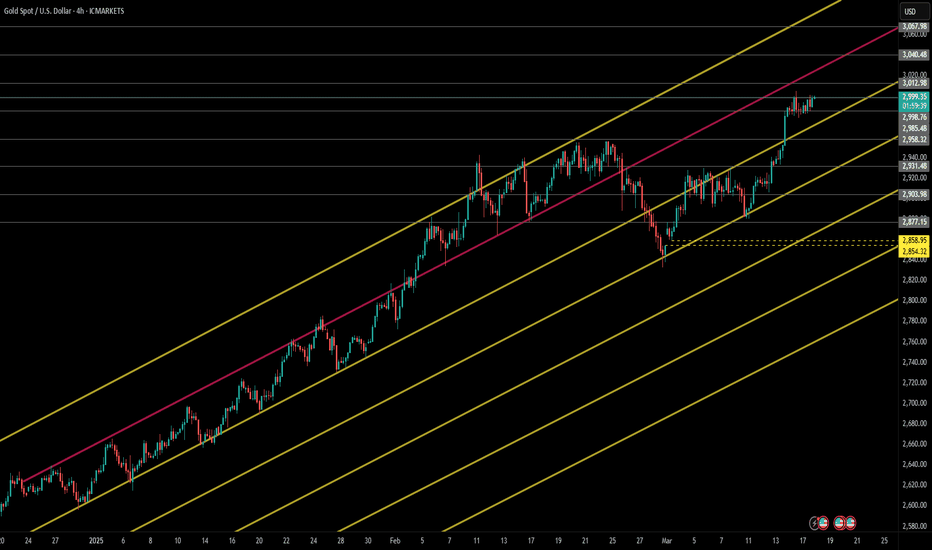

XAUUSD – Weekly (W1) Trading Plan🧱 Market Structure

Clear bullish structure with sustained Higher Highs (HH) and Higher Lows (HL).

Strong impulsive candles show aggressive bullish momentum, no signs of exhaustion yet.

Order flow remains bullish until proven otherwise.

🔍 Key Zones (S&D, FVGs, Gaps)

🔝 Premium Zone

Current price is within this premium area, which contains a weekly FVG / imbalance.

Price is reacting inside this inefficiency (3064–3094) → draw on liquidity.

This is not a demand zone, but rather a sell-side trap area for late buyers.

Possibilities:

Price fully fills the gap to ~3094 → then reverses (bearish reaction).

Or, price continues pushing up for ATH sweep (liquidity above all-time-high).

🧩 Below Current Price – Mitigation Zones

🔵 2900–2950: Minor imbalance, could be used as short-term retracement target.

🔵 2750–2800: OB + structural retest zone → high-interest mitigation area.

🔵 ~2480–2550: Deep retracement zone – valid only if major structure breaks.

📈 EMA Overview

(Assuming standard 5/21/50/200 EMA stack)

Price is far above all EMAs → strong bullish sentiment.

A revisit to the 21 or 50 EMA (weekly) would represent healthy retracement.

⚖️ Bias

Term Direction Reason

Long-term ✅ Bullish Strong structure, unmitigated imbalances above

Medium-term ⚠️ Neutral-to-bullish Depends on reaction from 3064–3094

Short-term 🔄 Await reaction LTF confirmation needed for short setups

🎯 Trade Scenarios

🟩 Bullish Continuation

If price uses 3064–3094 as support (mitigation → continuation)

Targets: New ATH above 3100+

Strategy: Wait for bullish PA confirmation (engulfing / BOS on D1/H4)

🟥 Bearish Rejection

If price shows strong bearish reaction from 3064–3094 zone

Ideal confirmation: bearish engulfing / CHoCH on H4/H1

Targets:

TP1: 2950

TP2: 2800

SL above the high (once structure confirms)

⏳ What to Watch Next

Weekly close relative to the 3064–3094 zone

Daily/H4 candlestick behavior: rejection vs continuation

Look for divergence between price and momentum, or exhaustion candles

XAUUSD.F trade ideas

breakout - gold price rebounds 3045⭐️GOLDEN INFORMATION:

Gold prices remained stagnant late in the North American session, constrained by a rebound in the US Dollar Index (DXY), which initially dipped to 104.18 before recovering. The turnaround came after the White House confirmed that President Donald Trump would unveil new automobile tariffs around 22:00 GMT. As of writing, XAU/USD is trading at $3,019, showing little change.

Despite reports from The Wall Street Journal suggesting that Trump may introduce limited tariff measures, including on automobiles, bullion traders struggled to find momentum. Meanwhile, the DXY, which measures the Greenback against a basket of six major currencies, climbed 0.32% to 104.55, further weighing on gold’s appeal.

⭐️Personal comments NOVA:

Gold price recovers, breakout of H1 frame. With the latest 25% car tax policy, gold price reacts strongly and increases again.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3045 - $3047 SL $3052

TP1: $3038

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3023 - $3021 SL $3016

TP1: $3030

TP2: $3040

TP3: $3057

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAUUSD SHORTING CONCEPTMorning ladies & gents.

Ok... Gold has been playing games & hard to get for a while. I don't know bout you guys.

As per today and the picture you're currently looking at, the market has cleared so many buy-side liquidities without proper retracements.

Being a Thursday, we could possibly have a TGIF setup, or maybe have it on a good old fashioned Friday.

So, even if we're in an uptrend or a downtrend, I want to see the market either clear Asian highs & or up to the 4 hr end of fvg, and give a sell model or just reverse where it currently is.

My targets: 1 hr Inversion fvg/ 4 hr end of fvg / other discount arrays.

I'ma update frequently on this trade idea so stay tuned.

& If you like my content, ideas and more, just hit the follow button & boost for a thumbs up

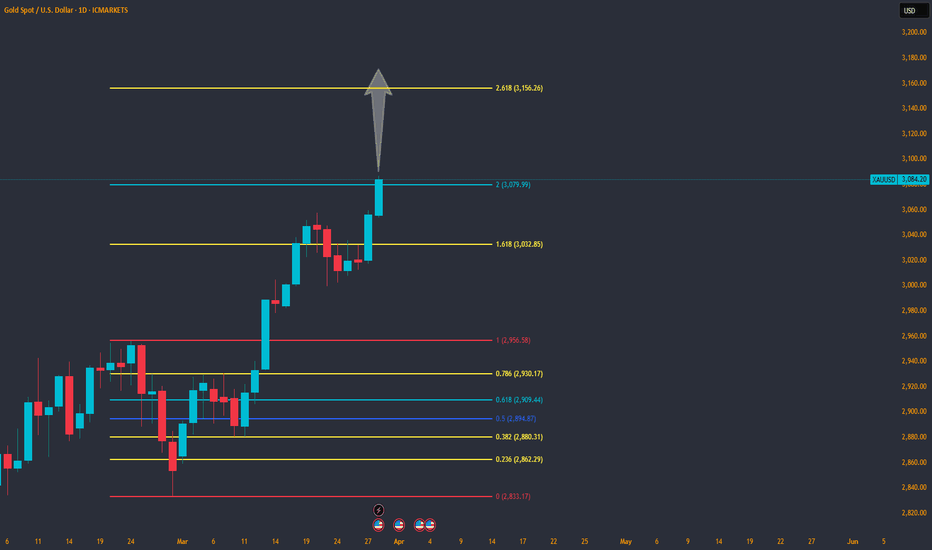

Gold Breaks Resistances_ Is a New All-Time High(ATH) on the Way?Gold ( OANDA:XAUUSD ) is moving in the Resistance zone($3,032-$3,021) and has managed to break the Resistance lines .

In terms of Elliott Wave theory , it seems that Gold has completed the main wave 4 . The structure of the main wave 4 is Double Three Correction(WXY) . One of the signs of the completion of the main wave 4 can be the breakdown of the resistance lines and the Resistance zone($3,032-$3,021) .

I expect Gold to trend upwards in the coming hours and can even create a New All-Time High(ATH) .

Do you think Gold can create a new All-Time High(ATH)?

Note: If Gold goes below $3,013, we should expect more dumps.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

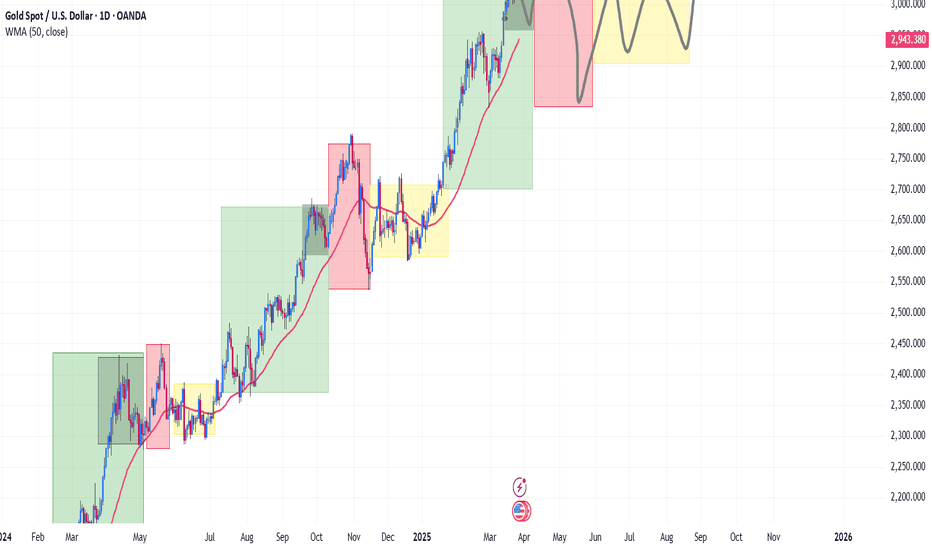

GOLD MARKET ANALYSIS AND COMMENTARY - [March 31 - April 04]This week, the international OANDA:XAUUSD increased sharply from 3,003 USD/oz to 3,087 USD/oz and closed this week at 3,085 USD/oz.

The reason for the sharp increase in gold prices is that US President Donald Trump decided to impose a 25% tax on imported cars into the US. This seems to go against Mr. Trump's previous statement about "easing" tariffs, causing investors to worry that US partner countries will retaliate, making the global trade war more intense.

Some countries, such as the UK and Japan, have taken some steps to appease and actively negotiate to avoid US tariffs, while many other countries have announced their readiness to retaliate against US tariffs. Therefore, many experts believe that the tariff policy announced by Mr. Trump on April 2 will be very unpredictable.

If Mr. Trump still decides to impose tariffs on many countries, the gold price next week may continue to increase sharply, far exceeding 3,100 USD/oz. However, if Mr. Trump narrows the scale of tariffs as announced and does not impose additional industry-specific tariffs on lumber, semiconductors, and pharmaceuticals, the gold price next week is at risk of facing strong profit-taking pressure, especially when the gold price is already deep in the overbought zone.

In addition to the Trump administration's tax policy, investors also need to pay close attention to the US non-farm payrolls (NFP) report to be released next weekend, because this index will directly impact the Fed's interest rate policy.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

The most notable economic news in the coming week will be the US implementation of global trade tariffs on Wednesday, along with the March non-farm payrolls report due Friday morning. Experts warn that both events could increase the appeal of gold as a safe-haven asset. In addition, a number of other important US economic data will be released, including the ISM manufacturing PMI and JOLTS job vacancies on Tuesday, the ADP employment report on Wednesday, along with the ISM services PMI and weekly jobless claims on Thursday.

📌Technically, short-term perspective on the H1 chart, gold price next week may continue to surpass the 3100 round resistance level, approaching the Fibonacci 261.8 level around the price of 3,123 USD/oz. The current support level is established around the 3057 level, if next week gold price trades below this level, gold price is at risk of falling to around the 3,000 USD/oz round resistance level.

Notable technical levels are listed below.

Support: 3,057 – 3,051USD

Resistance: 3,100 – 3,113USD

SELL XAUUSD PRICE 3133 - 3131⚡️

↠↠ Stoploss 3137

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

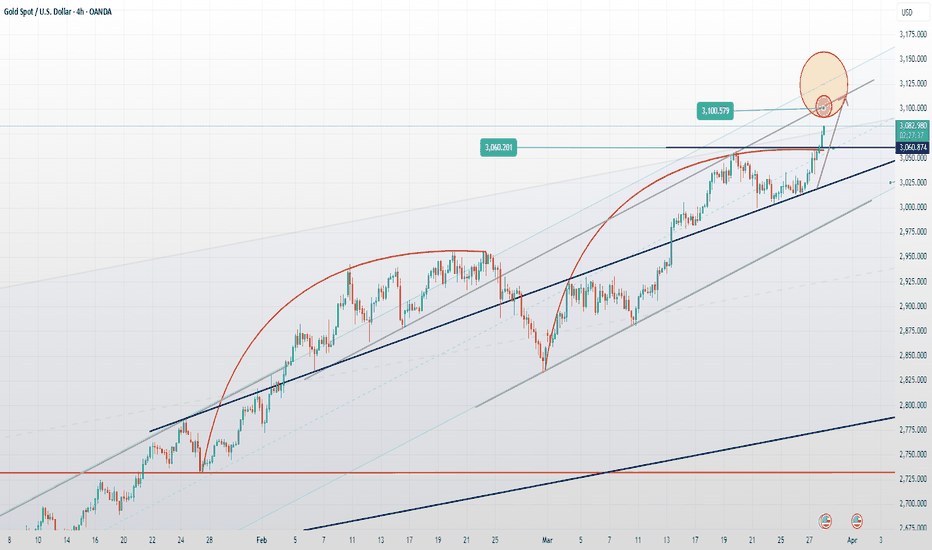

Gold continues to hit new highs! Trend analysisGold hit a new record high again, rising from 2858 to 3086. After four rounds of surges, gold is now close to the 3100 mark. The overall bull market is still there, and the general trend is still bullish. For gold's upper pressure, pay attention to the breakthrough of 3085-90 US dollars, which is the upper track position of the weekly Bollinger band. For upward breakthrough, pay attention to the integer position of 3100 US dollars, which is also the upper track position of the daily Bollinger band.

Strategy: Gold 3070 long, stop loss 3060, target 3100

GOLD knocking on heaven's door againAnd once again we are at the spot, where MARKETSCOM:GOLD is trying to go for another all-time high. Will we see another strong push, or is it time for the commodity to slow down and retrace? Let's dig in!

TVC:GOLD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

XAU/USD 27 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Bias and analysis remains the same as analysis dated 23 March 2025.

Price has printed a bearish CHoCH following printing further all time highs.

Price is now trading within an established internal range. I will however continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or nested Daily and H4 demand levels before targeting weak internal high priced at 3,057.590.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 24 March 2025.

As per analysis dated 19 March 2025 whereby I mentioned as an alternative scenario that internal range has significantly narrowed. All HTF's require a pullback, therefore, it would be completely viable if price printed a bearish iBOS.

This is how price printed, by printing a bearish iBOS.

Price has yet to print a bullish CHoCH to indicate bullish pullback phase initiation, however, price has traded into premium of 50% internal EQ, therefore, I am happy to confirm internal range.

Intraday Expectation:

Price has traded in to premium of 50% EQ and has mitigated M15 supply zone.

Technically, price to target weak internal low priced at 2,999.465.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

XAUUSD - Daily, Gold’s Next Big Move: Be Ready!XAUUSD - Daily Update 📈

With most analysts focusing on Gold’s bullish momentum, let’s step back and analyze where we are in the bigger picture and where we should secure profits before a potential correction.

Gold has been in a strong uptrend since the $2,000 zone, forming three major bullish legs as highlighted in the chart:

🔹 First leg correction: ~$150 drop

🔹 Second leg correction: ~$250 drop

🔹 Third correction may be deeper, so caution is needed in the target zone.

Key Levels to Watch:

📌 Potential Target Zone: $3,050 - $3,150

✔️ Measured Move: Previous legs suggest an extension into this zone.

✔️ Liquidity Grab: Gold tends to hunt liquidity over round numbers—just as it did at $2,000 → $2,060, it may break $3,050 before reversing.

✔️ Ascending Channel: The price is approaching the top of the channel, where market makers may trigger a fake breakout before a significant pullback.

🚨 Trading Strategy:

Swing traders: Secure profits near $3,050 - $3,150.

Daily traders: Use pullbacks as short-term profit opportunities.

💸 If you missed this rally, stay ahead for reversal signs & upcoming moves! Follow for more insights! 🚀

GOLD: The rally is getting stronger. Growth after a false crashOANDA:XAUUSD breaking upward and attempting to consolidate above the previous high of 3127 as part of the adjustment process. This will serve as an ideal support level for buyers. The price increase, against the backdrop of political and geopolitical issues, only intensifies.

Tariff increases are driving gold demand higher. Trump has rejected the idea of lowering tariffs and the Treasury Secretary has named 15 countries on the list for new measures. This has weakened the dollar and increased concerns about stagflation, boosting demand for gold as a protective asset.

Additionally, tariff tensions are unlikely to end after April 2, especially with auto tariffs taking effect on April 3, and this combined with growth uncertainty will keep buyers interested in gold if prices decline.

Technically, we have a strong upward trend, selling carries risk, and we are looking for strong areas or levels to buy. For example, if prices consolidate above 3127 or after breaking through the false 3119/3111 levels.

Before continuing growth, there may be adjustments to key support areas to normalize market imbalances and capture liquidity. Consolidation above levels after false breakouts will be a positive signal for growth.

But! There is upcoming news and high volatility potential!

Gold is expected to peak faster on FridayGold is expected to peak faster on Friday

Gold continued to rise sharply, breaking through the 3000 support, and then the bulls directly rose, forcing the bears to rush to 3080-90. Yesterday, the European session pulled up and broke through the high point, and the US market bottomed out and rebounded and continued to break through the high point, showing that it is still strong.

So will there be a short squeeze after 3080 points? Will there be a turning point?

At present, it is a typical short squeeze trend.

Of course, don’t think that it has reached the top after rising for two days. When it retreats, it is a big waterfall. It’s not that you can’t see it, but you have to be careful every time.

Then with the accelerated rise, the space behind becomes smaller, and the bulls continue to be bullish, but pay attention to prevent waterfall risks

According to the hourly chart below the big positive line:

The current support level is 3060-3065.

The watershed is 3054.

Above 3060, all operations are bullish

In addition, the market that breaks high and accelerates will generally last for 2-3 days. Today is Friday. It should be understood that even if the market does not fall on Friday, it is equivalent to rising, so the probability of oscillating upward next Monday is very high.

Therefore, next, pay attention to the support near 3060.

Go long when the callback is above 3060

Gold Potential Bullish ContinuationWith widespread panic about tariffs, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity.

Trade Plan:

Entry : 3131

Stop Loss : 3095

TP 1 : 3167

GOLD - single supporting area , holds or not??#GOLD. well guys now we have 3112 as immediate supporting area and upside we have 3125 as immediate resistance area so keep close and if market hold 3112 then we can expect another bounce towards upside next targets.

keep in mind that 3112 is our single supporting area so if market clear that level then we will go for short means cut n reverse but on confirmation.

good luck

trade wisely

Gold Weekly Analysis: Is This Manipulation at Play?Gold followed my analysis last week, reaching yet another all-time high as anticipated. The bullish momentum remains strong; however, given the consistent break of all-time highs, I now expect a pullback. While we may see some further upside, I anticipate a bearish weekly close, prompting me to look for sell opportunities. Additionally, I believe we could be entering a range, with the current highs representing potential manipulation. If this is the case, we may have set a temporary high for at least the next week or two.

Traders if you found this post useful than give it a boost!

Gold XAUUSD – Gann Analysis & Market Outlook# **📊 Gold (XAU/USD) – Gann Analysis & Market Outlook**

## **🔎 Market Overview:**

Gold is currently trading around **$2,999.84**, testing the **765° Gann level ($2,985.4)** as resistance. The price has shown strong bullish momentum, breaking past multiple resistance levels and now approaching **the psychological level of $3,000**.

The **810° Gann level ($3,012.8)** is the next key resistance, and a breakout above it could signal further gains. However, if gold faces rejection, a retest of the lower Gann levels is possible.

---

## **📈 Key Gann Levels & Their Implications:**

🔹 **Immediate Resistance:**

- **810° – $3,012.8**: Key resistance level; a break above it may confirm further upside momentum.

- **855° – $3,040.3**: If bullish momentum continues, this level could act as a short-term target.

- **900° – $3,067.9**: A strong resistance zone where profit-taking may occur.

🔹 **Immediate Support:**

- **765° – $2,985.4**: Price is currently testing this level; if it holds, buyers may push the price higher.

- **720° – $2,958.1**: A potential pullback zone where buyers may step in again.

- **675° – $2,931.0**: If price drops further, this level could act as a strong support area.

🔹 **Major Support Levels:**

- **630° – $2,904.0**: A breakdown below this could shift momentum bearish.

- **585° – $2,877.1**: Critical support, where a failure to hold may lead to deeper corrections.

- **540° – $2,850.4**: Strong demand zone; if price reaches here, it could provide a buying opportunity.

---

## **🚀 Potential Market Scenarios:**

### **🟢 Bullish Case (Breakout Scenario):**

✔ If price **breaks and holds above $3,012.8 (810° level)**, it could confirm further upside momentum.

✔ Next targets would be **$3,040 (855° level)** and possibly **$3,067 (900° level)** if gold remains strong.

✔ This scenario would require **higher trading volume** and a weaker USD or inflation concerns boosting gold demand.

### **🔴 Bearish Case (Pullback Scenario):**

❌ If gold fails to break **$3,012** and faces rejection, a pullback toward **$2,958 (720° level)** is possible.

❌ A deeper correction could bring price to **$2,904 (630° level)** or even **$2,850 (540° level)** if bearish momentum accelerates.

❌ This scenario could be triggered by **stronger USD, bond yields rising, or profit-taking at these levels**.

---

## **⚠️ Key Takeaways:**

📍 Gold is testing **critical resistance ($3,000 - $3,012)** and needs a breakout to confirm a further rally.

📍 Bulls must **clear $3,012** to target **$3,040+**; failure to do so may lead to a pullback.

📍 Supports to watch: **$2,985, $2,958, and $2,904** in case of rejection.

💬 **What’s your bias—bullish or bearish? Let me know your thoughts! 🚀📉**

#Gold #XAUUSD #GannAnalysis #Trading #TechnicalAnalysis 💰

High Volatility Trade Management & Risk Management Strategies

With a current geopolitical uncertainty and the election of Trump, forex market and gold experience wild price fluctuations. These unpredictable swings can result in substantial losses, particularly for the beginners in trading.

In this article, I will share with you the essential trade management and risk management tips for dealing with extreme volatility in trading.

I will reveal proven strategies and techniques for avoiding losses and unexpected risks.

1. First and foremost, pay attention to the news.

The main driver of high volatility on the markets are the news , especially the bad ones.

In normal times, high impact news events are relatively rare, while in times of uncertainty their frequency increases dramatically.

Such news may easily invalidate the best technical analysis setup: any powerful support or resistance level, strong price action or candle stick pattern can be easily overturned by the fundamentals.

Trump tariffs threats against Canada made USDCAD rise by 400 pips rapidly, while the change of rhetoric quickly returned the prices to previous levels.

One you hold an active trade, monitor the news. If you see the impactful news that may affect the pair or instrument that you trade, immediately protect your position, moving stop loss to entry.

It will help you avoid losses if the market starts going against you.

2. Even constantly monitoring the news, you will not be able to protect yourself from all the surprising movements.

Sometimes your trades will quickly be closed in a loss.

Therefore, I strictly recommend measure a lot size for every trade that you take. Make sure that you risk no more than 1% of your trading account per trade. That will help you to minimize losses cased by the impactful, uncertain events.

3. The impactful events may also occur on weekend, while Forex market is closed. Such incidents can be the cause of huge gap openings.

If you hold an active trading position over the weekend, remember that your entire account can be easily blown with such gaps.

Imagine that you decided to buy EURUSD on Friday during the NY session and keep holding the position over the weekend.

A huge gap down opening would make you face huge losses, opening the market 125 pips below the entry level.

By the way, this day I received a dozen of messages from my followers that their accounts were blown with the opening gaps.

4. If you see a significant price movement caused by some events, and you did not manage to catch it, let it go.

Jumping in such movements is very risky because quite ofter correctional movements will follow quickly.

It will be much safer and better to try to be involved in a trend continuation after a pullback.

Look what happened with Gold when Trump began a new trade war.

The price started to grow rapidly. However, even during such a sentiment, 500 pips pullback occurred, giving patient traders a safe entry point for the trade.

5. In the midst of geopolitical tensions and trade wars, the markets tend to rally or fall for the extended time periods.

The best trading strategies to use to get maximum from such movements are trend-following strategies.

While reversal, counter-trend trading might be extremely risky, providing a lot of false signals.

Trend trading may bring extraordinary profits.

These trading tips, risk management and trade management strategies and secrets are tailored for cutting and avoiding losses during dark times. Empower your strategy with this useful knowledge and good luck to you in trading high volatility on Gold and Forex.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD SELL(POSSIBLE DOWNWARD TREND) XAU/USD sell from 3084, here are the key levels to watch:

- *Immediate Support*: 3054 and 3032

- *Key Support*: 3000, a crucial level to maintain the bullish trend

- *Stop-Loss (SL)*: 3110, to limit potential losses if the price moves against your position

From a technical perspective, the path of least resistance for the Gold price remains to the upside, driven by safe-haven demand amid global trade war tensions and a potential US economic slowdown. However, the Relative Strength Index (RSI) on the daily chart is already flashing overbought conditions, warranting some caution.

The XAU/USD pair has been forming a correction within a descending channel, and the situation is becoming increasingly complex due to uncertainty around US tariff policies. Any corrective slide now seems to attract some dip-buyers near the $3,054-3,048 horizontal zone, which should help limit the downside for the Gold price near the $3,032-3,030 region.

In terms of economic indicators, investors are waiting for the US Personal Consumption Expenditure (PCE) Price Index data to gauge the trajectory for further rate cuts, which will influence the USD price dynamics and provide a fresh impetus to the non-yielding yellow metal ¹.

Keep your best wishes to the Travis 👍