XAUUSD.F trade ideas

Gold Trade plan 04/04/2025 ( Ascending Channel)Dear Traders,

yesterday, price Hit my Target around 3060

for Today i expect price will continue Uptrend (Ascending Channel)

"If it remains in the upward channel, my initial target is 3140."

If you enjoyed this forecast, please show your support with a like and comment. Your feedback is what drives me to keep creating valuable content."

Regards,

Alireza!

Hellena | GOLD (4H): LONG to resistance area 3100.Wave “3” is still continuing its progression. This means that the five-wave impulse is not over yet and we expect the upward movement to continue.

Of course I would like to see wave “4” as a corrective wave in the area of 3024 level, then I expect an upward movement to the area of 3100 level. This level is also considered to be quite strong, from which there could be a correction.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Gold Short: Completed wave 3Take note that this is a recounting of the waves again. I had not expected wave 3 to extend and thus even though I had previously called a short (and it worked for a super short while), that was obviously a failure.

This set up is cleaner for the waves and we can now CLEARLY see the 5-waves structure, as opposed to force-counting the last time. I'll link my last failed trade here so you can study my mistake.

Hanzo | Gold 15 min Breaks – Will Confirm the Next Move🆚 Gold

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bearish Setup After Break Out – 3111 Zone

Price must break liquidity with high volume to confirm the move.

☄️ Bullish Setup After Break Out – 3136 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 3142

Key Level / Equal lows Formation - 3111

Strong Rejection from 3149 – The Ultimate Pivot

Strong Rejection from 3100 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 3136 – Liquidity Engineered

Twin Wicks @ 3127 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 31 march 2025 – bearish Retest 3126

💯 31 march 2025 – bearish Retest 3126

💯 1 april 2025 – Liquidity Grab Range 3118 : 3126

💯 1 april 2025 – Bullish Retest At 3126 : 3130 Zone

👌 The Market Has Spoken – Are You Ready to Strike?

Golden Horizons on the PrecipiceGold on the Brink of a Downturn: A Shift in Market Sentiment

Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.

The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.

As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.

Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.

If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.

The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.

The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.

For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.

As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.

Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!

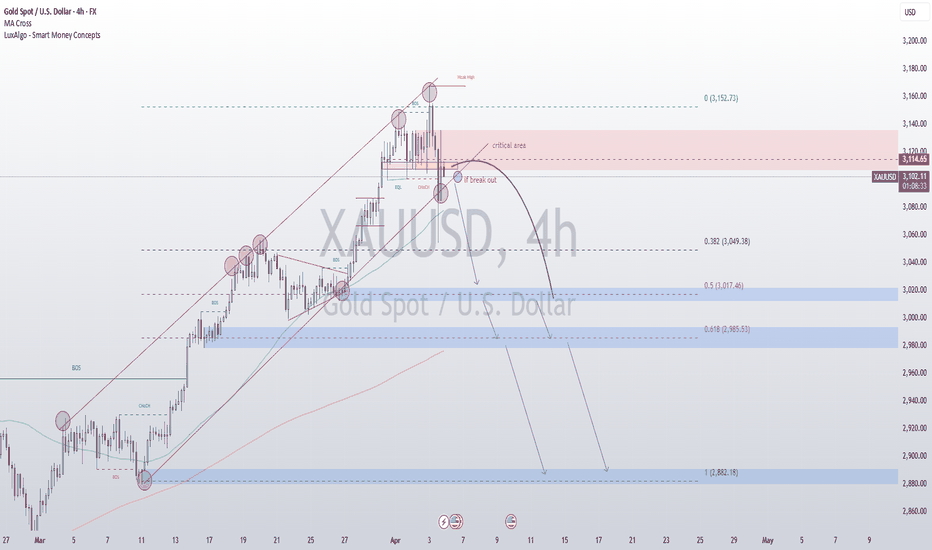

GOLD (XAU/USD) - Double Top & Bearish Breakdown Incoming?📉 GOLD (XAU/USD) - Double Top & Bearish Breakdown Incoming? 📉

Gold has been trading in an ascending channel, but a possible double top pattern is forming near $3,163. The recent breakdown from the midline suggests that sellers are stepping in! 🚨

🔎 Key Observations:

✅ Double Top Rejection: Price failed to break above $3,163, signaling a potential bearish reversal.

✅ Break Below the Channel Midline: A retest of $3,129 could act as a confirmation before further downside.

✅ Bearish Targets: Next support zones lie at $3,083 - $3,005, with potential for deeper correction.

📊 Possible Scenarios:

📌 Bearish Case: If price gets rejected at $3,129, expect further downside towards $3,060 - $3,040.

📌 Bullish Case: If bulls reclaim $3,129, gold might retest highs near $3,163.

⚠️ Watch price action closely! A confirmed breakdown could accelerate selling pressure! 📉

What do you think? Will gold hold, or is a deeper drop coming? Share your thoughts in the comments! 👇🔥

#Gold #XAUUSD #Trading #Forex #DoubleTop #TechnicalAnalysis #PriceAction

Parabolic Exhaustion – Short OpportunitySection: Tactical Setups & Opportunistic Fades

Asset Focus: Gold Spot (XAU/USD)

Setup Type: Parabolic Exhaustion – Short Opportunity

⸻

Setup Overview:

Gold has made a parabolic run that is now showing signs of exhaustion and blow-off behavior. A rejection wick has printed at the top of the range, with price extended far from its key moving averages. Beneath price lie clear zones of liquidity and untested structure, which may act as magnets on any unwind.

This setup fits the Jason Shapiro + Reflexivity hybrid model: when sentiment and positioning are maxed, reflexivity unwinds quickly — often violently.

⸻

COT & Sentiment Snapshot:

• Leveraged funds appear heavily skewed toward long exposure (pending confirmation via next release).

• Commercials may be building short pressure quietly.

• Narrative sentiment has shifted into consensus territory: gold is now being framed as the only safe haven — a common contrarian trigger.

• Open interest likely tracking price — a sign of crowding.

⸻

Market Structure & Technical Breakdown:

• Parabolic structure with increasingly shallow pullbacks suggests exhaustion.

• Price has departed cleanly from recent structure zones without testing them — signs of imbalance.

• A large rejection candle at the top signals early seller control.

• The asset is significantly extended from key means and moving averages.

• Below lie structural voids — shallow areas with little historical consolidation — prime for fast retracement once trend breaks.

⸻

Behavioral Finance Layer:

“Crowd psychology dictates that the asset everyone is hiding in will eventually be the most dangerous. Gold is no longer a secret — it’s a panic button.”

• The psychological belief that “gold can’t fall in crisis” creates emotional leverage — a dangerous crowd illusion.

• Traders are no longer hedging fear — they’re expressing it in unison. That’s a trap.

• Once the narrative breaks, the unwind is accelerated by disbelief.

⸻

Reflexivity Risk Model:

• Phase 1: Macro fear triggers buying

• Phase 2: Price rise confirms fear, fuels further inflows

• Phase 3: Positioning becomes one-sided

• Phase 4: Structural cracks appear; rejection triggers flight from the same door everyone entered through

⸻

GOLD Price Analysis: Key Insights for Next Week Trading DecisionGold surged to a record high of $3,086 last week as investors dumped Equities and Crypto for safe-haven assets. With rising inflation concerns and uncertainty surrounding Trump’s tariffs, fears of a US recession or stagflation are driving the market.

📈 Will Gold continue its rally, or is a pullback coming? In this video, I break down my thought process and how I’m strategically positioning for the next big move.

#GoldPrice #XAUUSD #MarketAnalysis #GoldTrading #Forex #Inflation #SafeHaven #TradingStrategy

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

The Bull is just getting startedSuppoXAUUSD has reached 3148.9 and is currently testing the upper resistance levels. Technical analysis indicates that the 3150 - 3170 range serves as a resistance zone. Given the robust bullish sentiment surrounding XAUUSD recently and the typically high trading volume and ample liquidity during the US trading session.

The 3100 level is a strong support area. Right above this support area,buying opportunities present themselves. At price points in this range, a significant amount of buy orders tend to flood the market, offering a buffer against further price decline.

It’s crucial to note that the XAUUSD market is characterized by high volatility. Thus, investors should avoid chasing rallies or engaging in short - selling at high levels. Chasing rallies exposes investors to substantial losses during short - term price retracements. Similarly, short - selling at high levels risks missing out on further upside potential. Stay vigilant to market dynamics, set stop - loss and take - profit levels rationally, and safeguard against potential risks.tr Zone

XAUUSD Trendline Break | 4H Structure | UTC-4📈 XAUUSD Trendline Break | 4H Structure | UTC-4

Description:

This chart shows XAUUSD with trendline analysis on the 4H timeframe, synced to UTC-4 (New York time). I'm comparing structure breaks and candle behavior between TradeLocker and TradingView. No indicators added — clean price action view.

Liberation dayApril 2nd, referred to as "Liberation Day" by President Trump, is the day he plans to announce new tariffs on imports from various countries, aiming to reduce reliance on foreign goods. The specific details of these tariffs are still unclear, but they are expected to impact a wide range of products. Gold has been on a face-ripping vertical rally up into this news on expectations that this will be big news, but it's pre-announced which means it's a clear sell the news event. I am going to buy 0DTE puts on gold at the market open on April 2nd and sell them before the close.

ADP in Focus: Will Strong Jobs Data Trigger Gold Pullback?🟡 GOLD MARKET BRIEF – Early Asian Surge Meets Resistance Ahead of Key US Jobs Data

Gold kicked off the day with a sharp rally during the Asian session, driven by consistent demand from Asian and Middle Eastern investors — a pattern we’ve seen forming repeatedly during early sessions lately.

However, price reacted swiftly at the 3130–3135 resistance zone, exactly as mapped out in yesterday’s trading plan. With sellers stepping in again, my outlook remains:

🔻 Look for reaction-based SELL opportunities in the Asian and London sessions, especially if price pulls back into key resistance.

📉 Technical Outlook:

Gold is approaching the apex of a symmetrical triangle pattern, suggesting a breakout is imminent.

✅ As always: Wait for the breakout — then trade the retest in the confirmed direction.

📰 Fundamental Focus:

All eyes today will be on the US ADP Non-Farm Employment report, which tends to offer early clues ahead of Friday’s NFP.

Should the data come in stronger than expected, USD could gain traction — likely applying downward pressure on Gold, in line with our target zone around 308x–307x.

🧭 Key Technical Levels:

🔺 Resistance: 3128 – 3135 – 3142 – 3148

🔻 Support: 3110 – 3100 – 3080 – 3070

🎯 Trade Plan:

🟢 BUY ZONE: 3102 – 3100

SL: 3096

TP: 3106 – 3110 – 3114 – 3118 – 3122 – 3126 – 3130

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

📌 Caution: With ADP on deck during the US session, expect a spike in volatility.

Stick to clear levels, protect capital, and trade with discipline — not emotion.

Let the market come to you.

— AD | Money Market Flow

Gold reverses sharply after Trump's tax announcementThe world gold price has reversed sharply because the global market has just received information last night (Hanoi time) that US President Donald Trump has just signed an executive order to impose taxes on all goods imported into the US, many countries will have to pay high taxes of up to tens of percent.

Specifically, the UK, Brazil, Singapore will be subject to a 10% tax. The European Union, Malaysia, Japan, South Korea, and India will be subject to 20-26%. China, Thailand, and Vietnam are among the countries subject to the highest tax rates, at 34%, 36%, and 46%, respectively. The highest is Cambodia, which will be subject to a tax rate of up to 49%. This tax rate will be applied from April 9. In addition, Mr. Trump said that a 10% import tax will be applied to all goods imported into the US from April 5.

Mr. Trump said that every year the US loses 1,200 billion USD due to the trade deficit due to 3,000 billion USD of imported goods.

After this information, the global financial market was shaken, in which the US stock market had a strong decline, losing from more than 1% to more than 2%. On the contrary, gold - an asset that ensures capital safety in case of risk - has benefited from a strong increase in price.

Many experts commented that the Trump government's tariff policy has increased global trade tensions. Previously, the US imposed tariffs on some goods from Canada, Europe and China, aluminum and steel. These countries have responded to the tariffs on the US.

GOLD corrects after hot rally, conditions remain optimisticOANDA:XAUUSD has retreated from an all-time high of $3,167.67/oz as investors began to take profits after a “parabolic” rally. While the rally was initially fueled by safe-haven demand stemming from US President Donald Trump’s plans for higher tariffs, questions are starting to arise about the sustainability of the rally as buying pressure wanes and the Relative Strength Index (RSI) moves into overbought territory.

Gold has rallied 19% so far in 2025 and this correction could be temporary

Gold prices have rallied 19% this year, supported by multiple macro uncertainties, historic central bank buying and continued inflows into ETFs. Despite the current pullback, from a fundamental perspective, this does not impact the overall bullish fundamental trend and the likelihood of near-term technical consolidation has begun to increase.

Trump’s tariffs a “catalyst” supporting the physical gold market?

Trump's proposal to impose 10% tariffs on most imports has stoked market concerns about slowing economic growth and rising business costs, while risk aversion has pushed gold prices higher.

However, the White House later clarified that "critical raw materials" including gold, copper and energy would be exempt, alleviating some concerns about supply chain disruptions and providing some support to the physical gold market.

Market sentiment remains bullish, with strong buying momentum on dips

Although the technical side is currently under some pressure, the market's optimism remains unshaken. It is difficult to try to assess the peak near the historical high, but it is clear that every pullback is quickly absorbed by buyers, which shows that the underlying bullish sentiment in the market is still strong.

Described by the sharp drop on Thursday, gold recovered very quickly after the drop.

Technical Outlook Analysis OANDA:XAUUSD

Gold may enter a correction phase after a long period of hot growth, depicted by the Relative Strength Index (RSI) falling below the overbought level, breaking the blue bullish channel. In the short term, if gold breaks below the short-term channel, converging with the 0.50% Fibonacci extension level, it will be in a position to correct further with the next target level around $3,066 in the short term, more than $3,040.

However, overall, gold still has a bullish technical outlook with the price channel as the long-term trend and the main support from the EMA21. As long as gold remains within the price channel and above the EMA21, the declines should be considered as corrections and not a trend. On the other hand, once gold recovers from the 0.50% Fibonacci extension and holds above the raw price point of $3,100, it will signal the end of the correction cycle, then the upside target will be the 0.786% Fibonacci extension in the short-term.

During the day, the long-term uptrend with the possibility of a short-term correction will be noticed again by the following positions.

Support: 3,086 – 3,066 – 3,040USD

Resistance: 3,100 – 3,106 – 3,135USD

SELL XAUUSD PRICE 3147 - 3145⚡️

↠↠ Stoploss 3151

→Take Profit 1 3139

↨

→Take Profit 2 3133

BUY XAUUSD PRICE 3061 - 3063⚡️

↠↠ Stoploss 3057

→Take Profit 1 3069

↨

→Take Profit 2 3075

Gold is Past Due for a PullbackReason #1: Gold reached $3000/oz and it has a strong tendency to pullback after reaching $1000 multiples for the first time as can be seen on the chart, specifically when it first reached $1000 and $2000. $1900 which is a whole number in the ballpark of $2000 was also stiff resistance in 2011.

Reason #2: Gold has been above the 52-week simple moving average for over 1 year. This alone is not reason enough to go short, as gold can stay above the 52-week average for 3 years like it did starting in 2008, but it is indicative of gold having rallied for an extended period of time without having any routine pullbacks. In the absence of routine pullbacks, gold can be said to be "past due" for a pullback the same way a person can be said to be "past due" for a dental appointment. A person being past due for a dental appointment isn't necessarily going to go to the dentist any time soon, but they will have to go eventually and the longer they put it off, the more cavities they'll have to have filled and possibly root canals once they do. This "number of days above moving average" metric is plotted at the bottom of the chart.

Reason #3: Gold tends to correct during stock market crashes. If the stock market keeps crashing, gold will likely follow, as it more often than not does.

Reason #4: Precious metals and industrial metals have dropped tremendously with the "Liberation Day" and retaliatory tariff announcements. Gold has been holding up like a champ in comparison. If other metals are rallying, it might not be a great time to short gold, but if they continue dumping or hold steady at or near current levels, gold may very well follow suit due to being in the same commodity family. Not a great reason, but a reason.

Reason #5: Gold is extended. Draw any trendline, look at any indicator, gold is flying high. This is similar to reason #2 but is less specific.

One might consider looking to catch downswings, particularly when price is below 3000. Gold is long-term bullish, but poised for downside price action in the near term.

Previous peak to troth moves with similar setups:

May 2006: -25.76% over 5 weeks

Mar 2008: -18.15% over 6 weeks

Sep 2011: -20.19% over 3 weeks

Aug 2020: -14.97% over 17 weeks

Current move: -4.8% over 1 week

2700 (-14.88%) before first week of August 2025 is a comparable move to the Aug 2020 move.

2530 (-20.12%) by April 25th 2025 is a comparable move to the Sep 2011 move.

GOLD (XAUUSD) Idea After the major economic processes GOLD also goes mad. Hence, the price is now testing the 4H Trend line and inside the ascending channel.

My insights about this pair is that price has reached some level of rejection and has to react from this zone. If not, next zone will be between 3040-3050 zone which may turn the Resistance into Support.

Also RSI Divergence can also pay out, which forms lower low but the price is actually on higher low.

I will seek for buy opportunities if get any confirmation in lower Time Frames.

Good Luck to All!

RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

GOLD BEARS ARE GAINING STRENGTH|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,101.76

Target Level: 2,970.42

Stop Loss: 3,188.94

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

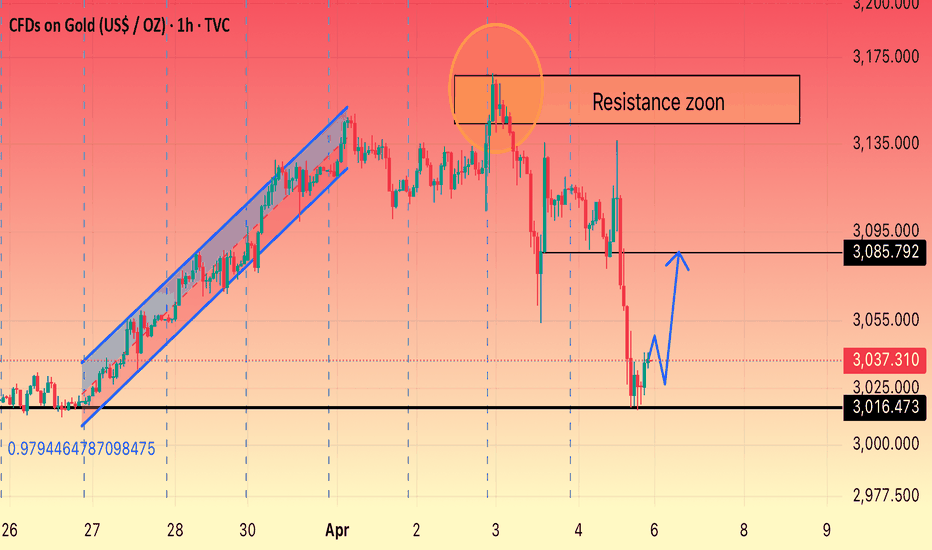

XAUUSD 1HOUR TECHNICAL ANALYSIS NEXT MOVE POSSIBLE • Bearish Reversal from Highs: Gold couldn’t break the upper resistance and started a downward correction.

• Possible Bullish Rebound: If support at ~$3,016 holds, there could be a rebound back toward ~$3,085 before any further move.

• Watch Zones:

• $3,016 as key support.

• $3,085 as near-term resistance.

• $3,135–$3,175 as strong longer-term resistance.

Gold is rising strongly, is it one step closer to 3200?Gold has risen sharply again, and the current surge has reached the 3167.5 US dollar line! Gold continues to be bullish and long, and there is still room and demand for further increases! It is not easy to operate at present. The resistance is the intraday high, and a small stop loss is needed to be short. In terms of short-term operation ideas for gold, it is recommended to mainly short on rebounds and supplemented by long on pullbacks. The short-term focus on the upper resistance of 3138-3140 is the focus, and the short-term focus on the lower support of 3100-3110 is the focus.

Strategy reference:

Short order strategy:

Strategy 1: Short (buy short) two-tenths of the position in batches near 3175-3178 of gold rebound, stop loss 6 points, target near 3155-3145, break to see 3140 line;

Strategy 2: Long (buy up) two-tenths of the position in batches near 3138-3140 of gold pullback, stop loss 6 points, target near 3160-3170, break to see 3180 line;