XAUUSD.P trade ideas

GOLD Next Possible GrowingA next GOLD All High top movement

From Mr Martin Date 15 Tuesday April 2025

Gold is very sacred to mover the top because all time price will high no any seems falling pattern the price is very strong reaching the US concessions on tariffs on Chinese electronics and china pledges to boost economic stimulus a next resistance zone 3270 and also fallow the Rejection support will be 3170.

Ps Support level with like and comments must Guys So we will Modify to share analysis with your and also share Your thought's about Bitcoin Price.

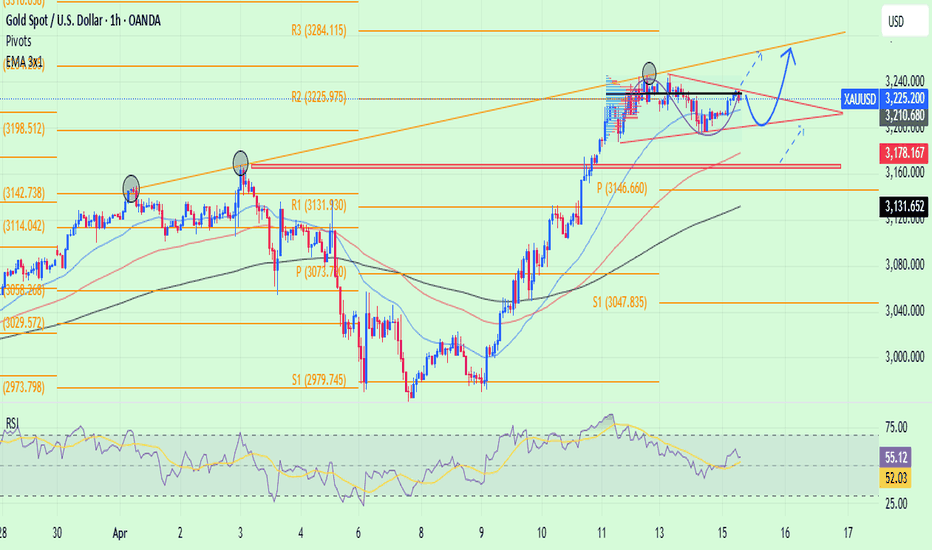

Gold hovers at the All-Time High (ATH)Gold Analysis Update:

As Gold hovers at the All-Time High (ATH), it's crucial to observe how the market behaves during the London session, which is known for its high liquidity and volatility. After taking the Asian session high, the price action is now poised to potentially revisit the marked Fair Value Gap (FVG) zone.

If the market retraces to this zone and provides a bullish confirmation, such as a strong bullish candlestick pattern or a break above a key resistance level, it could set the stage for a beautiful buy-side trade setup. This would potentially offer a lucrative trading opportunity for those looking to capitalize on the ongoing bullish trend.

Let's closely monitor the price action and wait for the market to provide a clear signal before making any trading decisions.

Maintain in uptrend line- retest ATH 3247🔔🔔🔔 Gold news:

➡️ Federal Reserve Governor Christopher Waller stated that the Trump administration’s tariffs delivered a significant shock to the U.S. economy, potentially forcing the central bank to cut interest rates to avoid a recession. Global risk sentiment improved after the White House announced on Friday that smartphones, computers, and other electronic devices would be temporarily exempt from Trump’s punitive tariffs.

➡️ However, Trump emphasized that these exemptions are only temporary and added that he plans to announce new tariffs on imported semiconductors next week. He also threatened to impose tariffs on pharmaceuticals in the near future. This ongoing uncertainty, along with underlying bearish sentiment surrounding the U.S. dollar, has provided some support for the XAU/USD pair.

Personal opinion:

➡️ Today there is not much news that directly affects the gold price so it will remain in the uptrend zone. Watch the technical analysis zones to get good profits for you

➡️ Analyze based on resistance - support levels and Volume profile combined with trend lines to come up with a suitable strategy

Plan:

🔆Price Zone Setup:

👉Buy Gold 3188 - 3190

❌SL: 3183 | ✅TP: 3195 - 3200 - 3205

👉Sell Gold 3244 - 3247

❌SL: 3252 | ✅TP: 3240 - 3235 - 3230

FM wishes you a successful trading day 💰💰💰

Gold prices soared again!Market news:

In the early Asian session on Wednesday, spot gold suddenly surged in the short term, breaking through the $3,275/ounce mark, with an intraday increase of more than $45. The latest report from Bloomberg News in the United States said that as the Trump administration pushed forward investigations that could expand the trade war, it stimulated demand for safe-haven assets, and the London gold price hit a record high again. As the escalating trade war has raised concerns about the prospect of a global recession, as a traditional safe-haven asset, gold has accumulated a gain of more than 23% in 2025, continuing to set a record. As investors increase their holdings of international gold-backed exchange-traded funds (ETFs) and central banks continue to increase their holdings of gold, major banks remain optimistic about the outlook for gold in the coming quarters. Investors are waiting for a speech by Federal Reserve Chairman Powell, scheduled for Wednesday, to look for clues related to interest rates. It is also necessary to pay attention to the US retail sales data at 20:30 on Wednesday and the specific implementation details of Trump's tariff policy. The analyst specifically reminded that market liquidity may decline before the Good Friday holiday, and any sudden policy changes may trigger sharp fluctuations.

Technical Review:

Gold opened sharply higher in the early trading and hit a new record high. It broke through the 3230 mark in the late trading and stabilized. The price continued to break the adjustment range of yesterday and rose in large volume. There was no technical movement during the day. The super-gain appeared in the early trading, and the price continued to hit a new record high. As investors turned to safe-haven assets amid the uncertainty brought by the continued tariff plan of US President Trump, additional tariffs could exacerbate the ongoing trade war and slow global economic growth. As global stock markets bottomed, the pressure on gold finally eased, and the precious metal rose sharply to a record high. The rise was very fierce because everyone rushed into the gold market, hoping to use it as a safe haven against the stagflation caused by the trade war. From a more macro perspective, gold is still in an upward trend because real yields may continue to fall because the threshold for rate hikes remains very high. Potential risks include another sharp sell-off in the stock market or a hawkish stance from the Federal Reserve. In the short term, given that gold's buying positions are too concentrated, if the trade war eases, gold prices are likely to experience a deeper correction, so it is necessary to pay close attention to developments in this regard. The current environment still supports the rise of gold, but the road to gold price rise will not be smooth, and there may be a temporary correction in the middle.

Today's analysis:

Gold directly broke through the new high in the early trading to avoid risks. The short-term adjustment of gold ended and finally completed the adjustment in a volatile manner. This kind of strong buying market of the breakthrough will basically not fall back too much. Since gold has chosen to break upward, since it has broken through, then it is to buy in the trend. The decline of gold is an opportunity to buy.The 1-hour moving average of gold began to turn upward. If the 1-hour moving average of gold continues to diverge upward, then the buying of gold will continue to exert its strength. After gold breaks through 3245, then gold 3245 has formed support in the short term. Buy on dips when gold falls back to 3245. The strength of the wave of gold in the morning was still there at that time, so after the high, you must wait patiently for adjustments and continue to go long. Gold can continue to buy when it falls back to around 3245.

Operation ideas:

Buy short-term gold at 3245-3248, stop loss at 3236, target at 3280-3290;

Sell short-term gold at 3293-3295, stop loss at 3304, target at 3250-3240;

Key points:

First support level: 3253, second support level: 3240, third support level: 3225

First resistance level: 3280, second resistance level: 3300, third resistance level: 3315

XAUUSD SET TO TRADE UPTO $3330 (261.8 FIBO LEVEL)Price is set to make another bullish move upto $3330 per ounce. This comes after we have an impulsive bullish movement which confirms the readiness of buyers to take price higher from the current price. A buy opportunity is envisaged from the current market price

GOLD - FEAR has switch to GOLDTeam, gold has been pumped non-stop on fearing trump tariff

But the current price indicates a double top

We expect the falling range around 3260 to 3215

current price is 3272 - if stop loss at 3285

Once the price hits 3265, bring the stop loss to BE and target a further range.

We do not often trade gold only sometimes.

Gold targets $3,475: Strong wave has not stoppedThe world gold price's uptrend continues to hold steady after a technical correction to the support zone around $3,336 - $3,369 (Fibonacci 0.5 - 0.618), coinciding with EMA34 on the H4 frame, showing that buying power is still dominant in the main trend. The price has now recovered to around $3,395/ounce and continues to maintain a strong uptrend pattern with the target of expanding to the $3,475 zone - the 100% Fibonacci level of the most recent uptrend. The convergence between the technical structure and macro news creates a solid foundation for the uptrend: safe-haven money continues to flow into gold amid geopolitical instability, a weakening USD and market sentiment worried about risks from US economic policy.

Comments from experts such as Sean Lusk and Christopher Vecchio also reinforce the bullish outlook, especially as speculative money and central bank buying have yet to show signs of cooling off. With the EMA34 and EMA89 maintaining a positive slope, the possibility of the price continuing to climb to the target area of $3,475 is very high, before a short-term correction to test the breakout zone may appear. In the short term, any correction to the $3,370–$3,390 area is seen as an opportunity to increase long positions following the trend.

CHECK XAUUSD ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

(XAUUSD) trading signals technical analysis satup👇🏼

I think now (XAUUSD) ready for(SELL)trade( XAUUSD ) SELL zone

( TRADE SATUP)

ENTRY POINT (3482) to (3480) 📊

FIRST TP (3474)📊

2ND TARGET (3463) 📊

LAST TARGET (3456) 📊

STOP LOOS (3490)❌

Tachincal analysis satup

Fallow risk management

Gold over BTCYep, them are some fightin' words right there. But, on a monthly chart, Gold / BTC tells a potential story. It may not happen this year, but it looks to be shaping up.

A black swan event could actually be a reversion to a gold standard or something similar, causing sovereigns to scramble for physical gold, causing the price to skyrocket.

Perhaps capital controls on USD? Something else related to USD? Who knows, but a falling wedge at this scale is important.

What if Kid Rock ran the Fed?Gold has broken above $3,400 for the first time, setting a new all-time high as investor confidence in the United States continues to decline.

Citi forecasts gold could reach $3,500 within the next three months. However, this projection might be underestimating Trump’s potential to further undermine confidence in the US.

On Monday, President Trump intensified pressure on Federal Reserve Chair Jerome Powell, calling him a “major loser” and demanding immediate interest rate cuts. Last week the President said, "Powell's termination cannot come fast enough,".

A move to dismiss Powell would likely trigger significant market volatility. Markets generally view Powell as a stabilizing figure, and history shows that a less independent central bank is less effective at keeping inflation under control.

I think it might be fair to wonder what a Federal Reserve Chairman Kid Rock would do for the price of gold.

XAUUSD : Accumulating around the peak areaGold prices today remain stable in the high zone around 3,330 USD. This precious metal is temporarily sideways due to the market entering the Easter holiday, but the upward momentum has not shown any signs of stopping.

Accordingly, geopolitical tensions, economic instability, and trade policies from the US continue to be supportive factors for gold during this period. The current resistance level is around 3,353 USD, while the nearest support zone is 3,300 USD.

Gold may correct slightly and accumulate momentum after the recent strong increase. We should wait for the price to return to important zones such as EMA 34, the support zone, or wait for the price to break the resistance zone to enter reasonable orders when the market is active again.

Prioritize trading according to the trend, everyone, don't forget to set full TP and SL to ensure safety.

GOLD LONGGold have had some of the best days in the market due to plenty of reasons finding supports on the ATH 's something very casual for gold not impressed we expect prices to reach 3500 on no time liquidity being swept and institutes putting money to increase the value of gold.

We expect to see the value to find a resistance point on 3400 either 3450 , either way we have good support from news and other factors look for ur buy position traders <3

4H Gold (XAUUSD) chart 4H Gold (XAUUSD) chart

Let’s break it down:

🧐 Current Structure:

• Price has pushed up strongly (big bullish momentum).

• Now it’s consolidating after the strong move (small candles, indecision).

• No clear breakout yet after consolidation.

• Last strong push started from around 3200-3220.

• Current level: around 3327.

📈 Is there a Buy Now?

NO, not immediately now.

• The price is stalling (small candles = indecision = possible short pullback).

• Buying now would be chasing — risky because price might correct first.

🔔 Better buy plan:

• Wait for price to pull back to a strong support zone.

• Good buy area = around 3280–3290 (small pullback) or stronger at 3250 (deeper pullback zone).

• Look for a bullish 4H candle confirmation at those levels (like a pin bar or bullish engulfing).

📉 Can you scalp a Sell?

YES, but very carefully.

• You can scalp a sell IF price breaks below 3320 with momentum.

• Target = 3300–3290 area for scalping (small pullback zone).

• Be careful: overall trend is still bullish, so selling is short-term only!

🛡️ Scalp Sell Setup Idea:

• Sell break below 3320.

• Stop loss above 3335.

• Target 3300–3290.

🚨 Quick Strategy Summary:

Action Condition Target

Buy Pullback to 3280–3250 with bullish candle 3350–3380

Scalp Sell Break below 3320 3290–3300

April 17, 2025 - XAUUSD GOLD Analysis and Potential OpportunitySummary:

For now, bullish momentum appears to be weakening slightly, but the overall strategy remains: buy on pullbacks to support.

Keep an eye on tariff-related headlines — if there's news about any suspension or reversal, the market outlook may shift quickly, and so should the trading strategy.

Most importantly:

✅ Set your Stop Loss

✅ Have a clear plan

✅ Execute the plan

If your plan no longer fits the current market conditions, step away — survival is key in trading!

Key Levels to Watch:

3360–3365: Bullish target zone

3358: ATH resistance

3343: Support

3333: Support

3322: Support

3314: Support

Short-Term (15m) Strategy:

For Shorts: Enter a SELL if the price breaks below 3343. Watch 3341 for quick reaction; if the drop continues, monitor 3337, 3333, and 3328.

For Longs: Enter a BUY if the price stabilizes above 3343. Watch 3348 for confirmation; if momentum continues, target 3351, 3355, and 3360.

👉 If my insights have been helpful to you, or if you traded based on my ideas, please consider giving a like — it’s a great encouragement for me! Thanks for your support!

Disclaimer: This is my personal opinion and not financial advice. Please manage your risk accordingly.

XAU/USD 16 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed according to yesterday's analysis, however, as I mentioned in my analysis yesterday whereby I stated that price has printed a bearish CHoCH and I would continue to monitor price.

Price has printed very minimal pullback and continued its bullish trajectory, therefore, I will again apply discretion and not classify a bullish iBOS. I have however marked this in red as a guide.

Intraday Expectation:

Await for price to print bearish CHoCH to indicate bearish pullback initiation phase. Bearish CHoCH positioning is denoted with a blue dotted line.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price did not print according to yesterday's analysis, failing to target weak internal low by printing a bullish iBOS. This is most probably due to Trump's tariff policy and ongoing uncertainty.

Price has now printed a bearish CHoCH to indicate bearish pullback phase initiation.

Price is now trading within an established internal range. However, I will continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of 50% internal EQ, or M15 demand zone before targeting weak internal high priced at 3,317.920

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

Gold latest analysis strategy signalis trading within a well-defined ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting a potential continuation.

The price has recently broken above a key resistance zone and may come back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward the 3,300 target, which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook stays intact. However, a failure to hold above this level could invalidate the bullish scenario and increase the likelihood of a pullback toward the channel’s lower boundary.