was further strengthened by the support trendline of the daily up channel from January and by the 50% Fibonacci correction of the sharp upward impulse from February.

Given the strong uptrend on the daily and weekly charts, Gold can be expected to rise to the next resistance level 3100.00.

The bull's charge trumpet was successfully soundedFrom the 4-hour analysis, the support below is around 3100-06, with a focus on the support line of 3086-94 below, and the short-term pressure above is 3127-3130. Keep the main tone of participation in the idea of buying on pullbacks unchanged. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for the shutdown point to enter the market.

Gold operation strategy:

1. Gold retreats to the 3100-3106 line for more, and retreats to the 3086-3094 line to cover more positions. The stop loss is 3079, and the target is the 3125-3130 line. If the position is broken, continue to hold;

Gold rose more than 1% in a single dayGold technical analysis

The resistance level of the daily chart is 3150, and the support level below is 3060

The resistance level of the four-hour chart is 3150, and the support level below is 3078

The resistance level of the one-hour chart is 3130, and the support level below is 3098

Risk aversion and policy expectations jointly push up the price of gold. After stabilizing at $3100, the next target is $3130-3170; if the NY market data is negative or a technical correction occurs, it is necessary to pay attention to the effectiveness of the support near 3100.

Comprehensive consideration is mainly to buy at low levels, focusing on the breakthrough signal of $3130, the 4-hour rising channel is intact, and the rising channel that breaks through 3130 will move towards the 3150-3170 range

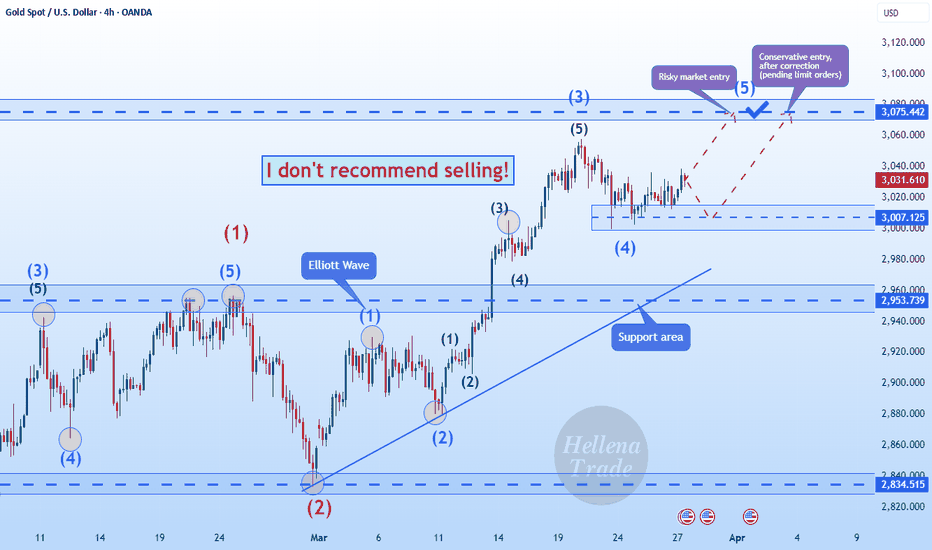

Hellena | GOLD (4H): LONG to resistance area 3075.Colleagues, I believe that price will reach the 3075 area, completing an upward five-wave impulse. Earlier I talked about the level of 3100 and I believe that it will be reached too, just a little later and after a correction.

In any case, within the wave “3” of the senior order, gold is waiting for an upward movement, because the big impulse is not completed yet.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Waiting for a healthy pullback or FOMO push to 3150+?🔸 News Update: Geopolitical Turmoil Boosts Gold’s Appeal 🔸

The Russian Ministry of Defense reported missile strikes on Ukrainian SBU and special operations units, further escalating tensions in Eastern Europe. This, combined with China’s continued gold hoarding and a weaker USD, has kept gold’s bullish momentum intact.

🟥 Sell Setup (Liquidity Trap Short)

Entry Zone: $3,121 – $3,125 (Liquidity Grab + HTF Supply)

Trigger: M5/M15 Bearish CHoCH + Weak Bullish Reaction

SL: Above $3,130 (Invalidation Level)

TP1: $3,100 (First Target)

TP2: $3,085 (Deep Profit Zone)

TP3: $3,074 (Full Breakdown)

📌 Why?

Liquidity Hunt Potential → Market may fake out longs before reversal

Bearish Order Flow Zone → Major supply area where sellers are active

HTF Expansion Exhaustion → Price needs to cool off before further gains

🟥 Sell Setup 2 (Momentum Reversal – Only If Confirmed)

Entry Zone: 3,150 – 3,155 (Extreme Supply Zone)

Trigger: Bearish CHoCH + FVG reaction

SL: Above 3,160

TP1: 3,120

TP2: 3,100

TP3: 3,073

📌 Reasoning:

Extreme premium level where HTF supply could react

Only valid if price extends to this level without pullback

Ideal for a larger reversal if bullish momentum fades

🟢 Buy Setup 3 (Intraday Continuation Play – If $3,100 Rejects)

Entry: $3,092 – $3,094 (LQ sweep + minor demand zone)

Trigger: M1/M5 CHoCH + bullish rejection wick

SL: Below $3,090

TP1: $3,100

TP2: $3,108

TP3: $3,117

📌 Why This Zone?

If NY sweeps $3,100 liquidity and retraces, $3,092 – $3,094 could be a quick buy-the-dip area.

Only valid if the previous demand structure remains intact.

Ideal for short-term scalps rather than a deep retrace buy.

⚠ If price drops aggressively below $3,090, don’t force the buy—$3,083 – $3,087 is the next stronger zone.

🟢 Next Fresh Buy Setup (If Price Dips Again)

Entry Zone: $3,067 – $3,070 (Untapped demand + imbalance fill)

Trigger: M1/M5 CHoCH + bullish confirmation

SL: Below $3,064 (Liquidity protection)

TP1: $3,090 (Reaction level)

TP2: $3,108 (Liquidity grab target)

TP3: $3,120+ (Continuation move)

📌 Why This Zone?

Previous NY session left unmitigated demand here.

If price pulls back, smart money will likely buy from this area.

Gold still bullish – this is the next potential buy-the-dip zone.

⚠️ If $3,067 fails, deeper support at $3,055 – watch for a strong reaction there!!

✅ Key Takeaways

✔ Gold remains bullish above $3,074 – buy dips, but avoid FOMO.

✔ A liquidity grab below $3,080 could be the next major long opportunity.

✔ Sells are scalps only – favor longs unless $3,067 breaks.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

Good luck on the market today.

XAU/USD 4 hour chart Hello traders. I had a buy limit set in the area for potential Long positions but it didn't get triggered as gold dropped as expected but I missed the trade. Pretty good analysis. Let's see how the rest of the day plays out. Tomorrow is a new trading day. Big G gets my thanks 🙏. Be well and trade the trend. Happy Monday.

Expect gold to retreat to the 3100-3090 zoneOn a crazy Monday, gold fell back to around 3076 and then rebounded, and continued to rise to around 3128. It has now fallen back slightly and is fluctuating in a narrow range around 3120!

Although gold does maintain a strong position at present, what makes me more alert is that once gold retreats $3-5, it will be enough to make more buyers crazy and actively rush into gold long transactions. This is an extremely dangerous signal in my opinion! Because if with the withdrawal of large funds and panic selling, more bulls will be defeated.

So I explicitly refuse to chase long gold above 3120, because as gold rises rapidly, the risk of going long is gradually accumulating, so the liquidity of gold is gradually weakening, so gold may need to retreat more to increase liquidity before continuing to rise! And if the tariff policy introduced on April 2 is carried out in a more moderate way, then market sentiment will be greatly eased, and gold may also collapse.

So I think in short-term trading, we can still short gold in batches in the 3125-3135 zone, and expect gold to at least fall back to the 3100-3090 zone.

The more you rise, the harder you fall, or what?The month of March has been a strong month for the TVC:GOLD bugs. The commodity has been hitting new highs every week. Let's see where the next target could be.

MARKETSCOM:GOLD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Recovers After Dip – Is a New ATH Next?After reaching its recent all-time high exactly one week ago, Gold began a correction, dropping to $3,000, where buyers stepped in. This led to a recovery, pushing the price above a key resistance zone at $3,025–$3,030.

At the time of writing, the price is sitting at the upper boundary of this support zone. If it stabilizes above this level, a new ATH could be on the horizon.

I remain bullish as long as the daily close stays above this zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.